Remittance tax has become a crucial topic for any individual or business involved in cross-border financial transactions. Starting January 1, 2026, the United States will implement a 1% remittance tax on specific transfers, as mandated by U.S. remittance regulations. This tax applies primarily to physical payment methods such as cash, money orders, and bank drafts, while providing exemptions for transactions funded through U.S. bank accounts or cards. Designed to streamline reporting and compliance, the new regulations from the IRS require remittance service providers to uphold these standards rigorously. As the landscape of money transfer evolves, understanding the implications of this tax, especially regarding cryptocurrency transfers, is essential for all participants in the global economy.

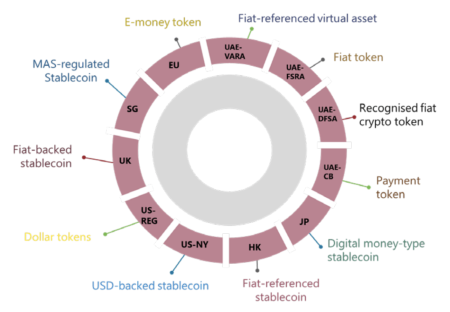

Cross-border transaction taxes, often referred to as remittance levies, are gaining attention due to their financial implications. Beginning on January 1, 2026, individuals and businesses will need to navigate the complexities of these financial regulations imposed by the U.S. Department of the Treasury. The new framework requires remittance centers to apply a 1% charge on certain types of money transfers, while also delineating exemptions for many electronic methods of payment. It is vital for anyone involved in sending money internationally to understand these changes and how they affect remittance service providers. Moreover, the classification of cryptocurrency and stablecoin transfers adds another layer of nuance to these evolving tax discussions.

Understanding the 1% Remittance Tax in the U.S.

As of January 1, 2026, a new remittance tax comes into effect in the United States, mandating a 1% tax on certain cross-border remittances. This rule, formulated by the IRS and the U.S. Department of the Treasury, primarily targets transactions facilitated through physical payment instruments such as cash, money orders, and bank drafts. Consequently, it is crucial for individuals and businesses engaging in cross-border remittances to familiarize themselves with this tax obligation to avoid compliance issues.

The introduction of this remittance tax underscores the U.S. government’s efforts to enhance tax revenue from international money transfers. By including a specific tax for remittance transactions, especially for cash-based transfers, the authorities aim to capture income that may often go unreported. For remitters, understanding the implications of these regulations could significantly impact their financial planning and transaction methods as they navigate cross-border payments.

Impact of U.S. Remittance Regulations on Service Providers

Remittance service providers will play a pivotal role in the enforcement of the new 1% remittance tax. With the responsibility to collect and report this tax, these providers must ensure that they have robust systems in place to comply with IRS requirements. This involves training staff to identify taxable transactions accurately and facilitating payment of the remittance tax to the authorities. As a response, many providers may need to reevaluate their service offerings to cater for clients who are impacted by this regulation.

Moreover, this regulatory change may influence the competitive landscape among remittance service providers. Those who can adeptly navigate the 1% tax collection could gain a significant advantage in customer trust and loyalty. Alternatively, providers who fail to comply risk incurring penalties which could tarnish their reputation and lead to financial losses, ultimately affecting their market position in the rapidly growing sector of cross-border remittances.

The Role of Cryptocurrency in Cross-Border Transfers

Recent discussions surrounding cross-border remittances have led to an increased interest in alternative payment methods such as cryptocurrency. Given the IRS’s current stance, cryptocurrency transfers are not classified as taxable remittance transfers under the new 1% remittance tax regulations. This exemption may incentivize more users to engage in cryptocurrency-based transactions for sending money across borders, providing a speedier and potentially less costly solution compared to traditional remittance services.

However, it is essential to note that while cryptocurrency offers advantages, it comes with its own risks and regulatory complexities. Factors such as market volatility, compliance with SEC regulations, and issues related to security can challenge users relying on digital currencies for remittances. As the landscape evolves, it will be pivotal for remitters to stay informed about both IRS regulations and cryptocurrency developments to navigate this changing environment successfully.

Navigating IRS Tax Regulations for Remitters

Navigating IRS tax regulations as a remitter can be complex, especially with the introduction of the 1% remittance tax. Every individual or business sending money internationally must now be vigilant about understanding how the new regulations affect their transactions. The IRS mandates that remittance service providers report taxable transactions actively, raising the stakes for remitters to ensure accurate reporting and payment of any applicable taxes on physical instrument transactions.

For U.S. citizens and residents, it is crucial to consult with tax professionals who specialize in international transactions to ensure compliance with IRS tax regulations. Failure to adhere could result in substantial penalties, not to mention the possibility of audits from the IRS. Staying informed about the latest rules and leveraging knowledgeable advisors can help mitigate risks associated with international remittances.

Comparing Traditional versus Cryptocurrency Remittances

The choice between traditional remittance methods and cryptocurrency has become a significant topic of discussion, especially following the new regulatory measures. Traditional remittance methods often incur processing fees and, now with the 1% tax on certain transactions, the overall cost can escalate for consumers relying on cash or bank drafts. In contrast, cryptocurrency transactions may offer lower fees and faster processing times, appealing to a demographic eager to save on costs.

Nevertheless, the decision to migrate toward cryptocurrency should be well-considered. Users must weigh the benefits against inherent risks which include technological barriers and the potential for legal scrutiny. Identifying the right balance between using traditional services or innovative digital currencies will ultimately depend on individual circumstances, transaction amounts, and the regulatory landscape surrounding these two methods.

