In this analysis of Bitcoin price prediction 2027, we explore the future trajectory of this prominent cryptocurrency. As market dynamics continue to evolve, many experts are weighing in on the potential for Bitcoin’s price growth. Notably, Galaxy Digital has made a bold forecast, estimating that Bitcoin could reach an impressive $250,000 by the close of 2027. This Bitcoin price forecast aligns with ongoing cryptocurrency trends 2027, particularly in light of institutional adoption and major market shifts. Understanding the Bitcoin market analysis today is crucial for investors looking to capitalize on this anticipated growth.

When considering the future of Bitcoin, alternative phrases like cryptocurrency valuation and digital currency trends come to mind. As we delve into what Bitcoin might be valued at by 2027, insights from financial analysts like those at Galaxy Digital provide critical perspectives. Their predictions not only reflect on past performance but also incorporate emerging trends in the investment landscape. With ongoing fluctuations in Bitcoin’s trading price, a comprehensive understanding of these factors is key to grasping the broader implications for investors. Engaging with these insights allows potential investors to navigate the complexities of the cryptocurrency market effectively.

Predictions on Bitcoin Price Growth by 2027

As we delve into Bitcoin’s price trajectory heading towards 2027, experts from Galaxy Digital are quite optimistic. Their analysis projects that Bitcoin will soar to an impressive $250,000 by the year’s end. This bullish prediction is rooted in the cryptocurrency’s historical trends, market behaviors, and increased institutional participation. By evaluating factors like the recent surge and subsequent correction in Bitcoin’s price, it’s evident that cryptocurrency trends are influenced not only by market sentiments but also by macroeconomic conditions. Analysts suggest that as the ecosystem matures, Bitcoin will carve out a more stable and upward trend.

The excitement around Bitcoin price forecasts hinges largely on the increasing adoption rates observed among institutional investors and corporations, which have begun integrating cryptocurrency into their portfolios. Such massive endorsement has historically played a vital role in propelling the prices of digital assets. Therefore, while current market fluctuations may introduce short-term volatility, the long-term perspective suggests an upward trajectory, aligning with Galaxy Digital’s forecast. As we approach 2027, it becomes essential to watch for emerging market patterns and investor behaviors that can influence Bitcoin’s journey.

Impact of Market Conditions on Bitcoin’s Forecast

The macroeconomic environment significantly impacts Bitcoin’s market performance and overall price predictions. Recently, Galaxy Digital highlighted that the challenges faced in 2025, including deleveraging and a shift in the investment narrative, have led to considerable price adjustments for Bitcoin. The ongoing corrections in the market are often seen as a natural response to broader economic indicators and investment sentiments. As external factors continue to dictate market conditions, understanding these dynamics is crucial for any stakeholders looking to capitalize on Bitcoin’s growth potential.

As we analyze these market conditions further, it’s essential to monitor how they could evolve by 2027. Galaxy Digital’s insights suggest that the integration of income-generating applications within blockchain protocols stands to enhance token utility, creating a more robust investment ecosystem. These developments could pave the way for greater price stability and growth. Moreover, monitoring large-scale distributions and the behavior of cryptocurrency whales could offer valuable insights into short-term market fluctuations, setting the stage for more informed predictions regarding Bitcoin price growth moving forward.

The Role of Institutional Adoption in Cryptocurrency Trends

Institutional adoption of Bitcoin and other cryptocurrencies plays a pivotal role in shaping market trends and price forecasts. The increasing interest from hedge funds, asset managers, and major corporations indicates a fundamental shift in how digital assets are perceived and utilized. Rather than being regarded as speculative assets, cryptocurrencies are increasingly being integrated into serious investment strategies, which contributes to more pronounced Bitcoin price movements. Galaxy Digital observes that as institutional involvement deepens, Bitcoin’s foundation becomes sturdier, potentially increasing its market value as seen in their ambitious prediction of $250,000 by the end of 2027.

Moreover, the momentum generated from institutional investors can lead to heightened trust and participation from retail investors, further boosting Bitcoin’s liquidity and affordability. As this trend continues to flourish, we may witness enhanced Bitcoin market analysis that aligns more closely with traditional financial models, resulting in clearer forecasting methodologies. Those monitoring cryptocurrency trends into the future must consider this institutional aspect alongside technological advancements — understanding that they are intrinsically linked in influencing Bitcoin’s overall value and market behavior.

Galaxy Digital’s Market Analysis and Predictions

By assessing the landscape of cryptocurrency, Galaxy Digital provides insightful market analysis that paints a picture of what to expect from Bitcoin in the upcoming years. Their forecast, which suggests that Bitcoin could hit $250,000 by 2027, is backed by thorough examinations of current market dynamics and historical performance. This predictive analysis reflects not only the anticipated growth of Bitcoin but also the positive indicators observed in broader cryptocurrency markets.

