Hyperliquid Margin Trading is revolutionizing the way traders engage with the cryptocurrency market, allowing for advanced strategies leveraging USDC deposits to amplify potential gains. Recently, an intriguing event was highlighted by on-chain analysis, where a single address deposited a significant 8 million USDC as margin on the Hyperliquid platform. This ambitious move enabled the opening of multiple long positions in various crypto assets such as IP, XPL, and MON, totaling an impressive position value of 13.76 million USD. Despite the current floating loss of 12,000 USD on these trading positions, the opportunities for profit in such a volatile market can be immense. By utilizing margin trading, users can effectively capitalize on price fluctuations, showcasing the power of technology in today’s financial landscape.

The concept of leveraging assets through margin trading in digital currencies is gaining traction, particularly on platforms like Hyperliquid. Utilizing substantial USDC inflows can set the stage for traders to manipulate their exposure in the crypto arena effectively, especially by initiating various long and short trading strategies. Insights from comprehensive on-chain evaluations reveal how significant transactions can influence market dynamics, exemplified by recent deposit activities. With traders venturing into diverse cryptocurrencies under fluctuating conditions, the importance of strategic positioning cannot be overstated. Overall, engaging in margin trading not only enhances potential returns but also reflects the evolving nature of financial transactions in the digital age.

Understanding Hyperliquid Margin Trading

Hyperliquid Margin Trading is a pioneering platform that allows traders to leverage their positions with cryptocurrency assets. This innovative trading method combines high liquidity with the ability to open long positions using margin deposits like USDC. Recently, an example of this was observed with an address that deposited 8 million USDC as margin, leading to substantial trading positions on various cryptocurrencies. With a total position value exceeding 13.76 million USD, traders can effectively maximize their potential returns in volatile markets.

The Hyperliquid platform offers advanced tools for engaging in margin trading, including functionalities for on-chain analysis. Understanding patterns and overall market sentiment through these analytical lenses is crucial for traders looking to capitalize on price movements. Information such as trading volumes, historical price data, and the behavior of specific assets, help inform decisions to manage risks effectively and optimize gains when operating with long positions in crypto.

The Impact of USDC Deposits in Trading Strategies

USDC, a stablecoin backed by US dollars, plays a vital role in the crypto market as it provides liquidity and stability for traders. By depositing USDC as margin, traders can open long positions with confidence, knowing their investment is backed by a stable asset. Recently, a significant deposit of 8 million USDC was made on the Hyperliquid platform, enabling the trader to engage in multiple long positions across various tokens without the concern of excessive volatility affecting their margin.

Incorporating USDC deposits into trading strategies allows for greater flexibility in managing risk and executing trades promptly. Traders can open leveraged positions while ensuring they have a secure foundation to fall back on, especially during market fluctuations. The stability of USDC alongside the dynamic nature of margin trading provides opportunities for profit maximization through various cryptocurrencies such as IP, XPL, and STBL.

Analyzing Long Positions in Cryptocurrency Trading

Long positions in cryptocurrency trading involve buying assets with the expectation that their value will increase over time. This strategy can be particularly profitable during bullish market conditions. For instance, the recent movements on the Hyperliquid platform, where long positions were opened on multiple assets valued between 600,000 to 2 million USD, show the potential for substantial gains. However, traders must also prepare for the possibility of floating losses, reflecting the volatile nature of the crypto market.

Effective analysis of long positions requires utilizing various tools, including on-chain analysis. By examining transaction histories and market trends, traders can gain insights into potential price movements and optimize their positions accordingly. Understanding the correlation between different trading pairs and overall market trends is essential for enhancing decision-making when operating on platforms like Hyperliquid.

Utilizing On-Chain Analysis for Trading Optimization

On-chain analysis refers to the analysis of blockchain data to assess the health and trends of cryptocurrency assets. This method provides unique insights that traditional analysis may not capture. By utilizing on-chain data, traders can monitor significant events, such as large USDC deposits, that indicate potential market movements. For example, the monitoring of a single address that deposited 8 million USDC on Hyperliquid showcases how on-chain analysis can inform trading decisions and strategies.

Traders leveraging on-chain analysis are better equipped to identify patterns that precede price rallies or drops. This capability enhances their ability to open and manage long positions effectively. Furthermore, understanding blockchain transaction trends allows traders to react swiftly to market changes, ensuring they maximize their potential returns while minimizing exposure to risk.

