Trend Research ETH withdrawal is making headlines as the institution has recently taken a bold step in the crypto market, pulling out 20,850 ETH valued at $63.28 million from Binance within a single hour. This significant withdrawal has caught the attention of cryptocurrency enthusiasts, especially following the latest ETH staking news, which highlights the volatile nature of Ethereum transactions. According to insights from Yihua Trend Research, the institution didn’t just stop at withdrawing; they also staked a portion of their holdings through a specified address while securing a loan of 40 million USDT. With a total of 600,850 ETH now in their possession, valued at an impressive $1.82 billion, this move positions Trend Research prominently in the world of big holdings. As such developments unfold, they’re bound to influence the overall landscape of Binance transactions and the broader cryptocurrency news ecosystem.

In recent developments, Trend Research has executed a remarkable withdrawal of Ethereum, a major cryptocurrency, further culminating in strategic staking and borrowing activities. This initiative is part of a larger trend observed in the crypto space, whereby institutions are making calculated moves to optimize their holdings and maximize returns amidst fluctuating market conditions. With a focus on staking Bitcoin and Ethereum, similar patterns have been noted across various exchanges, including Binance, where transaction volumes have surged. As institutions like Yihua engage in these financial tactics, the implications resonate throughout the cryptocurrency industry. Enhanced awareness around ETH and similar assets creates a ripple effect, influencing both retail investors and institutional strategies alike.

Understanding the Recent Trend Research ETH Withdrawal

In a notable development within the cryptocurrency market, Trend Research has executed a significant withdrawal of 20,850 ETH from Binance, amounting to $63.28 million. This transaction, reported by key analysts at Odaily Planet Daily, underscores the dynamic activities of cryptocurrency institutions that actively engage with leading exchanges. By strategically withdrawing assets from Binance, Trend Research signals a shift in their asset management strategy, aligning with ongoing trends in the Ethereum ecosystem. Such movements are closely monitored by investors eager to glean insights into market sentiments and liquidity positions.

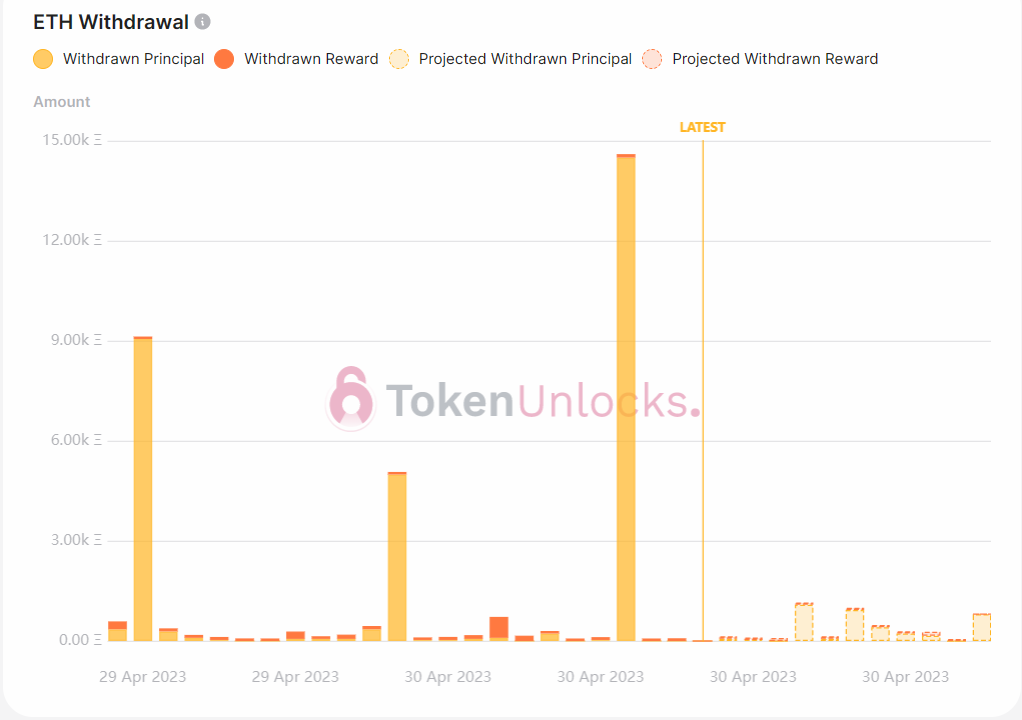

The recent ETH withdrawal by Trend Research is part of a larger context of evolving institutional interest in Ethereum. With Ethereum staking becoming a prevalent practice, institutions are exploring various strategies for maximizing their yield. This hefty withdrawal, followed by subsequent staking actions, indicates a proactive approach from Trend Research to enhance their cryptocurrency portfolio. Understanding these trends not only aids in grasping the institution’s investment strategy but also contributes to a broader understanding of the market dynamics that drive Ethereum and other digital assets.

