The term “BTC Hodler” has gained significant traction in the cryptocurrency community, especially among supporters of Bitcoin. Recently, Xiao Hong, the visionary founder of Manus AI, prominently featured this tag on his social media profile, highlighting his commitment to holding Bitcoin amidst the ever-changing landscape of crypto investments. As Bitcoin continues to dominate Bitcoin news, the hodler mentality has become a hallmark of resilience, encouraging investors to hold onto their assets for long-term gains rather than succumbing to market volatility. With the rising popularity of Bitcoin, it’s essential for enthusiasts and investors alike to stay informed about key figures like Xiao Hong, who are influencing the crypto space. By exploring insights from influential personalities such as Hong, BTC holders can cultivate a more robust understanding of their investments.

In the evolving world of cryptocurrencies, the concept of a “Bitcoin Holder” is pivotal, embodying a philosophy that prioritizes patience and strategic asset management. This alternative term, often referred to as a “Hodler,” signifies individuals who choose to retain their Bitcoin over time rather than engaging in frequent trading. As the digital currency ecosystem expands, those aligned with this mindset, including leading innovators like Manus’s founder, Xiao Hong, are making headlines. Understanding the dynamics of crypto assets and the hodler approach can provide valuable insights into making informed investment decisions. With the backdrop of current Bitcoin news and the emerging landscape of crypto investments, this discussion is more relevant than ever.

