The Responsible Financial Innovation Act, championed by Cynthia Lummis and supported by the U.S. Senate Banking Committee, marks a pivotal movement in the integration of digital assets into the traditional banking framework. This groundbreaking legislation aims to empower large financial institutions to provide digital asset custody, staking, and payment services under a robust regulatory framework. By recognizing that digital assets are increasingly significant to our financial system, this act could protect consumers while fostering unprecedented growth potential. The forthcoming markup session for the Responsible Financial Innovation Act in January signals that legislators are advancing towards a more inclusive and innovative future for banking regulation. As this legislation unfolds, it is crucial to understand its implications for the integration of digital assets within our banking system and the broader financial landscape.

The recent push for the Responsible Financial Innovation Act represents a transformative step towards modernizing banking practices in the U.S. The act focuses on allowing prominent banks to engage in digital asset management, which encompasses everything from custody services to facilitating staking and payment transactions. By moving digital currencies into regulated environments, the legislation seeks to provide essential consumer protections while capitalizing on the growth opportunities within the financial technology sector. In light of recent discussions within the U.S. Senate Banking Committee, it’s clear that the future of banking regulation is evolving, emphasizing the need for financial system integration with emerging digital markets. Hence, the dialogue surrounding this act not only highlights its significance but also reflects broader trends in how financial institutions will operate in the digital age.

The Responsible Financial Innovation Act: A Pathway to Regulated Digital Assets

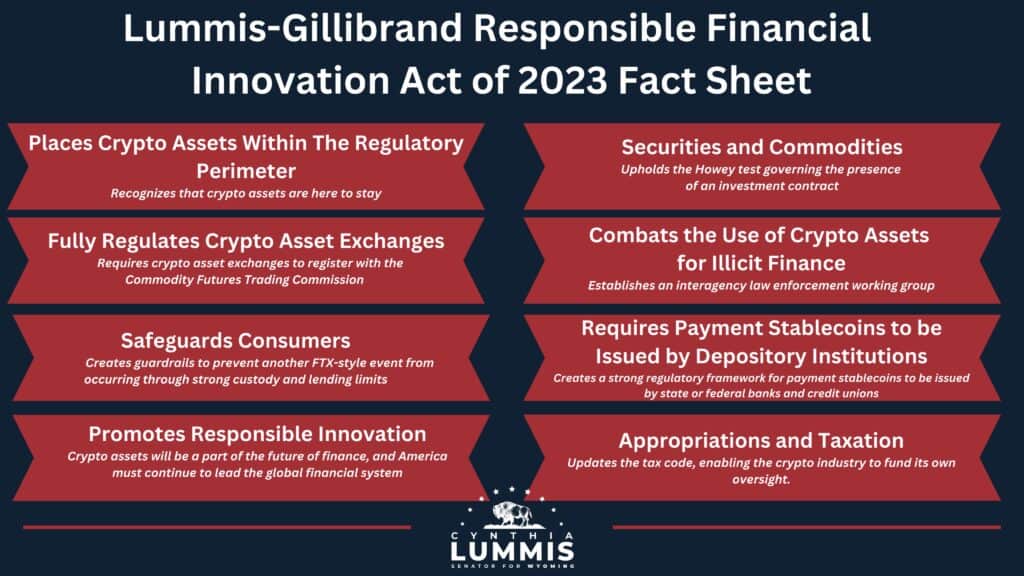

The Responsible Financial Innovation Act, championed by Cynthia Lummis, represents a critical legislative effort to integrate digital assets into the U.S. banking system. This act aims to create a framework that allows large banks to provide digital asset custody, staking, and payment services, all governed by proper regulations. By establishing guidelines, the act seeks to protect consumers from potential risks associated with digital transactions while fostering a promising environment for innovation in the financial sector.

This timely legislation acknowledges the burgeoning role of digital assets in modern finance. With the increasing popularity of cryptocurrencies and other digital currencies, integrating these innovations into the traditional banking infrastructure can enhance the overall financial system. The Responsible Financial Innovation Act not only addresses regulatory concerns but also seeks to ensure that these digital assets coexist safely and harmoniously with established banking practices.

Cynthia Lummis and the Future of Digital Assets in Banking

Cynthia Lummis, as the Chair of the U.S. Senate Banking Committee’s Subcommittee on Digital Assets, is at the forefront of pushing for sound banking regulation specific to digital assets. Her leadership is pivotal in framing policies that could redefine how banks interact with evolving financial technologies. Lummis stresses the need for an integrated approach that would mitigate risks associated with decentralized finance while harnessing the benefits of innovation for consumers and businesses alike.

