ETH trading analysis reveals a critical focus on the current price range of $2,920 to $3,020, where robust Ethereum support levels have emerged, suggesting potential stability as traders navigate the market. Recent on-chain analysis indicates a lull in trading activity, with the ETH trading volume falling significantly in the past 24 hours, signaling cautious investor sentiment during the holiday period. Monitoring the Ethereum market trends during this timeframe shows how shifts in liquidity can impact price fluctuations. Additionally, a considerable accumulation of over 13.41 million tokens in the support range from $2,772 to $3,050 indicates strong backing that may prevent sharp downturns. As traders analyze these factors, understanding the intricacies of ETH’s price range will be crucial for making informed decisions in this dynamic market.

Delving into the dynamics of Ethereum’s trading landscape, recent studies highlight the significant fluctuations experienced within the established price brackets. By evaluating Ethereum’s performance against its support benchmarks, market participants can gain insight into prevailing trading patterns and strategies. The current low liquidity environment has drawn attention to token distributions, emphasizing the importance of on-chain metrics in forecasting future price movements. With a notable decrease in trading volume, alternative analyses become imperative for grasping the overall health of Ethereum’s ecosystem amidst shifting market conditions. Understanding these elements can empower traders to better navigate the complexities of digital asset investment.

Current ETH Price Range Analysis

As of now, ETH is actively trading within a well-defined price range between $2,920 and $3,020. This interval has proven to be critical for traders and investors, as it reflects current market sentiment and potential price movements. The established support level at $2,772 plays a key role in this range, acting as a safety net for traders who are looking to minimize losses. Throughout the holiday period, trading volumes have shown a notable decrease, with approximately 180,000 tokens traded in the last 24 hours, highlighting the market’s low liquidity during this time.

The analysis indicates that the ETH price’s movement between $2,900 and $3,010 has been characterized by fluctuations that can be attributed to the reduced trading activity. As traders monitor the price closely, those in the market often utilize these support levels to inform their decisions on when to enter or exit the market. Understanding the operational dynamics within this price range provides traders with essential insights into potential future market trends.

Understanding Ethereum Support Levels

Support levels are vital for traders seeking strategies to mitigate risk. In the current ETH trading landscape, a significant support level is observed at $2,772. This level has gathered over 13.41 million tokens, suggesting that many traders are choosing to hold or buy ETH at this price point, viewing it as a favorable entry opportunity. Support levels not only provide insights into where price rebounds may occur but also signal to investors the underlying demand for ETH in times of price fluctuations.

The analysis of Ethereum’s support levels allows traders to better predict potential reversals in price direction. When the price approaches the $2,772 mark, it tests the limits of bear pressure; should it hold firm, it may prompt a rally toward the upper ranges of $2,900 to $3,020. Consequently, investors keeping a keen eye on these levels can position themselves strategically, leveraging potential resilience in the crypto-asset’s price action to maximize their returns.

Analyzing On-Chain Data for ETH

On-chain analysis serves as a crucial tool for understanding the underlying health and activity within a blockchain network, specifically for Ethereum in this context. Recent data collected from Ethereum’s URPD shows limited liquidity during the holiday period, revealing patterns in user transactions between January 1 and January 2, where prices remained between $2,900 and $3,010. Such insights provide traders with a clearer picture of market behavior and dynamics, informing their trading decisions.

Moreover, examining on-chain data, including transaction volumes and token concentration, allows traders to assess market sentiment and potential price trends. While the overall trading volume in the past 24 hours has dropped to 180,000 tokens from a previous 330,000, it emphasizes the importance of on-chain metrics, as they reflect not only the volume of trades but also the broader market trends influencing ETH’s price actions.

Evaluating ETH Trading Volume Trends

Surveying ETH’s trading volume illuminates the prevailing market trends influencing Ethereum’s price. The recent decline in trading volume, dropping from 330,000 tokens to 180,000 tokens, suggests a cooling off in investor activity during the holiday season. This is often indicative of seasonal behaviors in trading patterns, where market participation wanes, leading to reduced price movements and tighter trading ranges.

