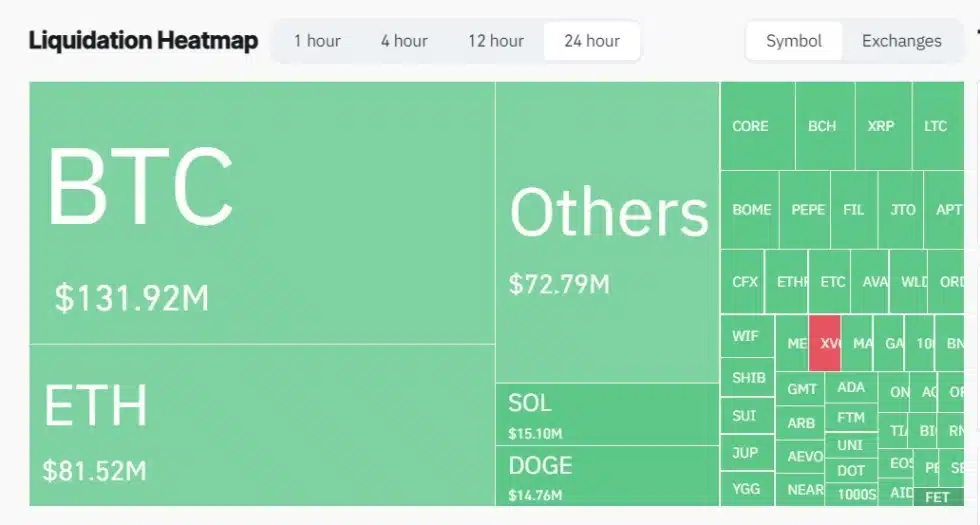

Cryptocurrency liquidation has become a significant event within the dynamic cryptocurrency market, particularly as traders adjust their strategies in response to market fluctuations. Over the past 24 hours, an astonishing $202 million has been liquidated, with long positions making up around 69% of these liquidations. This trend highlights the volatility and inherent risks associated with trading, as evidenced by the data from Coinglass, which reported that over 158,173 traders were affected. Among the liquidated amounts, long position liquidations accounted for a staggering $140 million, in contrast to the $62.349 million from short positions. Such dramatic shifts not only impact individual traders but also signal broader market trends that potential investors should closely monitor.

In recent days, the landscape of digital asset trading has witnessed a wave of forced selling, commonly referred to as liquidation. This phenomenon reflects the urgent need for traders to close their leveraged positions, often as a result of sudden market downturns. Monitoring platforms like Coinglass have reported a large number of both long and short position liquidations, showing just how quickly fortunes can change in the high-stakes realm of cryptocurrency. Investors should be aware that the liquidation process significantly affects the overall liquidity of the market, influencing price movements and trading strategies. Understanding these liquidation events is crucial for anyone looking to navigate the ever-evolving world of cryptocurrency.

Recent Trends in Cryptocurrency Liquidation

The cryptocurrency market has recently experienced a significant shift, resulting in a total liquidation of $202 million in just 24 hours. This substantial figure highlights the unpredictable nature of the market, where the volatility often leads to large-scale liquidations. According to Coinglass data, an impressive 69% of these liquidations were tied to long positions, illustrating a trend where many traders were caught on the wrong side of the price action.

Such significant liquidations can often trigger further downturns in market value as they compound the selling pressure. Market participants tend to respond to rapid shifts, and the factors leading to these events frequently encompass news, regulatory changes, or shifts in investor sentiment toward cryptocurrencies. With 158,173 individuals affected, the recent liquidations underscore the necessity for traders to employ sound risk management practices.

Understanding Long and Short Positions in Crypto Trading

In the context of cryptocurrency trading, long and short positions represent two fundamental strategies employed by investors. A long position entails buying a cryptocurrency with the anticipation that its price will increase, whereas a short position involves borrowing a cryptocurrency to sell it, intending to buy it back at a lower price. The balance between long and short positions often reflects market sentiment, with an increase in long positions typically indicating optimism and a rise in shorts showing bearish sentiment.

