XRP exchange reserves have reached an all-time low not seen in eight years, prompting a deep dive into the implications of such a decline on XRP’s overall market landscape. With Binance XRP reserves plummeting to around 2.6 billion, this trend sparks questions about liquidity and its potential impact on XRP price movements. As cryptocurrency trends shift, investors and analysts are eager for insight into how these dynamics may influence upcoming XRP price analysis. Historical data XRP provides a critical backdrop, revealing past patterns that could indicate whether this reduced reserve situation is a precursor to a significant market rally or simply an expected correction phase. Understanding the link between XRP exchange reserves and market dynamics can help investors navigate the complexities of their trading strategies effectively.

The current situation regarding XRP’s on-exchange supply is raising significant interest among cryptocurrency enthusiasts. A notable dip in collateral hosted on trading platforms, particularly Binance’s XRP stock, has stirred conversations about the broader implications for crypto market participants. As these dynamics play out, market participants often look at prior instances of low exchanges to gauge potential outcomes. Evaluating historical performance metrics can provide valuable context for interpreting recent fluctuations and aligning expectations with market potential. Additionally, these developments shed light on shifting investor behavior and the flow of assets among various wallets amid changing market conditions.

XRP Exchange Reserves: Understanding the Trends

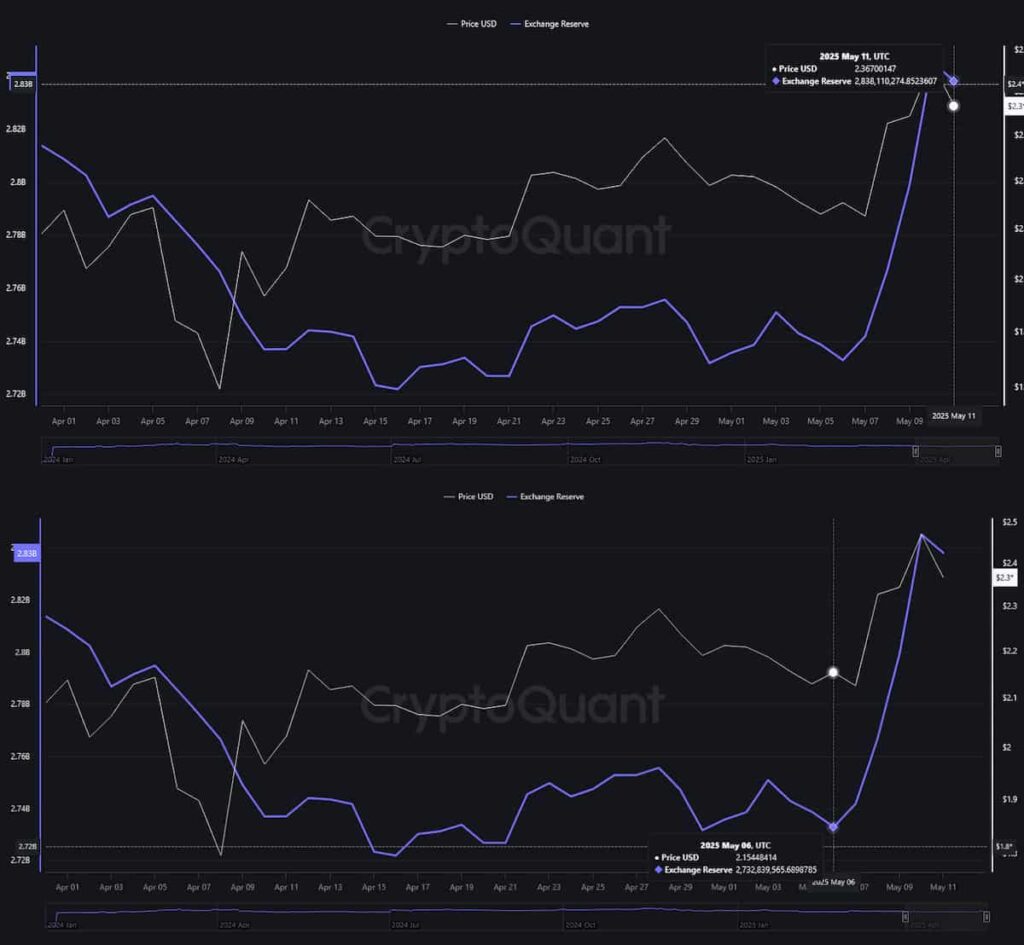

Recent data shows that XRP exchange reserves have plunged to their lowest levels in eight years, challenging the widely circulated narrative that such tight supply conditions automatically lead to price surges. Historically, low reserves on exchanges, particularly on platforms like Binance, have not consistently resulted in immediate bullish sentiment. Instead, they often preceded extended periods of stagnation, as observed in data reflecting similar trends since 2018.

