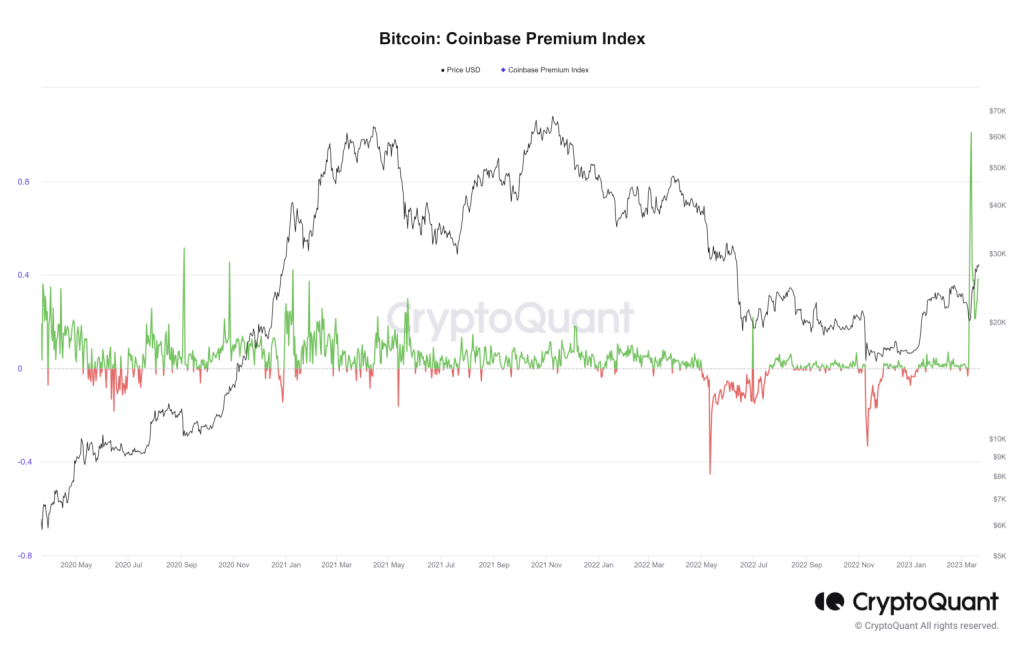

The Coinbase Bitcoin Premium Index has significantly drawn the attention of traders and investors alike, particularly as it has recorded a negative premium for 15 consecutive days, currently sitting at -0.0858%. This index tracks the disparity between Bitcoin’s price on Coinbase, a major player in the U.S. trading arena, and the global market average price. Such trends are pivotal for performing thorough Bitcoin price analysis, as they reflect shifts in capital flows and market sentiment. A negative premium suggests a potential decline in institutional investment and waning buyer confidence within the crypto market. Keeping an eye on the Coinbase Bitcoin Premium Index can provide crucial insights into emerging market trends and investor behavior in this dynamic financial landscape.

The Coinbase Bitcoin Premium Index serves as a vital metric for gauging Bitcoin’s market performance, revealing the price difference between Coinbase and the global standard. Presently, this index has been in the red for the past 15 days, indicating a sustained negative premium. Such market dynamics can lead to a deeper understanding of capital movement and investor psychology, particularly influencing institutional engagement with cryptocurrencies. Observing these shifts can illuminate broader trends within the cryptocurrency sphere, aiding analysts in predicting future price trajectories amidst varying economic conditions. Therefore, the importance of this index cannot be overstated in the ever-evolving crypto ecosystem.

Understanding the Coinbase Bitcoin Premium Index

The Coinbase Bitcoin Premium Index serves as a valuable metric for measuring the disparity between Bitcoin’s price on the Coinbase platform and the broader global market average. Currently, this index is exhibiting a negative premium for 15 consecutive days, specifically at -0.0858%. Such a situation indicates that the price of Bitcoin on Coinbase is lower than that of other exchanges worldwide, which can have significant implications for both retail and institutional investors. A continued negative premium raises questions about market sentiment and potential capital flows among U.S. investors.

In the context of cryptocurrency market trends, the Coinbase Bitcoin Premium Index is particularly crucial because it highlights how local trading conditions can differ from world markets. When trading platforms in the U.S. exhibit a consistent negative premium, it often reflects a lack of buying pressure or increased selling activity, leading to a decreased appetite for risk among investors. The evident trend of a negative premium also signals to market analysts that institutional investments may be slowing down, as large investors typically seek favorable pricing based on market conditions.

