In the ever-evolving landscape of cryptocurrencies, crypto trading signals have emerged as invaluable tools for traders aiming to navigate this volatile environment. These signals serve as indicators for potential market movements and strategies, helping investors capitalize on market trends effectively. With the rise of intricate strategies such as bear market strategies, crypto enthusiasts are increasingly focusing on altcoin investments for 2025, and monitoring assets like SOL for long positions. Additionally, understanding trader behavior analysis can offer insights into market sentiments, allowing investors to make informed choices. As leverage in crypto trading gains popularity, accessing accurate and timely signals becomes crucial for maximizing returns while managing risks.

Within the realm of digital asset trading, market indicators akin to crypto trading signals play a critical role in guiding traders through the unpredictable nature of the market. These indicators provide foresight into possible price movements, which is essential for building strategies, particularly in challenging conditions like bear markets. Investors are also exploring alternative cryptocurrencies, particularly with an eye towards promising altcoin investments in 2025. Moreover, analyzing trader behavior can significantly enhance one’s grasp of market dynamics, offering a deeper understanding of collective trading psychology. Furthermore, as the use of leverage becomes more prevalent in cryptocurrency trading, the necessity for precise signals to inform decision-making could not be more apparent.

Understanding Crypto Trading Signals and Market Trends

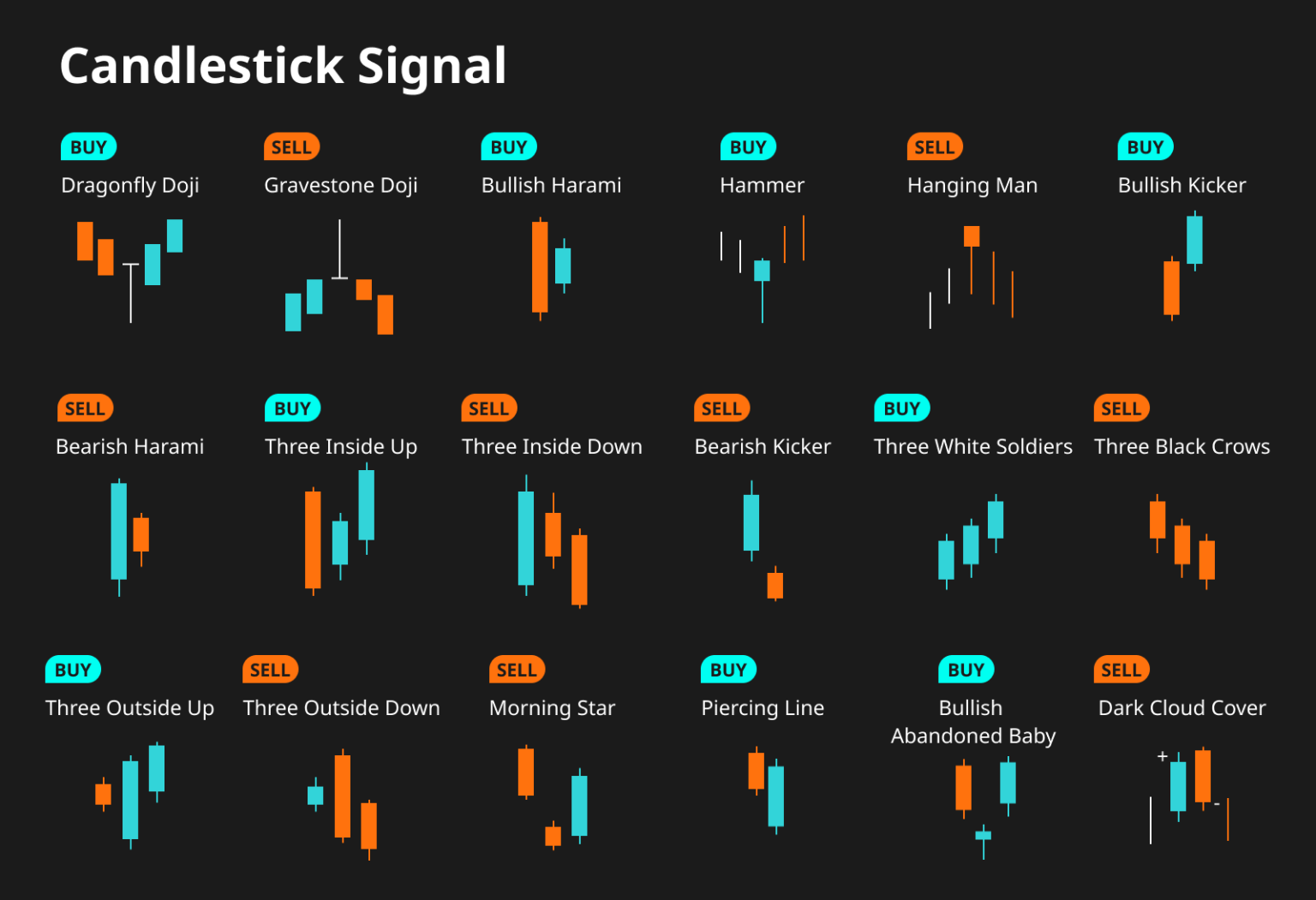

In the world of crypto trading, signals represent pivotal information that can dictate the strategies of traders. Crypto trading signals, whether they point toward bullish or bearish trends, often stem from the analysis of market data, sentiment, and technical indicators. For instance, the recent movements observed in the SOL market—specifically the swift opening of 850 SOL long positions—serve as an excellent example of how these signals can forecast potential upward momentum. As retail investors grapple with their fears of volatility, understanding these movements becomes crucial. Utilizing tools like Hypurrscan to analyze trading behaviors can provide significant insights into trader sentiment, which is essential when navigating volatile markets.

