Trump Trade Policies have had a significant impact on the U.S. economy and its businesses over the past few years. As Brian Moynihan, the CEO of Bank of America, noted, many companies have felt the brunt of tariffs introduced during the Trump administration. These trade policies, including a sweeping 10% tariff on imports and higher rates imposed on specific countries, created an atmosphere of corporate anxiety and turmoil. However, recent developments suggest that the U.S. trade situation may be stabilizing, potentially easing the pressures created by these tariffs. With global tariff benchmarks projected to align closer to 15%, businesses are shifting their focus away from tariffs and are more concerned about labor shortages and the uncertainties of immigration policy.

The trade regulations enacted during Trump’s presidency represent a pivotal shift in the landscape of American commerce. As explored by industry leaders like Brian Moynihan of Bank of America, the ripple effects of these trade measures have stirred considerable apprehension among corporations. The introduction of significant import tariffs has led to unrest in the business community, yet recent indicators suggest a possible realignment towards a more favorable trade environment. This evolving narrative highlights not only the consequences of tariff policies but also the broader context impacting U.S. businesses today. In this discussion, we will delve into the implications of these trade dynamics and their journey toward stabilization.

Impact of Trump Trade Policies on U.S. Businesses

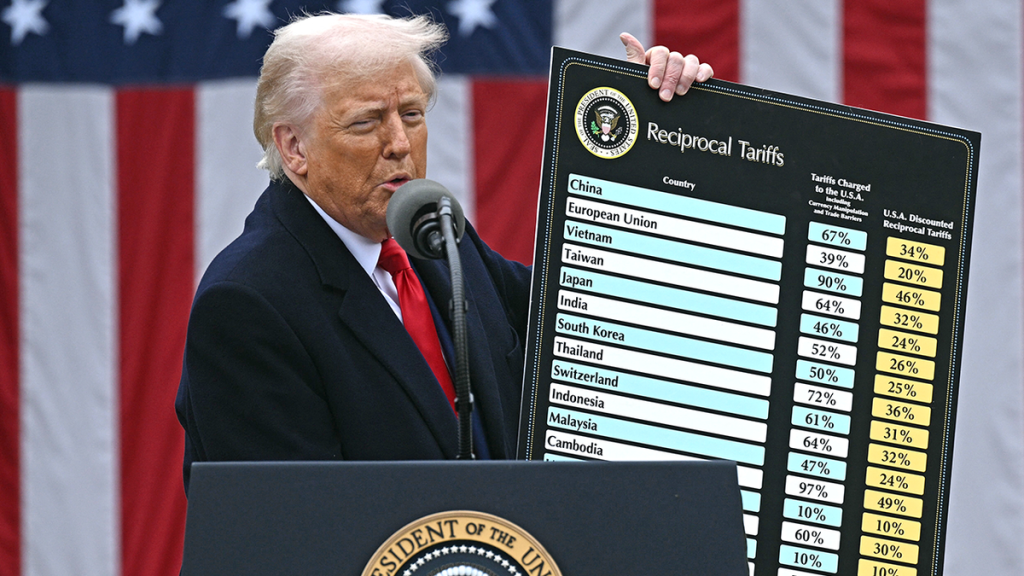

Trump trade policies have reshaped the landscape for U.S. businesses, particularly through the implementation of tariffs that have led to significant uncertainty. The 10% baseline tariff on imports, coupled with higher rates on certain countries, initially sparked corporate anxiety as companies struggled to navigate the financial burden. Manufacturers and retailers expressed concerns about the rising costs of imported goods, which ultimately impacted pricing strategies and profit margins. This environment of uncertainty challenged their operational capabilities and led many to reassess their supply chains.

However, recent developments indicate a potential easing of these policies, offering a glimmer of hope for businesses that have been wrestling with these economic headwinds. As tariffs begin to stabilize around a global benchmark of 15%, many industry leaders, including Brian Moynihan, have suggested that the severe panic felt within corporate sectors is diminishing. The resumption of more predictable trade dynamics may allow businesses to focus on innovation and growth rather than merely surviving the impacts of trade tariffs.

CEO Brian Moynihan’s Perspective on Trade Tariffs

As CEO of Bank of America, Brian Moynihan has a unique vantage point to assess the impact of trade tariffs on corporate America. His remarks highlight the need for clarity in the U.S. trade situation, particularly given the volatility of the past year. According to Moynihan, while tariffs have posed immediate challenges, the long-term effects of such policies are still unfolding. This ongoing evaluation reflects the complexities of international trade, where leadership decisions directly affect economic health and business confidence.

