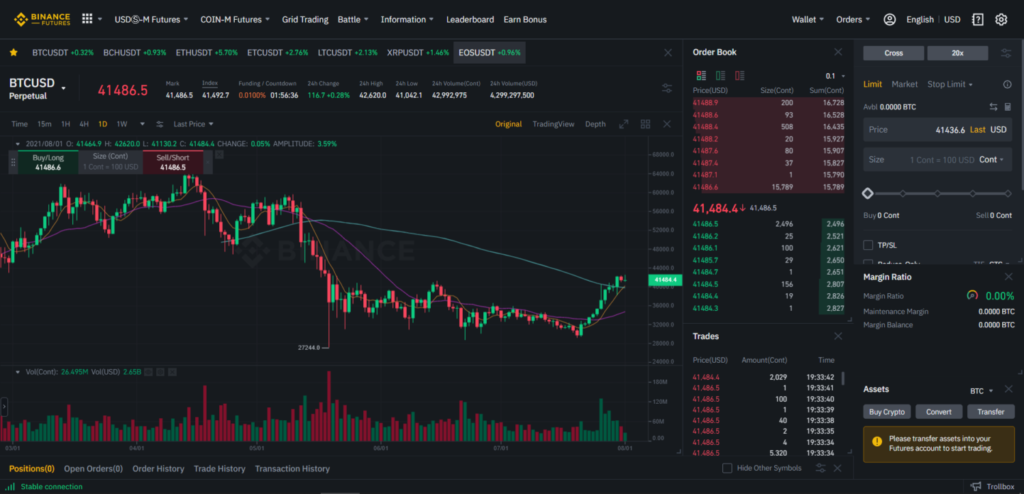

Binance Futures is set to revolutionize the way traders engage with cryptocurrency by introducing pre-market trading for the BREVUSDT perpetual contract. Launching on December 30, 2025, at 18:45 Beijing Time, this innovative move opens up new possibilities in the fast-paced world of cryptocurrency trading. With leverage trading options of up to 5 times, traders can maximize their potential returns while managing their risks effectively. In addition to the strategic advantages, this initiative has generated buzz in Binance trading news, making it a topic of keen interest among investors. Whether you’re a seasoned trader or a newcomer, Binance Futures offers a powerful platform to explore the evolving dynamics of the cryptocurrency market.

The upcoming features on Binance Futures can be seen as a significant advancement in the realm of derivatives and options trading within the crypto sphere. As the platform prepares for its launch of pre-market operations, traders will be able to engage with contracts such as the BREVUSDT, enhancing their investment strategies. This expansion provides an exciting opportunity for users looking to participate in leveraged trades, which can amplify both gains and losses. By keeping informed about the latest developments and trends in cryptocurrency trading, market participants can position themselves strategically. Ultimately, Binance’s initiative is expected to attract a diverse range of traders, further enriching the dynamic environment of digital asset trading.

Introduction to Binance Futures and Pre-Market Trading

Binance Futures has continuously set the benchmark for cryptocurrency trading, and its latest announcement regarding the launch of pre-market trading for the BREVUSDT perpetual contract further solidifies its position as a market leader. Starting from December 30, 2025, traders will have the opportunity to engage in pre-market trading at 18:45 Beijing Time, opening doors for enhanced trading strategies and flexibility. This innovative step aims to provide traders with more options, reflecting Binance’s commitment to innovation and responsiveness to market demands.

Pre-market trading is a crucial aspect of the financial markets that allows traders to buy and sell contracts before the regular trading hours. By integrating this feature into the Binance Futures platform, Binance is aligning itself with traditional market practices while catering specifically to the cryptocurrency trading demographic. Traders can expect increased market participation and potentially enhanced price discovery mechanisms as a result of early trading activities, making this a significant development for market dynamics.

