The introduction of the slippage limit feature by Gate’s perpetual contract marks a transformative step in enhancing the trading experience for users. This innovative market order slippage setting allows traders to establish their own acceptable limits, ensuring that their orders are executed within a predefined price range. By enabling traders to set these limits effectively, the feature significantly bolsters risk control trading, reducing the likelihood of unexpected price deviations during volatile market conditions. Designed to cater to both novice and seasoned traders, this feature is an integral part of the robust Gate exchange features aimed at providing a safer trading environment. With the slippage limit feature, users can trade with confidence, knowing that their orders will not be executed at prices far removed from their expectations.

In the rapidly evolving world of cryptocurrency trading, the introduction of a customizable slippage limit option redefines how traders interact with market orders. This new functionality, which addresses the need for better risk management during high volatility periods, allows for a more controlled trading experience. By integrating this feature within the Gate exchange platform, users can safeguard their investments against market fluctuations that may lead to significant losses. Whether you’re dealing with perpetual contracts or other trading instruments, having the ability to limit slippage is crucial for maintaining precision in order execution. Ultimately, this enhancement not only preserves capital but also empowers traders to make informed decisions in fast-paced markets.

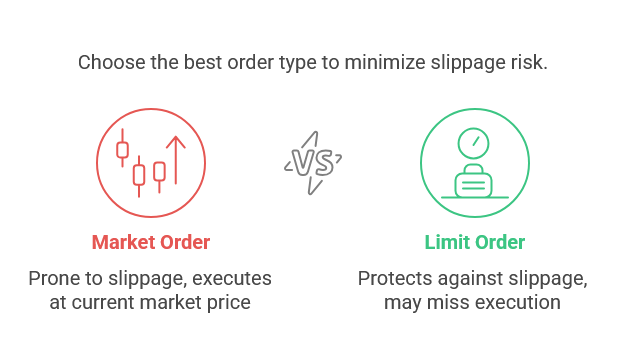

Understanding Market Order Slippage and Its Impact on Trading

Market order slippage is a phenomenon that occurs when a trader places a market order and the execution price differs from the expected price. This discrepancy can happen due to volatile market conditions, where the price of an asset fluctuates quickly, or during low liquidity scenarios, where there are insufficient orders to match the market order. Traders often experience slippage when trading perpetual contracts, as these contracts are sensitive to rapid price changes. Understanding the implications of slippage on trading outcomes is crucial for managing expectations and effectively strategizing trades.

With the launch of Gate’s slippage limit feature, traders now have enhanced control over their market orders by setting a predefined acceptable slippage percentage. This not only aids in risk control trading but also optimizes the overall trading experience on the exchange. By potentially reducing the costs associated with unexpected price shifts, users can make more informed decisions, thereby safeguarding their investments while navigating the complexities of the market.

Enhanced Trading Experience: Gate’s Slippage Setting Feature

The introduction of a slippage setting feature by Gate is a significant step towards improving user experience on their platform. This feature allows traders to specify a maximum slippage limit before executing their market orders, which greatly enhances predictability in trade execution. For instance, if a trader sets a slippage limit of 1%, their order will only be executed if the market price falls within that range, preventing unwanted surprises caused by rapid price movements or drop-offs in market depth.

This advancement emphasizes Gate’s commitment to providing top-tier trading solutions. Users benefitting from the slippage limit feature can focus more on profit strategies rather than worrying about the consequences of market volatility. By minimizing the potential for erratic transactions, traders can enjoy a more stable trading environment while confidently engaging in futures and perpetual contracts on the platform.

Implementing Risk Control Trading Strategies with Slippage Limits

Risk control is an essential aspect of trading, especially when dealing with volatile markets. Gate’s implementation of slippage limits serves as a powerful component of a trader’s risk management arsenal. By defining a clear threshold for slippage, users can effectively reduce their exposure to significant losses caused by unforeseen market movements. This proactive approach not only protects capital but also helps maintain psychological balance during trading.

In the context of perpetual contracts, where price swings are common, incorporating the slippage limit feature can lead to smarter decision-making. Traders who utilize this feature have the potential to enhance their overall trading strategy, allowing for better positioning in the market while simultaneously upholding stringent risk management protocols. This function underlines how Gate is tailoring its services to meet the demands of modern traders.

Optimizing Liquidity and Market Depth with Gate’s Innovative Features

Market depth and liquidity are critical factors that influence trading efficiency, especially during high volatility periods. Gate’s innovative features, particularly the maximum slippage limit for market orders, play a vital role in optimizing these aspects. By ensuring that orders are executed within a specified slippage range, traders can expect a more stable execution without the risks that typically accompany sudden market changes or lack of activity.

The availability of this slippage feature means that traders can pursue opportunities in various market conditions with increased confidence. Whether trading in high-volume or niche assets, the ability to customize slippage preferences helps users navigate the delicate balance of competing orders, ultimately leading to a more efficient trading process and greater satisfaction on the platform.

The Importance of Customization in Modern Trading Platforms

As trading technology evolves, so does the need for customization in trading platforms. Gate’s introduction of the slippage limit feature reflects an industry trend towards personalized trading experiences. Traders today are not merely looking for execution; they seek to tailor their trading environment to fit their unique strategies and risk tolerance levels. This level of customization enhances user engagement and satisfaction.

Being able to set specific slippage parameters means traders can engage with the market on their terms, significantly impacting their performance and satisfaction levels. This enhancement in user experience is essential for retaining traders and attracting new users who are looking for sophisticated trading tools that align with their individual needs and objectives.