In late December 2025, Binance’s XRP reserves were pegged at approximately 2.6 billion, echoing the conditions seen in July 2024. This raises critical questions about whether the current decrease in liquidity indicates an impending rally or is simply a symptom of market correction dynamics. Analyzing this trend requires looking beyond the numbers, considering factors such as market perception, trading patterns, and overall cryptocurrency trends, all of which significantly impact the price volatility of XRP.

Cryptocurrency Trends Impacting XRP Prices

As the cryptocurrency market continues to evolve, various trends emerge that can greatly influence the price of XRP. The pattern of declining exchange reserves is particularly noteworthy, as it often leads to speculative behavior among traders. The prevailing belief is that reduced supply should prompt price increases, a perception that might not hold true based on historical data. Recent XRP price analysis indicates that while tight supply situations can create price upward pressure, they frequently coincide with periods of market correction, leading to a more complex picture.

Moreover, the interplay between XRP’s market dynamics and external factors, such as regulatory developments or institutional interest, can heavily sway investor sentiment. This complexity makes it essential for investors to stay informed on XRP historical data and market shifts, rather than relying solely on traditional indicators like exchange reserves. Understanding broader cryptocurrency trends can provide a more accurate outlook on where XRP’s price might be headed next.

Historical Data of XRP: Key Insights

Examining historical data related to XRP provides valuable insights into its price behavior and trading patterns. The periods of low exchange reserves observed, particularly on Binance, serve as critical reference points for analysis. For example, following the low XRP reserves in July 2024, XRP saw a rally, but that increase did not occur immediately. Instead, it was several months before significant price movements were recorded, suggesting that historical patterns can often reveal more about market psychology than immediate supply-demand mechanics.

Further analysis shows that XRP has experienced multiple cycles where reduced exchange reserves were misinterpreted as signals for impending rallies. These historical cases often resulted in unexpected price drops or stagnant performance despite seemingly bullish indicators. Therefore, investors must recognize these patterns and consider potential market dynamics at play when evaluating the implications of XRP’s current exchange reserve situation.

Market Dynamics and Their Influence on XRP

Market dynamics surrounding XRP have shown significant fluctuations, especially during periods of both high and low exchange reserves. As illustrated by recent price movements, when Binance’s reserves drop below a certain threshold, reactions can be mixed, with traders exhibiting both bullish optimism and caution. This unpredictability underscores the need for thorough analysis beyond simple supply metrics, taking into account market sentiment, trading volume, and external economic conditions.

In the past, XRP has often found itself at a crossroads when facing these market dynamics. The interplay between exchange liquidity and investor behavior can drastically alter price trajectories. As seen in exchanges with falling reserves, the resulting liquidity crunch often leads to pricing pressures that could either suppress or transiently spike XRP value, highlighting the necessity for traders to adapt their strategies in real-time to these evolving market conditions.

The Future of XRP: Speculation and Predictions

As speculation around the future of XRP intensifies, key insights can be drawn from current trends and historical performance. Analysts suggest that while the current low exchange reserves may indicate tightening supply, this does not guarantee an imminent price increase. The cryptocurrency landscape is influenced by numerous factors, including regulatory changes and macroeconomic conditions, which could play pivotal roles in determining XRP’s next moves.

Predictions in the cryptocurrency realm can be fraught with uncertainty. However, as XRP stands at a critical juncture with historically low exchange reserves, the development of catalysts such as increased institutional adoption or favorable regulatory news could act as pivotal points for future price adjustments. Investors are keenly focused on whether XRP will break its historical mold and achieve sustainable growth amid the current market dynamics.

Profit-Taking Behavior: A Challenge for XRP

The phenomenon of profit-taking is becoming increasingly prominent as XRP’s price experiences volatility, especially following key resistance and support levels. As observed in the recent decline of Binance reserves, instances of profit-taking often coincide with tighter supply environments, complicating the typical bullish narrative. This creates a scenario where traders may opt to liquidate their positions, fearing price corrections despite purported tight supply.

Analyzing past performance, it becomes clear that profit-taking combined with a dwindling number of tokens available on exchanges can lead to price suppression rather than elevation. Investors need to manage their strategies carefully in this environment, as misinterpreting tight supply as a direct trigger for price increases can result in missed opportunities or unexpected losses.

The Reality of XRP’s Low-Reserve Scenario

The current scenario of XRP’s low reserves presents both opportunities and challenges for investors. The allure of tight supply often ignites speculative behavior, leading traders to anticipate sharp price increases. However, historical instances show that these low levels do not always guarantee immediate upward movements in price, and in some cases, they have led to prolonged stagnation.

