Nvidia Intel shares purchase has marked a pivotal moment in the semiconductor industry, highlighting Nvidia’s strategic investment approach. Recently, Nvidia confirmed in a filing that it has acquired $5 billion worth of Intel shares, enacting a deal first unveiled back in September. This acquisition, priced at $23.28 per share, is aimed at bolstering Intel’s financial structure amid its struggles and extensive capital expenditures. As one of the leading names in AI chip design, Nvidia’s financial backing is expected to bring a renewed vigor to Intel’s operations. Furthermore, the recent FTC Nvidia Intel approval signals a green light for this significant transaction, reinforcing the importance of semiconductor investments in today’s tech-driven economy.

The recent acquisition of Intel stock by Nvidia represents a monumental shift in the semiconductor landscape. In September, Nvidia disclosed plans to buy substantial shares of Intel, and the transaction has now been finalized with a value of $5 billion. This strategic move not only underscores Nvidia’s confidence in its rival but is also seen as a crucial step towards stabilizing Intel’s finances following a series of operational challenges. By investing in Intel, Nvidia is reinforcing its position as a key player in the technology sector, capitalizing on the growing demand for advanced semiconductor solutions. With the backing of regulatory approvals, including the recent endorsement from the FTC, this investment marks an exciting new chapter in the competitive dynamics of the industry.

Nvidia’s Strategic Intel Shares Purchase

In a bold move reported on Monday, Nvidia (NVDA.O) confirmed its acquisition of $5 billion worth of Intel (INTC.O) shares, solidifying a significant investment in the semiconductor sector. This transaction was initially announced back in September, when Nvidia revealed its plan to purchase Intel’s common stock at a competitive price of $23.28 per share. The purchase represents a strong vote of confidence in Intel’s potential, especially considering the company’s recent trajectory characterized by financial struggles and tumultuous transitional phases in its operations.

Acquiring over 214.7 million shares of Intel, Nvidia’s investment is not simply a financial maneuver; it aligns with broader industry strategies focusing on synergistic growth within the semiconductor landscape. Investors and analysts have noted that NVIDIA’s involvement could provide the much-needed capital injection to help revitalize Intel’s struggling business model, which has faced challenges in recent years due to excessive capital expenditures in various projects.

Implications of the Nvidia Intel Deal

The implications of the Nvidia Intel deal extend far beyond a simple financial investment; they could affect the entire semiconductor industry landscape. With Nvidia investing heavily in Intel, it may signal a broader trend where tech companies actively seek to bolster their positions by acquiring stakes in other firms. This potential industry consolidation could lead to innovations that reshape product development and capabilities in the rapidly advancing field of artificial intelligence and processing technologies.

Furthermore, the Federal Trade Commission’s (FTC) approval of Nvidia’s investment is a pivotal development in clearing regulatory hurdles typically associated with major transactions in the tech sector. This approval underlines not only the deal’s strategic vision but also hints at a more favorable outlook for such investments, encouraging more companies to consider similar paths. The combination of Nvidia’s advanced technological resources and Intel’s established infrastructure could usher in a new era of competition and innovation.

Understanding the Intel Stock Acquisition

The Intel stock acquisition by Nvidia represents a critical juncture for both companies amid an ongoing semiconductor revolution. Intel, historically a powerhouse in chip manufacturing, has encountered difficulties related to product delays and a shift in market demand. Nvidia’s investment comes at a crucial time, infusing Intel with needed capital while simultaneously positioning Nvidia as a significant player in the market through strategic ownership.

Investors are eyeing this acquisition closely, particularly because Intel’s ability to pivot and adapt with Nvidia’s support could reinvigorate its market position. This venture not only impacts stock values but also has the potential to alter the competitive dynamics across AI and computing markets. Investors are keen to see how the merger of technologies and expertise from both companies could impact future product lines and industry standards.

The Role of Semiconductor Investment in Tech Growth

Semiconductor investment remains a cornerstone of technological growth, as the escalating demand for efficient AI and computing solutions necessitates significant advancements within this sector. Companies like Nvidia are realizing that strategic investments in established firms like Intel are essential to stay competitive in an ever-evolving landscape. Through acquisitions, businesses can leverage each other’s strengths, thereby catalyzing rapid innovation while driving down resources spent on development.

