In the world of cryptocurrency, Ethereum price analysis remains a topic of great interest, especially among traders and investors keen to navigate its complexities. Over recent years, Ethereum has established itself not just as a digital currency but as a leading smart contract platform, driving the narrative of “Programmable Money” in the blockchain ecosystem. With historical price surges fueled by anticipation of growth in its underlying technology, many market participants have made bold Ethereum price predictions, hoping for future rallies. However, the recent price action has presented challenges, as Ethereum has entered a prolonged consolidation pattern characterized by significant volatility and range-bound trading. Understanding these Ethereum market trends is crucial for anyone looking to capitalize on potential price movements in the coming years.

When examining the emerging landscape of digital assets, insights into Ethereum’s price trajectory illuminate the challenges and opportunities within the cryptocurrency arena. Often regarded as the backbone for decentralized applications, this prominent blockchain has experienced fluctuating trends that have prompted discussions around its potential and forecasts for future performance. Price forecasts have varied widely, reflecting the market’s sentiment towards Ethereum’s evolving role as programmable financial technology. As the asset navigates through a significant period of price consolidation, it is critical to analyze these shifts to grasp the broader implications for investors. Navigating the landscape of Ethereum requires a keen understanding of its intricate market dynamics and the significant factors that could drive its next price movements.

Understanding Ethereum Price Trends for 2023

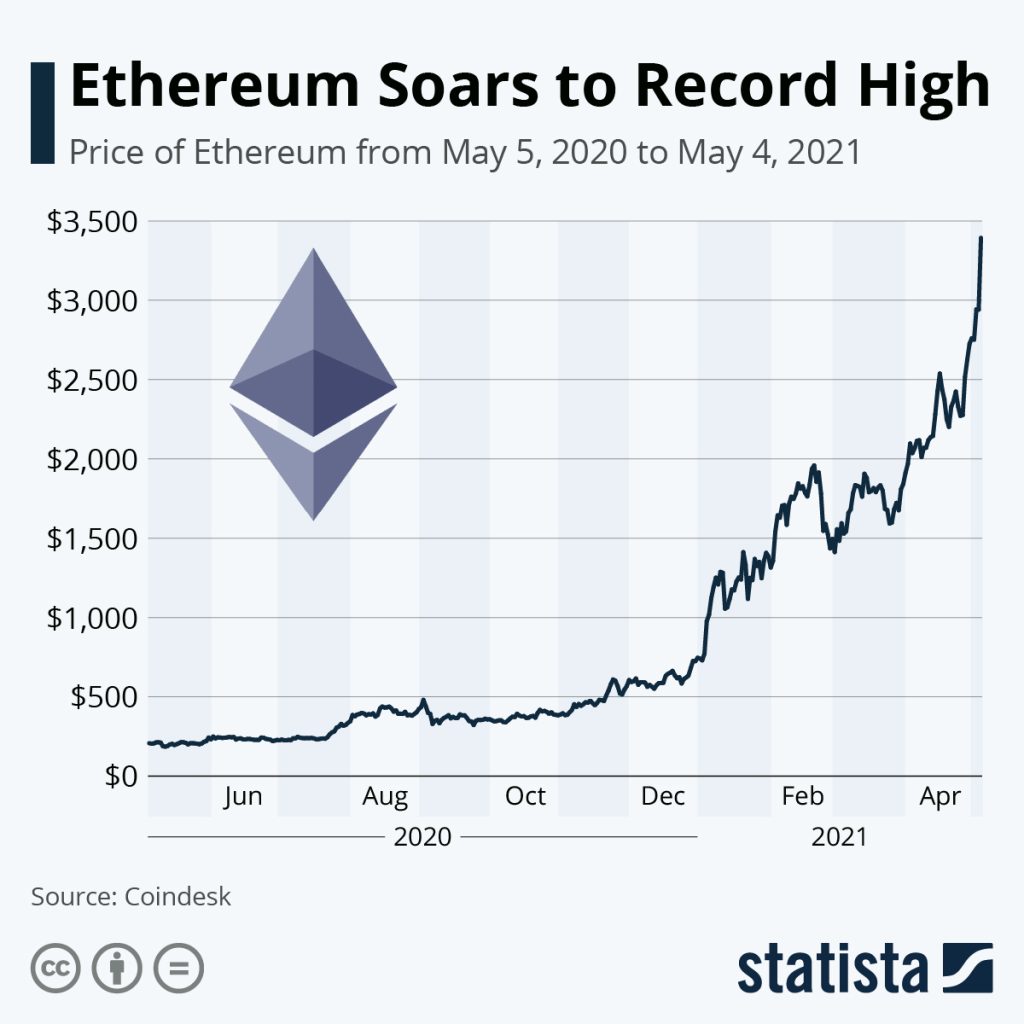

As we analyze the Ethereum price trends for 2023, it’s essential to acknowledge the historical context that influences market sentiment. After experiencing an unprecedented surge from 2020 to 2021, Ethereum captured significant attention as a leading smart contract platform. The growth during this period was largely fueled by the rise of decentralized applications (dApps) and the notion of ‘Programmable Money’—the ability to automate complex financial transactions through smart contracts. With the 2021 peak, many investors projected prices could soar as high as $10,000, reflecting an overwhelming optimism about Ethereum’s potential.

However, the reality was a swift correction, leading to a long-term consolidation phase. Despite several attempts to break out of the established triangular pattern, Ethereum’s price movements have demonstrated volatility without decisive directional trends. This suggests that investors should tread cautiously while recognizing that patterns of market behavior could also provide insights. Understanding the shifting dynamics in Ethereum’s price can help in making educated projections about future movements.