Understanding the Impact of BTC Hodlers on the Market

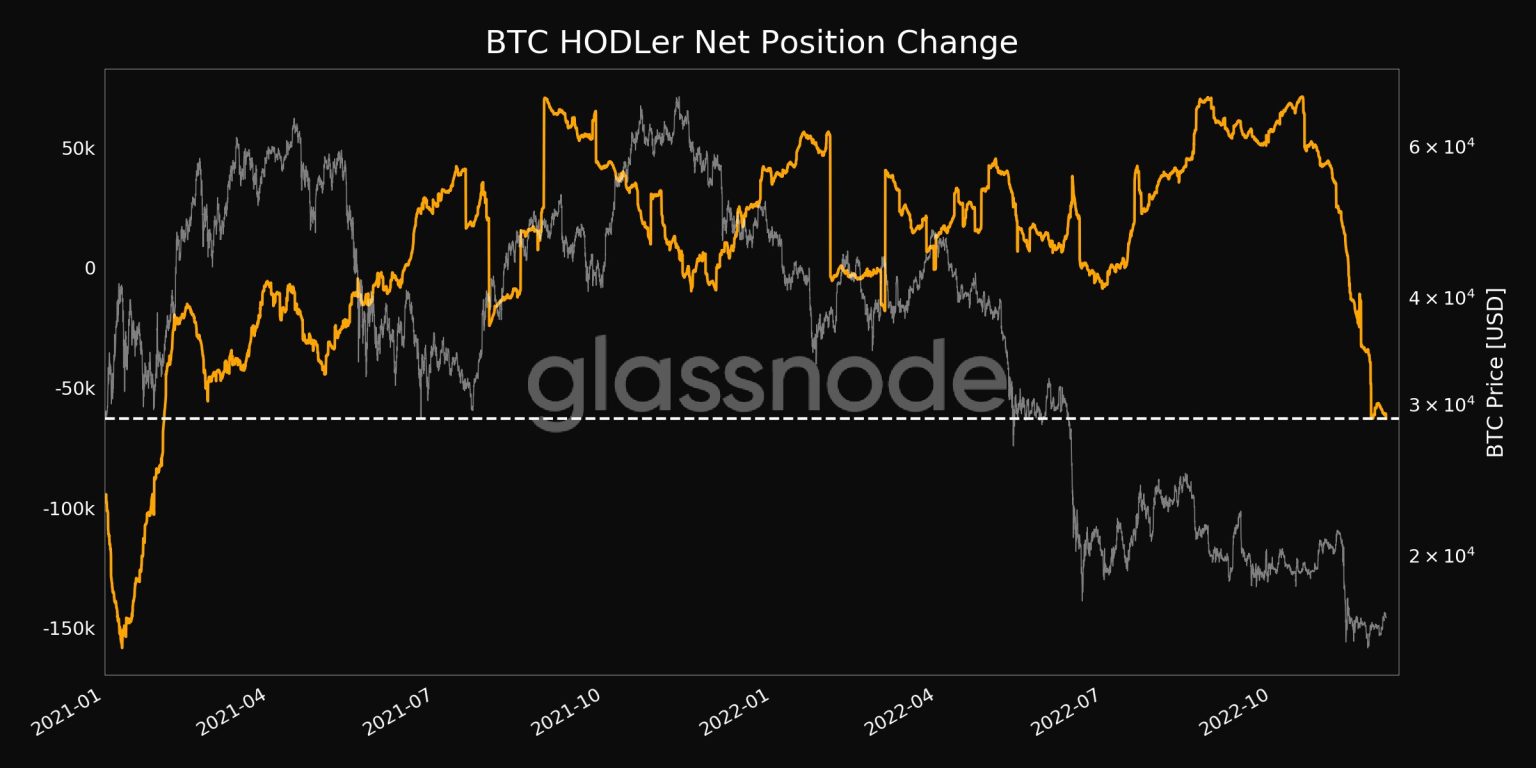

BTC Hodlers play a pivotal role in the cryptocurrency market, significantly impacting Bitcoin’s price stability and overall demand. These long-term investors, who hold Bitcoin without the intention of selling, contribute to a lower circulating supply and create scarcity. As more individuals adopt the strategy of holding their Bitcoin as a store of value, the demand continues to grow, often resulting in price surges. This creates a ripple effect across the market, influencing the behaviors of traders and investors alike.

The phenomenon of BTC Hodlers becomes even more intriguing when we examine their influence on market trends. As these holders refrain from selling during market fluctuations, it provides a buffer against volatility. This stabilization attracts new investors who are skittish about entering a seemingly unpredictable market. The psychological aspect cannot be understated; knowing that a substantial amount of Bitcoin is secured away enhances confidence among new entrants, fortifying the long-term bullish outlook on Bitcoin.

Xiao Hong: A Pioneer in AI and Crypto Investments

Xiao Hong, by establishing Manus AI, merges artificial intelligence with cryptocurrency insights, catering specifically to the needs of modern traders. His choice to identify as a BTC Hodler on social media indicates a long-term belief in Bitcoin’s potential. This dual focus on AI and crypto positions him uniquely to understand and navigate the complexities of the market, providing valuable insights that assist others in making informed crypto investments that align with innovative technologies.

With the rise of crypto technologies, the importance of having visionary leaders like Xiao Hong becomes evident. His social media presence as a BTC Hodler highlights the importance of belief in the assets we engage with. As the founder of a successful AI company, he blends technological advancements with investments, suggesting that the future lies in the integration of AI with cryptocurrency trading strategies.

The New Landscape of Crypto Regulations and Their Impact on Investments in 2026 and Beyond!

As we approach 2026, navigating the changing landscape of cryptocurrency regulations has become increasingly complex. New policies around the world are being introduced that aim to bring clarity to the marketplace while protecting investors. This can significantly impact crypto investments as governments strive to balance innovation with consumer protection. Analysts suggest that understanding these regulations is crucial for engaged BTC Hodlers and investors alike. Staying informed about regulatory changes can aid in making strategic decisions that foster sustainable growth.

For BTC Hodlers, adapting to evolving regulatory frameworks is essential. This might involve considering the implications of new laws that could impact ownership rights and taxation policies. By maintaining awareness of the regulatory environment, long-term holders of Bitcoin can protect their investments and take advantage of new opportunities as they arise. Ultimately, a strategic approach backed by understanding and foresight will be pivotal in navigating the shifting tides of cryptocurrency regulations.

