As the cryptocurrency market trends evolve, investors and enthusiasts alike must navigate the complex landscape shaped by fluctuations in the sector’s total market capitalization, currently sitting at $3.1 trillion, reflecting a 14% decline over the last year. This downturn emphasizes the urgent need for strategic crypto investment strategies, particularly as experts prepare for 2025 cryptocurrency predictions that signify the end of excessive speculation. While many traditional tokens faced setbacks, recent data shows that stablecoins performance has emerged as a reliable alternative, outpacing speculative assets like meme coins. Additionally, a thorough analysis of Bitcoin and Ethereum reveals their enduring potential amidst declining trust in crypto, emphasizing their status as credible investments. As we look toward the future, identifying the right cryptocurrency opportunities will become paramount for achieving success in this ever-evolving digital economy.

In the dynamic world of digital currencies, understanding emerging patterns is essential for investors aiming to position themselves favorably. The latest shifts indicate a notable retraction in market capitalization, while the prospection for 2025 unveils new horizons beyond mere speculation. Tactical approaches involving stable digital assets are proving their merit as they outperform traditional speculative endeavors. An insightful overview of major players like BTC and ETH sheds light on their growing reliability, especially as institutional confidence wanes. As these trends unfold, recognizing and adapting to the landscape will be vital for anyone looking to thrive in this cryptocurrency ecosystem.