Ethereum Price Analysis and Market Sentiment

Ethereum price analysis reveals the complexity of the market’s current phase. Following a period of rapid growth, the cryptocurrency market has entered a more mature stage, characterized by high volatility and fluctuating investor sentiment. Market participants are observing Ethereum’s price closely, particularly as it hovers near critical support and resistance levels influenced by the recent consolidation. This ongoing range-bound activity indicates the possibility of significant price movements when the market decides on a definitive trend direction.

As Ethereum approaches potential breakout points, market trends suggest that investor psychology will play a pivotal role. If the price catalyzes upwards out of the consolidation pattern, it could attract significantly more capital inflow, reminiscent of the earlier bullish momentum. On the flip side, failure to maintain upward momentum may lead to further downward corrections. As we progress through 2023, monitoring these price actions will be crucial for understanding how Ethereum fits within broader market trends.

The Role of Smart Contracts in Ethereum’s Evolution

Smart contracts are at the core of Ethereum’s value proposition and continue to drive its evolution as a leading platform for decentralized applications. These self-executing contracts with the terms of the agreement directly written into code have transformed how transactions are conducted across various sectors. By leveraging Ethereum’s capabilities, developers can create complex protocols that go beyond traditional applications, fostering innovation and financial inclusivity.

As the ecosystem matures, the facilitation of programmable money through smart contracts has opened new channels for investment and engagement. With an increasing number of projects and partnerships emerging within the Ethereum ecosystem, the potential for growth remains robust. The ongoing development of layer 2 solutions and scaling options will further solidify Ethereum’s standing in the smart contract space, allowing it to adapt and thrive in rapidly evolving market conditions.

Ethereum Consolidation Patterns: What They Mean

Ethereum’s price movements over the past few years have predominantly occurred within a recognizable consolidation pattern. Such patterns often indicate indecision in the market, where buyers and sellers are in a stalemate, creating a range of price activity. For traders, understanding these patterns can be vital, as they may signal upcoming volatility. Identifying the boundaries of this triangular formation can help investors make informed decisions about entry and exit points.

