Cryptocurrency regulation has become a heated topic of discussion, particularly in South Korea, where conflicts of interest are emerging among political figures. Recent reports have highlighted the controversial actions of Kim Byung-ki, a member of the ruling Democratic Party, as he faces scrutiny for criticizing Upbit, the nation’s largest cryptocurrency exchange, while his son was interning at its rival, Bithumb. This situation raises crucial questions about government regulation in the crypto sphere, particularly amidst ongoing political pressures and potential conflicts of interest. As South Korean cryptocurrency enthusiasts follow the Bithumb-Upbit conflict, the implications of such regulatory actions ripple through cryptocurrency exchange news, affecting investors and companies alike. Understanding these dynamics is vital for anyone looking to navigate the complex landscape of cryptocurrency in South Korea, especially with the looming uncertainty surrounding regulation.

The landscape of digital currency oversight is rapidly evolving, with various stakeholders vying for influence in this burgeoning market. In particular, the situation surrounding South Korea’s crypto sector exemplifies the intricate balance between political action and economic interests. Notably, figures such as Kim Byung-ki have emerged as central figures in the ongoing dialogue regarding digital asset governance, driving discussions about fairness and transparency. The conflicts between competing exchanges, like Upbit and Bithumb, illustrate the challenges faced by regulators as they attempt to establish frameworks that are both effective and equitable. As the conversation surrounding cryptocurrency oversight continues to unfold, examining these relationships is essential for understanding the future of financial innovation in the region.

Unraveling the Conflicts of Interest in Cryptocurrency Regulation

The recent revelations surrounding Kim Byung-ki, a member of South Korea’s ruling Democratic Party, highlight critical issues related to conflicts of interest in cryptocurrency regulation. As discussions mount regarding the fairness and integrity of government oversight in the cryptocurrency space, Kim’s actions raise significant concerns about the impartiality of legislative criticism aimed at major exchanges like Upbit. Reports indicate that while advocating for regulatory changes against Upbit, Kim’s son was interning at its competitor, Bithumb, leading many to question whether personal ties influenced professional decisions. Such scenarios underline the necessity for transparent governance as the cryptocurrency landscape continues to evolve.

The implications of these conflicts extend beyond Kim Byung-ki’s allegations, sparking a broader dialogue around the ethical responsibilities of political figures in the realm of cryptocurrency. The situation has amplified the need for strict regulatory frameworks that can mitigate the influence of personal relationships on policy-making. As cryptocurrency is increasingly integrated into the global financial fabric, South Korea must reinforce its commitment to fair practices and equitable competition among exchanges to foster a healthier market environment.

The Political Dynamics of South Korea’s Cryptocurrency Scene

South Korea’s cryptocurrency market has been characterized by rapid growth and intense political scrutiny. The ongoing conflict between Upbit and Bithumb reflects not only market competition but also reveals underlying tensions in the political landscape. Kim Byung-ki’s recent maneuvers to disparage Upbit, coupled with his son’s affiliation with its competitor, encapsulate the intertwined relationship between cryptocurrency exchange news and political agendas. This turbulence is further exacerbated by the public’s growing concern over government regulation of cryptocurrencies, which many view as necessary yet potentially susceptible to manipulative practices.

The dynamics between the ruling Democratic Party and the cryptocurrency sector illustrate the complexity of policymaking in an emergent technology landscape. As local authorities grapple with how best to regulate such rapidly changing markets, transparency and accountability in political dealings become paramount. Concerns regarding monopoly practices in the cryptocurrency sector parallel broader fears surrounding the implications of significant state intervention. In fostering a balanced regulatory environment, South Korea aims to uphold innovation while safeguarding investor interests in a fiercely competitive marketplace.

Understanding Kim Byung-ki’s motivations is essential in the context of South Korean politics, particularly as the country navigates the intersection of technology and governance. As political figures engage with transformative industries like blockchain and cryptocurrency, they must do so with an acute awareness of the implications their actions may have on public trust and regulatory efficacy. The recent developments surrounding Kim’s allegations ought to serve as a case study on the critical importance of establishing clear ethical guidelines for legislators involved in financial technology.