Their methodology includes a comprehensive analysis of macroeconomic trends, investor behaviors, and the overall legislative framework affecting cryptocurrency. This multifaceted approach allows for a robust Bitcoin price forecast, integrating variables such as market corrections, institutional investing patterns, and even external economic pressures. With such detailed analysis, Galaxy Digital sets the stage for informed decision-making for investors and stakeholders looking to navigate the evolving landscape of digital currencies.

Technological Innovations and Their Impact on Bitcoin

Technological advancements are among the key factors that can influence Bitcoin’s price trajectory and overall market stability. Innovations within the blockchain space, such as increased scalability, security protocols, and better user experiences, enable Bitcoin to compete effectively with newer cryptocurrencies. By improving its underlying technology, Bitcoin can attract diverse users and investors, thus enhancing its potential for growth. Galaxy Digital highlights these innovations as critical components that could facilitate Bitcoin reaching $250,000 by the end of 2027.

Furthermore, as Bitcoin continues to evolve, the integration of various applications and platforms can create greater synergy within the digital asset ecosystem. The rise of decentralized finance (DeFi) and interoperability between blockchains could open new revenue streams and use cases for Bitcoin, solidifying its position in the market. Analysts will need to stay attuned to these technological shifts to accurately gauge their implications on Bitcoin’s future price forecasts, emphasizing the importance of continual innovation in sustaining growth and market confidence.

Investor Sentiment and Behavioral Trends in Bitcoin Market

Investor sentiment and behavioral trends serve as critical indicators in analyzing Bitcoin’s market performance. Understanding the psychological aspects that contribute to market fluctuations can provide valuable information for predicting future price movements. Galaxy Digital’s latest reports highlight how emotional and irrational decision-making can lead to significant price swings, including the recent corrections after Bitcoin’s peak near $126,080.

As investors become more sophisticated, their reactions to market changes may also evolve, leading to a more tempered approach towards investing in Bitcoin. Simultaneously, the role of media influences and public perception cannot be overlooked; positive news can generate enthusiasm and buying pressure, while negative news can lead to rapid sell-offs. By monitoring these behavioral trends and sentiment, stakeholders will be better equipped to interpret Bitcoin price forecasts and develop risk management strategies accordingly.

The Future of Layer 1 Blockchains and Bitcoin’s Value

The evolution of Layer 1 blockchains is poised to have a significant impact on the cryptocurrency market and Bitcoin’s value proposition. As Galaxy Digital notes, advancements in these protocols, including the integration of value-generating applications, are set to enhance the functionality and appeal of cryptocurrencies. This transition promises not only to boost the overall utility of Bitcoin but also to open new avenues for investment.

Furthermore, as more Layer 1 blockchains emerge and evolve, there is potential for collaborative ecosystems that may include Bitcoin, allowing for improved transaction efficiencies and value exchanges. Such synergies could strengthen Bitcoin’s role within the larger cryptocurrency landscape and support its growth trajectory heading into 2027. Investors must keep an eye on these developments as they can fundamentally change Bitcoin’s market dynamics and impact its price forecasts.

Analyzing the Past to Forecast Bitcoin’s Future

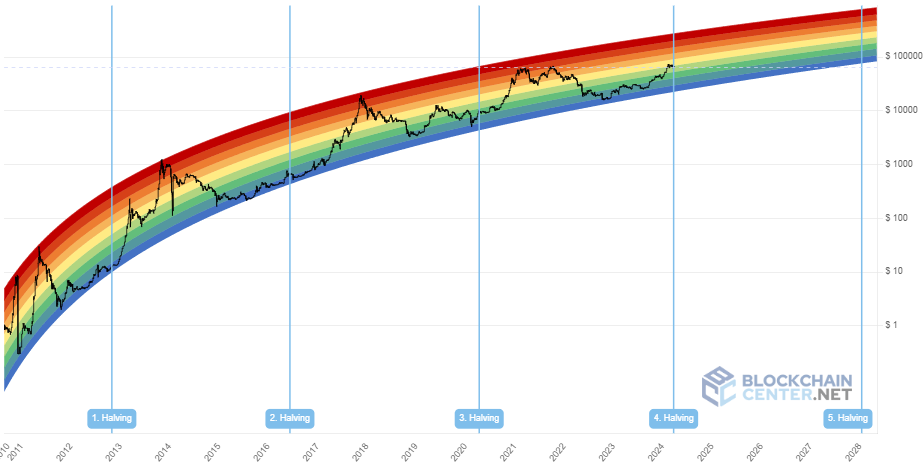

To effectively forecast the future of Bitcoin, it is vital to analyze its past performance and market behavior. Historical price movements can often reveal patterns that, when understood correctly, may assist analysts in making accurate predictions regarding Bitcoin’s trajectory. Galaxy Digital’s studies consider various historical cycles of boom and bust, helping to set realistic price forecasts for 2027 that factor in potential correction and recovery phases.