The recent data from Coinglass indicates that the liquidations heavily favored long positions, with a total amount of $140 million liquidated. This reveals a stark contrast in market psychology, signaling that many traders may have anticipated upward movement, only to be met with adverse conditions. Thus, understanding the dynamics between these positions can provide crucial insights into market trends and help traders make educated decisions.

Impact of Liquidation on the Cryptocurrency Ecosystem

Liquidations in the cryptocurrency market can have a profound impact on the overall ecosystem, influencing price movements and trader behavior. When positions are liquidated, especially on a large scale, it can create a chain reaction that leads to further sell-offs and increased market volatility. The liquidated amount of $202 million not only signifies losses for traders but also alters market sentiment, often resulting in increased caution from investors in subsequent trading sessions.

Moreover, liquidity constraints may arise as traders adjust their positions or exit the market out of fear. This change in liquidity can, in turn, affect the pricing and availability of cryptocurrencies across exchanges. Understanding the effects of liquidation events is crucial for participants within the cryptocurrency market, as it enables them to navigate these turbulent waters more effectively and identify potential recovery points.

Analyzing Coinglass Data for Market Insights

Coinglass has established itself as a key player in providing data and analytics within the cryptocurrency landscape. By monitoring liquidation events, this platform offers vital insights into trader behaviors and market reactions. For instance, their report detailing the recent liquidation figures highlights how concentrated long positions lead to significant financial impact, enabling traders to better understand potential scenarios in future market movements.

Furthermore, analyzing its data can assist in identifying patterns that correlate with market trends, including how sudden price changes affect liquidations. The comprehensive analytics provided by Coinglass empower both novice and seasoned traders to make more informed decisions, ultimately fostering a more educated trading environment within the cryptocurrency sphere.

Risk Management Strategies in Cryptocurrency Trading

In light of the recent massive liquidations in the cryptocurrency market, the importance of robust risk management strategies cannot be overstated. Traders must be equipped with tools and knowledge to mitigate losses, especially in such a volatile environment. Risk management techniques, including setting stop-loss orders and diversifying portfolios, can protect traders from the unpredictable nature of liquidations that have resulted in considerable losses.

Education on risk management principles is vital for anyone looking to participate in cryptocurrency trading. Understanding how leverage impacts liquidations and being aware of market conditions can dramatically reduce exposure to potential financial setbacks. Therefore, traders should continually evaluate their strategies and adapt to changing market dynamics to enhance their resilience against adverse liquidation events.

The Role of Market Sentiment in Liquidations

Market sentiment plays a pivotal role in the cryptocurrency market, influencing both trader behavior and ensuing liquidations. A shift in sentiment can quickly lead to a drastic alteration in market dynamics, as evidenced by the recent liquidation of long positions amidst bearish trends. Traders often rely on sentiment analysis to gauge the market direction, but misreading signals can result in heavily leveraged long positions facing liquidation.

Understanding sentiment indicators can empower traders to adapt more swiftly to changing market conditions. When negative sentiment prevails, as seen in the $202 million worth of liquidations, traders can recalibrate their strategies to minimize risks. Monitoring news developments, market analytics, and trader attitudes can offer insights that help avoid falling victim to sudden market downturns.

Consequences of High Liquidation Rates on Investors

High liquidation rates, such as the recent spike seen in the cryptocurrency market, lead to a cascade of consequences for investors. As liquidations push asset prices down, many holders experience significant losses, prompting fear and uncertainty within the trading community. This creates a ripple effect, dissuading potential investors from entering the market and decreasing overall market activity.

The psychological impact of witnessing substantial liquidations can also prompt a more conservative investment strategy among traders, reducing their willingness to engage in high-risk, high-reward trading. Consequently, market liquidity may be affected, which can complicate recovery and slow down potential bullish reversals. Therefore, understanding these consequences is essential for both new and seasoned investors in navigating the cryptocurrency landscape.