High trading volumes typically signify heightened interest and market pressure, while low volumes, such as those observed lately, may indicate uncertainty or a wait-and-see approach among traders. As the ETH market transitions out of this low-volume phase, any resurgence in trading activity could signal significant price movements, possibly breaking the current range and testing new levels.

Ethereum Market Trends Overview

To contextualize the current trading conditions for ETH, it’s essential to look at broader market trends influencing cryptocurrency dynamics. As a decentralized asset, Ethereum reacts to both macroeconomic factors and specific industry developments, which can impact trader psychology and subsequently, price movements. The recent fluctuations within the price range of $2,900 to $3,010 exemplify how external sentiments can sway price action.

Furthermore, understanding these trends can offer valuable insights into future price forecasts and potential market shifts. As we see developments in regulatory frameworks, technological upgrades, and increasing adoption of blockchain technologies, they fundamentally affect the supply and demand of ETH. As such, keeping abreast of these trends empowers traders to make informed decisions that align with potential market shifts.

Limitations of ETH Trading Analysis

While ETH trading analysis is crucial for making informed decisions, it is essential to recognize its limitations. Technical analyses, including support and resistance levels, may not always predict future price movements accurately, especially in volatile markets like cryptocurrency. Factors such as macroeconomic events, changes in investor sentiment, and other unforeseen conditions can drastically influence market direction.

Additionally, relying solely on trading volume without considering external variables is a common pitfall for traders. An effective ETH trading strategy should encompass a combination of technical analysis, on-chain metrics, and a keen awareness of market trends. By embracing a holistic approach, investors can navigate the complexities of the crypto market and make more calculated trading decisions.

The Role of On-Chain Analysis in Trading

On-chain analysis has emerged as a critical component of ETH trading strategies, allowing traders to derive actionable insights from blockchain data. Through on-chain metrics, traders can identify key indicators such as liquidity pools, transaction velocities, and wallet behaviors. This data helps forecast potential price movements and offers a more profound understanding of market sentiment beyond mere price history.

With Ethereum’s diverse ecosystem, on-chain analysis enables traders to monitor patterns among holders and movements of large wallets, which can have substantial market impacts. For instance, as transaction volumes show a downward trend alongside significant token concentration at specific prices, traders can deduce potential support and resistance scenarios. This analytical approach enhances the ability to capitalize on price fluctuations effectively.

Key Trading Indicators for ETH

Understanding key trading indicators is vital for any trader looking to engage with ETH. Among these indicators, the Relative Strength Index (RSI), volume analysis, and moving averages provide essential insights into the market’s momentum and overall health. For example, recent RSI readings may indicate whether ETH is nearing an overbought or oversold condition, informing strategic entry or exit points.

Moreover, trading volume remains one of the most significant indicators, as it highlights the number of tokens being exchanged. High trading volumes can validate price moves, while low volumes may indicate uncertainty or potential reversals. Employing a range of indicators facilitates a comprehensive approach to trading ETH, helping traders make informed decisions.