The concept of market trends also ties closely with trader behavior analysis, which helps in anticipating future movements based on past trading actions. For instance, a trader who has historically engaged in large shorts and then switches to a long position might be sending critical signals that can impact the broader market sentiment. Observing such shifts can illuminate potential scenarios for altcoin investments through 2025 and beyond. By applying a layered analysis of trading signals, traders can better position themselves to respond proactively rather than reactively, helping them make informed decisions about leveraging their investments.

Bear Market Strategies: Weathering the Crypto Storm

Navigating a bear market requires a distinctive set of strategies, particularly in the volatile landscape of cryptocurrency. Traders often focus on capital preservation while aiming for opportunistic investments in undervalued altcoins. One common strategy includes hedging positions to mitigate potential losses, allowing traders to enter and exit markets with a greater degree of safety. For instance, observing how significant wallets engage in diverse asset investments with leverage showcases a willingness to capitalize on fluctuations while minimizing exposure during downturns. The recent moves in SOL long positions highlight a risk-on approach that could pay dividends if market conditions shift positively.

However, the intricacies of bear market strategies extend beyond mere hedging. Developing a detailed understanding of funding rates and market correlations can significantly influence a trader’s decisions. If the funding costs for holding long positions become prohibitive, as indicated by the funding regime data available on platforms like CoinGlass, it might compel traders to rethink their strategies or reduce exposure altogether. Therefore, a well-rounded approach, integrating technical analysis with strategic positioning, is quintessential for navigating the uncertainties of a bear market.

The Impact of Altcoin Investments in 2025

As we approach 2025, the landscape of altcoin investments appears ripe for exploration and potential growth. The current data signals suggest that smart investors are increasingly allocating funds toward altcoins, particularly during bullish phases where prominent traders like the one behind ‘BitcoinOG’ are executing substantial long positions. This trend develops as traders seek to diversify their portfolios and exploit opportunities in altcoins that have distinct utility or market potential in the coming years. Investors must strategically analyze which altcoins could outperform based on emerging technologies and market sentiment.