Understanding Cryptocurrency Market Trends

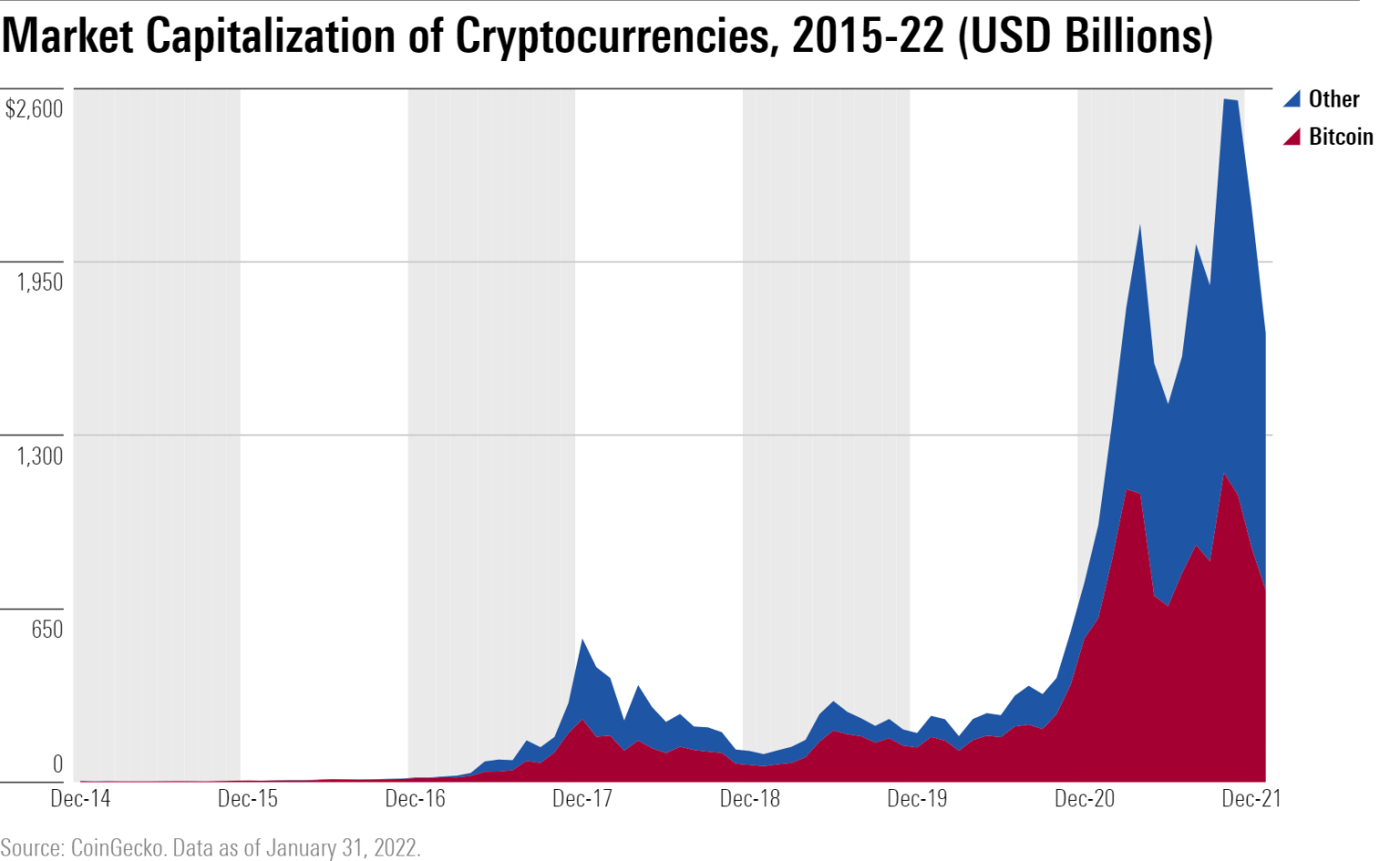

The cryptocurrency market trends have been fluctuating significantly over the years, with a current market capitalization of $3.1 trillion, reflecting a notable 14% decline in the past twelve months. This downturn can be attributed to various factors, including the bursting of the meme coin bubble and the failure of speculative ventures that once drew in substantial investment. However, this decline also signals a considerable shift within the industry, as long-overvalued and poorly constructed projects fade away. Investors are now faced with the challenge of identifying sustainable and valuable opportunities in this changing landscape.

In contrast, the emergence of products that do not solely rely on token speculation, such as stablecoins and platforms like Polymarket, indicate a maturation of the cryptocurrency space. As crypto investors grow increasingly cautious, they show a preference for stable investment options over volatile tokens, leading to a focus on assets that offer tangible returns. This shift is reflective of a broader trend where institutional trust is waning, pushing investors to seek out more reliable assets, thus shaping the dynamics of future market performance.

As we look into the future, understanding cryptocurrency market trends will be pivotal for investors aiming to navigate this complex environment successfully. Staying abreast of regulatory changes, technology improvements, and the overall sentiment in the investment community will help crypto enthusiasts make better-informed decisions. Furthermore, with the growing adoption of blockchain technology and an increased emphasis on utility-driven projects, there is potential for market recovery involving innovative solutions that prioritize long-term sustainability.

Ultimately, embracing these market changes and recognizing the underlying trends can lead to foresighted investment strategies. Investors who focus on credible cryptocurrencies like Bitcoin and Ethereum can build a strong portfolio resistant to the fluctuations that have previously characterized the cryptocurrency market.

Reevaluating Crypto Investment Strategies for 2025

In light of recent shifts within the cryptocurrency market, it’s crucial for investors to reevaluate their crypto investment strategies as we approach 2025. The past years have demonstrated the dangers of speculative investments, leading to the failure of many previously popular cryptocurrencies. As Nick Tomaino emphasizes, the era of ‘easy money’ has concluded, and the need for more disciplined investing approaches is paramount. Investors must prioritize projects that provide demonstrable value and are backed by solid fundamentals rather than succumbing to the temptation of high-risk coins with no clear trajectory.

Furthermore, strategies that incorporate a blend of traditional investment principles, alongside an understanding of the unique aspects of crypto, can lead to better outcomes. For instance, focusing on assets such as Bitcoin and Ethereum, which are often viewed as reliable stores of value, can help mitigate risks. Additionally, expanding portfolios to include stablecoins and decentralized finance (DeFi) products can offer stability and potential growth, thereby embracing the evolution of the cryptocurrency landscape.

To navigate the complexities of crypto investments successfully, engaging with market analytics and keeping an eye on emerging trends will be invaluable. Investors should be prepared to adapt their strategies in response to the inevitable changes within this dynamic sector, ensuring their portfolios remain resilient against market fluctuations. As we approach 2025, integrating informed decisions and robust strategies will play a critical role in the success of crypto investments.