As discussions on the Responsible Financial Innovation Act progress, Lummis emphasizes that regulated digital asset services provided by banks can facilitate greater public trust and engagement. By enabling banks to participate fully in this space, we can anticipate a more robust and secure financial ecosystem, positioning the U.S. as a leader in digital finance innovation and ensuring that consumers remain protected.

Integrating Digital Assets into Traditional Banking Structures

The integration of digital assets into traditional banking systems presents both challenges and opportunities. On one hand, financial institutions must navigate the intricate landscape of regulations, public perception, and technological readiness. On the other hand, these integrations can lead to competitive advantages and new revenue streams as customer demand for digital asset services rises. Banks that adapt early to these trends stand to benefit significantly.

Moreover, the Responsible Financial Innovation Act outlines necessary protocols for banks engaging in digital asset activities. It underscores the importance of security measures, compliance with anti-money laundering laws, and consumer protection standards. As banks embrace digital assets, these regulatory frameworks will serve as foundational pillars for building trust and stability in an increasingly digitized financial landscape.

Legislative Progress and the U.S. Senate Banking Committee’s Role

The U.S. Senate Banking Committee’s deliberations on the Responsible Financial Innovation Act signify a crucial step in recognizing the value of digital assets within the financial system. As the committee prepares for its markup session, there is a palpable sense of urgency to address the delays spurred by debates over decentralized finance and the broader implications of a lengthy government shutdown. This progress reflects the growing acknowledgment of digital assets as essential components rather than peripheral ones.

Having oversight from influential figures such as Cynthia Lummis helps to navigate the complex interplay between innovation and regulation. This committee’s engagement ensures that the voices of stakeholders, including banks, fintech companies, and consumers, are considered as they work towards a coherent strategy that balances growth with safety in the burgeoning digital asset market.

Consumer Protection in the Era of Digital Assets

One of the primary concerns surrounding the integration of digital assets into traditional banking is consumer protection. As financial systems evolve, lawmakers and regulatory bodies, led by advocates like Cynthia Lummis, are increasingly focused on developing robust safeguards to protect consumers from the unique risks associated with digital assets. The Responsible Financial Innovation Act seeks to establish clear guidelines for banks to follow, ensuring that consumer interests remain at the forefront of any new financial innovations.

Moreover, the act emphasizes transparency and accountability from financial institutions offering digital asset services. By implementing regulatory measures, consumers will be better equipped to navigate the complex landscape of digital financial products, thus increasing their confidence in engaging with banks that offer these services. This proactive approach is vital as it can encourage wider adoption of digital assets while minimizing risks.

How Digital Asset Custody is Shaping Financial Services

Digital asset custody is becoming a cornerstone of financial services, thanks in part to the Responsible Financial Innovation Act’s provisions. As banks are granted the authority to offer custody services for digital assets, it allows them to leverage existing relationships with clients while catering to the growing need for secure storage solutions for cryptocurrencies and other digital holdings. This evolution provides a valuable opportunity for banks to expand their service offerings.

Additionally, custody solutions not only provide security for clients but also pave the way for banks to innovate further with digital asset products. As banks develop new services such as staking and payment processing for digital currencies, it creates a more integrated financial ecosystem benefiting both the institutions and their customers.

The Role of the U.S. Senate: Balancing Innovation and Regulation

The U.S. Senate’s involvement in shaping legislation like the Responsible Financial Innovation Act exemplifies its role in balancing the need for regulatory oversight with fostering financial innovation. The Senate Banking Committee, particularly under the guidance of members like Cynthia Lummis, is tasked with ensuring that advancements in digital assets proceed responsibly. This means creating regulations that protect consumers while not stifling the growth of new financial technologies.

As the Senate prepares for discussions, the focus will inevitably be on how to craft comprehensive regulations that allow for the growth of digital assets while safeguarding the integrity of the financial system. This delicate balance is essential not just for the current landscape but for the long-term sustainability of financial innovations that will shape the future.

Implications of Digital Asset Regulation for Financial Institutions

As the Responsible Financial Innovation Act progresses through the legislative process, financial institutions are closely analyzing the implications of potential regulations on digital assets. Understanding these frameworks will be crucial for banks as they strategize their operational models to incorporate digital asset services. A well-regulated environment can reduce the risks associated with digital currencies while also creating a stable ground for banks to innovate.

Institutions that proactively engage with these regulatory developments, led by voices in the Senate Banking Committee like Cynthia Lummis, may find new opportunities to differentiate themselves in the market. Legislative clarity can allow banks to expand into digital asset markets confidently, potentially leading to an increased customer base and diversified revenue streams as more consumers seek integrated banking solutions for their digital assets.