The importance of monitoring these consolidation patterns cannot be overstated. As Ethereum approaches a decision point, speculative trading increases, which can swiftly alter the price. A breakout, whether upwards or downwards, can lead to significant market movements as traders anticipate the next trend. Consequently, recognizing the implications of these patterns prepares investors for rapid changes in pricing reflective of the underlying market sentiment.

Analyzing Ethereum’s Market Trends for Future Investment Decisions

In assessing Ethereum’s market trends, it’s evident that the cryptocurrency is entrenched in a complex interplay of supply and demand mechanics. The market has witnessed shifts due to external factors, such as regulatory developments and technological advancements, which have all contributed to the current volatility. As Ethereum aims to solidify its role as the premier smart contract platform, capturing the potential market growth while navigating uncertainties becomes a challenge for investors.

Moreover, recognizing cyclical patterns in Ethereum’s price can significantly bolster predictive analysis. The analysis of past cycles can yield insightful correlations that may suggest where Ethereum is headed next. Understanding these market trends equips both seasoned investors and new entrants to align their strategies based on technical signals and broader economic impacts.

Ethereum Price Prediction: Insights for 2026

Looking ahead to 2026, Ethereum price predictions are rife with speculation and enthusiasm, hinging largely on the projected end of its current consolidation phase. Analysts are cautiously optimistic that as Ethereum consolidates, it may soon undergo a decisive breakout, leading to robust price increases. The culmination of innovative developments, including upgrades to its network and increased adoption of decentralized finance (DeFi) protocols, will likely bolster its market position, allowing for a more bullish sentiment in future price forecasts.

Moreover, as Ethereum’s ecosystem continues to expand and mature, the concept of Programmable Money associated with smart contracts becomes increasingly relevant. A successful transition from the consolidation phase could be not just a rebound but a launchpad for surging prices. For investors and traders alike, keeping an eye on the significant dates and potential announcements that could impact Ethereum’s trajectory will be essential in making informed decisions.

Ethereum’s Impact on Financial Markets

Ethereum’s rise as a leading smart contract platform has significantly influenced financial markets, particularly in the realm of decentralized finance. By enabling peer-to-peer transactions without the need for intermediaries, Ethereum has challenged traditional banking systems, leading many financial institutions to explore blockchain technology’s potential applications. As adoption increases, Ethereum’s price dynamics will inevitably play a crucial role in shaping the market’s future.

Furthermore, Ethereum’s integration with various sectors, including insurance, real estate, and supply chain management, signifies a broader acceptance of blockchain technology within mainstream finance. As Ethereum continues to solidify its position and expand its use cases, its market behavior will become increasingly reflective of global economic trends, making its price outlook a topic of great interest among investors seeking to navigate the evolving landscape.

The Future of Ethereum: Opportunities and Challenges

As we peer into the future of Ethereum, a landscape of both opportunities and challenges emerges. The ongoing improvements to the network, including the transition to Ethereum 2.0, aim to enhance scalability and energy efficiency—critical factors in addressing market concerns. As green initiatives gain traction, Ethereum’s commitment to reducing its carbon footprint may further bolster investor confidence and attract new capital to the market.

However, challenges remain, particularly with rising competition from other blockchain networks that offer similar functionalities. Investors need to be vigilant and assess these competitive dynamics as they could affect Ethereum’s market share and pricing structure. Overall, navigating these complexities while recognizing the opportunities that lie ahead will be paramount for anyone looking to invest in Ethereum’s future.

Ethereum and the Rise of DeFi: A Transformative Era

The emergence of decentralized finance (DeFi) heralds a transformative era for Ethereum, positioning it at the forefront of financial innovation. By enabling decentralized lending, borrowing, and trading, Ethereum’s capabilities extend far beyond traditional finance paradigms. This shift towards DeFi underscores the significance of Ethereum’s programmable nature, allowing for complex financial instruments and services to be developed without intermediary involvement.