Impact of Staking on ETH Holdings

The action taken by Trend Research to stake their withdrawn ETH emphasizes the growing significance of staking in the cryptocurrency landscape. As institutional players recognize the benefits of staking, such as enhanced yields and reduced volatility, the demand for ETH is likely to increase. By staking their assets, Trend Research joins a host of investors looking to participate actively in the Ethereum network, thereby contributing to its security and functionality. Through this process, they can earn rewards while also holding a substantial portion of their investments in a poised state for further appreciation.

ETH staking news continuously highlights how institutions like Trend Research are adapting to the evolving financial ecosystem. The withdrawal followed by staking demonstrates a tactical allocation of digital assets that capitalizes on both immediate liquidity needs and long-term investment strategies. As the ETH landscape matures, the role of staking becomes indispensable for both individual traders and large entities, further solidifying Ethereum’s position among top cryptocurrency investments.

Institutional Investments Shape the Future of Ethereum

The recent action by Trend Research represents a significant trend within institutional investments in cryptocurrencies, particularly Ethereum. With the withdrawal of 20,850 ETH from Binance combined with a substantial staking action, institutions are redefining their portfolios to adapt to market volatility and capitalize on potential growth. These transactions by Trend Research reflect a shift in strategy as institutions leverage their resources to optimize both short-term liquidity and long-term asset appreciation.

Furthermore, the cumulative holdings of 600,850 ETH valued at $1.82 billion from Trend Research indicate a strong commitment to the Ethereum network. As institutions continuously engage in high-volume transactions and explore new protocols, their influence on Ethereum’s price action will be profound. This aligns with ongoing cryptocurrency news showcasing how the involvement of large players can drive market changes, prompting retail investors to reassess their strategies in light of institutional movements.

Cryptocurrency Transactions at Binance: What to Know

As a leading cryptocurrency exchange, Binance accommodates a vast array of transactions ranging from retail trades to substantial institutional movements. The recent withdrawal of ETH by Trend Research is a stark representation of the exchange’s pivotal role in the digital currency space. With the ever-growing volume of transactions noted on Binance, firms are opting to execute significant withdrawals to strategize for a range of market conditions, enhancing their trading flexibility.

Understanding the nuances of Binance transactions can provide insight into broader market trends and investor behavior. As Trader sentiment shifts, features such as withdrawal and deposit activities become key indicators. For instance, when notable amounts of cryptocurrencies, such as Ethereum, are withdrawn for staking or other purposes, it may reflect shifts in investor confidence or anticipated market changes. Monitoring these movements can provide essential cues for market participants, both institutional and retail.

Analyzing the Financial Implications of ETH Management

Strategically managing a large cryptocurrency portfolio involves a thorough understanding of financial implications, as evidenced by Trend Research’s recent maneuvers. By withdrawing ETH from Binance and subsequently staking it, the institution is not only engaging in risk management but also aiming to enhance their earnings potential. This dual strategy allows them to minimize exposure to price fluctuations while taking full advantage of Ethereum’s staking rewards, reflecting a savvy approach to crypto investment.

Further, the efficiency with which institutions can transfer large volumes of cryptocurrency for staked assets has been remarkably refined over the years. As the Ethereum ecosystem expands, the options available for generating returns through staking become more attractive. Thus, the financial implications of maintaining and managing such large amounts of ETH cannot be understated—especially as organizations seek to stay competitive in an increasingly crowded market.

The Role of On-Chain Analytics in Cryptocurrency Transactions

On-chain analytics play a critical role in understanding the flow of funds within the cryptocurrency space. Analysts like Ai Yi provide insights on transactions, such as the recent ETH withdrawal by Trend Research, which allows market participants to gauge potential market trends and investor sentiment. On-chain data deconstructed can offer transparency into the movement of large amounts of cryptocurrencies, thus promoting confidence and strategic decision-making among investors.

With tools that track daily transactions, the Ethereum network reveals patterns of activity that analysts leverage to inform trading strategies. The significant withdrawal of ETH by Trend Research highlights how on-chain metrics can indicate institutional interest and strategy shifts. This analytical lens serves as a nationwide perspective for the crypto community, enhancing the overall understanding of market behavior and giving insights that can drive the next phases in trading and investment strategies.

Ethereum Market Dynamics in Response to Institutional Moves

The interaction between institutional moves and market dynamics forms a significant part of the cryptocurrency ecosystem. Trend Research’s withdrawal of ETH from Binance and the subsequent staking activity echo a broader trend where institutional players are influencing Ethereum pricing and volatility. Each significant transaction contributes to a shifting market landscape, where supply and demand dynamics are continually adapting to the major players’ strategies.

As institutional holdings of ETH rise, a ripple effect is observed throughout the market. Investors closely monitor these movements, as they can shift sentiment and influence retail trading patterns. The interplay between institutional transactions—like those by Trend Research—and price fluctuations reflects an increasingly sophisticated market where knowledge of institutional behavior becomes paramount for both novice and seasoned traders alike.