Implications of a Negative Premium on Market Sentiment

The presence of a negative premium in the Coinbase Bitcoin Premium Index indicates a shift in market sentiment that could have broader implications for Bitcoin price analysis. When the index remains negative, it suggests that market participants may be facing heightened risk aversion, which could deter institutional investments from entering the crypto space. The strong selling pressure noted in the index might correlate with declining interest from major financial entities in Bitcoin as a viable asset class amidst uncertain economic conditions and market fluctuations.

Furthermore, the recent observations surrounding the negative premium enhance our understanding of capital flows within the cryptocurrency market. As Bitcoin’s demand weakens among U.S. investors, capital may be shifting away from domestic exchanges like Coinbase towards other platforms where price action may be more favorable. Understanding these shifts is critical for investors to adapt their strategies effectively and capture potential opportunities despite prevailing bearish sentiments.

Effects of Institutional Investment Trends on Cryptocurrency Markets

Institutional investment plays a fundamental role in shaping cryptocurrency markets, and trends in this area can often be observed through the lens of the Coinbase Bitcoin Premium Index. The persistence of a negative premium may suggest that institutional players are withdrawing or managing their positions more conservatively in response to market conditions. As institutional investors typically harbor substantial capital, their movements can significantly influence Bitcoin’s price and overall market dynamics.

With declining institutional interest reflected in a negative premium, one can anticipate potential shifts in crypto market trends. Should these institutions pull back further, it could lead to a slowdown in capital inflows, exacerbating price volatility and potentially creating a bearish environment. For investors, monitoring the Coinbase Bitcoin Premium Index not only provides insights into institutional sentiment but also serves as a bellwether for forthcoming market movements within the cryptocurrency ecosystem.

Analyzing Capital Flows Based on the Negative Premium

Capital flows are a key indicator of market health, and recent data highlighting a continuous negative premium in the Coinbase Bitcoin Premium Index offers vital insights into these movements. When capital flows out of the U.S. market as indicated by the current -0.0858% premium, it often signifies that investors are reallocating their assets, either towards safer investment vehicles or diversifying into international exchanges where they perceive more favorable conditions. This dynamic can staunchly affect Bitcoin’s price trajectory and market liquidity.

Moreover, the implications of such capital flows are twofold: on one side, it points towards potential bearish sentiment among U.S. traders, while on the other, it reveals opportunities for savvy investors looking to capitalize on lower prices. As the Coinbase Bitcoin Premium Index continues to signal a negative premium, there’s a pressing need for investors to remain vigilant and to analyze external market factors that might contribute to these capital outflows.

The Correlation Between Selling Pressure and Market Resilience

The consistent selling pressure observed through the Coinbase Bitcoin Premium Index’s negative premium serves as an alarming reminder of the current state of the crypto market. This dynamic indicates that market participants are less willing to buy, which contributes to further price declines and illustrates the challenges in achieving market resilience. When investors exhibit a reluctance to enter the market due to perceived risks, it creates a feedback loop that can significantly hinder recovery efforts in Bitcoin’s price.

Understanding how selling pressure interacts with market resilience is crucial for analysts and investors alike. Identifying the causes of increased selling—be it macroeconomic factors, potential regulatory changes, or shifts in investor sentiment—can provide insights into whether this trend will persist or if a rebound might be on the horizon. Thus, close scrutiny of market conditions, paired with insights from the Coinbase Bitcoin Premium Index, can offer valuable foresight into future trends and potential turnaround points in the market.

Future Outlook for Bitcoin Amidst Current Premium Trends

As the Coinbase Bitcoin Premium Index continues to show a negative premium, the future outlook for Bitcoin remains uncertain. Market analysts are keenly observing how ongoing trends will shape the cryptocurrency landscape, particularly in relation to Bitcoin’s price performance. A prolonged negative premium might signal deeper issues within the market, akin to broader economic instability that could dampen investment enthusiasm. However, should institutional investment re-establish itself with renewed vigor, this could prompt a shift in premium dynamics.

Additionally, investors should be thoughtful about market timing and strategies amid these challenging conditions. Trends observed in the Coinbase Bitcoin Premium Index can provide valuable guidance for future investments, allowing investors to make informed decisions about entry points and risk management. The potential for volatility remains high, but strategic positioning based on current market data may yield long-term benefits for patient investors.

How the Coinbase Bitcoin Premium Index Reflects Investor Behavior

The Coinbase Bitcoin Premium Index is not just a reflection of market prices; it provides vital insights into investor behavior and sentiment in the cryptocurrency space. As the index reflects a negative premium for 15 consecutive days, it highlights a current trend of decreased buying interest and potentially points to a change in investor psychology. The behavior of investors in response to this index can drive or hinder market recovery, making it a critical tool for understanding the sentiment dynamics in the crypto market.