Enhancing Investor Confidence with Current Bitcoin News

Staying updated on Bitcoin news is vital for BTC Hodlers aiming to maintain a robust portfolio. Recent developments, such as partnerships, technological advancements, and market predictions, can greatly affect investor sentiment and market performance. With the media frequently covering major movements, it’s crucial for investors to filter through the noise and identify signals that could inform their investment strategies.

For instance, innovations such as Bitcoin ETFs and regulatory approval could significantly bolster market confidence, attracting new investors to the fold. Additionally, consistent Bitcoin news related to adoption rates and market trends allows BTC Hodlers to pivot their strategies effectively, ensuring they remain aligned with the market’s direction and potential shifts.

The Evolution of Crypto Technologies and their Effects on Bitcoin

Crypto technologies are advancing at an unprecedented pace, fundamentally changing how we interact with Bitcoin and other cryptocurrencies. Innovations such as the Lightning Network and smart contracts offer new functionalities that enhance Bitcoin’s usability beyond a mere store of value. As these technologies develop, BTC Hodlers may find new avenues to leverage their investments, intertwining traditional holding strategies with active engagement in the crypto ecosystem.

Furthermore, as the infrastructure supporting crypto technologies improves, transaction speeds and costs will likely decrease, attracting more casual investors and enhancing the Bitcoin ecosystem’s overall health. For BTC Hodlers, this evolution brings optimism, as a more robust network can facilitate broader mainstream adoption, potentially driving Bitcoin’s market value even higher.

Future Trends in Bitcoin Investments in 2026

Looking ahead to 2026, the landscape of Bitcoin investments is poised for transformative trends, driven primarily by technological advancements and global economic factors. BTC Hodlers will need to stay informed about how developments in blockchain technology could revolutionize transaction methodologies and enhance security features. As Bitcoin continues to evolve, so too will the strategies that investors employ. Understanding these emerging trends will be crucial for those looking to maximize returns on their investments.

Additionally, as institutions increasingly embrace Bitcoin as a legitimate asset class, BTC Hodlers may see the trend of institutional investment continue to rise. This influx of capital could solidify Bitcoin’s status as a secure and viable option for investors looking for diversification within their portfolios. Keeping an eye on the interplay between institutional moves and individual investments will be key for Hodlers aiming to navigate this ever-changing landscape.

The Significance of Community Among BTC Hodlers

The community surrounding BTC Hodlers is one of the most significant aspects of the cryptocurrency ecosystem. This collective not only provides support and shared knowledge but also fosters a sense of belonging among individuals who believe in Bitcoin’s future. Various online forums and social media platforms allow Hodlers to exchange ideas and strategies, helping them navigate the often tumultuous waters of crypto investments together.

Moreover, the strength of this community can have a far-reaching impact, affecting Bitcoin’s price, perceived legitimacy, and wider adoption. When BTC Hodlers unite for a common cause, such as advocating for Bitcoin-related developments or pushing back against unfavorable regulations, their collective voice can influence markets and policy decisions alike. This highlight of community power showcases the importance of collaboration in nurturing a sustainable environment for crypto investments.

Analyzing Recent Changes in Bitcoin Market Dynamics

Recent shifts in Bitcoin market dynamics call for a thorough analysis as these changes can have structural implications on how BTC Hodlers approach their investments. Factors like market volatility, investor sentiment, and global economic conditions are consistently in flux, impacting Bitcoin’s price action. Understanding these dynamics is essential for Hodlers who need to develop a strategic and responsive investment approach.

Additionally, the introduction of various trading mechanisms and financial products has evolved the landscape further. As derivatives and futures become more commonly available, BTC Hodlers will have to consider how these instruments can either hedge against potential downturns or offer alternative ways to monetize their holdings. By adapting to these market changes, Hodlers can position themselves advantageously for long-term success.

The Intersection of AI and Cryptocurrency: A New Era for BTC Hodlers?

The integration of artificial intelligence within the cryptocurrency space showcases a significant evolution for BTC Hodlers. Technologies pioneered by innovators like Xiao Hong illustrate how AI can enhance trading strategies, optimize portfolio management, and automate decision-making processes. This convergence offers a unique opportunity for Hodlers to leverage AI advancements, potentially increasing profitability and simplifying the complexities of crypto investments.