Moynihan emphasizes that beyond tariffs, the current business ecosystem is more influenced by labor shortages and immigration policy uncertainties. These factors have taken precedence over trade tariffs, as companies seek skilled labor to support their growth. The discussion around U.S. trade must therefore evolve, integrating these labor market dynamics alongside tariff debates to create a comprehensive view of the economic landscape.

Understanding Tariffs and Corporate Anxiety

Tariffs have historically been a point of contention in trade discussions, often eliciting anxiety among corporations about their financial future. Many businesses feared the immediate cost increases associated with Trump’s trade policies, which left them scrambling to adjust budgets and pricing strategies. This atmosphere of corporate anxiety resulted in some companies reconsidering their investment plans, potentially stunting growth and innovation, as resources were diverted to managing tariff impacts instead.

Nevertheless, as the market adjusts, a new perspective is forming around these tariffs, with businesses beginning to engage in proactive planning. The stabilization of tariffs could help mitigate anxiety levels and allow corporations to shift focus towards long-term strategies. Encouragingly, this transition may pave the way for future investments, fostering an environment where businesses can thrive despite the uncertainties posed by initial tariff implementations.

The Future of U.S. Trade Relationships

The shifting landscape of U.S. trade relationships is critical in understanding how domestic companies will navigate future challenges. With the potential easing of Trump trade policies, there is optimism regarding the restoration of more stable and cooperative trade relationships globally. These relationships are essential not only for tariff adjustments but also for fostering international alliances that lead to mutual economic benefits. For U.S. businesses, this translates to better access to foreign markets and resources.

Despite the optimism, industry experts emphasize that vigilance is necessary in monitoring how the U.S. trade situation evolves. Companies must remain agile and prepared to pivot in response to new trade regulations or shifts in policy. The future remains uncertain, but leveraging stable trade partnerships could offer a foundation for growth in an increasingly interconnected global economy.

Navigating Labor Shortages Amid Tariff Uncertainty

While tariffs have dominated trade-related discussions, the pressing issue of labor shortages is rapidly gaining attention. As Brian Moynihan points out, more anxious faces are emerging from corporate boardrooms concerning the availability of skilled workers. This shortfall impacts productivity and can hinder companies from capitalizing on new opportunities as they arise. In light of this, firms are compelled to reassess their human resources strategies to attract and retain talent despite a turbulent job market.

Consequently, the focus on labor shortages brings a multifaceted challenge that extends beyond mere economic metrics; it encompasses the broader socioeconomic fabric affecting the U.S. workforce. Companies must not only contend with tariffs but must also innovate in hiring practices, creating supportive work environments, and addressing immigration policy implications that affect workforce participation. The interplay of these elements requires strategic planning and adaptability to ensure that businesses thrive in a complex landscape.

The Role of Economic Policy in Corporate Strategy

Economic policy shapes corporate strategy in profound ways, particularly as companies react to changes in trade tariffs and broader market conditions. Trump’s trade policies have prompted companies to evaluate their financial strategies critically, balancing the immediate costs of tariffs against longer-term growth plans. Businesses have to think critically about supply chain management, logistics, and pricing structures to mitigate tariff-related costs while still maintaining competitive pricing.

Furthermore, as companies engage with evolving economic policies, they must also focus on resilient business models. This adaptability proves essential as firms respond to the dynamic nature of trade laws and tariffs. The lessons learned during turbulent trade times can inform future corporate strategies—leading companies to adopt more flexible and innovative approaches in anticipation of continued changes in the U.S. trade environment.

Corporate Responses to Evolving Trade Norms

Corporations are actively responding to the evolving norms of international trade under the influence of the Trump administration’s policies. Following a year marked by tariff upheavals, businesses are increasingly focused on developing strategies to align with changing regulations and expectations in global markets. This proactivity is essential in ensuring that they can maintain a competitive edge, avoiding pitfalls while capitalizing on emerging opportunities.

In this redefined trade landscape, companies are also considering geographic diversification and investment in local supply chains as part of their long-term strategies. Such measures are not only a response to tariffs but also an effort to mitigate the risks associated with single-source dependencies. By embracing these changes, corporations are laying the groundwork for a more resilient and adaptive operational framework that can thrive in fluctuating trade climates.

