Bitcoin options have gained significant traction in the financial landscape, offering a unique mechanism for traders looking to maximize their investments. As the cryptocurrency market evolves, Bitcoin options trading provides opportunities for both institutional and retail investors to hedge against price volatility while exploring new revenue streams. With the rise of strategies like covered calls Bitcoin, traders can leverage existing positions to generate yield even in uncertain market conditions. This uptick in trading activity reflects broader Bitcoin market trends that suggest a shift in how traders approach risk management amid fluctuating Bitcoin price analysis. As more participants flock to cryptocurrency options, understanding their implications becomes crucial for anyone looking to navigate this dynamic market.

In recent times, the use of various derivatives involving Bitcoin has spurred discussions around innovative trading techniques. These financial tools, commonly referred to as digital contracts, allow investors to speculate on Bitcoin’s future price movements while managing their exposure. Specifically, mechanisms such as covered call strategies have emerged as popular ways to generate income from existing Bitcoin holdings. As the market continues to experience transformative changes, insights into Bitcoin options trading reveal crucial aspects of trader behavior and sentiment. By analyzing these patterns within the context of broader trends in the cryptocurrency market, investors can better position themselves for potential gains.

Understanding Bitcoin Options Trading

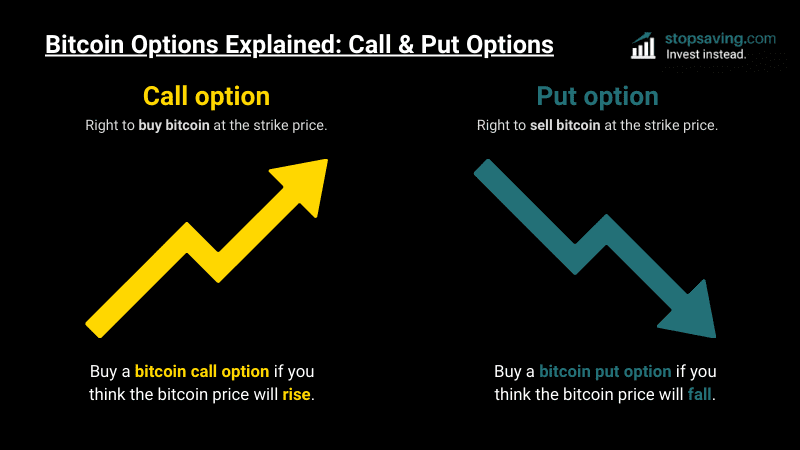

Bitcoin options trading has gained significant traction among investors, especially as traditional cash-and-carry strategies have waned in popularity. This trading method allows investors to speculate on the future price movements of Bitcoin without having to own the cryptocurrency outright. One of the main attractions of Bitcoin options is their ability to provide leverage, enabling traders to amplify their positions without committing substantial capital upfront. As the interest surrounding Bitcoin options continues to rise, understanding their implications on market dynamics becomes crucial.

Moreover, Bitcoin options trading offers various strategies to participants, including covered calls and protective puts. By employing these strategies, traders can manage risk while also seeking potential profits from the volatility inherent in the cryptocurrency market. With Bitcoin’s price constantly fluctuating, options trading serves as a mechanism for hedging against potential downturns or capitalizing on price rallies, attracting both retail and institutional investors to explore different opportunities within the crypto landscape.

The Rise of Covered Calls in Bitcoin Trading

The covered call strategy has emerged as a popular choice among Bitcoin investors, especially with the diminishing cash-and-carry market. This approach involves selling call options on Bitcoin that an investor already holds, providing them with an immediate premium while capping potential upside. Many traders have turned to this strategy as a way to generate income in a market that has seen fluctuating prices. The appeal of earning consistent returns has surpassed the desire for aggressive capital appreciation, leading to more funds embracing covered calls.

However, the debate continues regarding whether covered calls are suppressing Bitcoin’s price potential. Critics argue that by encumbering their holdings through options contracts, investors inadvertently create resistance levels, limiting Bitcoin’s ascension. Nevertheless, evidence indicates that many traders remain bullish despite the use of covered calls, showing that those engaged in options trading still look forward to Bitcoin’s price recovery and the monetization of marked volatility.