Future Outlook for Ethereum Trading

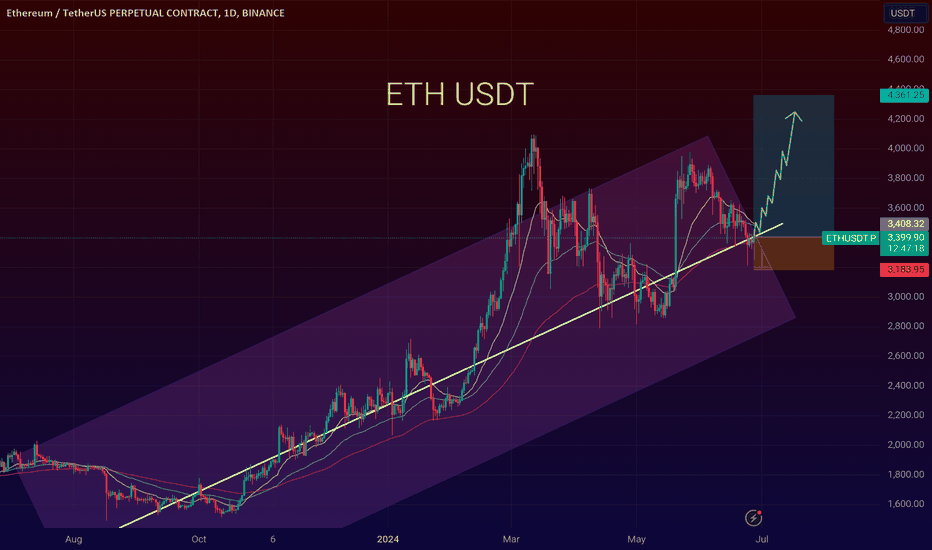

Looking ahead, the future outlook for Ethereum trading remains a topic of significant interest for both novice and seasoned investors. With ETH’s price existing within a narrow range, market participants are keenly awaiting catalysts that could trigger changes in trading dynamics. Developments such as upgrades to the Ethereum network, institutional participation, and macroeconomic trends could influence ETH’s trajectory significantly.

As Ethereum continues to evolve, maintaining a proactive stance through continuous analysis and market awareness will be crucial. Future price movements could reveal broader market trends, making it imperative for traders to stay updated on both technical and fundamental developments influencing ETH.

Frequently Asked Questions

What is the current ETH price range and its significance in trading analysis?

Currently, ETH is trading within a price range of $2,920 to $3,020. This range is significant as it reflects a consolidation phase, indicating potential support levels around $2,772, where considerable on-chain analysis shows nearly 13.41 million tokens have accumulated. Traders often look at these levels to assess potential breakout points or reversals in Ethereum market trends.

How do Ethereum support levels impact ETH trading volume?

Ethereum support levels, such as the current range of $2,772 to $3,050, play a crucial role in influencing ETH trading volume. With nearly 13.41 million tokens concentrated in this range, traders use these levels to predict possible price stability and to gauge the likelihood of increased ETH trading volume as buyers enter the market.

What does on-chain analysis reveal about recent ETH trading activity?

On-chain analysis has shown that in the recent 24-hour period, the total ETH trading volume decreased to approximately 180,000 tokens, down from 330,000 the previous day. This decline occurred during a holiday period characterized by low liquidity, and trading has primarily focused on the established price range of $2,920 to $3,020, suggesting a cautious market sentiment.

How do ETH market trends affect trading strategies?

Current Ethereum market trends, particularly the tight price range of $2,920 to $3,020, suggest traders should adopt strategies that account for potential volatility. Observing support levels and recent trading activities, like the noted drop in trading volume, can help traders develop entry and exit strategies aligned with market behaviors.

Why is analyzing ETH trading volume crucial for effective trading strategies?

Analyzing ETH trading volume is crucial because it provides insights into market sentiment and liquidity. For instance, with current trading volumes at 180,000 tokens compared to previous days, traders may conclude that market enthusiasm is waning, influencing their decisions regarding Ethereum support levels and overall trade execution.

What role do Ethereum market trends and support levels play in price prediction?

Ethereum market trends and established support levels, such as those around $2,772 to $3,050, are essential in making price predictions. By evaluating on-chain analysis and recent trading patterns, traders can better anticipate potential price movements and identify strong buy or sell signals in ETH trading analysis.

| Key Point | Details |

|---|---|

| Current Trading Range | ETH is trading within the range of $2,920 to $3,020. |

| Support Levels | Support has accumulated around $2,772, totaling approximately 13.41 million tokens. |

| On-Chain Data | ETH’s trading volume shows 180,000 tokens traded in the last 24 hours, down from 330,000 the previous day. |

| Price Fluctuation | Price fluctuated between $2,900 and $3,010 over the holiday period due to low liquidity. |

| Trading Focus | Most trading is centered on the $2,920 to $3,020 range, with occasional trades at $3,500. |

Summary

ETH trading analysis reveals that the cryptocurrency is currently experiencing fluctuations within a defined price range while supported by significant token accumulation. Understanding these trading behaviors is crucial for investors looking to navigate ETH’s price movements effectively.

Related: More from Market Analysis | Earnings season is wrapping up with a mixed bag of results across | Polymarket Bet Fails to Catch Insider Traders