The increasing interest in Bitcoin Ethereum ETF demand highlights a pivotal moment in the evolution of cryptocurrency investments within the financial market. However, recent data reveals that despite the buzz, Bitcoin ETF inflows and Ethereum ETF performance are struggling to reflect a robust recovery in interest. As analysts scrutinize cryptocurrency demand, the negative slope in the 30-day moving average ETFs raises eyebrows among investors who closely monitor market trends. With the ongoing volatility in the financial markets, the future of Bitcoin and Ethereum ETFs remains uncertain, yet their role as potential investment vehicles cannot be overlooked. Investors should stay informed as understanding these trends can be crucial for making informed decisions in the ever-evolving landscape of digital assets.

In the dynamic world of cryptocurrency investments, the spotlight is increasingly shifting towards the market for Bitcoin and Ethereum exchange-traded funds. This unfolding scenario illustrates the current state of asset flows and performance metrics, which are integral for assessing the viability of these financial instruments. As the demand for digital assets grows, so does the critical examination of trend indicators such as the 30-day moving average for ETFs. Despite perceived enthusiasm, the data suggests that the segment is still grappling with a decline in net inflows, prompting a deeper analysis of overall market health. Engaging with financial market trends helps shed light on the complex relationship between investors’ appetite for cryptocurrencies and the available investment products.