Analyzing Bitcoin Market Trends and Their Impact on Options

Understanding Bitcoin market trends is essential for traders looking to navigate the complexities of options trading. As Bitcoin experiences phases of bullish and bearish momentum, these trends dictate the behavior of options market participants. For instance, during downtrends, many traders seek protection through put options, while bullish rallies may prompt increased activity in call options. Analyzing market sentiment and historical price movements can provide valuable insights into potential future price action, assisting traders in crafting informed strategies.

The interactions between Bitcoin price dynamics and options trading are becoming increasingly sophisticated. As institutional investment rises, large players are utilizing options as tools for hedging their portfolios against volatility. By incorporating Bitcoin price analysis into their strategies, they can optimize their positions and make decisive trades based on expected market movements. Therefore, comprehending current market trends alongside options strategies is vital for achieving success in Bitcoin trading.

Exploring the Put-to-Call Ratio in Bitcoin Options

The put-to-call ratio is a key indicator in Bitcoin options trading, reflecting the balance between bearish and bullish sentiment among traders. A stable put-to-call ratio, often observed in Bitcoin options markets, signifies a cautious yet optimistic outlook among participants. This metric helps traders gauge market sentiment, highlighting how many traders are willing to hedge against potential declines versus those looking for upside opportunities through call options. A balanced ratio indicates that while some traders are preparing for downside risks, there remains significant faith in Bitcoin’s growth.

Moreover, fluctuations in the put-to-call ratio can provide critical insights into market psychology. For example, a rising demand for puts might signal growing uncertainty regarding Bitcoin’s price, while an increase in calls could indicate heightened bullish expectations. Therefore, monitoring the put-to-call ratio not only aids in assessing market sentiment but also assists traders in identifying strategic opportunities based on prevailing conditions.

The Role of Institutional Investors in Bitcoin Options

Institutional investors have become increasingly influential in the Bitcoin options market, driving significant fluctuations in both price and trading volumes. Their participation has enhanced the legitimacy of Bitcoin as an asset class, attracting more retail investors seeking exposure to the cryptocurrency space. The influx of institutional capital has contributed to the boom in Bitcoin options trading, enabling institutions to leverage their positions and manage risks more effectively through strategic options contracts.

Additionally, institutional investors often employ sophisticated trading strategies, which can impact market dynamics considerably. By utilizing options for hedging purposes, these large players help stabilize the market during volatile periods, as their actions may counterbalance movements driven by retail traders. Consequently, understanding the role of institutional presence in Bitcoin options trading is crucial for anticipating potential market shifts and price trends.

The Effect of Implied Volatility on Bitcoin Options

Implied volatility plays a significant role in Bitcoin options trading, as it dictates the premium that traders are willing to pay for options. When traders anticipate greater price fluctuations in the Bitcoin market, implied volatility tends to increase, leading to higher option premiums. Conversely, periods of low volatility can reduce these premiums, impacting the profitability of options strategies. Thus, understanding how implied volatility reflects market mood can provide valuable insights for traders considering their positions.

Moreover, fluctuations in implied volatility can also indicate potential turning points in Bitcoin’s price trajectory. A surge in implied volatility after a prolonged downtrend could signal that traders expect a price rebound, while a decline in volatility during a bullish phase may suggest an impending correction. Consequently, monitoring implied volatility can help traders time their entry and exit points more effectively, ensuring they capitalize on market opportunities in Bitcoin options trading.

Yield Opportunities in the Bitcoin Options Market

As traditional yield-generating strategies face challenges, the Bitcoin options market has provided an alternative for investors seeking returns. The shift towards options-based yield strategies, like covered calls, grants investors the ability to earn premiums while still maintaining their Bitcoin holdings. This approach caters to those looking to capitalize on stability in the cryptocurrency’s fluctuating environment, drawing in more participants willing to explore innovative avenues for generating income.

Furthermore, as fund managers increasingly gravitate towards yield strategies in the Bitcoin realm, the popularity of options trading continues to escalate. With returns from cash-and-carry trades diminishing, covered calls present an attractive alternative, offering annualized yields that surpass many conventional investment products. By actively managing their risk with Bitcoin options, investors can enhance their yield potential while remaining exposed to Bitcoin’s upside.

Balancing Risk and Reward in Bitcoin Options Strategies

Navigating the world of Bitcoin options requires a keen understanding of the balance between risk and reward. Each strategy, whether it be buying calls, selling covered calls, or purchasing protective puts, comes with its own set of associated risks and potential rewards. Traders must weigh the possibilities of market movement against their risk tolerance and investment objectives, ensuring that their options strategies align with their overall financial goals.

