Bubblemaps is making headlines as it unveils staggering insights into crypto funding trends, highlighting the recent withdrawal of $250 million from the Lighter platform just a day after the Token Generation Event (TGE). This analysis sheds light on the rapidly evolving landscape of cryptocurrency, where substantial amounts are shifting in response to market movements and investor sentiment. As TGE news continues to circulate, the data offered by Bubblemaps becomes an essential resource for understanding the implications of such withdrawals. With investor confidence being tested, monitoring changes via platforms like Bubblemaps is critical for those engaged in crypto funding. Prepare to dive deeper into the nuances of these trends and their potential impact on the future of the crypto market.

The world of cryptocurrency is witnessing a remarkable shift, as indicated by recent figures that reveal significant financial movements. In a noteworthy development, post-Token Generation Event (TGE), around $250 million has been extracted from the Lighter platform. Bubblemaps provides a comprehensive analysis that helps uncover the underlying factors behind these shifts in funding. By examining the flow of capital and trends, investors can better navigate the complexities of the crypto market. As we explore the implications of these massive withdrawals, it’s clear that understanding this space requires a keen insight into both current events and analytical tools.

Significant Withdrawals from the Lighter Platform

Following the recent Token Generation Event (TGE), the Lighter platform experienced significant withdrawals, amounting to an astonishing $250 million. This surge in capital movement highlights the immediate impact of TGE news on investor sentiment and behavior in the cryptocurrency market. As users clamored to secure their assets, it became evident that TGE events can instigate rapid reactions from investors, signaling potential volatility in the underlying tokens and associated platforms.

The sudden withdrawal of funds reinforces the importance of strategic asset management for both investors and platforms alike. By monitoring similar events, stakeholders can gain insights into market patterns and investor psychology. Furthermore, platforms like Lighter must enhance their security and liquidity measures to effectively handle such large and swift transactions, ensuring user confidence remains steadfast even amidst fluctuating conditions.