Investor psychology often plays a crucial role in determining market trends, especially in the notoriously volatile crypto space. As the Coinbase Bitcoin Premium Index continues to indicate lower pricing than the global average, it is essential for market participants to analyze these trends closely and adjust their strategies accordingly. Those who can interpret the signals provided by this index may find themselves better positioned to navigate the complexities of the market and respond effectively to impending changes.

Comparing Coinbase’s Pricing with Global Market Averages

The importance of comparing Coinbase’s pricing with global market averages cannot be overstated, particularly in the context of the Coinbase Bitcoin Premium Index reporting a negative premium for several days. Such comparisons allow investors to gauge the overall health of the Bitcoin market, providing them with insights that are indispensable for making informed trading decisions. By analyzing how Coinbase pricing deviates from worldwide averages, investors gain critical context that informs their market strategies.

Emerging trends, such as a persistent negative premium, might suggest wider economic implications, including the potential impact of U.S. regulatory stances or shifts in investor confidence. Investors relying solely on Coinbase’s prices without considering global benchmarks could find themselves misled about Bitcoin’s true worth in the market. Hence, a comprehensive understanding of both local and global price dynamics is essential to fully appreciate how external factors might influence domestic trading sentiment.

Navigating Market Sentiments During Crypto Volatility

Navigating market sentiments during times of increased volatility can be daunting for crypto investors, especially amid indications such as the Coinbase Bitcoin Premium Index being in a negative position. This index serves as a reminder of the fluctuating nature of both investor confidence and market dynamics, signaling caution for those involved in Bitcoin trading. By understanding the implications of such volatility, traders may be able to devise strategies that not only safeguard their investments but also leverage the fluctuations for profit.

In turbulent times, being informed is crucial. The insights derived from the Coinbase Bitcoin Premium Index, along with broader market analysis, can empower investors to respond to volatility strategically. Whether employing risk management techniques or diversifying into other assets, the ability to interpret market signals effectively can enhance one’s chances of navigating the complexities of the cryptocurrency landscape successfully.

Frequently Asked Questions

What does the Coinbase Bitcoin Premium Index signify in Bitcoin price analysis?

The Coinbase Bitcoin Premium Index measures the price difference of Bitcoin on Coinbase compared to the global average. A positive premium indicates strong demand and institutional investment in the U.S. market, while a negative premium, such as the current rate of -0.0858%, reflects selling pressure and decreased risk appetite.

How can a negative premium in the Coinbase Bitcoin Premium Index affect crypto market trends?

A negative premium in the Coinbase Bitcoin Premium Index suggests increased selling pressure, which may influence crypto market trends by indicating lower investor confidence and potential capital outflows from the U.S. market.

What are the implications of prolonged negative premium on institutional investment according to the Coinbase Bitcoin Premium Index?

A prolonged negative premium, such as the one lasting 15 consecutive days at -0.0858%, could signal reduced institutional investment as it reflects a bearish sentiment in the market and a lack of liquidity supporting significant capital flows.

How does the Coinbase Bitcoin Premium Index relate to capital flows in the cryptocurrency market?

The Coinbase Bitcoin Premium Index serves as an indicator of capital flows into the U.S. cryptocurrency market. A negative premium indicates that capital may be exiting due to lower demand, affecting overall market liquidity and institutional investment trends.

Why is monitoring the Coinbase Bitcoin Premium Index important for understanding Bitcoin’s market dynamics?

Monitoring the Coinbase Bitcoin Premium Index is crucial for analyzing Bitcoin’s market dynamics as it provides insight into investor sentiment, capital flows, and potential shifts in institutional investment amid changing crypto market trends.

| Key Point | Details |

|---|---|

| Current Status | Coinbase Bitcoin Premium Index is at -0.0858% for the past 15 days. |

| Definition | Measures price differences on Coinbase compared to global average. |

| Significance of Positive Premium | Higher price indicates strong demand and optimism among U.S. buyers. |

| Significance of Negative Premium | Lower price suggests selling pressure and risk aversion in the market. |

Summary

The Coinbase Bitcoin Premium Index has drawn considerable attention as it indicates current market dynamics, being consistently negative for 15 days at -0.0858%. This persistence reflects a potential decline in investor confidence and increased selling pressure in the U.S. market. Monitoring the Coinbase Bitcoin Premium Index is crucial for understanding institutional investments and market sentiment as these factors are crucial in shaping future Bitcoin trends.