Bitcoin prices are poised for potential growth in the coming years, particularly as expectations of a Fed rate cut begin to influence market dynamics. Analysts predict that as the dollar index experiences its most significant annual decline since 2017, nearly plummeting 10% in 2025, Bitcoin may become an attractive alternative for investors. With the Federal Reserve maintaining an accommodative posture, many anticipate that monetary easing will pave the way for a bullish crypto market in 2026. Experts like Timot Lamarre suggest rate cuts could attract a surge of both retail and institutional Bitcoin investors, ramping up demand. As these changes unfold, the ultimate impact on Bitcoin prices will rely heavily on broader economic shifts and investor sentiment.

The trends in cryptocurrency valuation, particularly concerning Bitcoin, signal exciting prospects ahead as fiscal policies evolve. With a potential reduction in interest rates from the Federal Reserve, the financial landscape may shift dramatically, pushing investors towards digital assets. The anticipated decline of the dollar could elevate the status of cryptocurrencies, thereby encouraging more participation in the market. As we delve deeper into the implications of these monetary adjustments, it’s crucial to understand the pivotal role they play in shaping investment strategies in the evolving digital currency sphere. The interplay between interest rates and asset values is more relevant now than ever for cryptocurrency enthusiasts and stakeholders.

The Future of Bitcoin Prices: Impact of Fed Rate Cuts

The anticipation surrounding Fed rate cuts has the potential to influence Bitcoin prices significantly by 2026. Analysts project that the accommodative steps taken by the Federal Reserve will lead to a weaker dollar, thereby creating a favorable environment for Bitcoin investors. With the dollar index projected to drop 10% in 2025, many investors are turning to Bitcoin as a hedge against dollar depreciation. This shift indicates a changing market landscape, where Bitcoin could emerge as an attractive alternative for wealth preservation.

As monetary easing takes center stage, it could propel Bitcoin prices upwards. Financial experts, including James Knightley, emphasize the need for adaptive strategies in response to shifting economic policies. If the Fed implements a rate cut, it is likely to trigger increased liquidity in the market, enticing both retail and institutional participants. This scenario will not only bolster Bitcoin’s credibility but may also lead to substantial growth in investor interest, driving Bitcoin prices higher than previously anticipated.

The Correlation Between Dollar Index Decline and Crypto Market Growth

The impending decline in the dollar index is closely linked to potential growth within the crypto market. As the dollar weakens, investors may seek alternative assets like Bitcoin to preserve their purchasing power. This dynamic creates a strong correlation between the dollar’s performance and the crypto market’s success. Analysts have noted that such shifts often lead to increased volatility but also open up numerous opportunities for profit in decentralized currencies.

Timot Lamarre, a notable market researcher, has highlighted that monetary easing could serve as a significant accelerator for Bitcoin and other cryptocurrencies. With a precariously declining dollar, the market may witness an influx of capital into crypto, as investors look to diversify their portfolios. This emerging trend could stimulate not only Bitcoin prices but also encourage advancements in blockchain technology and operational methodologies within the crypto market.

Bitcoin Investors and their Strategies in a Changing Market Landscape

As the market landscape shifts due to economic policies, Bitcoin investors are reevaluating their strategies in anticipation of favorable conditions. With expectations of a Fed rate cut and a declining dollar index, many investors are starting to position themselves for potential gains in Bitcoin prices. This proactive approach enables them to capitalize on movements within the financial landscape, ensuring they remain competitive as the crypto market evolves.

Furthermore, as institutional interest in Bitcoin grows, it’s imperative for individual investors to stay informed about market trends and economic indicators. Understanding the implications of monetary easing and Fed rate cuts can be crucial for making informed decisions. Strategies that emphasize diversification and risk management are becoming increasingly relevant, enabling Bitcoin investors to navigate the complexities of this dynamic crypto environment.

Why Monetary Easing Could Empower the Crypto Market

Monetary easing is expected to empower the crypto market, notably because it encourages borrowing and investing. As the Federal Reserve signals a departure from higher interest rates, more liquidity enters the system, potentially enhancing Bitcoin’s market appeal. Investors seeking returns may consider cryptocurrencies rather than traditional assets, leading to heightened demand and ultimately driving up Bitcoin prices.

In addition, the effects of monetary easing can create an environment ripe for innovation within the crypto sector. As capital becomes more readily accessible, blockchain projects can secure funding, spurring technological advancements. Enhanced infrastructure and broader adoption of cryptocurrencies could integrate Bitcoin further into the economy, culminating in greater stability and value appreciation in the long term.