Bubblemaps Analysis on Crypto Funding Trends

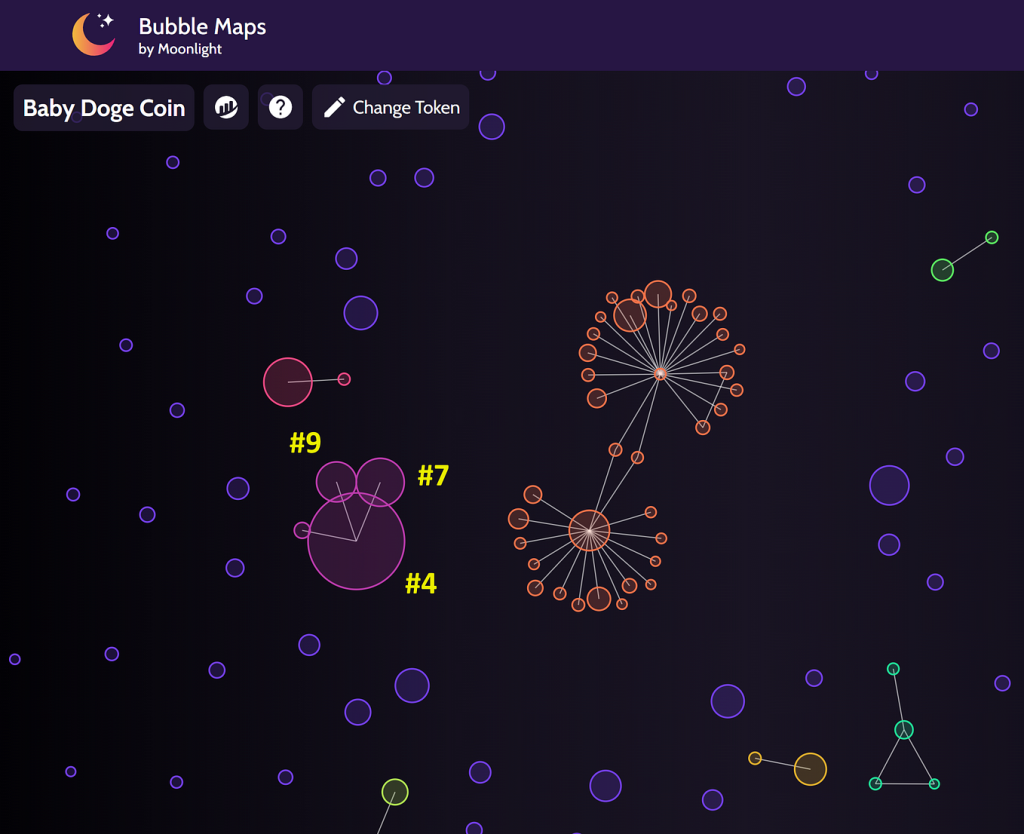

Bubblemaps has emerged as a crucial analytical tool in understanding the landscape of crypto funding, especially post-TGE events. As highlighted in their recent data, the platform’s ability to track and visualize fund movements enables stakeholders to analyze trends, such as the $250 million withdrawn from Lighter. This analysis is essential for investors seeking to navigate the complex terrain of crypto funding, allowing them to make informed decisions based on real-time data.

Through Bubblemaps, users can identify patterns in withdrawal behaviors, revealing insights into investor confidence and potential shifts in funding dynamics. Such analysis not only aids investors in evaluating their strategies but also helps platforms improve their offerings by addressing the needs and concerns reflected in the data. The continuous evolution of funding mechanisms in the crypto world emphasizes the need for tools like Bubblemaps, equipping users with the clarity required to thrive in a competitive market.

Impact of TGE on Investor Behavior and Market Sentiment

The Token Generation Event (TGE) serves as a pivotal moment for both projects and investors in the cryptocurrency domain. In the case of Lighter, the immediate $250 million withdrawal suggests that investors frequently reassess their positions and liquidity following such events. The dynamics of market sentiment can shift rapidly, making it crucial for stakeholders to remain vigilant and adaptable in their strategies.

This rapid shift in behavior calls attention to the growing importance of understanding market signals framed by TGE news. Investors are not just reacting to the immediate outputs of a TGE but are considering broader implications such as potential market expansions, regulatory adjustments, and technological advancements tied to the assets involved. Analyzing such responses can enhance predictive models for future investment behaviors.

Strategic Insights on Future Investment Opportunities

With Lighter’s recent withdrawal activity, investors are tasked with re-evaluating their strategies and potential entry points within the cryptocurrency realm. The $250 million withdrawal from the Lighter platform not only underscores immediate reactions but also hints at new paradigms for investment opportunities arising from TGE events. Investors can leverage this information to identify upcoming projects that might follow similar withdrawal patterns, thereby aligning their portfolios accordingly.

Understanding the nuances of investor behavior post-TGE can reveal lucrative chances for early adopters willing to navigate the changing tides of crypto funding. By capitalizing on tools such as Bubblemaps, savvy investors can structure their portfolios to not only mitigate risks but actively seek higher reward avenues based on empirical data and historical trends.

Ensuring Comprehensive Risk Management in Crypto Investing

The recent withdrawals amounting to $250 million from the Lighter platform serve as a reminder of the inherent risks associated with crypto investing, especially during key events like a Token Generation Event (TGE). These rapid shifts in investor behavior underline the necessity for robust risk management strategies. Investors must ensure they are not only aware of their assets but also capable of reacting to market volatility that could arise from sudden capital reallocations.

In managing risks effectively, investors may look to diversify their portfolios, engage in thorough research, and utilize analytical platforms such as Bubblemaps. By employing a proactive approach to tracking fund dynamics, particularly around significant events, investors can better position themselves against potential downturns while maximizing their capital utilization in promising projects.

The Role of Analytical Tools in Enhancing Trading Strategies

As the crypto market continues to evolve, analytical tools like Bubblemaps play a pivotal role in enhancing trading strategies. Understanding the data surrounding significant withdrawals like the $250 million from the Lighter platform provides traders with actionable insights that can inform their buying and selling strategies. Such platforms allow for deeper analysis of market movements, making them indispensable for modern traders in the fast-paced digital financial landscape.

By effectively utilizing data-driven insights, traders can enhance their decision-making processes, thus increasing their chances of success in a volatile environment. The ability to visualize capital flows following crucial events like a TGE can help traders anticipate market trends, maximizing their investment returns while minimizing potential losses.