The Bithumb-Upbit Rivalry: Implications for the Future of Cryptocurrency in South Korea

The rivalry between Bithumb and Upbit represents more than just competition; it reflects a battleground for future cryptocurrency regulation in South Korea. As these leading exchanges vie for market dominance, the scrutiny of their practices by political figures, such as Kim Byung-ki, becomes increasingly relevant. Allegations of monopolistic behavior not only impact the reputation of firms but also influence how cryptocurrency regulation will evolve within the national framework. The potential for conflicts of interest raises questions about how much trust users can place in the governmental oversight of the cryptocurrency market.

This rivalry also underscores the need for ongoing dialogue between industry leaders and regulators. Cryptocurrency exchanges play an integral role in the broader financial ecosystem, and their interactions with political entities can shape public perception and investor confidence. By addressing the challenges presented by competition, such as transparency in operations and equitable access to markets, South Korea’s government can pave the way for a more stable regulatory environment that benefits all stakeholders. This could lead to a more robust cryptocurrency framework, fostering innovation while ensuring ethical conduct among participants.

Government Regulation in the Cryptocurrency Market: Challenges and Opportunities

As South Korea grapples with its approach to cryptocurrency regulation, government bodies face the dual task of fostering innovation while protecting investors. The instance of Kim Byung-ki’s criticism of Upbit amidst familial ties to Bithumb serves as an emblematic case highlighting the complexities of regulatory oversight in a rapidly evolving sector. Optimal cryptocurrency regulation would require clear standards that not only protect the integrity of the market but also promote fair competition. By resolving potential conflicts of interest among political figures, South Korea can create a sound regulatory environment that motivates growth and public trust.

In navigating the regulatory landscape, education and awareness within the public sector become pivotal. Implementing comprehensive training on blockchain technology and cryptocurrency can empower regulators to make informed decisions that positively influence market dynamics. With adequate frameworks and guidelines inspired by successful regulatory practices globally, South Korea can cultivate an environment conducive to innovation in cryptocurrency, thereby ensuring that governmental regulation bolsters rather than stifles industry growth.

Future Trends in South Korea’s Cryptocurrency Regulation

Looking ahead, the landscape of cryptocurrency regulation in South Korea appears poised for significant transformation. The evolving dynamics of exchanges like Upbit and Bithumb in conjunction with rising public interest necessitate a rethink of current regulations to adapt to changing technological advancements. By addressing issues such as monopolistic practices and potential conflicts of interest in legislative affairs, South Korea can position itself as a leader in the responsible governance of cryptocurrency. This could ultimately result in a well-regulated environment that encourages innovation while safeguarding consumer rights.

Moreover, as the global conversation surrounding cryptocurrency regulations intensifies, South Korea’s approach could serve as a blueprint for other nations grappling with similar challenges. By fostering transparency, accountability, and responsible engagement from both political and corporate entities, South Korea can enhance its reputation as a forward-thinking nation in this space. These efforts will not only cement the country’s commitment to fair trade but could also attract international investors, eager to engage in a market characterized by its robust regulation and decreasing uncertainties.

Navigating Ethical Dilemmas in Cryptocurrency Politics

The ethical dilemmas faced by politicians in the fast-evolving world of cryptocurrency cannot be overstated. The recent accusations against Kim Byung-ki serve as a reminder of the moral responsibilities that political leaders must uphold, especially in sectors characterized by significant financial implications. Maintaining a clear separation between personal interests and public duty is essential to foster trust among constituents and ensure fair regulatory practices. As more issues similar to Kim’s case arise, the call for ethics in cryptocurrency politics reinforces the need for stringent guidelines governing the conduct of public officials.

Moreover, these ethical challenges highlight the importance of implementing checks and balances within the regulatory framework. By establishing independent oversight committees capable of evaluating potential conflicts of interest, South Korea could pave the way for transparent governance in the cryptocurrency market. This would not only diminish the possibility of unethical behavior but also enhance public confidence in the legitimacy of cryptocurrency regulations. Ultimately, the path forward must prioritize ethical standards to ensure that cryptocurrency remains a vehicle for innovation, rather than a source of corruption.