Maximizing Returns with the Hyperliquid Platform

The Hyperliquid platform is designed for traders seeking to maximize their returns through strategic margin trading. By offering high liquidity and the ability to open long positions with various cryptocurrencies, traders can capitalize on price increase opportunities. The recent activity of an address opening long positions valued at over 13.76 million USD using USDC deposits exemplifies the platform’s capacity for significant returns when utilized effectively.

Moreover, the platform’s user-friendly interface and tools empower users to navigate the complexities of margin trading confidently. By continuously monitoring positions and leveraging on-chain analysis, traders can stay ahead of market trends and make informed decisions. As seen with the recent trading activities, participating in the Hyperliquid platform can potentially enhance investment strategies and lead to notable profits.

Crypto Trading Positions: Strategies for Success

In the fast-paced world of crypto trading, strategic positioning is vital for achieving success. Traders must develop a robust understanding of their assets and the market conditions that influence price movements. By opening long positions based on careful analysis and market sentiment, such as those recently executed on the Hyperliquid platform, traders can position themselves to benefit from upward price trends effectively.

Successful trading requires more than just choosing the right assets; it demands a comprehensive strategy that incorporates risk management and market research. Monitoring on-chain activity and recognizing pivotal moments, such as large USDC deposits, play a crucial role in shaping trading positions. Implementing a mix of strategies, including analysis of both current trends and historical data, is essential for optimizing returns in crypto trading.

Risk Management in Margin Trading

Effective risk management is essential for margin trading, where the potential for high returns comes with an equal risk of significant losses. Traders on platforms like Hyperliquid must establish pre-defined limits on their positions to safeguard their capital. The recent case of a trader opening multiple long positions — with an aggregate position value of 13.76 million USD yet encountering floating losses — highlights the necessity of vigilance in managing risks.

Utilizing tools such as stop-loss orders and regularly reviewing on-chain data allows traders to adapt to market fluctuations quickly. By setting clear risk thresholds and engaging in thorough market analysis, traders can minimize losses while maximizing the potential upside of their margin positions. Understanding the balance between risk and reward is paramount when participating in volatile crypto markets.

The Future of Crypto Trading on Hyperliquid

The future of crypto trading, particularly on platforms like Hyperliquid, looks promising as new technologies and strategies evolve. As more traders adopt margin trading strategies and utilize stablecoins like USDC, the market will likely see increased liquidity and trading volume. With the implementation of advanced features that support on-chain analysis, traders will be better positioned to navigate the complexities of the cryptocurrency landscape.

Looking ahead, robust market education and resources will play a pivotal role in shaping successful trading strategies. As traders continue to explore long positions and margin trading on Hyperliquid, the importance of comprehensive knowledge and adaptive methodologies will be crucial. Facilitating a community that engages with innovative trading practices will ultimately contribute to the growth and evolution of the crypto trading ecosystem.

Essential Tools for Crypto Traders

In today’s digital trading environment, having the right tools is critical for success in crypto markets. Traders engaging on platforms like Hyperliquid benefit from a suite of analytical and trading tools designed to enhance their trading experience. These tools can include charting software, market analytics, and access to on-chain data, which play vital roles in formulating effective trading strategies.

For instance, employing on-chain analysis allows traders to identify optimal entry and exit points for their positions. By understanding market dynamics through available data and technical indicators, traders can make informed decisions that align with their long positions, ultimately enhancing their profitability. Consequently, investing in robust trading tools is a fundamental aspect of thriving in cryptocurrency trading.

Frequently Asked Questions

What is Hyperliquid Margin Trading and how does it work?