Moreover, the growing need for enhanced processing power in various applications—from data centers to personal computing—makes semiconductor investment a focal point for future technological advancements. As Nvidia and Intel collaborate post-acquisition, the expectation is that this partnership will yield groundbreaking developments that enhance not only their offerings but also elevate standards across the tech industry.

FTC Approval of Nvidia Intel Deal

The recent approval from the Federal Trade Commission (FTC) for Nvidia’s investment in Intel has significant implications for the tech industry. This regulatory green light clears one of the major obstacles that previously hindered similar transactions, sending a positive signal to other companies contemplating significant investments or mergers in the sector. It indicates a possible shift in the prevailing regulatory attitudes toward such consolidations in technology, especially amidst the heightened focus on AI.

FTC’s approval is a testament to the perceived strategic importance of the Nvidia Intel deal, which not only promises to bolster the technological capabilities of both companies but also ensures consumer benefit through enhanced products and services. Clinching this approval could encourage other tech firms to consider mergers or acquisitions as a viable strategy to navigate and adapt to the competitive landscape more effectively, ultimately pushing the industry towards further innovation.

Leveraging Nvidia’s Expertise Post-Acquisition

Post-acquisition, one of the most significant advantages for Intel will be the access to Nvidia’s expertise in artificial intelligence and machine learning, areas that are becoming increasingly pivotal in semiconductor innovation. Nvidia is renowned for its advancements in GPU technology and its role in AI development, which could greatly benefit Intel as it seeks to enhance its manufacturing processes and product offerings. Collaborating on R&D initiatives could lead to breakthroughs that position Intel in a more favorable light within the tech ecosystem.

Additionally, Nvidia’s stewardship and guidance could help realign Intel’s operational focus, promoting agility in adapting to changing market trends. This renewed direction will be vital for Intel as it aims to regain its footing amid fierce competition. By leveraging Nvidia’s renowned innovative culture, Intel may not only enhance its competitiveness but also respond more dynamically to the global demand for cutting-edge semiconductor solutions.

Market Reactions to Nvidia’s Intel Investment

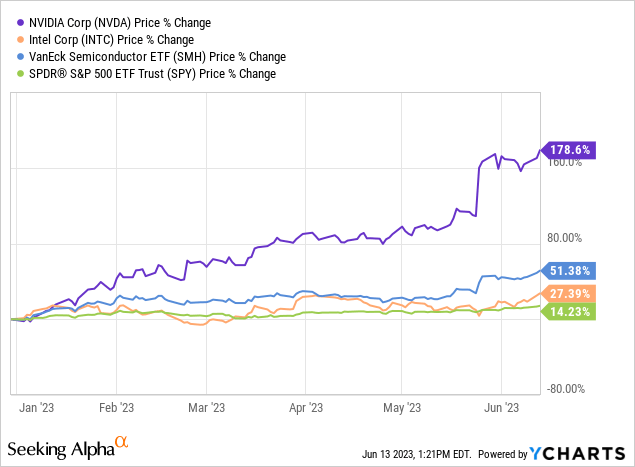

The market reactions to Nvidia’s substantial investment in Intel have been mixed yet revealing; shares of both companies showed movement following the announcement, as investors reassess the potential impacts of this acquisition. While Nvidia’s stock has consistently performed well due to its dominance in AI technology, Intel’s shares have historically been more volatile. However, many analysts predict that Nvidia’s backing will drive a resurgence in Intel’s stock performance over time, positively influencing investor sentiment.

Overall, this acquisition may foster a sense of optimism among stakeholders regarding the future of both companies. It presents an opportunity for Intel to modernize its operations and rebrand itself as a significant contender in the AI chip market, potentially leading to more robust stock performance. As the market digests these developments, the focus will remain on the execution of the merger’s strategic benefits and its ripple effects through the technology supply chain.

Future Prospects for Nvidia and Intel Collaboration

Looking ahead, the collaboration between Nvidia and Intel holds promising potential within the semiconductor industry. As technologies continue to converge—particularly in AI and cloud computing—the partnership could lead to integrated solutions that redefine market offerings. The combination of Nvidia’s stronghold in GPU technology and Intel’s prowess in CPU manufacturing creates fertile ground for innovative products that appeal to a wide range of consumers and enterprises focused on performance.