The Role of Media in Exposing Cryptocurrency Conflicts

The role of media in highlighting conflicts of interest in the cryptocurrency sector cannot be understated. In the case of Kim Byung-ki, South Korean news outlets have played a pivotal role in unveiling the questionable ethics surrounding the legislative criticisms aimed at Upbit. Investigative journalism is essential for promoting accountability and transparency in cryptocurrency regulation, as it sheds light on dubious connections between lawmakers and financial entities. Such media exposure not only informs the public but also places pressure on policymakers to act responsibly and ethically in their dealings with the cryptocurrency market.

Furthermore, the coverage surrounding these controversies serves as a crucial feedback mechanism, prompting regulatory bodies to reassess their policies and practices in light of public concerns. A media landscape that prioritizes thorough investigation and reporting can drive change in the cryptocurrency industry by prompting dialogues about best practices and ethical conduct. As the market matures, the media must remain vigilant, advocating for regulatory integrity and nurturing a fair environment for all participants in the cryptocurrency ecosystem.

Community Perspectives on Cryptocurrency Regulation

Community perspectives on cryptocurrency regulation are essential in understanding the broader implications of governmental actions on individual investors. Recent events surrounding figures like Kim Byung-ki have sparked intense debate among cryptocurrency enthusiasts and skeptics alike, highlighting the diverse opinions on the role of regulation in fostering a fair trading environment. Many members of the community express concerns that stringent regulatory measures could stifle innovation and limit access to the market for emerging projects. Yet, there’s a consensus that some level of oversight is necessary to protect consumers from fraud and market manipulation.

Moreover, engaging the community in discussions about cryptocurrency regulation can lead to more informed and balanced policies. By incorporating feedback and insights from users, exchanges, and traders, South Korea can develop a regulation framework that aligns with the needs and realities of the market. Ultimately, fostering a collaborative atmosphere where regulators and the cryptocurrency community communicate openly can help create more resilient and effective regulations that address the challenges presented by this dynamic industry.

Implications of International Cryptocurrency Regulations on South Korea

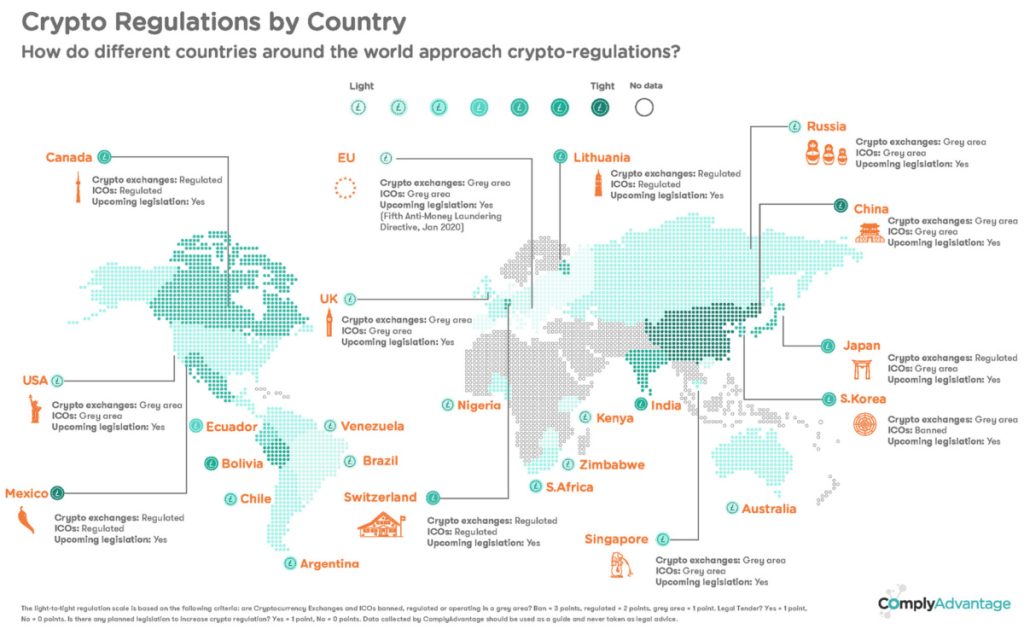

As countries globally begin to establish their own cryptocurrency regulations, South Korea’s approach may be influenced by international standards and practices. The scrutiny surrounding local exchanges like Upbit and Bithumb reveals the interconnected nature of global cryptocurrency markets, where regulations in one nation can ripple across borders. Understanding how foreign policies and agreements shape domestic regulations is essential for South Korea as it navigates the complexities of cryptocurrency governance. The challenge lies in balancing local industry needs with the pressures of adhering to international norms.