Evaluating Long-term Trends in Cryptocurrency Investment

The withdrawal of $250 million from the Lighter platform highlights not just immediate market reactions but the long-term implications of TGE events on the broader cryptocurrency investment ecosystem. As investors reevaluate their strategies post-TGE, it is essential to analyze how these significant movements can influence long-term market trends and the viability of emerging platforms.

Investors today must consider the larger narrative that transactions post-TGE create, leading to shifts in institutional interest and regulatory responses. Understanding these developments is crucial for forecasting future potential and stability within the crypto landscape, ultimately guiding investors toward sustainable financial growth in an ever-changing market.

Investor Sentiment Trends in Response to Major Withdrawals

Following substantial withdrawals, such as the $250 million reported for the Lighter platform, investor sentiment can often be indicative of broader market conditions. Analyzing these emotional responses provides vital context for decision-making in the cryptocurrency sector. The immediacy of withdrawal following TGE news may signal a panic reaction, or it could reflect strategic reallocation by savvy investors.

Understanding the nuances of investor sentiment can aid platforms and services in tailoring their offerings to better serve the community’s needs. By examining past events, including significant withdrawals post-TGE, stakeholders can better anticipate what strategies resonate with the investing community, paving the way for more effective engagement and retention.

Forecasting the Future of Crypto Funding Mechanisms

The $250 million withdrawal from the Lighter platform sets a precedent for what can occur in crypto funding post-TGE. For stakeholders, this signals a critical period of reflection regarding how funding mechanisms are configured. Careful analysis of Bubblemaps data can highlight potential pitfalls and successful strategies that other platforms might adopt in the future.

As market conditions evolve, understanding and forecasting funding trends will be paramount in guiding investment strategies. Such predictive analyses can empower platforms and investors alike to capitalize effectively on upcoming TGE events and similar market occurrences, shaping the future of crypto funding with innovative approaches.

Frequently Asked Questions

What is Bubblemaps and how does it relate to crypto funding?

Bubblemaps is a blockchain analytics platform that provides insights into crypto funding activities. Recently, it revealed that around $250 million in funds were withdrawn from the Lighter platform shortly after its Token Generation Event (TGE), showcasing the dynamics of crypto investments and funding.

What recent news has Bubblemaps published regarding the Lighter platform withdrawal?

Bubblemaps reported that $250 million was withdrawn from the Lighter platform soon after its TGE, highlighting significant movements in crypto funding and investor interest post-event.

How can I analyze crypto funding trends with Bubblemaps?

You can use Bubblemaps to analyze crypto funding trends by exploring their extensive data on funds flow, like the recent $250 million withdrawal from the Lighter platform, which occurred just after the TGE.

What is the significance of the TGE news shared by Bubblemaps?

The TGE news shared by Bubblemaps is significant because it marked a pivotal moment where $250 million was withdrawn from the Lighter platform, indicating strong market reactions and the potential of projects in the crypto funding space.

Why is the $250 million funds withdrawal from the Lighter platform important for investors?

The $250 million funds withdrawal from the Lighter platform, reported by Bubblemaps, is crucial for investors as it reflects the immediate response to the TGE, indicating investor confidence and the viability of funding opportunities in the crypto market.

What insights can Bubblemaps analysis provide about post-TGE activities?

Bubblemaps analysis provides valuable insights into post-TGE activities by tracking significant fund movements, such as the $250 million withdrawn from the Lighter platform, allowing stakeholders to gauge market behavior and investment strategies.

How does Bubblemaps enhance the understanding of crypto market dynamics?

Bubblemaps enhances the understanding of crypto market dynamics by offering detailed analytics, like those surrounding the $250 million withdrawn from the Lighter platform after its TGE, which illustrate investor actions and funding flows in real-time.

| Key Point | Details |

|---|---|

| Total Funds Withdrawn | $250 million |

| Platform | Lighter |

| Event | TGE (Token Generation Event) |

| Withdrawal Timeframe | One day post-TGE |

Summary

Bubblemaps has reported significant developments in the crypto space, highlighting the withdrawal of $250 million from the Lighter platform just one day after the Token Generation Event (TGE). This considerable financial movement raises questions about investor confidence and market stability, marking a pivotal moment in the recent activities surrounding digital asset platforms.