Bitcoin moving averages have become a focal point for investors looking to predict price fluctuations in the ever-volatile cryptocurrency market. As analysts closely monitor indicators like the 10-week and 50-week moving averages, the implications of a crossover are often significant. Recent discussions have pointed to historical patterns where such crossovers have preceded dramatic corrections, sparking concerns about potential market downturns. Many traders are now analyzing past Bitcoin correction history to anticipate what might come next, especially with current cryptocurrency trends suggesting a possible decrease in Bitcoin’s value. Understanding these moving average trends is essential for making informed Bitcoin price predictions amid market uncertainty.

When discussing Bitcoin’s price movements, many turn to technical indicators like moving average patterns to gauge market sentiment. These statistical tools not only help in identifying potential entry and exit points but also reveal crucial moments when market corrections might occur. By examining historical instances of moving average crossovers, crypto enthusiasts can better appreciate the dynamics of price fluctuations. As traders engage in cryptocurrency analysis, recognizing these indicators can provide insights into future price corrections, thus enhancing their understanding of overall market trends. For anyone invested in Bitcoin, familiarity with these terms and concepts is vital to navigate the complexities of digital asset trading.

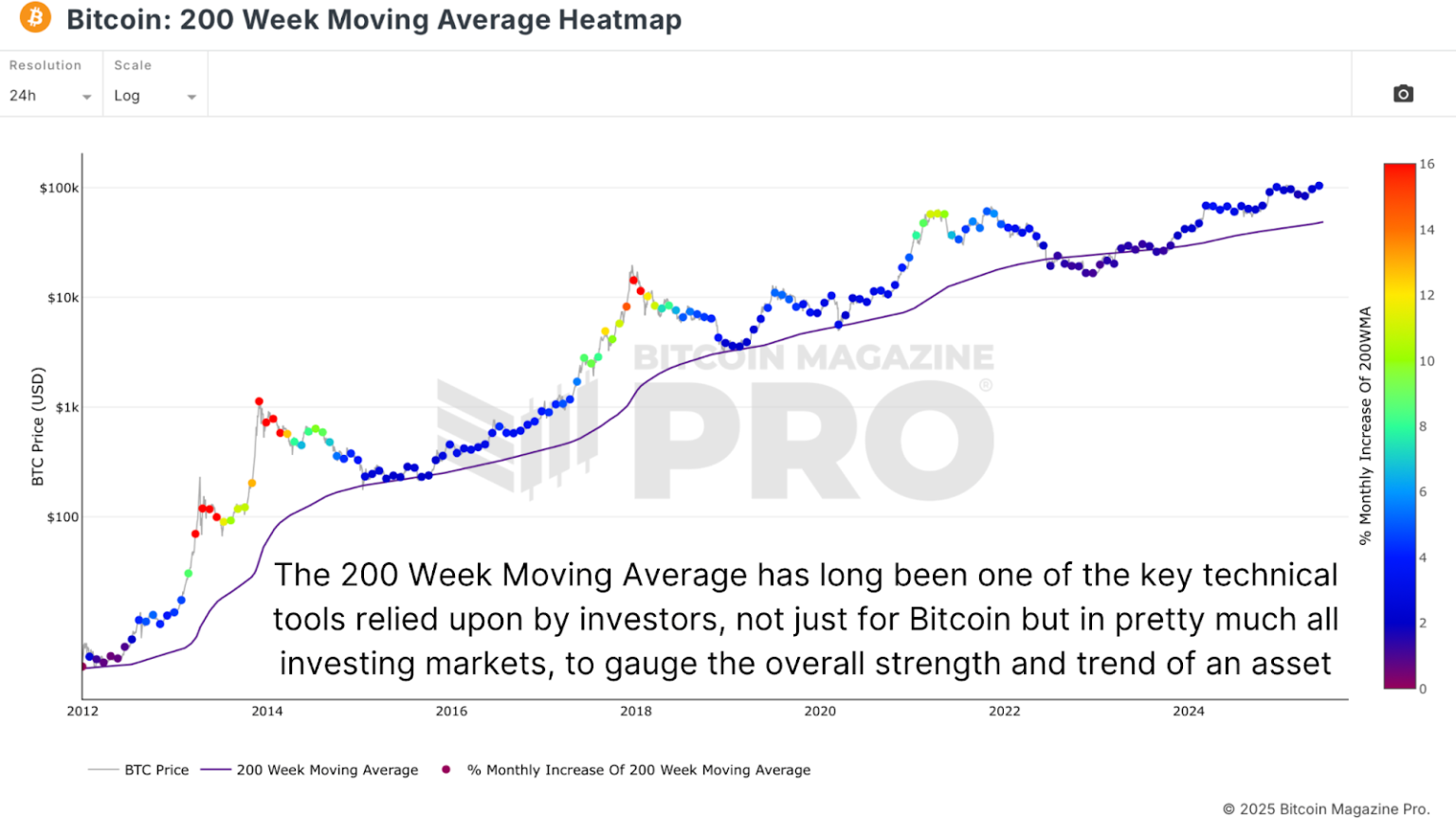

Understanding Bitcoin Moving Averages

Bitcoin moving averages are vital indicators that help traders and investors make informed predictions about future price trends. The two most commonly referenced moving averages are the 10-week and the 50-week averages. When these two moving averages cross each other, it is considered a significant event in the crypto community. Analysts watch these movements closely, as they often precede substantial price changes; for instance, a crossover can signal bullish or bearish market conditions, depending on the direction of the crossing.