Exploring the BREVUSDT Perpetual Contract

The BREVUSDT perpetual contract represents a unique trading opportunity for investors on the Binance Futures platform. Perpetual contracts, unlike traditional futures, do not have an expiration date, allowing traders to hold their positions indefinitely, provided they can meet margin requirements. This feature appeals to a broad spectrum of traders, from long-term holders to those engaging in short-term leverage trading strategies. With the introduction of the BREVUSDT contract, Binance is expanding its diverse offerings to meet the needs of various trader profiles.

Moreover, the BREVUSDT perpetual contract will allow users to leverage trades by up to five times, presenting both opportunities and risks. Leverage trading can amplify profits, but it can equally lead to substantial losses if market movements go against traders’ positions. As with all cryptocurrency trading on Binance, it’s essential for traders to utilize risk management strategies and carefully consider their leverage options to enhance their trading effectiveness while safeguarding their capital.

The Impact of Leverage Trading on Market Dynamics

Leverage trading is a double-edged sword; while it can enhance potential returns, it significantly increases systemic risks. As Binance Futures prepares to introduce pre-market trading for the BREVUSDT perpetual contract, understanding the implications of leverage trading becomes paramount. Traders should remain vigilant about their strategies, as the use of leverage can lead to heightened volatility in pricing. This dynamic is especially pronounced in the cryptocurrency markets, where price movements can occur rapidly and dramatically.

Moreover, the influence of leverage trading extends beyond individual accounts to affect overall market dynamics. Greater leverage can increase market liquidity, but it may also create scenarios where price swings become exaggerated due to cascading liquidations. This is why keeping abreast of Binance trading news is critical, as developments can significantly impact trader psychology and market behavior. Engaging in prudent risk management and having an updated understanding of market trends will be vital for anyone looking to trade the BREVUSDT perpetual contract.

Understanding Risks in Pre-Market Trading

Although pre-market trading offers exciting prospects, it is not without its risks. The introduction of pre-market hours for the BREVUSDT perpetual contract on Binance Futures will likely lead to reduced liquidity during these periods, which can intensify price volatility. Traders must navigate an environment where market information may be less transparent than during regular trading hours, increasing the chance of unexpected price movements. Thus, having a solid grasp of risk management strategies is essential for anyone planning to trade in this new pre-market framework.

Additionally, traders should be wary of the impact external factors can have on pre-market trading conditions. News events, such as regulatory announcements or major industry developments, can dramatically shift market sentiment, particularly in the cryptocurrency sector. It’s important for traders engaging in pre-market activities on Binance Futures to stay informed on the latest cryptocurrency news that could affect their positions in the BREVUSDT perpetual contract.

Technical Analysis Strategies for BREVUSDT

Technical analysis will play a crucial role in successfully navigating trades in the BREVUSDT perpetual contract on Binance Futures, especially given the leverage options available. Traders should familiarize themselves with various indicators and chart patterns to not only recognize potential entry points but also determine accurate exit strategies. Utilizing tools such as moving averages, relative strength index (RSI), and support and resistance levels can aid traders in comprehensively analyzing market movements and making informed decisions.

Moreover, as pre-market trading hours provide an atypical trading environment, adapting technical analysis techniques to this context is vital. Traders may need to adjust their indicators or modify their approach to account for lower liquidity and increased volatility. Continuous monitoring of price action during pre-market hours will be essential for effective trading, requiring traders to remain agile and responsive to evolving market signals.

Identifying Market Trends in Cryptocurrency

Recognizing market trends is crucial for success in cryptocurrency trading, and the launch of the BREVUSDT perpetual contract provides another layer for traders to examine. As market conditions continually shift, traders should be adept at identifying trends—whether bullish or bearish—and aligning their strategies accordingly. Utilizing a combination of fundamental and technical analysis will enable traders to get a broader understanding of market shifts and the underlying factors at play.

In the context of pre-market trading on Binance Futures, monitoring external indicators and relevant news can significantly impact trend analysis. For instance, notable developments in Bitcoin or Ethereum can have ripple effects across the cryptocurrency market, impacting the BREVUSDT contract. Staying ahead of market sentiment and exploring trading setups that align with confirmed trends can enhance overall trading outcomes, making it imperative for traders to invest time in thorough market analysis.