Future Outlook of Liquidations in the Cryptocurrency Market

Looking forward, the future of liquidations in the cryptocurrency market remains uncertain, heavily influenced by the underlying market volatility. With ongoing regulatory developments and potential shifts in investor sentiment, the possibility of further large-scale liquidations looms. Traders must stay attuned to market signals and be prepared for rapid changes that could trigger more liquidations, especially in heavily leveraged pools.

While trader education and risk management strategies will play crucial roles in mitigating the effects of potential liquidations, technological advancements in trading platforms may also offer better tools for risk assessment. Innovations in analytics can provide real-time insights, enabling traders to make more educated decisions and potentially reducing the scale of future liquidations.

Leveraging Technology to Manage Liquidation Risks

Advancements in technology have ushered in new tools for managing liquidation risks in cryptocurrency trading. Platforms that incorporate AI and machine learning can analyze market trends, warning traders of potential liquidation scenarios based on historical data and current market conditions. Such predictive analytics can help traders make timely adjustments to their positions, potentially averting significant losses during volatile periods.

Moreover, increased transparency in trading platforms enables greater visibility into market movements and liquidation statistics. By utilizing data from sources like Coinglass, traders can better understand market behavior and anticipate liquidation thresholds that could impact their trading strategy. Leveraging these technological advancements is crucial for modern traders aiming to minimize risks and adapt to the rapidly changing cryptocurrency landscape.

Frequently Asked Questions

What factors contribute to cryptocurrency market liquidations?

Cryptocurrency market liquidations are primarily influenced by price volatility, margin trading, and market sentiment. When prices fall rapidly, traders holding long positions may face liquidation as their collateral becomes insufficient to cover losses. Likewise, excessive leverage can amplify these liquidations, leading to significant market movements.

How do long positions affect cryptocurrency liquidation rates?

In the context of cryptocurrency liquidation, long positions are particularly susceptible to being liquidated during a market downturn. Recent data showed that 69% of the total liquidations in the cryptocurrency market were long positions, indicating that many traders were unable to maintain their investments as prices declined.

What role does Coinglass data play in understanding cryptocurrency liquidations?

Coinglass data provides real-time insights into cryptocurrency liquidations, helping traders monitor market dynamics. For instance, the recent report indicated a total liquidation amount of $202 million, with 158,173 traders affected. Analyzing Coinglass data allows investors to better understand market trends and potential risks associated with long and short positions.

Why is it important to monitor short positions during cryptocurrency liquidations?

Monitoring short positions during cryptocurrency liquidations is crucial as it provides a counterbalance to long position dynamics. Despite long positions dominating liquidations recently, understanding short positions, which amounted to $62.349 million, can offer insight into market sentiment and potential reversals, helping traders make informed decisions.

What was the highest liquidation reported in the cryptocurrency market recently?

The highest liquidation reported in the cryptocurrency market recently occurred on the Hyperliquid platform, specifically for Bitcoin (BTC-USD), totaling $5.8577 million. Monitoring such significant liquidations can provide insights into trading behaviors and potential market impacts.

How does cryptocurrency liquidation affect market stability?

Cryptocurrency liquidation can greatly impact market stability. Large liquidations, like the $202 million observed recently, can lead to increased volatility, triggering further sell-offs. Understanding the patterns of liquidations can help traders gauge market sentiment and potential price fluctuations.

What percentage of liquidations in the cryptocurrency market are long positions?

According to recent data, approximately 69% of liquidations in the cryptocurrency market were long positions. This statistic highlights the risks associated with holding long positions during volatile market conditions.

| Key Statistic | Value | |

|---|---|---|

| Total Liquidation Amount | $202 million | |

| Percentage of Long Liquidations | 69% | |

| Total Number of Liquidated Individuals | 158,173 | |

| Total Long Liquidation Amount | $140 million | |

| Total Short Liquidation Amount | $62.349 million | |

| Largest Single Liquidation | $5.8577 million | |

Summary

Cryptocurrency liquidation has significantly impacted the market, with a total of $202 million liquidated in just 24 hours. The overwhelming majority of these liquidations involved long positions, making up about 69% of the total. As market volatility continues, traders should remain cautious, keeping in mind the risks of liquidation, especially during such tumultuous periods.