Navigating Volatile Markets with Enhanced Safety Features

Volatility can pose significant challenges in trading, often leading to unexpected slippage that erodes gains or results in losses. Gate’s newly introduced slippage limit feature empowers traders to navigate these turbulent conditions with enhanced safety. By implementing maximum slippage thresholds, traders can confidently execute market orders even in fast-moving environments, minimizing the risk of adverse price effects.

This feature is particularly useful during major market events when liquidity can swiftly diminish, amplifying the risk of unintentional slippage. Gate’s solution ensures traders retain control over their trade outcomes, contributing to a more measured approach to market engagement. Such risk mitigation strategies are vital for ensuring long-term trading success.

Building a Robust Trading Strategy with Gate Exchange Features

To cultivate a robust trading strategy, utilizing all available tools and features is imperative. Gate’s perpetual contract offerings, along with the slippage limit functionality, provide a comprehensive framework that traders can leverage. By integrating these features into their strategies, traders can not only mitigate risks but also enhance their overall market performance.

Moreover, adopting a holistic approach that combines slippage limits, risk control measures, and market analysis empowers users to make informed decisions. As the trading landscape continues to evolve, Gate’s innovations enable users to adapt their strategies effectively while capitalizing on market opportunities without compromising their risk appetite.

The Future of Trading: Innovations in Slippage Management

In the rapidly evolving world of trading, innovations in slippage management are crucial. Gate’s recent feature introduces a preventive mechanism against potential slippage, redefining how traders approach market orders. This evolution signifies a shift towards more sophisticated platforms that prioritize user experience and risk management.

As traders demand more from their trading environments, features like customizable slippage limits will likely become standard across platforms. The future looks promising as exchanges like Gate pave the way for enhanced trading experiences that cater to individual trader needs while fostering a culture of responsible trading.

Assessing the Effectiveness of Gate’s Slippage Limit Feature

To gauge the effectiveness of Gate’s slippage limit feature, it is essential to analyze user feedback and trading outcomes post-implementation. Preliminary reports suggest that traders appreciate the ability to manage their slippage thresholds, leading to improved order execution conditions and higher satisfaction rates. The impact on overall trading performance is becoming increasingly apparent as users share their experiences and strategies.

Further studies can focus on how this feature influences trading behavior across different market conditions. By continuously monitoring trader responses and making adjustments based on user experiences, Gate can further enhance this feature, solidifying its position as a leader in innovative trading solutions that meet the dynamic needs of its user base.

Frequently Asked Questions

What is the slippage limit feature in Gate’s perpetual contract?

The slippage limit feature in Gate’s perpetual contract allows users to set a maximum acceptable price deviation for their market orders. This means that if the execution price of a market order exceeds the user-defined slippage threshold, the order will either be intercepted or canceled, thereby enhancing risk control in trading.

How does the slippage limit feature enhance the trading experience on Gate exchange?

The slippage limit feature enhances the trading experience on Gate exchange by providing users with the ability to customize their slippage range. This control helps prevent unexpected price deviations, especially during volatile market conditions, ensuring more predictable and safer trading outcomes.

Why is controlling market order slippage important for traders?

Controlling market order slippage is crucial for traders as it minimizes the risk associated with price fluctuations and market depth issues. By utilizing the slippage limit feature, traders can ensure that their orders are executed within an acceptable price range, reducing potential losses from severe market movements.

How does the slippage setting feature improve risk control in trading?

The slippage setting feature improves risk control in trading by allowing users to define their acceptable limits for slippage. This proactive measure helps intercept or cancel orders that would otherwise execute at unfavorable prices, thus providing a smarter approach to managing trading risks.

What are the benefits of using the slippage limit feature during times of low liquidity?

Using the slippage limit feature during low liquidity periods offers significant benefits, including improved order execution accuracy and minimized risk of slippage. This feature helps traders avoid executing orders at undesired prices during times of high volatility or when market depth is insufficient.

Can I customize the slippage limit for each market order on Gate exchange?

Yes, on Gate exchange, users can customize the slippage limit for each market order. This flexibility allows traders to adjust their settings based on market conditions, enhancing overall control and improving the trading experience.

How does Gate’s new feature affect perpetual contract trading?

Gate’s new slippage limit feature significantly affects perpetual contract trading by enhancing safety and controllability. It helps traders manage their risk efficiently, particularly in fast-moving markets, thereby allowing for a more stable and reliable trading environment.

What should I do if my market order exceeds the slippage threshold?

If your market order exceeds the slippage threshold you’ve set, the order will be automatically intercepted or canceled by the system. This feature helps protect traders from executing orders at unfavorable prices, ensuring better risk management.

Is the slippage limit feature useful for all types of traders?

Yes, the slippage limit feature is useful for all types of traders, particularly those engaging in volatile markets or trading with low liquidity. It provides crucial tools for risk control, making it beneficial for novice and experienced traders alike.

Where can I find more information about the slippage limit feature on Gate exchange?

More information about the slippage limit feature can be found on the Gate exchange official website or in their user guides. Additionally, their customer support team can provide assistance for specific inquiries.

| Feature | Description |

|---|---|

| Maximum Slippage Limit | Users can set a maximum threshold for slippage before a market order is executed. |

| Order Interception/Cancellation | If the execution price is beyond the defined slippage limit, orders will be intercepted or canceled. |

| Risk Control | This feature allows for better control of risks associated with price deviations caused by market conditions. |

| Market Conditions | Designed for scenarios with rapid price movements or low liquidity. |

| Enhanced Trading Experience | Provides users with a customizable trading experience and smarter risk control options. |

Summary

The slippage limit feature significantly enhances the trading experience by allowing users to set their desired slippage tolerance, making market order execution safer and more controllable. This innovation minimizes the risks associated with unexpected price movements and is particularly advantageous in volatile market conditions. By implementing this feature, Gate offers its users better management of their trades, thus fostering a more efficient and secure trading environment.