The Interplay Between Tariffs and Global Markets

The interplay between U.S. tariffs and global markets creates a web of complex interactions that can dramatically affect business operations. U.S. companies must be keenly aware of how tariff rates imposed by the Trump administration impact not only their costs but also their relationships with international partners. These changes affect everything from pricing strategies to supply chain restructuring, compelling companies to align their practices with global trade norms to mitigate adverse effects.

Moreover, as global markets continue to respond to U.S. trade policies, businesses are tasked with navigating this intricate landscape effectively. Understanding international trade dynamics becomes crucial for U.S. companies looking to maintain their competitive advantage. Engaging with global partners, analyzing market trends, and adapting to changes in tariffs will be essential in determining success in this multifaceted trade environment.

Corporate Strategies for Managing Tariff Impacts

In response to tariff impacts, businesses are adopting a variety of corporate strategies designed to cushion the financial blow and maintain profitability. Many companies are reassessing their pricing mechanisms, with some opting to absorb the costs while others pass them onto consumers. Strategic planning in pricing will not only mitigate losses but can also help maintain market share during periods of high volatility.

In addition to pricing, businesses are also investing in supply chain optimization to enhance efficiency and decrease dependency on imports that may be subject to increased tariffs. This may include sourcing materials locally or diversifying suppliers to reduce risk. By adopting these proactive measures, companies are better positioned to withstand the pressures of tariffs while continuing to pursue growth and innovation.

Frequently Asked Questions

What are the recent developments in Trump Trade Policies according to Bank of America’s CEO?

Brian Moynihan, CEO of Bank of America, noted that Trump Trade Policies are showing signs of easing after a challenging year for businesses impacted by tariffs. These developments suggest a potential stabilization in the U.S. trade situation and alleviation of corporate anxiety.

How do Trump Trade Policies impact American businesses according to current analyses?

Recent analyses, including insights from Bank of America, indicate that Trump Trade Policies, particularly the introduction of tariffs, have created turmoil for American businesses. However, easing signs in the trade policies suggest that companies may experience less corporate anxiety moving forward.

What role do tariffs play in the current U.S. trade situation under Trump Trade Policies?

Tariffs have played a significant role in shaping the U.S. trade situation under Trump Trade Policies, with a 10% baseline tariff on imports and increased rates on specific countries. This has led to corporate anxiety; however, recent trends indicate potential easing and stabilization in tariffs.

How might easing Trump Trade Policies affect corporate anxiety levels?

The easing of Trump Trade Policies, including potential stabilization of tariffs, is likely to reduce corporate anxiety levels among U.S. businesses. As noted by Brian Moynihan from Bank of America, there are signs of a cooling trade situation which may allow companies to focus more on other pressing issues like labor shortages.

What did Brian Moynihan say about tariffs and their impact on U.S. companies’ concerns?

Brian Moynihan pointed out that U.S. companies are currently more anxious about issues such as labor shortages rather than the tariffs themselves under Trump Trade Policies. This shift indicates a possible transformation in the concerns businesses are focusing on amid changes in the trade situation.

How does the current tariff situation relate to Trump Trade Policies and corporate strategy?

The current tariff situation, shaped by Trump Trade Policies, influences corporate strategy as businesses adapt to the potential for rising tariffs on imports. As the trade situation shows signs of stability, companies may reconsider their strategies to focus beyond tariffs, addressing factors like labor shortages and immigration uncertainties.

| Key Point | Details |

|---|---|

| Easing Trade Policies | Under the Trump administration, tariffs have begun to show signs of easing after a turbulent year for businesses. |

| Introduction of Tariffs | Trump introduced a 10% baseline tariff on imports along with higher tariffs on certain countries and specific products. |

| Global Tariff Stabilization | Global tariff benchmarks are expected to stabilize around 15%, helping to reduce corporate panic. |

| Current Business Concerns | U.S. companies are more worried about labor shortages and immigration uncertainty than tariffs. |

Summary

Trump Trade Policies have undergone notable changes as the administration signals an easing of previously aggressive tariffs. After a challenging year, businesses are beginning to breathe easier, as the anticipated stabilization of global tariff rates promises a more favorable trading environment. Nevertheless, the primary concerns for U.S. companies have shifted from tariffs to pressing issues such as labor shortages and uncertainty around immigration policies.