The Federal Reserve interest rates play a crucial role in shaping the economic landscape of the United States, influencing everything from consumer spending to business investments. Current interest rates news indicates that a more stable approach may be on the horizon, as experts weigh the implications of recent labor market trends. With economic outlooks becoming increasingly optimistic, the Federal Reserve update could reflect a decision to maintain interest rates unchanged for a longer period. Brian Jacobsen’s comments highlight a surprising improvement in the labor market last December, which could further underpin this strategy. As we move forward, understanding these dynamics will be essential for navigating the changing economic environment.

In discussions surrounding monetary policy and financial markets, the adjustments made by the central banking system significantly impact various sectors. The borrowing costs, often referred to as federal interest rates, remain a focal point for economists and financial analysts alike. Recently, the latest updates suggest a cautious but steady stance, particularly in light of positive shifts in employment dynamics. With attention on the evolving job market and its implications, many are eager to see how upcoming decisions will shape economic forecasts. Following expert insights, especially from notable figures like Brian Jacobsen, it’s clear that current conditions could well dictate a prolonged period of stability in interest rates.

The Federal Reserve’s Interest Rate Policy Explained

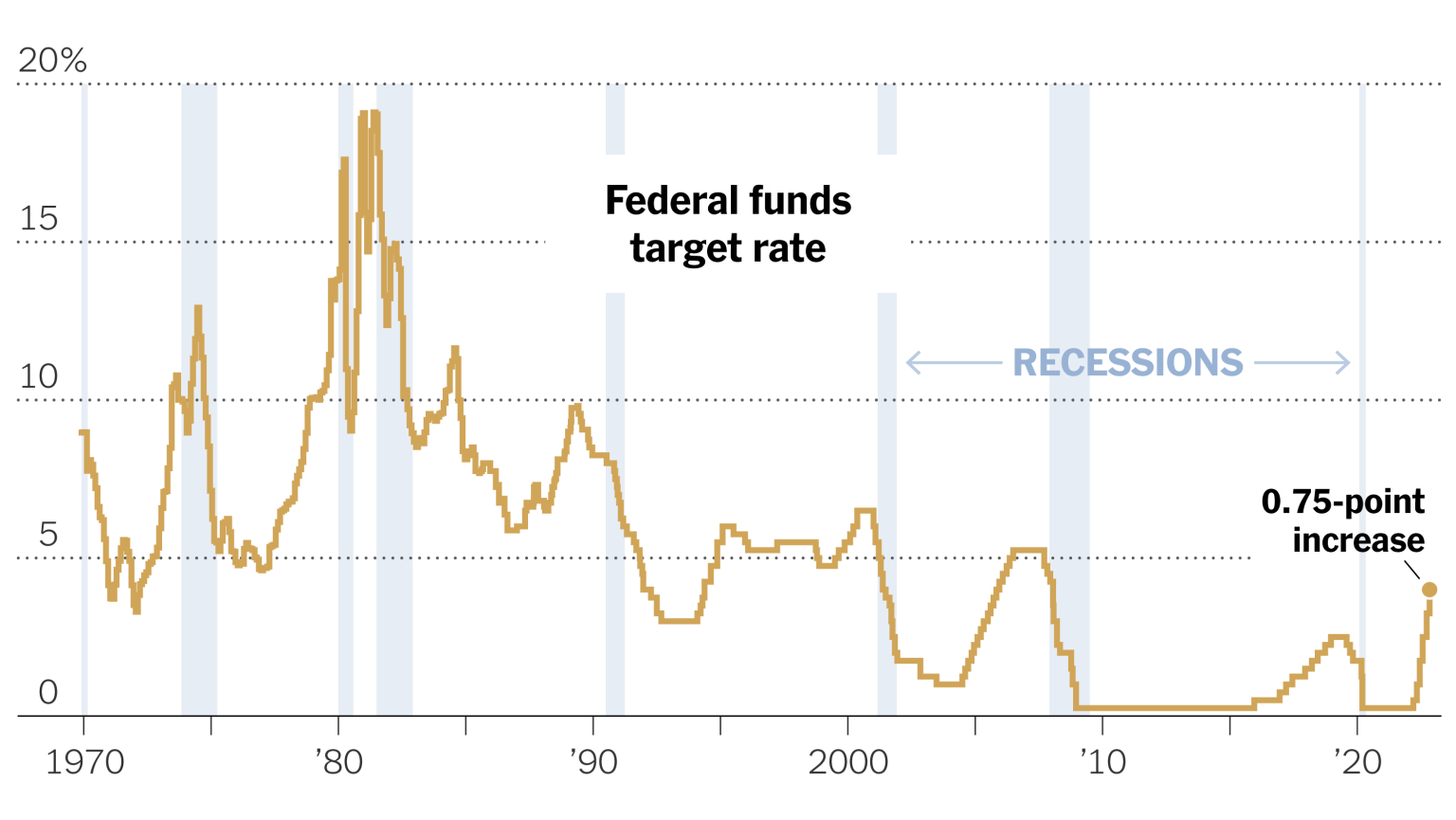

Understanding the Federal Reserve’s interest rate policy is crucial for anyone involved in the economy, from investors to average consumers. The Federal Reserve, America’s central bank, adjusts interest rates to influence economic activity. Higher interest rates typically cool economic growth and help curb inflation, while lower rates can stimulate borrowing and spending. As we look ahead, many economists are starting to predict that the Federal Reserve may hold interest rates steady for an extended time, depending on various factors such as the labor market and broader economic outlook.

Recent comments from economists like Brian Jacobsen highlight the potential for this prolonged period of stable interest rates. Jacobsen suggests that the economy may be showing signs of recovery, especially with improvements noted in labor market trends. His insights come during a critical phase where the Federal Reserve must navigate the balance between fostering growth and controlling inflation, making it necessary to analyze how interest rates impact consumer behavior and business investment.

Labor Market Trends and Their Impact on Interest Rates

The labor market trends are vital indicators that significantly influence the Federal Reserve’s decision-making regarding interest rates. As unemployment claims fluctuated during the holiday season, they provided a snapshot of current economic health. Jacobsen’s observations about the labor market improving in December signal potential economic stability. Historically, a stronger labor market can lead to increased consumer spending, which may prompt the Federal Reserve to reconsider rate hikes if inflation appears manageable.