Understanding Bitcoin ETF Inflows

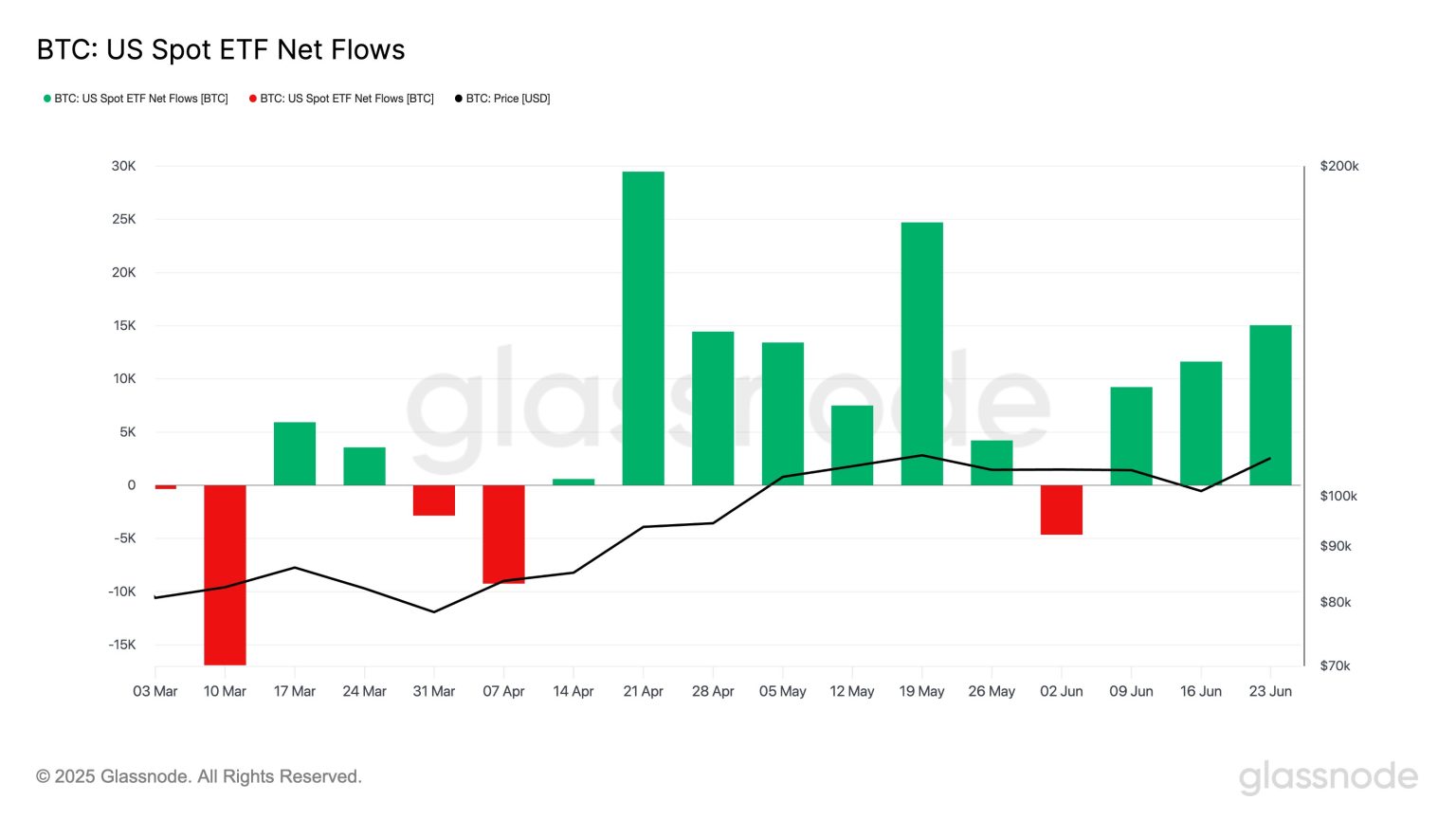

In recent developments, the Bitcoin ETF inflows have shown a notable stagnation, reflecting broader financial market trends. The data released by Glassnode indicates that despite the increase in interest around cryptocurrencies, the net inflows for Bitcoin ETFs remain disappointing. This mirrors the recent volatility in the cryptocurrency markets, where investors are adopting a cautious approach. The lack of recovery in demand is puzzling, as many anticipate a rally in response to regulatory changes and growing institutional interest.

Analyzing the 30-day moving average of inflows is critical for understanding the momentum of Bitcoin ETFs. The continued negative trajectory in this metric suggests that investor confidence may still be wavering. While some market analysts remain hopeful about future inflows, the consistent decline raises concerns regarding the overall appeal of Bitcoin as an investment. Factors contributing to this trend may include macroeconomic uncertainties and shifts in investor sentiment, emphasizing the need for a careful examination of market dynamics.

Ethereum ETF Performance Insights

Ethereum ETFs, much like their Bitcoin counterparts, are experiencing similar challenges concerning demand. Glassnode’s analysis points out that the current performance of Ethereum ETFs is faltering, as it too reflects a negative trend in net inflows. This situation is particularly significant as Ethereum has historically been viewed as a leading player in the cryptocurrency market, and many expected its ETF performance to align with the growing adoption of decentralized finance (DeFi) applications.

Factors affecting Ethereum ETF performance can be linked to broader cryptocurrency demand fluctuations and investor behavior in the financial markets. The ongoing shifts in regulatory environments and trading volumes can substantially impact the attractiveness of Ethereum ETFs. As fluctuations in the 30-day moving average indicate a lack of upward movement, investors are left questioning the potential of Ethereum as a viable asset. Addressing these concerns is vital for the long-term success of Ethereum ETFs in an ever-evolving market.

Exploring the driving forces behind cryptocurrency demand is also essential for understanding ETF trends. Investors are currently looking for stability and sustainable growth, and uncertainty can deter investment in both Bitcoin and Ethereum ETFs. Educational initiatives and increased market transparency might be necessary to revitalize interest in these ETFs. By focusing on enhancing the understanding of Ethereum’s utility and potential benefits, the market could foster renewed confidence among potential investors.

The Role of Financial Market Trends on ETF Demand

Recent tendencies within the financial markets play a crucial role in shaping the demand for Bitcoin and Ethereum ETFs. The significant fluctuations in global markets influence how investors perceive risk and potential returns from these digital assets. Consequently, investors’ risk appetite can affect the inflow dynamics, leading to decreased investments in ETFs when markets are embroiled in uncertainty. Understanding these trends can help enhance investment strategies in the crypto space.

Moreover, insights into financial market trends help investors make informed decisions regarding ETF participation. As portfolio diversification gains traction, tracking shifts in ETF performance concerning broader market movements can help showcase the resilience of Bitcoin and Ethereum assets. A correlational analysis of historical data may reveal how past performance in turbulent markets can inform future ETF demand.

Market Analysis of Cryptocurrency Demand Challenges

A persistent issue within the cryptocurrency landscape is understanding and addressing the challenges relating to cryptocurrency demand. Current trends indicate that both Bitcoin and Ethereum face obstacles that lead to diminished ETF net inflows. Investors are keenly observing market indicators, which point toward a cautious yet discerning approach when investing in these digital assets.

Another challenge stems from the competition among cryptocurrencies itself. With numerous alternative cryptocurrencies now available, investors grapple with choices that might dilute their interest in traditional Bitcoin and Ethereum ETFs. A clear understanding of cryptocurrency demand can pave the way for strategies that highlight the unique features of Bitcoin and Ethereum, potentially rekindling investor interest towards ETFs rooted in these foundational digital currencies.

Impact of 30-Day Moving Average on ETF Strategy

The 30-day moving average plays an integral role in understanding the demand dynamics for Bitcoin and Ethereum ETFs. By analyzing this metric, investors can gauge market sentiment and identify trends affecting inflows. A downward trajectory in the 30-day moving average provides cautionary signals to investors, indicating a potential need for reevaluation of their strategies.

Moreover, incorporating the 30-day moving average into investment strategies can aid in enhancing positioning during market fluctuations. Close monitoring of this indicator can help investors anticipate movements in cryptocurrency demand, supporting more informed decisions around ETF investments. As traders respond to these signals, ETFs can become a more adaptable tool for navigating the crypto market landscape.