In the context of Bitcoin price prediction, the crossing of the 10-week and 50-week moving averages can indicate a potential market reversal. If the short-term average surpasses the long-term average, it signals bullish momentum. Conversely, when the short-term average falls below the longer-term average, it could indicate a bearish trend or an impending correction. Understanding these dynamics is crucial for anyone involved in cryptocurrency analysis, as they can provide insight into future trends and price movements.

Historical Bitcoin Correction Patterns

History reveals that Bitcoin often experiences significant corrections after moving average crossovers. For example, such crossovers preceded notable declines in 2014, 2018, 2020, and 2022, where Bitcoin saw prices drop by 67%, 54%, 53%, and 64%, respectively. These historical patterns suggest that the current market situation may lead to a similar correction in the future. For traders, reviewing these past incidents can be essential in preparing for potential downturns, enabling them to adopt strategic positions ahead of time.

The data shows that after the recent crossover of the 10-week and 50-week moving averages, analysts anticipate a correction could take Bitcoin to between $38,000 and $50,000. If this scenario unfolds, it would align with the historical volatility characters of cryptocurrency trends, reminding investors of the unpredictable nature of digital assets. Investors should remain alert and consider leveraging moving average strategies alongside other analytical tools to navigate potential market corrections effectively.

Exploring the causes behind these corrections is equally as important. Market sentiment, regulatory changes, and macroeconomic factors play significant roles in influencing Bitcoin’s price dynamics. For instance, sudden news regarding government regulations or technological advancements in the blockchain space can trigger instabilities contributing to the price changes observed during previous correction phases. Understanding these dynamics can help investors develop a well-rounded strategy, taking historical data into account.

Cryptocurrency Analysis for Informed Decisions

In the fast-paced world of cryptocurrency investing, staying informed through thorough analysis is key. Professional analysts utilize various indicators and trends, including moving average crossover signals, to predict future price movements and market conditions. For investors looking to capitalize on potential price shifts, understanding how to interpret these signals is essential. Tools like stochastic oscillators, the relative strength index (RSI), and volume analysis, combined with moving averages, provide a robust arsenal for efficient cryptocurrency analysis.

Consulting historical patterns alongside current market data can greatly enhance decision-making processes for both novice and experienced investors. As the cryptocurrency market consolidates and volatility persists, an informed approach will help traders avoid potential losses. The insights derived from moving averages and historical corrections empower investors to make strategic decisions regarding entry points, exits, and portfolio adjustments.

Implications of Moving Averages on Trading Strategies

Moving averages are not just for technical analysis; they can significantly impact trading strategies and risk management. When traders recognize crossover patterns, they may decide to buy or sell based on the perceived direction of price movements. For instance, a bullish crossover may prompt traders to go long on Bitcoin, anticipating a price increase. Conversely, recognition of a bearish crossover can lead to taking profit or implementing stop losses to mitigate risks associated with potential downturns.

Additionally, integrating moving average signals with other technical indicators can create a more comprehensive trading strategy. Investors should consider combining moving average analyses with fundamental research and market sentiment evaluation. This multidimensional approach allows traders to develop detailed strategies based on a well-rounded understanding of both data-driven signals and external factors influencing the cryptocurrency market.

Navigating Market Volatility with Moving Averages

Market volatility is a hallmark of the cryptocurrency space, often leading to panic and hasty decisions among traders. However, moving averages can be leveraged to navigate turbulent times by offering clear signals for potential market shifts. By identifying key moving average levels and crossover points, traders can establish more disciplined trading tactics, reducing the impulsiveness that often accompanies price fluctuations.

Moreover, during periods of heightened market volatility, maintaining a focus on moving average trends may help investors stay calm. Instead of reacting to daily price swings, aligning their strategies with established moving average patterns can contribute to sounder decision-making and long-term investment success. By trusting the indicators provided through moving averages, investors can steer their portfolios more confidently through uncertain market climates.

The Role of Market Sentiment in Bitcoin Trends

Market sentiment plays a pivotal role in influencing cryptocurrency prices, often spurring movements that even solid technical signals may not predict. Investor psychology can drive sharp rises or drops, independent of technical indicators. Understanding how market sentiment intertwines with cryptocurrency trends is crucial for interpreting the implications of moving averages in real-world trading situations.

For instance, a generally bullish sentiment might prompt investors to overlook the bearish signals provided by a moving average crossover. Conversely, if market sentiment is overwhelmingly negative, it can amplify the impact of a bearish crossover, resulting in exacerbated price drops. By examining market sentiment in conjunction with moving averages, traders can develop a more nuanced perspective on potential price trends and corrections.