Moreover, it’s essential for traders to continually evaluate their strategies while monitoring current market conditions. By staying informed on Bitcoin price trends and market sentiment, traders can pivot their options strategies as needed, minimizing risk exposure while maximizing potential returns. Thus, achieving the right balance in Bitcoin options trading is not only about understanding market mechanisms but also about continuously adapting to changing circumstances.

Future Prospects for Bitcoin Options Trading

The future of Bitcoin options trading appears promising as the market becomes increasingly sophisticated. With the ongoing development of financial instruments and products tied to Bitcoin, investors can anticipate more innovative options that fit their trading needs. As institutional participation continues to rise, it’s likely that we will witness increased liquidity and more competitive pricing in the options market, drawing even more participants from various backgrounds.

Additionally, as regulatory frameworks evolve around cryptocurrencies, Bitcoin options trading could gain greater acceptance and stability, promoting widespread adoption. This evolution will not only enhance the credibility of Bitcoin as an asset class but also encourage a broader range of market participants to engage in options trading. Therefore, the prospects for Bitcoin options trading are bright, reflecting the asset’s potential for growth and diversification in investment portfolios.

Frequently Asked Questions

What are Bitcoin options and how do they work in cryptocurrency options trading?

Bitcoin options are financial derivatives that give traders the right, but not the obligation, to buy or sell Bitcoin at a predetermined price before a specific expiration date. In cryptocurrency options trading, traders use various strategies, including covered calls, to generate income and hedge against market volatility. Essentially, they can profit from Bitcoin price movements while managing risk.

How do covered calls impact the Bitcoin market trends and price analysis?

Covered calls involve holding Bitcoin and selling call options to earn premium income. While this strategy can provide yields in the current market, it may create resistance levels where large investors cap the price appreciation. However, analyses suggest that covered calls do not fundamentally suppress Bitcoin prices, as many traders are also active in acquiring puts to hedge against downward trends.

What role does the put-to-call ratio play in Bitcoin options trading?

The put-to-call ratio measures the volume of put options traded relative to call options. In Bitcoin options trading, a stable put-to-call ratio, especially under 60%, indicates that while some investors are selling upside call options, a larger group is buying puts as protection, suggesting a balanced market sentiment where both bullish and bearish strategies coexist.

How is the increasing open interest in Bitcoin options affecting market behavior?

The rising open interest in Bitcoin options, which reached $49 billion in December 2025, signifies growing participation in cryptocurrency derivatives. This trend reflects traders’ preferences for using options for yield generation rather than holding cash-and-carry trades, enhancing market dynamics and providing alternative strategies for managing price exposure.

Can Bitcoin price analysis benefit from the use of options strategies like covered calls?

Yes, Bitcoin price analysis can benefit from options strategies such as covered calls, as they help investors earn income while holding BTC. An understanding of these strategies can give insights into market expectations and volatility predictions, ultimately influencing trading decisions and portfolio management.

| Key Point | Details |

|---|---|

| Bitcoin Options Demand | Institutional inflows and corporate accumulation were unable to maintain BTC prices as demand shifted towards Bitcoin options. |

| Covered Calls Popularity | As cash-and-carry trades declined, the popularity of covered calls increased, providing yield despite concerns about price suppression. |

| IBIT Options Open Interest | Total open interest for Bitcoin options rose dramatically, suggesting increased use of covered calls for income generation. |

| Price Movement Impact | Traders argue that the sale of call options creates a ‘sell wall’ and suppresses Bitcoin price movements. |

| Shift from Cash-and-Carry | Funds transitioned to covered calls for higher yields as cash-and-carry trade premiums diminished. |

| Put-to-Call Ratio Stability | A stable put-to-call ratio indicates that yield-focused sellers are matched by buyers anticipating price breakouts. |

| Volatility Trends | Implied volatility decreased, reflecting a lower incentive to engage in suppressive strategies in the options market. |

Summary

Bitcoin options have become increasingly relevant in the current financial landscape, particularly as traders adapt strategies to navigate market challenges. The growing demand for Bitcoin options reflects a significant shift, especially in the context of the declining cash-and-carry trades. As institutional interest and covered call strategies evolve, investors continue to explore profitable avenues while balancing risk. The stability of the put-to-call ratio suggests that amid concerns over price suppression, the Bitcoin options market is actually serving as a venue for monetizing volatility and fostering strategic hedging.