Improving labor market conditions often lead to a trickle-down effect on various sectors of the economy. If more individuals are employed and earning wages, spending typically increases, boosting economic growth. Such trends could inspire the Federal Reserve to maintain existing interest rates longer, as stability in employment can encourage businesses and consumers alike to invest and spend confidently without the pressure of heightened borrowing costs.

Economic Outlook: Predictions for 2024

The economic outlook for 2024 appears cautiously optimistic, especially with recent trends indicating improvement in key areas such as the labor market and consumer spending. If these trends continue, it is crucial for stakeholders to monitor the Federal Reserve’s updates on interest rates closely. With Brian Jacobsen emphasizing the importance of labor data, the central bank may hold off on any rate adjustments as it seeks to support ongoing economic recovery.

Moreover, policymakers are likely to consider various economic indicators, including inflation rates and consumer confidence, as they evaluate the timing of future interest rate changes. The balance between promoting growth and curbing inflation will be at the forefront, especially with interest rates remaining a fundamental tool for managing economic activity.

Understanding Recent Federal Reserve Updates

The latest Federal Reserve updates indicate a cautious approach to interest rates, reflecting broader economic assessments. As of late 2023, there are heightened discussions about potential shifts depending on future labor market data and inflation metrics. Experts, including Jacobsen, argue that the data are particularly important during transitional periods, such as holiday seasons when employment figures can be distorted.

As the Federal Reserve navigates these updates, the emphasis remains on clear communication with the public and markets to manage expectations. By keeping interest rates unchanged, the intention may be to foster confidence among consumers and businesses, allowing the economy to grow organically while assessing the long-term impact of recent global events.

Implications of Interest Rates for Investors

For investors, understanding the implications of Federal Reserve interest rate policies is essential for making informed decisions. An extended period of unchanged rates could signal stability, or it may point towards a cautious stance by the Fed as it waits for more favorable economic indicators. This uncertainty can lead to volatility in investment markets as fluctuations in interest rates directly impact the valuation of stocks and bonds.

Investors should be particularly attentive to insights shared by economists like Brian Jacobsen, whose analysis of labor market trends can provide valuable foresight into consumer spending patterns and overall economic health. As conditions evolve, strategic adjustments to investment portfolios may be necessary to mitigate risks associated with potential interest rate changes.

The Role of Consumer Confidence in Economic Growth

Consumer confidence plays a pivotal role in driving economic growth, particularly in relation to interest rates and spending habits. As individuals feel secure in their jobs and financial situations, they tend to spend more, which in turn stimulates the economy. The Federal Reserve’s interest rates influence this cycle, as lower rates typically encourage borrowing and spending.