Additionally, international collaborations on cryptocurrency regulations can present both opportunities and challenges for South Korea. On one hand, embracing a cooperative approach can enhance regulatory consistency and foster a more resilient financial ecosystem. On the other hand, aligning with international regulations may require significant adaptations in existing frameworks, potentially sparking debates among stakeholders. Ultimately, as the cryptocurrency landscape continues to evolve, South Korea must remain proactive in its regulatory strategies to adapt to the ever-changing global market dynamics.

Frequently Asked Questions

What recent controversies have emerged around cryptocurrency regulation in South Korea?

Recent controversies concerning cryptocurrency regulation in South Korea have surfaced due to allegations of conflicts of interest involving Kim Byung-ki, a parliamentary representative. This controversy escalated as he criticized Upbit, South Korea’s largest cryptocurrency exchange, while his son interned at its competitor, Bithumb. These developments highlight the complexities of government regulation of crypto and its impact on market dynamics.

How does the South Korean government regulate cryptocurrency exchanges like Upbit and Bithumb?

The South Korean government regulates cryptocurrency exchanges through the Financial Services Commission, which establishes compliance requirements, anti-money laundering measures, and consumer protection protocols. The ongoing scrutiny of exchanges like Upbit and Bithumb indicates that government regulation of crypto is evolving in response to market challenges and potential conflicts of interest, as seen in recent events involving Kim Byung-ki.

What role does political influence play in South Korea’s cryptocurrency regulation?

Political influence plays a significant role in South Korea’s cryptocurrency regulation, as evidenced by the recent actions of Kim Byung-ki. His attempts to regulate and criticize Upbit amid alleged ties to Bithumb raise concerns about impartiality in government oversight. Such instances highlight the need for transparent and fair regulation in the cryptocurrency sector to avoid conflicts of interest.

How have recent conflicts among South Korean politicians affected cryptocurrency exchange operations?

Recent conflicts among South Korean politicians, particularly involving government figures like Kim Byung-ki, have cast a shadow over cryptocurrency exchanges like Upbit and Bithumb. The political outcry surrounding these exchanges can lead to increased regulatory scrutiny, potential market instability, and diminished public trust, complicating an already challenging regulatory landscape for cryptocurrency.

What are the implications of government regulation on cryptocurrency exchanges in South Korea?

Government regulation has significant implications for cryptocurrency exchanges in South Korea, including operational compliance, licensing requirements, and enhanced scrutiny on business practices, as seen in the case of Upbit. Ongoing political controversies, such as those involving Kim Byung-ki, further complicate these implications, emphasizing the need for clear regulatory frameworks that promote fair competition and consumer protection.

| Key Points | Details |

|---|---|

| Conflicts of Interest | Kim Byung-ki faces criticism for potential bias due to his son’s internship at Bithumb while criticizing Upbit. |

| Allegations of Corruption | A former assistant stated that Kim’s team engaged in a ‘focused attack’ against Upbit—the leading exchange. |

| Political Actions | Prior to the criticism, Kim met with Bithumb executives, raising ethical considerations about his motives. |

| Denial of Wrongdoing | Kim Byung-ki denies any conflict of interest, arguing his stance is based on anti-monopoly principles. |

| Media Scrutiny | Investigations and reports from various media outlets highlight concerns over legislative integrity. |

Summary

Cryptocurrency regulation is increasingly under scrutiny, particularly as conflicts of interest among officials come to light. The case of Kim Byung-ki highlights the importance of transparency and ethical conduct in the legislative process. As the debate over market monopolies continues, the South Korean government must strive to ensure that its regulatory framework is fair and unbiased, fostering a healthy environment for all cryptocurrency exchanges.