The Future of Bitcoin and Ethereum ETFs

The outlook for Bitcoin and Ethereum ETFs is currently uncertain, primarily due to the observed decrease in demand. As previously discussed, negative inflows over recent months may deter potential investors and disrupt long-term growth strategies. However, the market is continually evolving, presenting new opportunities for thoughtful innovation and strategic adaptation.

Looking ahead, stakeholders in the cryptocurrency ecosystem must focus on addressing prevailing investor concerns, fostering trust within the market. By actively engaging with potential investors through educational initiatives and transparent reporting practices, the landscape may shift towards renewed demand for Bitcoin and Ethereum ETFs, ultimately supporting their future success in the financial market.

Investor Sentiment and ETF Demand

Investor sentiment is a critical factor influencing the demand for both Bitcoin and Ethereum ETFs. Current market observations indicate that negative inflows may be a reflection of cautious sentiment amongst investors, as they navigate uncertainty within the cryptocurrency landscape. Educating investors and rebuilding trust could be key steps toward improving overall sentiment.

Additionally, understanding the psychological aspects of trading can help entities involved with Bitcoin and Ethereum ETFs tailor their strategies to encourage greater participation. Sentiment analysis may reveal how perceptions and emotions affect investment decisions, offering valuable insights into revitalizing demand during times of stagnation in the cryptocurrency market.

Regulatory Environment Impacting ETF Demand

The regulatory environment surrounding cryptocurrencies has significant implications for the demand for Bitcoin and Ethereum ETFs. Ongoing discussions and evolving regulations can create both challenges and opportunities within the ETF space. Investors often approach markets with caution when faced with regulatory uncertainties, which can lead to a hesitancy to participate in ETF investments.

Nonetheless, favorable developments in regulatory frameworks could foster a more conducive environment for Bitcoin and Ethereum ETFs. As regulators adapt to the cryptocurrency landscape, the introduction of clearer guidelines and policies may help bolster investor confidence and drive substantial ETF inflows in the future.

Long-term Trends in Cryptocurrency ETF Performance

Examining long-term trends in cryptocurrency ETF performance reveals critical insights into future demand. Despite the current negative trajectory, historical performance can highlight how Bitcoin and Ethereum ETFs may react to broader market dynamics and evolving financial trends. Understanding these patterns aids investors in making informed strategic decisions.

It’s vital to recognize that while present conditions may seem bleak, the regulatory landscape and market maturity can evolve, leading to a potential upturn in demand for Bitcoin and Ethereum ETFs. Historical context provides a foundation for anticipating future movements, encouraging a proactive approach among investors in navigating the complex web of cryptocurrency demands.

Frequently Asked Questions

What are the current trends in Bitcoin ETF inflows and Ethereum ETF performance?

Recent data shows that Bitcoin ETF inflows and Ethereum ETF performance are not reflecting a strong recovery in demand. According to Glassnode, both assets have a 30-day moving average of net inflows that is currently in negative territory, indicating ongoing challenges in the cryptocurrency demand landscape.

How does cryptocurrency demand affect Bitcoin ETF inflows?

Cryptocurrency demand directly influences Bitcoin ETF inflows. As indicated by recent reports, the current low demand for cryptocurrencies has resulted in negative net inflows for Bitcoin ETFs, which suggests that investor interest is waning despite potential market opportunities.

What does the negative 30-day moving average mean for Bitcoin and Ethereum ETFs?

The negative 30-day moving average signals a decline in investor confidence and participation in Bitcoin and Ethereum ETFs. This trend can be attributed to reduced cryptocurrency demand and prevailing financial market trends that do not favor these digital assets at this moment.

Are financial market trends impacting Bitcoin and Ethereum ETF demand?

Yes, financial market trends significantly impact Bitcoin and Ethereum ETF demand. Current trends indicate a challenging environment for these ETFs, as reflected by their sustained negative net inflows and lack of recovery in demand, according to reports from platforms like Glassnode.

What should investors consider regarding Bitcoin ETF inflows and Ethereum ETF performance?

Investors should closely monitor Bitcoin ETF inflows and Ethereum ETF performance as indicators of overall cryptocurrency demand. The negative 30-day moving average suggests caution, as ongoing market conditions may not support a rebound in these ETFs in the near term.

| Key Points |

|---|

| Glassnode’s Analysis on Bitcoin and Ethereum ETF Demand. |

| Flow data shows no recovery in demand for Bitcoin and Ethereum ETFs. |

| The 30-day moving average (30D-SMA) of net inflows remains negative. |

Summary

The current situation regarding Bitcoin Ethereum ETF demand is concerning as evidenced by the data from Glassnode, which indicates that demand has not shown signs of recovery. The net inflows over the past 30 days continue to be in negative territory, reflecting a lack of investor interest in Bitcoin and Ethereum ETFs. Without a significant turnaround in demand, these ETFs may continue to struggle in attracting investments.