The Role of Binance Trading News in the Cryptocurrency Market

Keeping informed with Binance trading news is vital for traders to navigate the ever-changing landscape of cryptocurrency markets effectively. News releases can significantly impact trading behavior, especially when it pertains to new offerings like the BREVUSDT perpetual contract. Understanding how news influences price action allows traders to make more calculated decisions, minimizing potential risks associated with market sentiment driven by external events.

In addition to direct trading news, insights into market analysis and expert opinions can also shape trading strategies. The integration of news, coupled with technical and fundamental analysis, creates a comprehensive approach to cryptocurrency trading. Traders leveraging resources such as the Binance Futures platform can greatly enhance their understanding and responsiveness to both opportunities and threats present in the dynamic world of cryptocurrency.

Future Trends in Cryptocurrency Trading

Looking ahead, the introduction of features like pre-market trading for the BREVUSDT perpetual contract on Binance Futures signals a shift towards more sophisticated trading practices in the cryptocurrency domain. As the market continues to evolve, it’s expected that platforms will enhance their offerings to accommodate increasing trader expectations for flexibility and innovation. Future trading strategies will likely incorporate advanced tools and analytics, empowering traders to maximize their potential earnings while minimizing risks.

Furthermore, as more traders embrace cryptocurrency as a legitimate asset class, the integration of features such as pre-market trading will enhance overall market efficiency. Innovations related to leverage, contract types, and technological advancements in trading platforms will play a significant role in shaping how trades are executed and how traders react to market movements. Keeping an eye on these trends will be essential for traders looking to remain competitive in an increasingly sophisticated trading landscape.

Frequently Asked Questions

What is Binance Futures and how does it relate to cryptocurrency trading?

Binance Futures is a decentralized trading platform offered by Binance that allows users to trade cryptocurrency contracts with leverage. It enables traders to speculate on the price movements of various cryptos, using leverage options that can amplify potential gains or losses.

What does the launch of pre-market trading for the BREVUSDT perpetual contract mean for traders?

The launch of pre-market trading for the BREVUSDT perpetual contract allows traders to open and close positions outside of standard market hours. This feature enhances trading flexibility and opportunity for those looking to capitalize on market movements prior to regular trading sessions.

How much leverage can I use when trading the BREVUSDT perpetual contract on Binance Futures?

When trading the BREVUSDT perpetual contract on Binance Futures, traders can use a maximum leverage of up to 5 times. This means that for every $1 in your account, you can control up to $5 in the futures market.

Where can I find the latest Binance trading news regarding futures?

You can find the latest Binance trading news, including updates on futures contracts like BREVUSDT, directly on the Binance platform or through their official news channels and social media feeds. Keeping up with these updates helps traders make informed decisions.

What benefits does leverage trading on Binance Futures offer for cryptocurrency?

Leverage trading on Binance Futures allows cryptocurrency traders to amplify their investments. By using leverage, traders can increase their exposure to price movements without needing to commit a large amount of capital upfront, thereby potentially increasing their profits.

What are the operational hours for pre-market trading on Binance Futures for the BREVUSDT contract?

Pre-market trading for the BREVUSDT perpetual contract on Binance Futures will commence at 18:45 Beijing Time on December 30, 2025. This allows traders early access to market movements before the official trading session begins.

| Key Point | Details |

|---|---|

| Launch Date and Time | December 30, 2025, at 18:45 Beijing Time |

| Trading Type | Pre-Market Trading for the BREVUSDT Perpetual Contract |

| Maximum Leverage | Up to 5 times |

| Source | Official Announcement by Binance Futures |

Summary

Binance Futures is set to enhance trading opportunities by launching pre-market trading for the BREVUSDT perpetual contract on December 30, 2025. This new feature will enable traders to access the markets earlier, with a significant leverage option of up to 5 times. Such advancements reflect Binance’s continuous efforts to innovate and provide its users with more flexible and profitable trading solutions.