Ethereum’s Position Among Major Cryptocurrencies

As Ethereum continues to hold its ground as one of the leading cryptocurrencies, institutional withdrawals and staking actions contribute significantly to its reputation. Recent transactions, such as Trend Research’s, highlight Ethereum’s robustness in the face of fluctuating market conditions. With a strong backing from institutional stakeholders, Ethereum’s position is fortified by investor confidence and an expanding ecosystem.

The ETH market’s resilience hinges on its adaptability and the diverse strategies emerging among institutional investors. With a focus on both immediate returns from staking and long-term value retention, Ethereum is shaping up to remain a central player in the cryptocurrency market. Analyzing these factors paints a promising picture of Ethereum’s trajectory moving forward as it continues to evolve alongside institutional engagement.

The Future of Ethereum: Trends and Predictions

Looking ahead, the future of Ethereum appears to be steadfastly intertwined with the participation of institutional investors. The recent withdrawal and staking activities by Trend Research may serve as an indicator of upcoming market trends and potential price movements. As more institutions adapt their strategies to encompass staking and secure returns, Ethereum’s market infrastructure is positioned to benefit from these developments.

Predictions for Ethereum’s future often consider the implications of increased institutional participation. With Ethereum’s ongoing upgrades and improvements aimed at scalability and utility, the potential for appreciation in value continues to attract interest. As such, market players will closely observe institutional patterns, which not only shape immediate market conditions but also lay the groundwork for Ethereum’s long-term success in the ever-evolving landscape of digital currencies.

Frequently Asked Questions

What triggered the Trend Research ETH withdrawal from Binance?

The recent withdrawal of 20,850 ETH by Trend Research from Binance is part of their strategic investment approach, reflecting ongoing activities in ETH staking and cryptocurrency management. This move appears to be a response to market dynamics and the institution’s overall holding strategy.

How much ETH has Trend Research withdrawn from Binance recently?

Trend Research has recently withdrawn a substantial amount of 20,850 ETH, equivalent to approximately $63.28 million, from Binance within a single hour, showcasing their active engagement in Ethereum trading and staking.

What is the total ETH holding of Trend Research after their recent withdrawal?

Following the latest withdrawal, Trend Research now holds a total of 600,850 ETH across five addresses, valued at around $1.82 billion. This adjustment in their holdings reflects ongoing trends in ETH staking news and investment strategies.

What does the withdrawal of 20,850 ETH imply for the cryptocurrency market?

The withdrawal of 20,850 ETH by Trend Research from Binance may indicate a shift in institutional confidence in Ethereum, potentially impacting market trends and signaling strategic moves within the cryptocurrency news space. It highlights trends in liquidity and investment strategies focused on ETH.

How does Trend Research’s ETH withdrawal impact their staking strategy?

After withdrawing 20,850 ETH from Binance, Trend Research staked a portion of it, demonstrating a commitment to ETH staking strategies that maximize their yield and leverage their holdings for future gains in the Ethereum ecosystem.

What are the implications of Trend Research borrowing 40 million USDT after the ETH withdrawal?

By borrowing 40 million USDT post-ETH withdrawal, Trend Research is likely positioning itself to utilize this capital for further investments or liquidity management, which is a common practice in cryptocurrency trading to optimize returns on ETH and other assets.

Can we expect more withdrawals from Trend Research in light of recent transactions?

Given the recent trend of significant withdrawals and strategic staking actions, it is possible that Trend Research may continue to adjust their ETH holdings in response to market conditions, signaling further movements in the cryptocurrency sphere.

| Key Point | Details |

|---|---|

| Withdrawn Amount | 20,850 ETH valued at $63.28 million |

| Source | Odaily Planet Daily, on-chain analyst Ai Yi |

| Institution | Trend Research (under Yihua) |

| Staking and Borrowing | Staked ETH via address 0x8FD…97f43 and borrowed 40 million USDT |

| Total ETH Holdings | 600,850 ETH valued at $1.82 billion across five addresses |

| Previous Holdings | Previously held 580,000 ETH with an average cost of about $3,150 |

| Current Average Cost | After recent withdrawals, the average cost is approximately $3,146 |

Summary

Trend Research ETH withdrawal has garnered significant attention as the institution makes substantial moves in the crypto market. Recently, Trend Research withdrew 20,850 ETH worth $63.28 million from Binance, followed by staking a portion of these holdings and borrowing 40 million USDT. This activity not only highlights the liquidity strategies being utilized by the institution but also reflects the rising confidence in Ethereum, as evidenced by their total holdings of 600,850 ETH valued at $1.82 billion. As the market continuously evolves, monitoring such withdrawals provides keen insights into institutional behavior and trends in cryptocurrency investing.