Economists like Brian Jacobsen point out that with the recent improvements noted in the labor market, consumer confidence may rise, fostering an environment conducive to economic expansion. This increase in confidence can have significant implications for GDP growth, reinforcing the idea that the Federal Reserve’s interest rates should remain favorable to support ongoing recovery.

Analyzing Inflation in Context of Interest Rates

As the Federal Reserve contemplates its interest rate policies, inflation remains a critical factor for consideration. The interplay between inflation and interest rates is a delicate one. When inflation rises, the Fed may feel pressured to increase rates to keep prices in check. Conversely, if inflation remains stable and employment data shows signs of recovery, maintaining interest rates could be advantageous for ongoing growth.

Experts, including Jacobsen, emphasize the importance of monitoring inflation trends closely, as they can have far-reaching impacts on consumers and businesses. A prolonged period of stable interest rates amidst controlled inflation can lead to heightened investor confidence, allowing for more predictable economic planning and decision-making.

The Future of Interest Rates: What to Expect

Looking ahead, the future of interest rates will largely depend on ongoing evaluations by the Federal Reserve in response to evolving economic conditions. Economists are divided on whether we will see adjustments in the short term or if rates will remain stable into 2024. Factors such as the labor market, inflation, and consumer spending are central to these considerations.

The insights of commentators like Brian Jacobsen will be essential as stakeholders seek guidance on what these economic indicators mean for interest rates and the broader financial landscape. As trends unfold, investors and consumers alike should stay informed and prepared for possible changes that could affect their financial strategies.

Monitoring Key Economic Indicators

Keeping a close eye on key economic indicators is crucial for understanding the direction of Federal Reserve interest rates. Indicators such as unemployment rates, consumer spending patterns, and inflation levels provide a comprehensive view of economic health. As businesses adjust to these signals, the Federal Reserve can fine-tune its policies to address the nuances of the current economic climate.

Brian Jacobsen’s assertions about labor market data highlight the importance of these indicators in shaping economic forecasts. With the possibility of a longer period of stable interest rates, the need for accurate data and interpretation becomes even more pivotal for both policymakers and financial markets.

Frequently Asked Questions

How are Federal Reserve interest rates influenced by labor market trends?

Federal Reserve interest rates are closely tied to labor market trends because employment data helps gauge economic health. For instance, Brian Jacobsen noted that improving labor market conditions may lead the Federal Reserve to keep interest rates unchanged for a longer period.

What impact does the Federal Reserve update on interest rates have on the economic outlook?

Federal Reserve updates on interest rates can significantly affect the economic outlook. A stable interest rate suggests confidence in the economy, while adjustments can signal changes in inflation expectations and economic growth. Jacobsen’s comments highlight how recent trends may lead to a prolonged period of unchanged rates.

What recent interest rates news should I be aware of regarding the Federal Reserve?

Recent interest rates news reveals that, according to Brian Jacobsen, the Federal Reserve is likely to maintain current rates longer than anticipated due to improving labor market data, even amidst seasonal fluctuations in unemployment claims.

How does the Federal Reserve’s stance on interest rates affect consumers and businesses?

The Federal Reserve’s stance on interest rates impacts consumers and businesses significantly. Lower rates often lead to increased borrowing and spending, while higher rates can cool economic activity. Current insights from economists suggest that rates may remain stable for an extended period, providing a predictable environment for financial planning.

Why is understanding Federal Reserve interest rates important for investors?

Understanding Federal Reserve interest rates is crucial for investors because these rates influence the broader economic environment, investment strategies, and market expectations. With expert comments suggesting rates may stay unchanged, it presents an opportunity for investors to reassess their portfolios against a backdrop of stable borrowing costs.

| Key Point | Details |

|---|---|

| Economist Insight | Brian Jacobsen highlights the importance of unemployment claims data in assessing labor market health. |

| Labor Market Improvement | There was an unexpected improvement in the labor market in December. |

| Federal Reserve’s Decision on Rates | The Federal Reserve may keep interest rates unchanged for a longer period than expected. |

Summary

Federal Reserve interest rates are likely to remain steady for a longer duration as indicated by recent insights from Chief Economist Brian Jacobsen. He emphasized the key role of unemployment claims data in evaluating the labor market’s health, reporting a positive trend in December. This suggests that economic conditions might support the Federal Reserve’s decision to hold rates steady, providing a stable outlook amidst fluctuating market signals.