Ultimately, a well-researched crypto investment strategy that focuses on credible assets and remains attuned to market trends is more likely to yield favorable results. Recognizing the importance of diversified holdings and sustainable projects will empower investors to thrive even in uncertain market conditions.

The Performance of Stablecoins in Today’s Market

In recent times, stablecoins have emerged as a beacon of stability within the volatile cryptocurrency market. With a total market capitalization that reflects a growing trust and adoption, stablecoins are frequently seen as a valuable asset for risk-averse investors. Their ability to maintain a stable value amidst the erratic price movements typical of cryptocurrencies enables users to create a safer haven for their assets while still participating in the overall market dynamics. This trend indicates a shift towards more prudent investment practices in the crypto world.

Moreover, stablecoins offer various functionalities that can be leveraged in DeFi applications, which have garnered significant attention in the community. With the backing of fiat currencies or other assets, stablecoins can facilitate transactions, yield farming, and liquidity provision, contributing to a more robust ecosystem. As the cryptocurrency market adjusts to external economic factors and evolving consumer preferences, the performance of stablecoins will undoubtedly shape investment strategies moving forward, solidifying their role as essential components of diversified crypto portfolios.

The performance of stablecoins has proven particularly resilient in an environment characterized by declining trust in many projects. Their unique positioning as reliable digital currencies places them at the forefront of investment discussions, where they act as bridges between traditional finance and the burgeoning world of cryptocurrency. Investors seeking security should consider incorporating stablecoins into their portfolios to diversify their assets and hedge against market uncertainties.

As the market matures, understanding the nuances of stablecoins and their place within the cryptocurrency ecosystem will be paramount for investors. By harnessing their stability and functionality, savvy investors can navigate the challenges of the market while capitalizing on opportunities that arise from the ongoing evolution of the crypto landscape.

Bitcoin and Ethereum: Analyzing Their Market Position

Bitcoin and Ethereum remain the two dominant cryptocurrencies within the market, each serving distinct yet complementary roles. Bitcoin, often referred to as digital gold, is primarily viewed as a store of value, while Ethereum provides a robust platform for decentralized applications (dApps) through its smart contract capabilities. The recent trends indicate that both cryptocurrencies have maintained their credibility and market position despite the dynamic shifts within the broader crypto environment. Investors continue to regard them as foundational assets for any cryptocurrency portfolio.

The analysis of Bitcoin and Ethereum reveals not only their resilience but also the adaptability to changes in the market landscape. While Bitcoin’s value is often driven by macroeconomic factors and institutional adoption, Ethereum’s growth is attributed to its vibrant ecosystem that fosters innovation and development. As various projects build on the Ethereum network, it has become clear that the demand for scalable blockchain solutions is only going to increase, positioning Ethereum favorably in terms of long-term investment potential.

Despite these strengths, both Bitcoin and Ethereum are not immune to market volatility. The current climate reflects a cautious sentiment among investors, particularly amid the declining trust in the crypto space. To understand the future trajectory of these leading cryptocurrencies, it is crucial to analyze market sentiment, regulatory developments, and technological advancements affecting their respective ecosystems. This comprehensive analysis empowers investors to make informed decisions, based on both historical performance and forward-looking potential.

Ultimately, Bitcoin and Ethereum’s ability to adapt to the evolving market dynamics will significantly influence their performance in the coming years. Careful monitoring of their developments, alongside strategic investment planning, can guide investors looking to capitalize on the opportunities presented by these leading cryptocurrencies.

The Impact of Declining Trust in Crypto Markets

The decline in trust regarding cryptocurrencies has been a significant topic of discussion in recent months, particularly as high-profile failures and scams have surfaced within the industry. As investors experience disillusionment with speculative assets, a trend of skepticism is evidently reshaping the landscape. This decreasing level of confidence is not only affected by the volatility seen in numerous coins but also by the shoddy practices of poorly regulated projects that have tarnished the reputation of the sector.