In doing so, investors can learn critical lessons from past market crashes and bull runs, emphasizing the importance of adopting a comprehensive investment strategy. Understanding cyclical patterns can aid in navigating future uncertainties and provide a framework for predicting Bitcoin’s price growth. As we look ahead, this retrospective approach will continue to be essential for discerning the likely pathways for this leading cryptocurrency.

Understanding Global Economic Influences on Bitcoin Prices

Global economic conditions inevitably shape the trajectory of Bitcoin prices, where factors such as inflation, interest rates, and geopolitical tensions come into play. Galaxy Digital’s analysis highlights that macroeconomic trends not only influence investor sentiment but also determine the level of institutional adoption of Bitcoin. As financial landscapes shift, cryptocurrency investors must remain cognizant of these broader influences that can usher about significant price changes.

As we approach 2027, the impacts of emerging economic policies and their consequences on market confidence cannot be understated. Stakeholders will benefit from monitoring developments in traditional markets, as Bitcoin often acts as a hedge against economic instability. The correlation between global financial trends and Bitcoin price fluctuations amplifies the need for a nuanced understanding of these factors, as they will play a vital role in determining the future valuation and stability of Bitcoin.

Frequently Asked Questions

What is the Bitcoin price prediction for 2027 according to Galaxy Digital?

Galaxy Digital predicts that the Bitcoin price will reach $250,000 by the end of 2027. This forecast is based on current market trends and anticipated institutional adoption.

How does the current Bitcoin price forecast impact the Bitcoin market analysis for 2027?

The current Bitcoin price forecast suggests a bullish trend, indicating significant growth potential for Bitcoin in 2027. Market analysis aligns with these expectations, highlighting factors such as increased institutional investment and market recovery.

What factors could influence the Bitcoin price growth leading up to 2027?

Bitcoin price growth leading up to 2027 could be influenced by several factors including macroeconomic conditions, the entry of institutional investors, advancements in blockchain technology, and overall cryptocurrency trends that shape market sentiment.

How might cryptocurrency trends in 2027 affect Bitcoin’s price prediction?

Cryptocurrency trends in 2027, such as increased adoption, regulatory developments, and technological advancements, are likely to play a crucial role in shaping Bitcoin’s price prediction. A favorable environment could support Galaxy Digital’s view of a $250,000 target.

Can the Bitcoin market analysis help investors anticipate the price forecast for Bitcoin in 2027?

Yes, comprehensive Bitcoin market analysis provides insights into current trends, investor behavior, and economic indicators, helping investors anticipate the price forecast and make informed decisions regarding Bitcoin investments.

What role do major whales play in Bitcoin price predictions for 2027?

Major whales significantly influence Bitcoin price predictions, including forecasts for 2027. Their investment strategies, large cash movements, and market behaviors can create volatility and impact overall market sentiment.

Will institutional adoption affect the Bitcoin price forecast for 2027?

Yes, institutional adoption is expected to positively affect the Bitcoin price forecast for 2027. As institutional interest and investment in Bitcoin increase, it is likely to drive demand and contribute to a higher price.

What market conditions are anticipated for Bitcoin in 2027 based on the latest analysis?

Based on the latest analysis, market conditions for Bitcoin in 2027 are expected to become increasingly favorable, driven by enhanced institutional involvement, technological advancements, and expanding acceptance of cryptocurrencies.

| Key Point | Details |

|---|---|

| Current Bitcoin Price | Around $87,000, down from $94,000 at the beginning of 2025. |

| Previous All-Time High | Reached $126,080 on October 6, 2025. |

| Galaxy Digital Prediction | Bitcoin is expected to reach $250,000 by the end of 2027. |

| Market Influences | Market affected by macroeconomic factors, investment narrative changes, and large-scale distributions by whales. |

| Institutional Adoption | Continues to grow despite short-term uncertainties. |

| 2026 Predictions | Market value on Solana expected to grow from $750 million to $2 billion. |

Summary

The Bitcoin price prediction for 2027 suggests a bullish outlook where Bitcoin could potentially reach $250,000 as forecasted by Galaxy Digital. This optimistic view is driven by increased institutional adoption and anticipated growth in digital capital markets, despite facing corrections and market volatility in the near term. Investors and analysts should keep an eye on the evolving market conditions and technological advancements as we approach the end of 2027.