The cryptocurrency sector decline is becoming increasingly evident as the market reels from a dramatic downturn. Recent reports indicate that HODL has dropped by a staggering 6.96%, signaling troubling trends in cryptocurrency trading news. This decline is mirrored by the overall performance of U.S. stocks, which closed down across major indexes, with the Dow Jones, S&P 500, and Nasdaq all showing negative results. Investors are closely monitoring cryptocurrency market analysis to understand the factors behind these stock market trends and the broader implications for digital currencies. As traditional assets falter, the ripple effects on the crypto landscape raise questions about the future viability of many tokens in this highly volatile market.

As we delve into the recent downturn in the digital currency space, it’s essential to recognize the broader implications of market fluctuations. The deterioration of the cryptocurrency sector has not only affected traditional virtual assets but has also caused a significant impact on conventional stock indices. With reports highlighting a notable drop in key cryptocurrency valuations, including HODL and several altcoins, analysts are turning to economic indicators and trading patterns for insight. The intersection of cryptocurrency and stock market dynamics remains a vital area for examination, particularly in understanding the ongoing shifts in investor sentiment and trading behavior. These developments are crucial for anyone interested in the future of both digital currencies and traditional financial markets.

Analysis of U.S. Stocks Performance Amid Cryptocurrency Sector Decline

The recent downturn in U.S. stocks coinciding with the decline in the cryptocurrency sector raises important questions about market correlations. In the last trading session, indices like the Dow Jones and Nasdaq reflected minimal losses, attributed in part to investors’ cautious sentiment toward volatile assets. As HODL dipped by 6.96%, investors are left to ponder the sustainability of both stock and crypto markets in such shifting economic conditions.

Moreover, this decline in the cryptocurrency sector may influence future stock market trends. Investors often react to changing dynamics within the cryptocurrency space, leading to adjustments in their stock portfolios. As cryptocurrency market analysis continues to highlight the interdependencies of various asset classes, the latest performance of U.S. stocks offers insights into broader market confidence and risk assessment.

Exploring the Impact of HODL Drops on Cryptocurrency Trading News

HODL’s significant drop of 6.96% serves as a critical indicator of investor sentiment within the cryptocurrency trading landscape. This decline is not isolated, as ALTS and ABTC also faced notable losses, suggesting a trend where even established cryptocurrencies are losing ground. Traders and investors need to stay informed through comprehensive cryptocurrency trading news to navigate these tumultuous markets effectively.

The depth of the HODL drop raises discussions about the strategies investors might adopt following market volatility. As stories and trends unfold in the cryptocurrency realm, analysis becomes essential for making informed decisions. Additionally, understanding the factors leading to HODL’s performance can unveil potential future movements, helping traders plan their next steps more cautiously amid uncertainty.

Understanding Stock Market Trends During Cryptocurrency Sector Decline

Stock market trends often reflect underlying economic issues, and the recent decline in the cryptocurrency sector adds a layer of complexity to these trends. With the S&P 500 and Nasdaq recording slight downturns, analysts are assessing whether the instability in cryptocurrencies is affecting investor behavior on traditional exchanges. The link between these markets becomes especially apparent as concerns over capital migration become more pronounced.

As investors assess their positions, understanding shifts in both the stock and cryptocurrency markets remains crucial. The behavior of U.S. stocks amidst the cryptocurrency decline suggests a cautious outlook, making it essential for market participants to closely observe how external factors may impact the overall financial landscape.

The Relationship Between Cryptocurrency Market Analysis and U.S. Stocks

Recent cryptocurrency market analysis indicates a remarkable correlation between cryptocurrency performance and U.S. stocks. As the cryptocurrency sector declines, it often triggers a ripple effect through the stock markets, revealing shared investor sentiments. The recent figures showing decreases in the Dow Jones and S&P 500 indicate how intertwined these asset classes have become.

Market analysts are increasingly urging investors to integrate cryptocurrency insights into their stock investment strategies. The decline in major cryptocurrencies like HODL mirrors hesitation in U.S. equities, suggesting that traders must stay vigilant and adaptive to both markets. A comprehensive analysis can provide a roadmap for making informed investment choices during periods of volatility.

Future Outlook for Cryptocurrency in the Face of Market Declines

With the recent decline in cryptocurrencies, particularly HODL dropping 6.96%, market analysts are scrutinizing the future outlook for digital assets. Amidst fears of a broader downturn, the cryptocurrency market faces increased pressure from regulatory scrutiny and investor skepticism. As traders react to these developments, the potential for recovery appears challenging without significant market reform or new technological advancements.

Additionally, as cryptocurrencies fall from grace, the investments once viewed as revolutionary now face greater scrutiny from both institutions and individual investors. This changing landscape necessitates careful observation of market trends, as the future of cryptocurrency could hinge on how these assets adapt to evolving market expectations.

Investor Sentiments Shifting with Cryptocurrency Sector Decline

Investor sentiment plays a critical role during periods of market decline, especially seen in the cryptocurrency sector with recent drops such as HODL’s 6.96% fall. Concerns about the viability and future of cryptocurrencies are evident, as traders weigh their options against the backdrop of declining prices. Understanding how investor psychology shifts during these times can provide valuable insight into market movements.

Recent trading news indicates a move toward caution among investors, with many opting to hold onto stable assets rather than venturing further into volatile cryptocurrencies. The overarching narrative that successful investing involves not just knowledge but also emotional intelligence becomes vital as traders navigate uncertain waters in the current market.

What Leads to Declines in the Cryptocurrency Sector?

The recent declines in the cryptocurrency sector, prominently marked by HODL’s drop, raise pivotal questions about the factors contributing to such downturns. Economic climates, regulatory changes, and market speculation are all intertwined elements that test the resilience of digital assets. This analysis emphasizes the importance of investors understanding the broader implications of external news on cryptocurrency trading dynamics.

