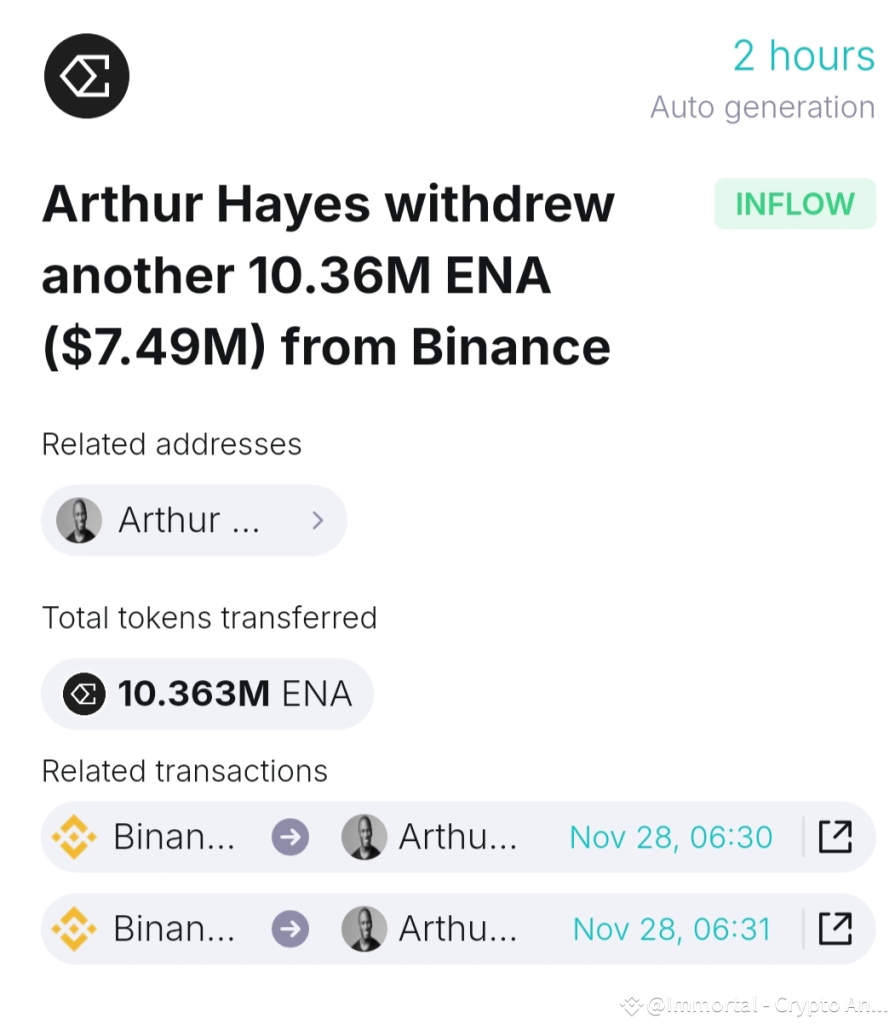

Arthur Hayes’ recent Binance withdrawal is making waves in the cryptocurrency community, as he moved approximately $2 million worth of various tokens. Monitored closely by Onchain Lens, the transaction revealed that Hayes pulled out 4.826 million ENA tokens, valued at around $984,000, alongside other significant crypto withdrawals including 274,000 PENDLE and 440,000 LDO. This financial maneuver has sparked Arthur Hayes news buzz, emphasizing the continuing importance of Binance transactions in shaping the digital asset landscape. Moreover, the involvement of ETHFI tokens in his withdrawal highlights the diverse investment strategies that traders are employing today. As such, understanding the implications of these actions can provide insights into market trends and individual trading behaviors.

In the ever-evolving world of digital currencies, the recent activity involving prominent figure Arthur Hayes has captured significant attention. His withdrawal from the popular exchange platform Binance showcases a strategic move, reflecting broader trends in cryptocurrency transactions. The withdrawal encompassed a diverse array of assets, including ENA and ETHFI tokens, highlighting the dynamic nature of investment choices in the crypto space. The implications of such withdrawals are critical, as they not only affect individual portfolios but also influence market sentiment. Tracking these transactions can provide valuable insights into the behaviors and strategies of leading traders in the industry.

Arthur Hayes Binance Withdrawal: A Significant Move

In a notable development within the cryptocurrency sector, Arthur Hayes, renowned for his influence as a co-founder of BitMEX, recently executed a substantial withdrawal from the Binance exchange. This transaction, amounting to approximately $2 million, included various cryptocurrencies such as ENA, PENDLE, LDO, and ETHFI tokens. Such a move not only highlights Hayes’s ongoing engagement in the crypto market but also underscores the shifts occurring within large exchanges like Binance. Market watchers are keen on understanding the implications of these significant withdrawals on the broader cryptocurrency landscape.