As AI continues to permeate the financial sector, BTC Hodlers might find themselves at the forefront of a new investment paradigm. With the capacity to analyze vast datasets and predict market trends, AI tools will become invaluable. Embracing these technologies can help holders refine their investment strategies and adapt to emerging market conditions more effectively.

Frequently Asked Questions

What does the term BTC Hodler mean in the context of cryptocurrency investments?

The term ‘BTC Hodler’ refers to individuals who hold onto their Bitcoin investments for the long term, regardless of market volatility. This strategy is based on the belief that Bitcoin will appreciate significantly over time, making it a popular tactic among crypto investors.

How does the social media presence of Xiao Hong relate to BTC Hodlers and Bitcoin news?

Xiao Hong, the founder of Manus AI, highlights the importance of being a BTC Hodler by using this tag in his social media profiles. His affiliation with significant crypto developments draws attention to the Bitcoin community and reinforces the long-term investment mindset many BTC Hodlers share.

Why should crypto investors consider adopting a BTC Hodler strategy?

Adopting a BTC Hodler strategy can provide significant benefits for crypto investors, including potential profit from long-term price appreciation. By holding onto Bitcoin through market fluctuations, BTC Hodlers may avoid panic selling during downturns and capitalize on the overall upward trend of Bitcoin as seen in various Bitcoin news reports.

What are the risks associated with being a BTC Hodler in the volatile cryptocurrency market?

While being a BTC Hodler can lead to substantial gains, there are also inherent risks. The cryptocurrency market is highly volatile, and the price of Bitcoin can experience dramatic fluctuations. BTC Hodlers must be prepared for potential losses and should stay informed about the latest Bitcoin news and market trends.

How has Manus AI and its founder influenced the BTC Hodler community?

Manus AI, founded by Xiao Hong, has made significant waves in the tech and crypto sectors. His advocacy and personal branding as a BTC Hodler not only shine a spotlight on Bitcoin but also inspire confidence within the community, encouraging more investors to consider long-term holdings in their crypto investments.

What are the advantages of following Bitcoin news for BTC Hodlers?

Staying updated with Bitcoin news is crucial for BTC Hodlers as it helps them make informed decisions regarding their investments. Knowledge about market movements, regulatory changes, and technological advancements can enhance their investment strategies and inform their approach to holding Bitcoin long-term.

How can I become a successful BTC Hodler like Xiao Hong?

To become a successful BTC Hodler like Xiao Hong, start by educating yourself about Bitcoin and the cryptocurrency market. Develop a solid investment strategy that aligns with your risk tolerance, and commit to holding your Bitcoin through market fluctuations. Engage with the community and follow reliable Bitcoin news sources to stay updated on relevant developments.

What is the significance of the BTC tag in social media profiles for influencers like Xiao Hong?

The BTC tag in social media profiles, such as those of influencers like Xiao Hong, signifies their support for Bitcoin and aligns them with the BTC Hodler community. This not only reinforces their credibility in the cryptocurrency space but also helps connect with a broader audience interested in crypto investments.

| Key Points | Details |

|---|---|

| Founder Information | Xiao Hong is the founder of the AI application Manus and the Butterfly Effect development company. |

| Social Media Tag | Xiao Hong’s social media tag includes ‘BTC Hodler,’ highlighting his association with Bitcoin holding. |

| Recent Acquisitions | Meta has acquired Manus AI for billions, indicating the value of AI within the tech industry. |

| Financial Updates | There are reports of financial turmoil within companies in the sector, including changes in auditors at Alt5 Sigma. |

Summary

BTC Hodler is an important tag that underscores Xiao Hong’s commitment to cryptocurrency and Bitcoin. Given the growing interest and market dynamics surrounding Bitcoin, this association could enhance the relevance of Xiao Hong’s ventures in the AI and tech sectors. As the landscape continues to evolve, those identifying as BTC Hodlers are positioned to navigate the complexities of cryptocurrency investments.