Regulatory news, in particular, has a far-reaching impact, causing market jitters and leading to sell-offs among eager traders. As various events unfold within the cryptocurrency market, there lies an opportunity for analysts and investors to digest these trends to better navigate potential declines in the future.

The Role of Decentralized Platforms in Cryptocurrency Trading News

Decentralized platforms like msx.com are shaping the future of cryptocurrency trading and analysis. The recent performances reported on stocks and their corresponding tokens demonstrate the growing significance of these platforms. As investors increasingly turn to decentralized solutions amid a sector decline, the connection between traditional and digital assets becomes more prominent within cryptocurrency trading news.

Moreover, these platforms facilitate greater accessibility to different asset types, allowing investors to diversify their portfolios. In light of the recent declines, understanding the reach of decentralized trading platforms could provide investors with new opportunities and insights into navigating the volatile nature of the cryptocurrency market.

Impact of External Economic Factors on Cryptocurrency Sector

Various external economic factors greatly influence the performance of the cryptocurrency sector. As seen with HODL’s significant drop and the overall decline across digital assets, economic indicators can lead to substantial repercussions. Investors must take into account global economic trends alongside domestic economic performances, such as stock market trends, to assess their portfolios effectively.

The interplay between the stock market and cryptocurrency suggests that shifts in one can directly affect the other. This interconnectedness highlights the importance of considering external factors when analyzing investment strategies, as the crypto sector is not isolated from the broader economic environment.

Frequently Asked Questions

What factors contributed to the recent cryptocurrency sector decline?

The cryptocurrency sector decline can be attributed to various factors including negative trends in U.S. stocks performance, leading to broader market anxiety. Recent reports indicate that the Dow Jones, S&P 500, and Nasdaq Composite all experienced slight downturns, which often correlate with declines in the cryptocurrency market. Additionally, HODL and ALTS have seen significant drops of 6.96% and 5%, respectively, suggesting a cautious trading environment affecting investor confidence.

How does the cryptocurrency sector decline affect HODL prices?

The decline in the cryptocurrency sector has a direct impact on HODL prices, which have dropped 6.96% recently. Such downturns often occur during negative U.S. stock performance, leading investors to reassess their positions in digital assets. The intertwined nature of stock market trends and cryptocurrency market analysis highlights the susceptibility of cryptocurrencies to external economic factors.

What should investors consider during a cryptocurrency sector decline?

During a cryptocurrency sector decline, investors should closely monitor stock market trends and overall U.S. economic performance. With significant drops noted in cryptocurrencies like HODL and others, understanding market sentiment is crucial. Keeping updated with cryptocurrency trading news can provide insights and potential strategies for reacting to these market movements.

Is it advisable to HODL during a cryptocurrency sector decline?

Deciding to HODL during a cryptocurrency sector decline depends on individual risk tolerance and market outlook. The latest downtrend, including a 6.96% drop in HODL, suggests a period of volatility. Investors should assess their long-term strategies and remain informed through cryptocurrency market analysis to determine whether holding or selling aligns with their financial goals.

What impact does U.S. stock performance have on cryptocurrency market dynamics?

U.S. stock performance significantly influences cryptocurrency market dynamics. As evidenced by the recent decline in major stock indices, such market movements can create a ripple effect, leading to declines in cryptocurrencies, including HODL and ALTS. Investors often shift their focus to safer assets during stock market downturns, pressuring the cryptocurrency sector.

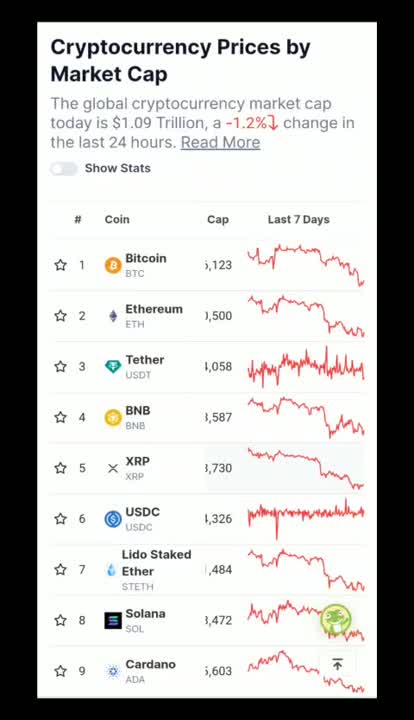

| Market Indicator | Change (%) | Notes |

|---|---|---|

| Dow Jones | -0.2 | U.S. stock market indicator, representing a slight decline. |

| S&P 500 | -0.14 | Broader stock market index showing minimal decrease. |

| Nasdaq Composite | -0.24 | Tech-heavy index that also experienced a drop. |

| HODL | -6.96 | Highlighted cryptocurrency with significant decline in its value. |

| ALTS | -5 | Other altcoins facing downturn alongside HODL. |

| ABTC | -4.97 | Another cryptocurrency showing a significant drop. |

Summary

The cryptocurrency sector decline has been notably marked by a significant drop in key assets, with HODL falling by 6.96%. This trend reflects a broader bearish sentiment affecting not only the digital currency market but also major U.S. stock indices, which closed slightly lower. The simultaneous decline across both markets may indicate a cautious investor sentiment amidst economic uncertainties. With cryptocurrencies struggling to maintain their market positions, analysts are closely monitoring the implications of these trends on future investments and the overall health of the crypto landscape.

Related: More from Regulation & Policy | UK Gambling Regulator Examines Cryptocurrencies for Licensed Bettors in Crypto Regulation | Blocks Retreat Signals Broader Payments Shifts