The specific breakdown of Hayes’s withdrawal is intriguing as it showcases a diversification of his holdings in lesser-known tokens alongside major cryptocurrencies. For instance, the withdrawal of 4.826 million ENA tokens, roughly valued at $984,000, caught the attention of analysts who are eager to evaluate the potential for ENA in the marketplace. Additionally, with increasing interest in PENDLE, LDO, and ETHFI, Hayes’s choices may signal trends that today’s traders cannot overlook. Overall, such movements to withdraw from Binance could indicate strategic repositioning within the volatile crypto trading environment.

Insights on Binance Transactions Following Hayes’s Withdrawal

Arthur Hayes’s recent Binance withdrawal is becoming a focal point for discussions around exchange transactions and market dynamics. As significant withdrawals like this one are monitored closely, they often precede or influence market reactions. Traders often analyze such high-profile movements to predict potential shifts in asset value, which may result from increased scarcity or notable investor sentiment. In the wake of Hayes’s transaction, many investors are scrutinizing their Binance accounts for potential implications on their crypto withdrawals.

Moreover, the nature of Binance transactions is notable, concerning both the efficiency of the platform and security in executing trades. With the increasing popularity of digital assets, understanding how exchanges manage large-scale withdrawals is crucial. Investors may wish to consider whether similar transactions affect their strategies. With Hayes’s actions on the radar, it’s essential for crypto enthusiasts to remain informed on how such significant withdrawals influence overall exchange activity.

In addition, observing the response from other cryptocurrency holders to the news of Hayes’s activity can provide further insights into market psychology. As different assets experience fluctuations around major withdrawals, knowing how these events transpire can assist others in making informed decisions and advanced trading strategies. Therefore, monitoring Binance transactions closely, especially those involving high-profile figures like Arthur Hayes, will yield valuable data for the community.

Analyzing Trends in Crypto Withdrawals from Binance

The recent activity surrounding Arthur Hayes’s withdrawal can indicate broader trends in crypto withdrawals from exchanges like Binance. As investors grapple with market volatility, such as fluctuating prices and regulatory scrutiny, the patterns of withdrawing funds reveal significant behavioral insights. Crypto withdrawals are often influenced by investor sentiment regarding specific tokens, making it important to analyze the broader implications Zel Matter and trends involving tokens like ENA and ETHFI.

Currently, various reasons could justify why cryptocurrency investors might opt to withdraw their assets. These might include concerns over exchange security, a desire to engage in peer-to-peer transactions, or a strategic decision to diversify portfolios away from centralized exchanges. Tracking withdrawals over time, especially those associated with notable figures such as Hayes, will help paint a clearer picture of trends and attitudes among crypto holders, outlining how institutional and retail investors respond to the market tides.

The Role of ENA and ETHFI Tokens in Latest Withdrawal Trends

Among the tokens withdrawn by Arthur Hayes, ENA and ETHFI stand out for their unique market positions and potential growth trajectories. The withdrawal of substantial amounts of these tokens reflects a burgeoning interest in decentralized finance (DeFi) sectors, where projects are designed to provide investors with innovative financial solutions. As Hayes navigates through increasingly complex crypto waters, his movement of such assets signals potential shifts in demand and usability for these tokens.

The growing interest in ENA and ETHFI, both of which are integral within their respective ecosystems, often leads other investors to reevaluate their positions. As partnerships and developments around these tokens evolve, they could foster a more robust trading environment. The crypto community continues to keep a close watch on how such withdrawals may affect the liquidity and perceived value of these tokens, along with how these factors play into the broader market trend following major transactions by influential figures.

Market Reactions to Arthur Hayes’s Binance Withdrawal News

The crypto market often reacts swiftly to news about significant withdrawals, particularly from high-profile individuals like Arthur Hayes. Investors frequently take cues from such movements, adjusting their positions based on perceived sentiment and the potential for market shifts. The reverberations of Hayes’s recent Binance withdrawal could stir reactions across various platforms, influencing trading volumes and investor confidence in specific tokens.

As analysts and traders digest the implications of Hayes’s withdrawal, it becomes essential to gauge the collective market mood. If the withdrawal is perceived as Hayes diversifying his portfolio or preparing for a shift away from high-volatility exposure, this may prompt others to consider similar strategies. Conversely, strategic decisions by influential figures often raise concerns regarding liquidity, prompting market-wide adjustments that every investor should heed.