Looking Ahead: The Future of Digital Finance in the United States

As discussions surrounding the Responsible Financial Innovation Act unfold, the future of digital finance in the United States appears promising. With strong advocacy from leaders like Cynthia Lummis, the integration of digital assets into the mainstream financial system is gaining traction. This movement signifies a pivotal shift towards recognizing the potential benefits that digital asset services can offer both consumers and financial institutions.

Looking ahead, the successful passage of the Responsible Financial Innovation Act could usher in a new era of digital finance, characterized by enhanced security measures, increased consumer protection, and innovative financial products. As banks adapt to this evolving landscape, the U.S. stands to benefit from being a leader in the integrated digital asset space, ultimately driving economic growth and fostering technological progress.

Frequently Asked Questions

What is the Responsible Financial Innovation Act introduced by Cynthia Lummis?

The Responsible Financial Innovation Act, introduced by Cynthia Lummis, aims to integrate digital assets into the U.S. financial system by allowing large banks to provide services such as digital asset custody, staking, and payment processing under regulated frameworks. This initiative is intended to enhance consumer protection while fostering innovation in the financial sector.

How will the Responsible Financial Innovation Act affect banking regulation in the U.S.?

The Responsible Financial Innovation Act is expected to significantly impact banking regulation in the U.S. by formalizing the role of large banks in the digital asset space. By establishing clear regulatory guidelines, the Act seeks to integrate digital assets into traditional banking, ensuring both stability in the financial system and protection for consumers.

What are the expected benefits of the Responsible Financial Innovation Act for digital assets?

The Responsible Financial Innovation Act is anticipated to provide numerous benefits for digital assets, including enhanced legitimacy and acceptance in the banking sector. By allowing regulated banks to offer custody and payment services for digital assets, the Act could lead to increased adoption, consumer protection, and overall market growth for digital financial innovations.

Why is the U.S. Senate Banking Committee focusing on the Responsible Financial Innovation Act?

The U.S. Senate Banking Committee is focusing on the Responsible Financial Innovation Act due to the growing importance of digital assets in the global financial landscape. Chair Cynthia Lummis emphasizes that integrating digital assets into a regulated framework will protect consumers and stimulate economic growth, addressing the challenges posed by decentralized finance and ensuring a robust regulatory environment.

When is the markup session for the Responsible Financial Innovation Act scheduled?

The markup session for the Responsible Financial Innovation Act is expected to be held in the second week of January, following months of deliberation and delays. This session marks a critical step in advancing the Act, which aims to regulate and facilitate the integration of digital assets within the U.S. banking system.

How does the Responsible Financial Innovation Act align with consumer protection in financial systems?

The Responsible Financial Innovation Act is designed to enhance consumer protection by integrating digital assets into a regulated banking environment. By allowing banks to offer services related to digital assets, the Act aims to ensure that consumers are safeguarded against risks while benefiting from the growth and innovation digital assets can bring to the financial system.

What challenges did the Responsible Financial Innovation Act face during its introduction?

The Responsible Financial Innovation Act faced several challenges during its introduction, including concerns from Democratic lawmakers regarding decentralized finance and potential regulatory gaps. Additionally, the prolonged government shutdown in U.S. history contributed to delays in legislative progress, but recent movements within the U.S. Senate Banking Committee suggest a renewed focus on the Act.

Who are the key figures involved in the discussion of the Responsible Financial Innovation Act?

Cynthia Lummis, as the Chair of the U.S. Senate Banking Committee’s Subcommittee on Digital Assets, is a key figure championing the Responsible Financial Innovation Act. Her advocacy highlights the importance of regulatory frameworks for digital assets, showcasing a commitment to modernizing banking practices in relation to emerging financial technologies.

| Key Point | Details |

|---|---|

| Cynthia Lummis’ Role | Chair of the U.S. Senate Banking Committee’s Subcommittee on Digital Assets |

| Purpose of the Act | To allow large banks to provide digital asset custody, staking, and payment services under regulation |

| Importance of Digital Assets | Digital assets are seen as vital to the financial system and their regulation will protect consumers while promoting growth |

| Legislative Progress | The U.S. Senate Banking Committee is expected to discuss the bill in January after previous delays |

| Concerns for Legislation | Previous delays were linked to concerns about decentralized finance and government shutdown issues |

Summary

The Responsible Financial Innovation Act represents a crucial step towards regulating digital assets within the U.S. banking system. By allowing large banks to provide essential services related to digital assets, the act aims to integrate these financial innovations into the mainstream banking framework. This integration is not only expected to safeguard consumers but also catalyze growth in the financial sector. With ongoing discussions and anticipated legislative advancements, the Responsible Financial Innovation Act is poised to usher in a new era for banking in the digital age.

Related: More from Regulation & Policy | Blocks Retreat Signals Broader Payments Shifts | Cardone Announces Real Estate Portfolio Tokenization