As more users engage with DeFi platforms, Ethereum’s utility increases alongside its demand, potentially leading to upward price momentum in the long run. The ongoing expansion of DeFi indicates a fundamental shift in how financial transactions occur, with Ethereum as a pivotal player in this evolution. Tracking the developments within the DeFi landscape will be crucial for predicting Ethereum’s price trajectories moving forward.

Frequently Asked Questions

What can we expect from Ethereum price analysis in the near future?

Ethereum price analysis indicates a critical point as the market approaches the conclusion of a long-term triangular consolidation pattern. With the operating space compressing, we can anticipate potential price movement and volatility in the upcoming months, particularly as we approach 2026.

How does the Ethereum market trends affect price predictions?

Ethereum market trends significantly influence price predictions, especially considering its past performance during the smart contract platform expansion. The narrative of Programmable Money propelled prices upward from 2020 to 2021, and the remnants of this momentum can still affect future predictions as the consolidation pattern is nearing its end.

What does the Ethereum consolidation pattern signify for future price moves?

The Ethereum consolidation pattern highlights a phase of indecision in the market. This triangular pattern indicates that price is compressing, and once it breaks out—either upward or downward—we can expect significant volatility and directional confirmation that will shape future price moves.

How does the concept of Programmable Money relate to Ethereum price analysis?

The concept of Programmable Money has been integral to Ethereum price analysis, as it contributed to investor excitement and funding during the smart contract platform expansion. This narrative helped drive prices up until the peak sentiment of 2021, showing the impact of innovative concepts on market dynamics.

What factors contribute to the volatility observed in Ethereum price analysis?

The volatility in Ethereum price analysis is largely driven by its historical consolidation pattern, with failed attempts to break out leading to further range-bound trading. Additionally, shifting market sentiment and external economic factors continue to play a significant role in Ethereum’s price dynamics.

Will Ethereum’s price predictability improve as we approach the end of the consolidation phase?

Yes, as Ethereum approaches the end of its long-term consolidation phase, price predictability is expected to improve. Structural compression suggests that a breakout is imminent, potentially leading to clearer price trends and movements in 2026.

What role do incremental funds play in Ethereum price prediction?

Incremental funds play a crucial role in Ethereum price prediction by providing indicators of market confidence. During previous cycles, investments surged due to expectations of growth in the smart contract platform, reflecting how funding trends can forecast potential price trajectories.

Can Ethereum’s past price performance guide future predictions?

Absolutely. Analyzing Ethereum’s past price performance, particularly during key phases of growth and consolidation, can offer valuable insights for future price predictions, helping traders identify potential trends and entry points.

How significant is the $10,000 price target in Ethereum price analysis?

The $10,000 price target remains a significant point in Ethereum price analysis, as it represents peak market sentiment and ambition. While it wasn’t sustained, the psychological impact of such milestones continues to influence traders and investors in their strategies.

| Key Point | Details |

|---|---|

| Incremental Funding | Ethereum attracted incremental funds during its previous cycle due to expectations of growth in its smart contract ecosystem and the ‘Programmable Money’ narrative. |

| Price Increase | From 2020 to 2021, Ethereum’s price saw a rapid increase, peaking with expectations of hitting $10,000 in 2021. |

| Market Correction | After reaching its all-time high, Ethereum could not sustain its price, leading to a long-term period of volatility and range-bound trading. |

| Triangular Consolidation | Ethereum’s price has been moving within a large triangular consolidation pattern, showing no clear trend. |

| Breakout Attempts | The price attempted to break out of its consolidation range twice but was unable to sustain either move, reverting back within the range. |

| Future Outlook | As the triangular formation converges, 2026 could be a critical year for Ethereum to make a significant directional choice in its price movement. |

Summary

Ethereum price analysis shows that the cryptocurrency experienced significant investment during its previous cycle, primarily due to market expectations regarding its ecosystem growth. Following a steep rise leading up to 2021, the inability to maintain such positive momentum has resulted in extended volatility. As Ethereum approaches the end of its longstanding consolidation phase, critical developments in 2026 may dictate its next price movements, making it a pivotal moment for investors.