Moreover, as both companies engage in collaborative projects, the opportunity to address pressing industry challenges such as energy efficiency and scalability will become more tangible. With Nvidia’s resources and R&D capabilities backing Intel, new horizons for advancements in processing power, speed, and efficiency are not just aspirations; they could become concrete realities in the tech space. The joint efforts could lead to revolutionary breakthroughs that may reshape ecosystems, making both firms indispensable players in the industry.

Investing in the Future of AI Technologies

Through the acquisition of Intel shares, Nvidia is positioning itself not just as a leader in the semiconductor market but as a key player in the future of AI technologies. As artificial intelligence continues to permeate various sectors, from healthcare to automotive, having a strong stake in Intel may give Nvidia a competitive advantage in the development of integrated hardware and software solutions designed to meet the needs of an increasingly digital world. This strategic alignment could enhance their innovation trajectory and market responsiveness.

As they harness combined capabilities, both companies stand to benefit significantly from the ongoing growth in AI-driven applications. The partnership presents a unique opportunity to share insights, technologies, and resources, ultimately accelerating the development of next-generation AI tools. This clear commitment to driving the semiconductor industry’s evolution towards smarter architectures will likely result in robust returns for investors, as AI’s prominence continues to expand.

Frequently Asked Questions

What is the significance of Nvidia’s purchase of Intel shares?

Nvidia’s purchase of Intel shares, totaling $5 billion, represents a strategic investment aimed at providing crucial financial support to Intel after its challenges in the semiconductor market. This deal is significant as it marks Nvidia’s entry into Intel’s stock, potentially influencing future collaborations in AI and semiconductor technology.

How many shares of Intel did Nvidia acquire in this transaction?

In the Nvidia Intel shares purchase, Nvidia acquired more than 214.7 million shares of Intel, reflecting its commitment to investing in the semiconductor sector and enhancing its portfolio amidst ongoing industry shifts.

What was the price per share in the Nvidia Intel deal?

The Nvidia Intel deal involved the acquisition of Intel’s common stock at a price of $23.28 per share, as confirmed in Nvidia’s recent filing regarding the stock acquisition.

Why did Nvidia decide to invest in Intel at this time?

Nvidia’s investment in Intel is seen as a strategic move to support a key player in the semiconductor industry amidst Intel’s recent financial struggles. This strategic acquisition can help bolster Nvidia’s position in the market and potentially lead to future cooperative ventures.

Has the FTC approved Nvidia’s investment in Intel?

Yes, the U.S. Federal Trade Commission (FTC) has approved Nvidia’s investment in Intel, clearing the way for the semiconductor investment to proceed without antitrust concerns. This approval is crucial for the completion of the Nvidia Intel shares purchase.

How does the Nvidia Intel stock acquisition impact the semiconductor industry?

The Nvidia Intel stock acquisition is poised to impact the semiconductor industry positively, as it may lead to stronger collaborations and innovations while also providing Intel with much-needed financial support to enhance its operations and product development.

What are the implications of the Nvidia Intel deal for investors?

The Nvidia Intel deal could have significant implications for investors, as it signals Nvidia’s confidence in Intel’s recovery and future prospects in the semiconductor market. This strategic move might attract more investor interest in both companies, potentially affecting their stock prices.

What challenges is Intel facing that led to Nvidia’s investment?

Intel has been facing several challenges, including years of operational missteps and substantial capital expenditure that have strained its finances. Nvidia’s $5 billion investment is viewed as a vital support mechanism to help Intel stabilize and innovate moving forward.

Can Nvidia’s acquisition of Intel shares lead to future collaborations?

Nvidia’s acquisition of Intel shares opens the door for potential future collaborations, particularly in AI and semiconductor technology, both of which are critical for the growth and evolution of the tech industry.

| Key Point | Details |

|---|---|

| Transaction Value | Nvidia has purchased $5 billion worth of Intel shares. |

| Number of Shares | Nvidia acquired more than 214.7 million shares of Intel. |

| Price per Share | The shares were purchased at a price of $23.28 each. |

| FTC Approval | The U.S. Federal Trade Commission has approved the investment. |

| Significance of the Deal | This investment is seen as significant financial support for Intel after its recent struggles. |

Summary

Nvidia’s purchase of Intel shares not only represents a significant investment but also highlights a strategic partnership that may help rejuvenate Intel’s position in the market. Given the complexities involved and the approval from the FTC, this move could be a game changer for both companies. The Nvidia Intel shares purchase demonstrates confidence in the semiconductor industry’s future, particularly in the face of challenges that have affected Intel’s performance.