Moreover, the correlation between major cryptocurrencies and altcoins often dictates the overall performance of investment portfolios. When Bitcoin and Ethereum experience gains, there is typically a positive spillover effect on altcoins. By keeping a close eye on investor behavior, funding rates, and the strategic movements of major wallets, investors can identify which altcoins to focus on for 2025. Understanding the nuances of altcoin market dynamics will be essential for anyone looking to optimize their investment strategies in the new year.

Leveraging Strategies in Crypto Trading: Risks and Rewards

The realm of leverage in crypto trading serves as a double-edged sword, offering both substantial rewards and risks that can escalate quickly. Using leverage allows traders to amplify their positions and potential returns on investment, but it can equally lead to significant losses if market conditions turn against them. As evidenced by the recent large-scale moves made by prominent wallets, leveraging trading positions in volatile markets like cryptocurrency demands a keen understanding of market signals and behavior. Traders must be diligent in monitoring how funding rates affect their leveraged positions to maintain a balance between risk management and capital growth.

Ultimately, it’s the behavior of seasoned traders during these periods that provides valuable insights into successful leveraging strategies. For instance, examining the wallet movements and their responses to market fluctuations reveals how knowledgeable market participants strategize their use of leverage. By adopting a disciplined approach to leverage, understanding the intricacies of funding costs, and continuously analyzing trader behavior, individuals can make informed decisions that align with their risk tolerance and investment goals.

Trader Behavior Analysis: Decoding Market Movements

Trader behavior analysis reveals critical patterns and strategies that can be pivotal when gauging market movements. Insights drawn from observing how certain wallets operate, particularly in the rapid execution of trades, can highlight trending sentiments and even foreshadow larger market shifts. Understanding whether these trades are driven by individual traders or automated algorithms provides a deeper perspective into the overall market’s psyche. For instance, clustered activities in long positions, like the SOL case, suggest either confidence in a bullish turnaround or a tactical response to imminent market changes.

Moreover, dissecting the motivations behind significant trades can assist traders in making educated guesses about future movements. Are traders acting based on technical indicators, news reactions, or internal trading patterns? By continuously analyzing these factors, investors can better assess the risks associated with certain trading behaviors, thus refining their own market strategies. Gaining such insights into competitor and market behaviors can empower traders to seize opportunities and mitigate risks in their own trading endeavors.

Funding Regimes in Crypto: A Crucial Monitoring Tool

As funding costs play a critical role in determining the viability of long positions or overall strategies in the crypto space, monitoring funding regimes becomes essential for savvy traders. These funding rates can indicate whether the cost of holding long positions outweighs potential benefits, especially in sideways or bearish market conditions. Tools such as CoinGlass offer valuable insights into these dynamics, allowing traders to effectively assess when to enter or exit positions based on prevailing funding trends.

Additionally, fluctuations in funding costs can serve as a harbinger of broader market sentiment. If funding becomes excessively high, it could signal a potential shift in investor behavior, prompting traders to rethink their long positions. Thus, a proactive approach to funding regime analysis not only helps mitigate risks but also enhances a trader’s ability to capitalize on favorable market conditions. Adapting strategies based on this actionable data can lead to strategically sound investment decisions.

Future Predictions for the Crypto Landscape

With the crypto market continuously evolving, making future predictions requires a nuanced understanding of present behaviors and strategic market investments. Based on current trends such as the increasing popularity of altcoins and the observed shifts in major wallets, we can anticipate a blend of continued growth and volatility in the sector leading into 2025. Speculators are emphasizing the importance of maintaining diversified portfolios while navigating the uncertain landscape of crypto trading.

Furthermore, as market participants increasingly utilize technology for trading, the role of algorithmic trading will likely expand. Many traders are already leveraging existing data to make informed decisions, which could signal a more calculated and strategic trading environment. Overall, monitoring key market indicators, including long versus short positions and funding rates, will be crucial for understanding how the landscape of crypto unfolds in the coming months and years.

Strategies for Long Positions in High Leverage Environments

Engaging in long positions while utilizing high leverage requires a comprehensive understanding of both the benefits and risks inherent in such strategies. The recent establishment of SOL long positions by major traders indicates a confidence in favorable market movements. However, it is vital for traders to approach such engagements with caution, being well-informed about the implications of leveraging techniques. Key strategies include setting clear stop-loss orders and carefully monitoring market conditions to safeguard against potential downturns.