Learning from Previous Bitcoin Market Cycles

Studying past market cycles provides valuable lessons for navigating the cryptocurrency landscape. Each cycle showcases the impact of moving average crossovers, corrections, and market sentiment shifts over time. For instance, Bitcoin’s early years reflected tremendous price volatility, with numerous corrections following significant crossover events, acting as a reminder of the cyclical nature of cryptocurrencies.

By analyzing these historical cycles, investors gain insight into development patterns and can better anticipate future trends. Engaging in cryptocurrency analysis that incorporates a retrospective understanding of market behaviors allows traders to cultivate resilience and strategic foresight, especially during uncertain times when moving averages may signal incoming corrections or price recoveries.

Future Projections for Bitcoin Prices

With the recent crossing of the 10-week and 50-week moving averages, discussions surrounding the future trajectories of Bitcoin prices have intensified. Experts are predicting a potential decline based on historical patterns, estimating prices could retreat to ranges between $38,000 and $50,000. Thus, market participants are contemplating various strategies to either safeguard profits or position for future rebounds.

In considering future projections, it’s imperative to factor in prevailing crypto trends such as increased institutional interest and potential regulatory implications. The landscape of cryptocurrency is continuously evolving, impacting both technical indicators like moving averages and the broader market sentiment. Observing how these dynamics interplay will be essential for making predictions about the next phases of Bitcoin’s price journey.

Integrating Moving Averages into a Comprehensive Trading Plan

Developing a robust trading plan involves integrating moving averages along with other technical indicators and fundamental insights. For those considering entry and exit points in Bitcoin trading, the significance of moving average crossovers cannot be overstated. Incorporating this information into a broader trading framework can facilitate better timing of trades and enhanced risk management.

Moreover, a comprehensive trading plan should accommodate varying market conditions, especially given the volatility inherent to cryptocurrency markets. Establishing protocols for mitigating risks through stop-loss orders or flexible trading strategies can provide security during unpredictable price movements. By harnessing insights from moving averages alongside other tools, traders can create a balanced approach that leverages both technical foresight and risk mitigation.

Frequently Asked Questions

What does the crossover of Bitcoin’s 10-week and 50-week moving averages indicate?

The crossover of Bitcoin’s 10-week and 50-week moving averages can signal potential shifts in market trends. Historically, this pattern has preceded significant price corrections, such as the drops in 2014, 2018, 2020, and 2022. Investors often monitor these moving averages as part of their cryptocurrency analysis to predict upcoming corrections.

How can Bitcoin moving averages inform price prediction?

Bitcoin moving averages, such as the 10-week and 50-week averages, are essential tools for price prediction. Analysts look at the interactions between different moving averages to assess market momentum. A crossover can suggest that the current price trend may reverse, providing critical data for forecasting future price movements.

What is the significance of Bitcoin correction history in understanding moving averages?

Bitcoin correction history is crucial for understanding moving averages. Each previous correction, often following moving average crossovers, reveals patterns that can assist investors in anticipating potential downturns. By studying historical data, traders can better gauge how drastic future corrections might be following similar trends.

What recent cryptocurrency trends relate to Bitcoin moving averages?

Recent cryptocurrency trends have shown that Bitcoin moving averages can signal potential market corrections. The latest crossover of the 10-week and 50-week moving averages aligns with past trends of significant declines. Observers note that understanding these trends can help investors make informed decisions during volatile periods.

How do traders use moving average crossovers in cryptocurrency analysis?

Traders utilize moving average crossovers in cryptocurrency analysis to identify potential buy and sell signals. When the shorter moving average crosses above the longer one, it may indicate a bullish trend, while the opposite crossover can signal a bearish trend, often forecasting corrections in Bitcoin’s price.

What are the potential price implications if Bitcoin experiences a correction after a moving average crossover?

If Bitcoin experiences a correction following a moving average crossover, historical patterns suggest a possible 50%–60% decline. This could potentially lower its value to between $38,000 and $50,000, as seen in past corrections. Investors should be cautious and prepare for such scenarios when analyzing Bitcoin’s market behavior.

| Key Point | Details |

|---|---|

| Crossover of Averages | The 10-week and 50-week moving averages of Bitcoin have crossed. |

| Historical Corrections | Historically, such crossovers have led to significant price corrections. |

| Previous Drops | – 67% drop in September 2014 – 54% drop in June 2018 – 53% drop in March 2020 – 64% drop in January 2022 |

| Potential Future Correction | A potential correction of 50%-60% may bring Bitcoin’s price down to between $38,000 and $50,000. |

Summary

Bitcoin moving averages indicate a crucial point for traders and investors, as the recent crossover of the 10-week and 50-week moving averages suggests a possibility of a significant correction ahead. Past trends show that such crossovers have often been precursors to deep price drops, as witnessed in 2014, 2018, 2020, and 2022. If the history of Bitcoin’s moving averages continues to unfold similarly, we could be looking at a substantial decline in the near future, highlighting the importance of monitoring these indicators closely for future investment decisions.

Related: More from Bitcoin News | BTC ETFs See $1.1B Inflows in Three Days, Set for Biggest Week | ETF Holders Preempt Potential Bitcoin Price Drop Below $60K