As a direct consequence of declining trust, investors are shifting their focus towards more trustworthy alternatives, such as established cryptocurrencies like Bitcoin and Ethereum, which continue to exhibit a degree of stability amidst uncertainty. Additionally, the rise of stablecoins and transparent projects signifies a growing demand for accountability and reliability in the cryptocurrency market. Investors are seeking assurance that their assets are protected and can yield returns without the risks associated with speculative investments.

The implications of declining trust extend beyond mere sentiment; they influence market behavior and investment strategies across the board. Increased regulatory scrutiny is anticipated as authorities seek to enhance protection for investors against fraudulent activities. As this regulatory landscape adjusts, legitimate projects will likely flourish, while less scrupulous entities struggle to survive under the weight of renewed oversight and consumer skepticism.

In summary, tackling the issue of declining trust is pivotal for the future of the cryptocurrency market. Projects that prioritize transparency and foster consumer confidence will likely emerge as leaders, driving an evolution that emphasizes prudence and long-term viability. Investors who understand and adapt to these shifting dynamics will be better positioned to thrive in an ever-changing digital economy.

Frequently Asked Questions

What are the latest cryptocurrency market trends and their impact on crypto investment strategies?

The latest cryptocurrency market trends reveal a significant decline in overall market capitalization, now at $3.1 trillion, a 14% decrease over the past year. This decline signals a shift in crypto investment strategies as investors are likely to focus more on products that do not rely solely on token speculation, such as stablecoins and decentralized finance (DeFi) applications. As the market matures, successful strategies will be those that incorporate these trends into diversified portfolios.

How do 2025 cryptocurrency predictions suggest the market will evolve?

2025 cryptocurrency predictions indicate a pivotal transition from the ‘easy money’ era to a more sustainable market landscape. Experts foresee reduced reliance on inflated ventures like meme coins and an increased emphasis on valuable products, including stablecoins and platforms that prioritize utility over speculation. As a result, investors may need to adapt by targeting assets that align with this evolving focus to capture future market opportunities.

What should investors know about stablecoins performance in today’s cryptocurrency market trends?

Stablecoins have demonstrated remarkable resilience in today’s cryptocurrency market trends, especially as they begin to outperform speculative tokens that have faltered recently. Their performance indicates a growing preference among crypto investors for dependable assets in an environment marred by volatility and declining trust in traditional cryptocurrencies. This shift highlights the importance of stablecoins as a viable component of modern crypto investment strategies.

What is the significance of Bitcoin and Ethereum analysis in understanding current cryptocurrency market trends?

Bitcoin and Ethereum analysis is crucial for understanding current cryptocurrency market trends because they continue to be the only two cryptocurrencies perceived as possessing credible neutrality. As trust in the market wanes, institutional investors may increasingly gravitate toward these leading coins, emphasizing their role in shaping the future landscape of crypto investments.

Why is there a declining trust in crypto impacting the cryptocurrency market trends?

The declining trust in cryptocurrency is impacting market trends significantly, as institutions have grown wary of past failures in the industry. The shift away from speculative investments suggests a preference for trustworthy neutral currencies like Bitcoin and Ethereum. This trend highlights an urgent need for innovation and transparency within crypto markets, which will be pivotal for attracting both retail and institutional investment moving forward.

| Key Points | Details |

|---|---|

| Current Market Capitalization | $3.1 trillion; 14% decline over the past year. |

| Historical Context | Market cap was $0 in 2009. |

| End of ‘Easy Money’ Era | 2025 marks the end of inflated sales, meme coins, and DAT’s failure. |

| Emerging Products | Products not relying on token speculation such as Polymarket and stablecoins are outperforming. |

| Investment Strategies | To achieve excess returns, focus on developing neutral products. |

| Constant Trends | 1. Awareness of fraudsters; 2. Declining trust; 3. Bitcoin and Ethereum as credible neutrals. |

Summary

Cryptocurrency market trends indicate significant shifts as the industry faces a challenging landscape. The total market capitalization, despite falling, highlights the remarkable evolution since 2009. As 2025 looms, the industry must prepare for a new era, prioritizing trustworthy innovations over mere speculation to navigate potential opportunities effectively.

Related: More from Market Analysis | Earnings season is wrapping up with a mixed bag of results across | Polymarket Bet Fails to Catch Insider Traders