Additionally, traders should focus on maintaining diversification within their leveraged positions. Relying solely on one asset can lead to substantial losses, especially if market corrections occur. By creating a balanced investment approach, traders can better navigate the high-risk terrain of levered trading, ensuring that they are positioned to capitalize on gains while minimizing exposure to losses. Implementing these strategies can significantly enhance the likelihood of success in leveraging long positions.

Adapting to Market Conditions: A Trader’s Survival Guide

Adaptability is a hallmark trait for successful traders navigating the unpredictability of the crypto market. As the landscape shifts, particularly in contexts like bear markets or periods of rapid growth, the ability to pivot strategies can determine one’s success or failure. Traders should continually assess the implications of market behavior—whether it be through analyzing leverage, trader sentiment, or funding conditions—to adapt their strategies appropriately. Staying informed through reliable data sources and market analysis tools will empower traders to make calculated decisions.

Moreover, developing a versatile trading plan that incorporates various market scenarios will help to buffer against unexpected volatility. For instance, recognizing when to switch from aggressive long positions to a defensive stance can save traders from significant losses during harsh market corrections. As the crypto space evolves, embracing a mindset of continuous learning and flexibility will ensure traders are prepared to navigate the ever-changing landscape.

Frequently Asked Questions

What are crypto trading signals and how do they relate to bear market strategies?

Crypto trading signals are indicators or notifications that assist traders in making decisions about buying or selling cryptocurrencies. In bear market strategies, these signals help identify potential opportunities, such as shorting assets or opting for stable coins, when the market is trending downwards.

How can I utilize crypto trading signals for altcoin investments in 2025?

Utilizing crypto trading signals for altcoin investments in 2025 involves tracking market trends, analyzing data, and receiving alerts for significant price movements. This data helps identify promising altcoins that could provide high returns, especially when backed by reliable signals that indicate bullish trends.

What role do crypto trading signals play in SOL long positions?

In SOL long positions, crypto trading signals provide insights into optimal entry points and potential market movements, allowing traders to capitalize on upward trends. By analyzing these signals, traders can manage their leverage efficiently and maximize their investment returns.

How can trader behavior analysis enhance my crypto trading signals strategy?

Trader behavior analysis can enhance your crypto trading signals strategy by offering insights into market sentiment and patterns of professional traders. Understanding their actions can provide context for the signals you receive, helping you make more informed trading decisions.

What risks should I consider when using leverage in crypto trading based on trading signals?

When using leverage in crypto trading based on trading signals, you should consider risks such as increased volatility, funding costs, and sudden market downturns. Monitoring these factors closely ensures that you can adjust your positions accordingly and avoid significant losses.

| Key Point | Details |

|---|---|

| Trader’s Shift in Strategy | The trader known for a $197M BTC short is moving to long SOL positions. |

| High Leverage Usage | The trader is leveraging positions heavily with a multi-asset portfolio. |

| Market Behavior Analysis | Observations indicate the trader’s actions resemble algorithmic behavior. |

| Significant Net Inflows | The wallet saw a net inflow of $291.5 million mainly from USDC deposits. |

| Potential Risks | Risks include funding rates and correlation across assets that could affect performance. |

| Future Scenarios | Three outcomes: continued risk-on, stagnation, or a risk-off shock. |

Summary

Crypto trading signals are becoming increasingly significant as traders adapt to market conditions. The story of a wallet transitioning from a massive BTC short to long positions in SOL underlines the dynamic nature of crypto trading. With substantial inflows and carefully executed trades, traders must navigate potential risks like funding rates and market correlations. Observing these patterns offers valuable insights into market behavior and future trading strategies, essential for anyone looking to thrive in the crypto trading landscape.

Related: More from Market Analysis | Earnings season is wrapping up with a mixed bag of results across | Polymarket Bet Fails to Catch Insider Traders