Effect of Remittance Tax on Lower-Income Families

The introduction of a 1% remittance tax could disproportionately affect lower-income families who rely on cross-border remittances to support their households. For many families, especially those with relatives working abroad, remittances are a lifeline. With the added expense of this tax, the financial burden could lead to reduced support for family members in need, exacerbating economic challenges for these households.

Additionally, the tax could discourage sending smaller transfer amounts often utilized by low-income families, leading to a further reduction in the economic support provided through these channels. Policymakers must carefully consider the implications of this tax on vulnerable groups to ensure that the structural changes foster financial inclusion rather than hinder it.

Best Practices for Remittance Service Providers

With the new remittance tax in effect, remittance service providers must adopt best practices to comply with IRS requirements effectively. Implementing advanced software solutions to track transactions and automatically calculate taxes will streamline operations and reduce human error. Service providers should also invest in training programs that educate staff about the latest regulations and the importance of compliance to safeguard their business against penalties.

Moreover, enhancing communication with customers regarding tax liabilities can significantly improve transparency. By explaining which transactions are subject to the 1% remittance tax, providers can guide their clients through the complexities of managing their international transfers while fostering trust and promoting better compliance.

Future of Cross-Border Remittance in the Context of Regulation

The future of cross-border remittances is poised for transformation as U.S. regulations evolve. The 1% remittance tax is just one example of how governments are adapting to globalization and the increasingly digital nature of financial transactions. Stakeholders, including banks, remittance agents, and regulators, must prepare for a landscape where compliance is paramount and customer preferences are shifting toward faster and cheaper alternatives.

As remittance service providers adapt to these changes, innovative solutions such as blockchain technology may gain popularity, potentially offering secure and cost-effective methods to transfer funds internationally. Understanding these trends and preparing for regulatory shifts will be essential for businesses aiming to thrive in the dynamic environment of international money transfers.

Educating Users on Remittance Regulations and Their Implications

Educating users about remittance regulations, including the implications of the 1% tax, is crucial for compliance and financial security. By providing educational resources, remittance providers can empower their customers to make informed decisions regarding their transactions. This education could cover the finer points of IRS regulations, exemptions, and the types of transactions that might trigger the remittance tax.

Moreover, user education can foster trust between service providers and customers. As clients become better informed about their financial responsibilities and rights, they are likely to appreciate the services offered by their providers. This trust can lead to long-term loyalty and enhanced customer satisfaction, benefiting both parties within the rapidly evolving space of cross-border remittances.

Frequently Asked Questions

What is the remittance tax on cross-border remittances in the United States?

As of January 1, 2026, the United States imposes a 1% remittance tax on certain cross-border remittances processed through remittance service providers. This tax applies to transactions funded with cash or physical payment instruments, as regulated by the IRS.

Who is affected by the U.S. remittance regulations for cross-border transfers?

U.S. remittance regulations apply to overseas remitters, including U.S. citizens and residents sending money outside the country. Service providers must collect the 1% remittance tax on eligible transactions, specifically those funded by cash or similar physical payment methods.

What are the exemptions for the 1% remittance tax under IRS tax regulations?

Under IRS tax regulations, transactions funded through U.S. bank accounts or using debit and credit cards are generally exempt from the 1% remittance tax. Only remittances processed with cash or physical payment instruments are subject to this tax.

How does the remittance tax affect cryptocurrency transfers?

According to current IRS regulations, cryptocurrency and stablecoin transfers are not considered taxable remittance transfers. Therefore, using cryptocurrencies for cross-border remittances is exempt from the 1% remittance tax, although this understanding may evolve over time.

What types of transactions require payment of the remittance tax?

The remittance tax applies to cross-border transfers made with cash or physical payment instruments like money orders and bank drafts. If a remittance is funded through electronic means such as bank transfers or card payments, it is typically exempt from this tax.

When does the remittance tax take effect in the United States?

The remittance tax takes effect on January 1, 2026, as mandated by new tax regulations introduced by the U.S. Department of the Treasury and the IRS, aiming to regulate certain cross-border remittance activities.

What legislation introduced the remittance tax in the U.S.?

The remittance tax was introduced as part of the ‘Big and Beautiful’ tax and spending legislation under the Trump administration, adding a layer of taxation to cross-border remittances processed by designated service providers.

Are remittance service providers responsible for collecting the tax on cross-border remittances?

Yes, remittance service providers are responsible for collecting the 1% remittance tax on applicable transactions and must report and remit this tax according to IRS regulations.

How should remitters prepare for upcoming U.S. remittance tax regulations?

Remitters should consult with tax professionals for guidance on how to comply with the new U.S. remittance tax regulations and understand the implications for their cross-border transactions beginning January 1, 2026.

What are the implications of the remittance tax for sending money internationally?

The remittance tax may increase the cost of sending money internationally through physical payment methods. Remitters should be aware of these changes and consider alternative methods that may be exempt under the IRS regulations.

| Key Point | Details |

|---|---|

| Implementation Date | January 1, 2026 |

| Tax Rate | 1% |

| Who is Affected? | Overseas remitters including U.S. citizens and residents |

| Payment Methods Subject to Tax | Cash and physical payment instruments (money orders, bank drafts) |

| Exempt Transactions | Transfers from U.S. bank accounts, debit and credit card payments |

| Tax Legislation Origin | Part of the “Big and Beautiful” legislation linked to the Trump administration. |

| Cryptocurrency Status | Not considered taxable remittance transfers. |

Summary

Remittance tax is a significant new regulation enforced by the United States starting January 1, 2026, mandating a 1% tax on specific cross-border transfers. This policy specifically targets transactions using cash or physical payment instruments while exempting those funded by U.S. bank accounts and card transactions. As such, understanding the implications of the remittance tax is crucial for individuals and service providers involved in cross-border financial activities, particularly in navigating the intersections with evolving cryptocurrency practices.