Understanding the underpinnings of XRP’s market dynamics is vital in navigating this low-reserve scenario. Factors such as macroeconomic influences, regulatory developments, and changes in trading behavior contribute significantly to the interpretation of exchange reserve data. As the crypto market navigates these complexities, attention to detailed analytics and historical trends will be essential for informed trading decisions.

XRP Price Movements: A Comparative Analysis

To better understand XRP’s recent price movements, a comparative analysis of its historical price patterns reveals significant insights. Despite evidence suggesting that tight supply conditions often coincide with price increases, the reality has shown that such situations do not always materialize into immediate gains. Notably, during previous periods of low exchange reserves, XRP experienced both upward spikes and unexpected corrections.

By comparing various periods of price action against exchange reserve levels, traders can glean important lessons from past trends. This analysis not only highlights the role of Binance XRP reserves but also emphasizes the importance of broader market sentiment and external influences on price trajectories. Being cognizant of these historical comparisons can aid investors in developing robust strategies tailored to current market conditions.

The Role of Institutional Interest in XRP’s Future

Institutional interest in XRP has been a topic of discussion among analysts, especially in the context of its current low exchange reserves. The influx of institutional capital can provide substantial support for price resilience, even amid tightening liquidity conditions on exchanges. As institutions explore cryptocurrencies as a legitimate investment avenue, the implications for XRP could be profound, potentially fueling demand that offsets the effects of decreasing supply.

However, the relationship between institutional interest and XRP’s pricing is multifaceted. While increased participation from institutional investors might signal a positive outlook, it also necessitates a more profound understanding of how these players interact with market liquidity. Historical data demonstrates that institutional buying pressures can alleviate some of the vulnerabilities associated with low exchange reserves, yet the overall market context remains a pivotal factor in determining XRP’s future performance.

Frequently Asked Questions

What are the implications of XRP exchange reserves hitting an 8-year low?

XRP exchange reserves dropping to an 8-year low suggests reduced liquidity in the market and can indicate potential upward price movements in the future. However, historical data shows that similar low-reserve conditions have often led to periods of stagnation or declines rather than immediate rallies.

How do Binance XRP reserves influence XRP price analysis?

Binance XRP reserves are critical to XRP price analysis, as fluctuations in supply can impact price dynamics. A tight supply may suggest potential upward pressure on prices, but the historical context indicates that such conditions don’t automatically lead to significant price increases.

What historical data XRP can help predict future market dynamics?

Historical data XRP reveals patterns in price movements relative to exchange reserves, showing that previous lows in reserves often coincided with price declines or stagnation before any meaningful rally.

Why did Binance XRP reserves fall below 2.7 billion in December 2025?

Binance XRP reserves fell below 2.7 billion in December 2025 due to a combination of profit-taking and a shift towards self-custody among investors, reflecting a cautious market environment and potentially impacting future liquidity.

What does a decrease in XRP exchange reserves mean for cryptocurrency trends?

A decrease in XRP exchange reserves can suggest shifts in cryptocurrency trends, such as increased self-custody or movement to ETFs, impacting overall market dynamics and trading behaviors.

Are low XRP exchange reserves a reliable indicator for future price rallies?

Low XRP exchange reserves are not necessarily reliable indicators for future price rallies, as past instances show they often precede periods of price stagnation rather than immediate bullish movements.

How do Binance’s decreasing XRP reserves correlate with overall XRP market dynamics?

Binance’s decreasing XRP reserves correlate with overall XRP market dynamics by indicating lower liquidity, which may affect trading patterns and price stability, often leading to market corrections over time.

Can the current state of XRP reserves inform investors about potential price movements?

The current state of XRP reserves can inform investors about potential price movements, but it should be viewed in conjunction with broader market trends and historical patterns to gauge possible outcomes.

| Key Point | Details |

|---|---|

| XRP Reserves at 8-Year Low | XRP balances on exchanges have fallen to their lowest level since 2018. |

| Binance’s Current Status | XRP reserves on Binance dropped to approximately 2.6 billion as of December 2025. |

| Historical Context | Previous similar reserves did not lead to immediate price increases, indicating tight supply may not mean imminent rallies. |

| Price Fluctuation Patterns | Historically, XRP’s price increased after reserves were replenished, not when reserves were at their lowest. |

| Current Market Behavior | Tight supply observed with no significant upward price movement, as liquidity appears reduced during corrections. |

| ETF Influence | Current decline in reserves occurs amidst high ETF inflows, shifting supply away from exchanges. |

Summary

XRP exchange reserves are at an eight-year low, raising questions about future price movements. The historical analysis suggests that while low exchange reserves might indicate a potential accumulation phase, they do not guarantee immediate price surges. Instead, tighter liquidity has typically resulted in slowing price growth rather than rapid increases. As the market evolves, the impact of factors such as ETF activity further complicates the relationship between supply and price, emphasizing the need for caution in interpreting reserve levels as bullish signals.