Market Predictions: Bitcoin’s Resilience Amid Economic Shifts

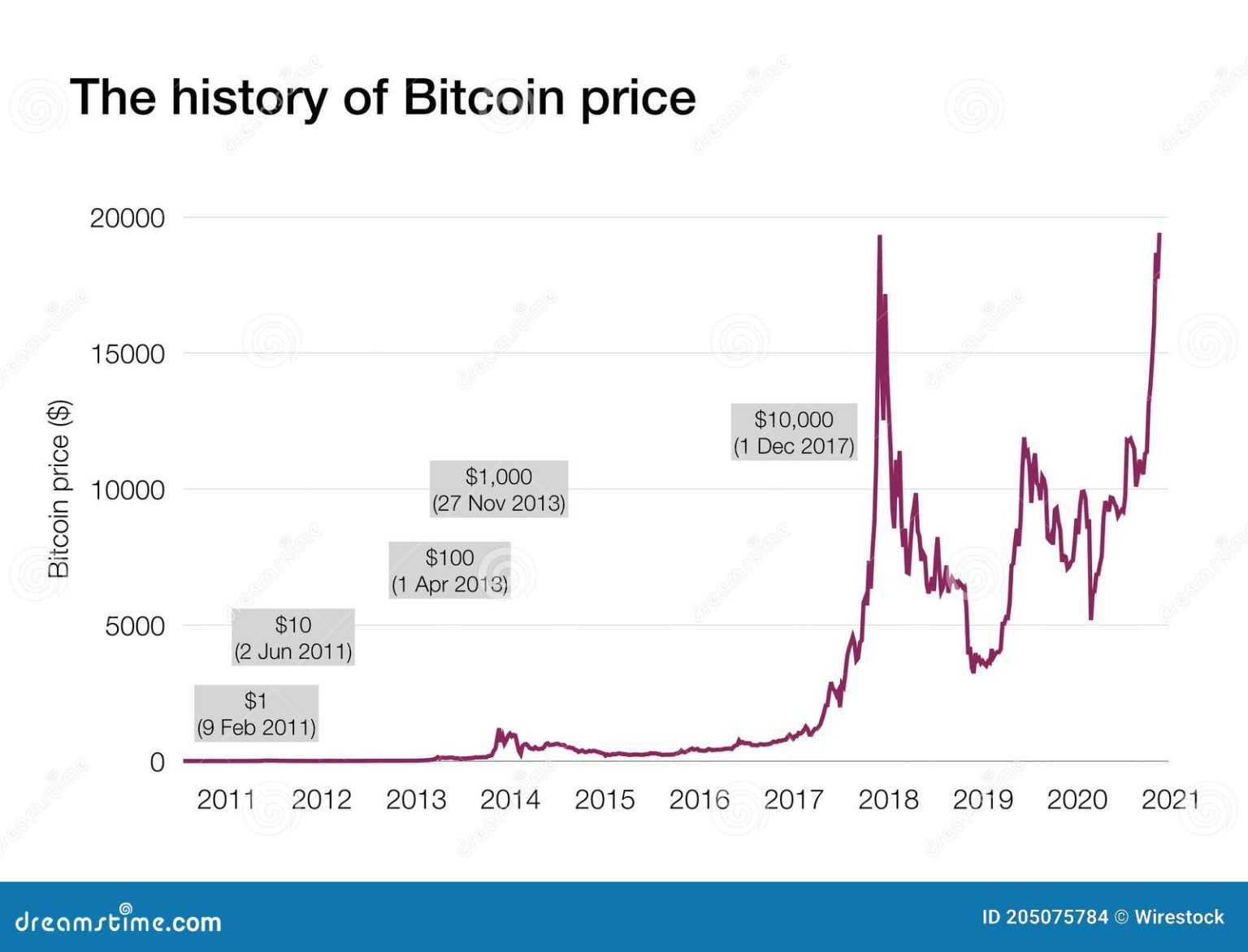

Even as economic shifts occur, Bitcoin is often viewed as a resilient asset. Market predictions indicate that the combination of Fed rate cuts and a weakening dollar could work to Bitcoin’s advantage by increasing its visibility among both retail and institutional investors. Observing historical patterns, Bitcoin has shown a tendency to thrive during periods of economic instability, drawing in those seeking alternative investment avenues.

Experts are optimistic about Bitcoin’s resilience in the face of these economic changes, with growth forecasts provided by analysts reinforcing this perspective. They highlight the importance of understanding the broader economic context, which shapes investor behavior. As traditional markets exhibit uncertainty, Bitcoin could emerge as a stable, reliable asset, leading to sustained increases in its value as the crypto-market gains traction.

Institutional Investment Trends in 2026: Bitcoin’s Role

Institutional investment trends are expected to take center stage in 2026, primarily characterized by a growing interest in Bitcoin. With anticipated rate cuts fostering a more favorable investment climate, institutions are increasingly recognizing the potential of cryptocurrencies as long-term assets. This shift is likely to draw in a wave of both strategic and opportunistic investors, further solidifying Bitcoin’s position as a cornerstone of the crypto market.

The collaboration between institutional investors and cryptocurrency platforms is expected to enhance market maturity, offering more sophisticated investment products based around Bitcoin. As monetary easing creates a vibrant investment atmosphere, early adopters are poised to reap substantial benefits, positioning Bitcoin as an integral component of diversified portfolios.