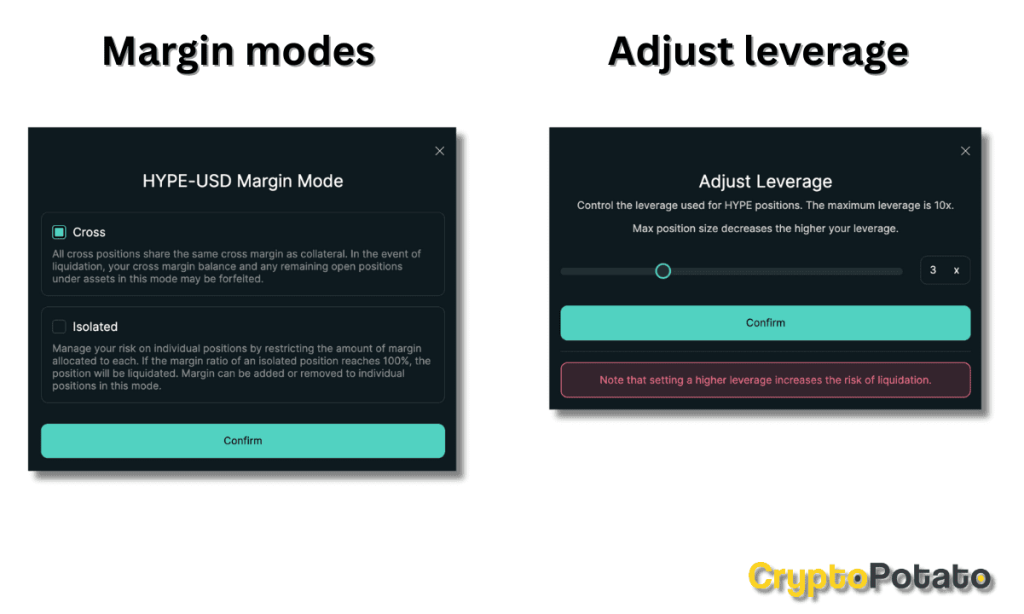

Hyperliquid Margin Trading allows traders to leverage their positions by using borrowed funds, enabling them to trade with a larger capital base than their initial deposit. On the Hyperliquid platform, users can deposit USDC as margin and open various trading positions such as long positions in crypto assets.

How do I deposit USDC for margin trading on the Hyperliquid platform?

To deposit USDC on the Hyperliquid platform, navigate to the deposit section of your account, select USDC from the available options, and follow the instructions to complete the transaction. Once deposited, you can use these funds to open margin trading positions.

Can I open long positions in crypto with Hyperliquid Margin Trading?

Yes, Hyperliquid Margin Trading allows you to open long positions in various cryptocurrencies. By using the margin provided through your USDC deposits, you can amplify your trading strategy and increase potential returns on the Hyperliquid platform.

What are the risks associated with using Hyperliquid Margin Trading?

The main risks of Hyperliquid Margin Trading include liquidations if the market moves against your positions and the potential for significant losses. It’s essential to conduct thorough market analysis, including on-chain analysis, and manage your trading positions carefully to mitigate these risks.

How can on-chain analysis inform my trading positions on Hyperliquid?

On-chain analysis involves examining blockchain data to inform trading decisions. By utilizing on-chain analysis, you can identify trends, monitor large deposits like the recent USDC margins, and make informed decisions when opening long positions or other trading positions on the Hyperliquid platform.

What types of assets can I trade using Hyperliquid Margin Trading?

On the Hyperliquid platform, you can trade various crypto assets including IP, XPL, STBL, and more. Each asset allows for different trading strategies, such as opening long positions, which can be funded with your USDC margin deposits.

What should I do if my margin trading position results in a loss on Hyperliquid?

If your margin trading position results in a loss on Hyperliquid, assess the situation by reviewing your on-chain analysis and market conditions. Consider whether to hold the position in anticipation of a reversal or to reduce losses by closing the position promptly.

How is my profit or loss calculated in Hyperliquid Margin Trading?

Your profit or loss in Hyperliquid Margin Trading is calculated based on the difference between the entry and exit prices of your trading positions, adjusted for your leveraged margin. Keep an eye on real-time updates to remain informed about your portfolio’s performance.

| Key Point | Details |

|---|---|

| Address | 0xEa6…061EE |

| Deposit Amount | 8 million USDC |

| Long Positions Opened | IP, XPL, STBL, MON, PUMP, GRIFFAIN, VVV, AIXBT, HEMI, MAVIA, STABLE |

| Position Value Range | 600,000 to 2 million USD each |

| Total Position Value | 13.76 million USD |

| Current Floating Loss | 12,000 USD |

Summary

Hyperliquid Margin Trading is gaining traction as significant deposits and long positions reflect the strategic moves in the crypto market. Recently, a certain address deposited 8 million USDC for margin trading on Hyperliquid and opened various long positions valued at a total of 13.76 million USD, showcasing both opportunity and risk, with a minor floating loss of 12,000 USD. Such activities indicate heightened interest and confidence in margin trading on platforms like Hyperliquid, highlighting the dynamic nature of cryptocurrency investments.

Related: More from DeFi & Stablecoins | Germany Launches Regulated Stablecoin Pegged to Swiss Franc | U.S. Regulator Challenges Crypto Stablecoins