The Importance of Monitoring Crypto Withdrawals During Market Fluctuations

Monitoring crypto withdrawals, especially during periods of high market volatility, has become increasingly critical for investors looking to protect their assets. With Arthur Hayes’s recent withdrawal as an example, keeping tabs on such significant transactions can provide insight into potential shifts in the market dynamics. Investors who can predict the reactions to such withdrawals, including interest in specific tokens like ENA and ETHFI, position themselves advantageously in the rapidly evolving crypto landscape.

These monitoring practices can reveal essential patterns, from identifying trends in asset preferences to helping predict liquidity issues that could arise from large-scale withdrawals. Engaging with resources that track exchange activity can equip investors with the knowledge to make informed decisions as the market fluctuates. Understanding the context within which these withdrawals occur means staying ahead of the curve, particularly when consensus appears to shift following significant events.

Understanding the Future of Withdrawals on Major Exchanges Like Binance

The landscape of crypto withdrawals on exchanges, specifically Binance, is expected to evolve continually as the market matures and regulatory environments change. Notably, Arthur Hayes’s recent withdrawal emphasizes the necessity for regular evaluation of exchange practices surrounding large transactions. As the regulatory scrutiny of cryptocurrencies intensifies, how exchanges handle withdrawals will significantly impact investor trust and engagement.

Furthermore, assessing the trends established through withdrawals, like those from Hayes, may prompt exchanges like Binance to adapt and innovate their offerings. Whether through better liquidity management, improved security protocols, or expanded withdrawal options for less mainstream tokens, exchanges will need to remain competitive. Identifying these trends could prepare crypto enthusiasts for a smoother transition into the future of digital asset management, allowing them to react proactively rather than reactively.

Strategic Implications of High-Profile Withdrawals in the Crypto World

High-profile withdrawals, such as Arthur Hayes’s recent transactions, can signal strategic pivots within the cryptocurrency space. Investors often watch these moves to decipher the intentions behind such substantial asset movements. By analyzing the underlying strategies, traders can align their investment decisions and portfolio management techniques to better navigate the volatile waters of cryptocurrency.

Additionally, understanding the implications of withdrawing major assets can help investors reassess their exposure to varying cryptocurrencies. When such influential figures withdraw significant amounts from exchanges, it often prompts a reevaluation of risk versus reward—pushing investors to either follow suit or adopt contrarian strategies. This aspect of behavioral finance is crucial, especially as the crypto market remains heavily influenced by news and trends driven by high-profile individuals.

Frequently Asked Questions

What tokens did Arthur Hayes withdraw from Binance?

Arthur Hayes recently withdrew several tokens from Binance, including 4.826 million ENA valued at approximately $984,000, 274,000 PENDLE worth around $515,000, 440,000 LDO approximately totaling $260,000, and 358,000 ETHFI tokens valued at about $250,000.

How much money did Arthur Hayes withdraw from Binance?

In total, Arthur Hayes withdrew approximately $2 million worth of various tokens from Binance, which included ENA, PENDLE, LDO, and ETHFI.

What is the significance of Arthur Hayes withdrawing from Binance?

The withdrawal by Arthur Hayes from Binance highlights significant movements within crypto transactions, drawing interest from the crypto community, especially concerning the potential implications for ENA, ETHFI, and other tokens involved.

Is it common for large crypto holders like Arthur Hayes to conduct Binance transactions?

Yes, large holders or whales in the crypto market often conduct Binance transactions to manage their portfolios or move significant amounts of crypto tokens, such as ENA and ETHFI, to different exchanges or wallets.

What could be the impact of Arthur Hayes’ Binance withdrawal on crypto market trends?

Arthur Hayes’ withdrawal of substantial amounts from Binance may influence market trends, particularly for the tokens involved like ENA and ETHFI, as it may indicate strategic reallocations or market sentiment shifts.

Where can I find updates on developments related to Arthur Hayes and Binance?

For the latest news and updates on Arthur Hayes, Binance transactions, and related tokens, following credible cryptocurrency news outlets and monitoring onchain analytics platforms is advisable.

| Token | Amount Withdrawn | Approximate Value (USD) |

|---|---|---|

| ENA | 4,826,000 | $984,000 |

| PENDLE | 274,000 | $515,000 |

| LDO | 440,000 | $260,000 |

| ETHFI | 358,000 | $250,000 |

| Total | — | $2,009,000 |

Summary

Arthur Hayes Binance withdrawal involved a substantial total of approximately $2 million, split across various tokens including ENA, PENDLE, LDO, and ETHFI. This significant withdrawal highlights the ongoing developments and movements within the cryptocurrency market, emphasizing the strategic financial maneuvers by key players like Hayes.