Understanding Fed Rate Cuts and their Influence on Bitcoin Prices

Fed rate cuts are pivotal moments that can significantly influence Bitcoin prices. These monetary policy adjustments often lead to shifts in investor sentiment, as reduced interest rates make traditional savings and bonds less attractive. Consequently, Bitcoin may gain traction as a viable asset, appealing to those who wish to navigate inflationary concerns in a faltering economy.

Moreover, the expectancy surrounding upcoming rate cuts can create immediate effects on market movements. Investors often react preemptively, buying into Bitcoin in anticipation of price surges. This psychological aspect demonstrates how deeply intertwined Bitcoin prices are with broader economic policies, reflecting a market that is exceptionally responsive to monetary developments.

The Role of the Dollar Index in Cryptocurrency Valuation

The dollar index plays a crucial role in determining cryptocurrency valuations, particularly for Bitcoin. As the dollar weakens, it typically increases the buying power of foreign investors, potentially driving up demand for Bitcoin. This relationship highlights how fluctuations in currency strength can influence crypto price movements, as many investors see Bitcoin as a hedge against fiat currency depreciation.

In this context, the dollar index’s projected decline sets the stage for a potentially lucrative environment for Bitcoin. Investors need to closely monitor these economic indicators, as they can provide essential signals regarding when to enter or exit positions in the crypto market. Understanding this connection allows market participants to make informed decisions as they navigate the complexities of cryptocurrency investments.

Long-Term Outlook: Bitcoin in a Post-Fed Rate Cut Landscape

The long-term outlook for Bitcoin following Fed rate cuts is filled with potential. Analysts predict that once the rate cuts are implemented, there could be a significant uptick in Bitcoin prices as market conditions stabilize and investor confidence increases. The crypto market’s response to such changes can be profound, often leading to price rallies that attract new investors eager to join the momentum.

Additionally, as Bitcoin continues to embed itself into the financial system, its acceptance as a legitimate asset class only strengthens. The post-Fed rate cut landscape may see Bitcoin gaining traction among mainstream investors, possibly leading to regulatory adjustments that further solidify its market presence. Overall, the outlook remains cautiously optimistic, with many anticipating that Bitcoin might redefine itself within the investment world.

Frequently Asked Questions

How will the Fed rate cut affect Bitcoin prices in 2026?

Expectations of a Fed rate cut are projected to drive Bitcoin prices up in 2026. As interest rates decrease, the dollar tends to weaken, which can make Bitcoin and other cryptocurrencies a more attractive investment for both retail and institutional investors within the crypto market.

What impact will the declining dollar index have on Bitcoin prices?

Analysts predict that as the dollar index declines by nearly 10% in 2025 and continues to weaken in 2026, Bitcoin prices are likely to benefit. A weaker dollar enhances Bitcoin’s appeal as a hedge against inflation, potentially increasing demand among Bitcoin investors.

How does monetary easing influence Bitcoin prices?

Monetary easing, such as expected Fed rate cuts, typically leads to lower interest rates and increased liquidity in the market. This environment is favorable for Bitcoin prices, as it encourages investment in cryptocurrencies by boosting confidence among Bitcoin investors looking for alternative assets.

What role do Bitcoin investors play in responding to Fed rate cuts?

Bitcoin investors are likely to react positively to Fed rate cuts, as lower interest rates can lead to higher Bitcoin prices. This is because easier monetary policy tends to stimulate investment in risk assets, including Bitcoin, particularly as its scarcity becomes more appealing in an inflationary environment.

Why do analysts believe Bitcoin will perform well in the crypto market during monetary easing?

Analysts, like Timot Lamarre, suggest that monetary easing will improve Bitcoin’s performance in the crypto market due to expectations of increased capital flow. Lower interest rates make traditional savings less appealing, prompting investors to seek higher returns in Bitcoin, thereby driving its price up.

| Key Point | Details |

|---|---|

| Fed Rate Cut Expectations | Analysts anticipate a Fed rate cut will boost Bitcoin prices in 2026. |

| Dollar Index Decline | The dollar index is expected to drop nearly 10% in 2025, marking its largest decline since 2017. |

| Future Monetary Policy | ING’s Chief International Economist asserts that the Fed is maintaining an accommodative monetary policy stance. |

| Market Predictions | Polymarket indicates a 96% chance of a rate cut before June 2026. |

| Impact on Bitcoin | Experts believe monetary easing will positively affect Bitcoin prices and attract investors. |

| Investor Sentiment | Rate cuts are seen as a major factor in drawing both retail and institutional investors to the crypto market. |

Summary

Bitcoin prices are likely to rise in 2026 due to anticipated Fed rate cuts, alongside a significant decline in the dollar index. Analysts suggest that as the dollar weakens, and with the Fed’s accommodating stance, Bitcoin could attract more investors, especially with predictions supporting rate cuts this year. This combination of factors is set to create a favorable environment for Bitcoin, potentially leading to notable price increases.