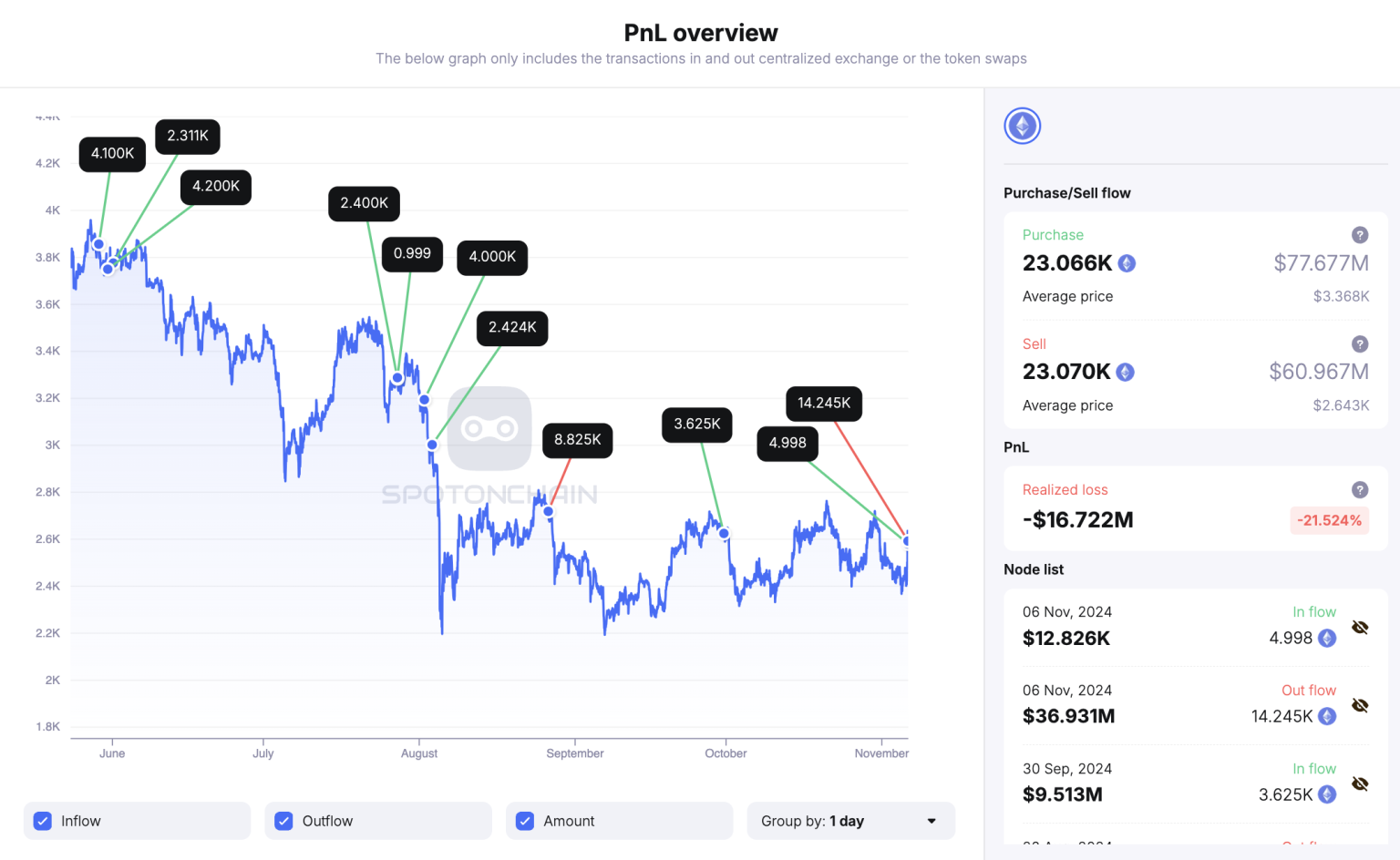

ETH trading losses have become a significant talking point among cryptocurrency enthusiasts, especially when considering the recent closure of a major short position by a seasoned trader. On December 29, 2025, news outlets, including Odaily Planet Daily, reported that a trader with an impressive 83% win rate suffered a staggering loss of $3.4 million. This event highlights the volatile nature of the Ethereum market and the risks inherent in crypto trading. Lookonchain monitoring tracked the trader’s activities, noting that they had executed around 70 transactions, yielding an overall profit of $21.84 million despite this setback. As traders digest this crypto trading news, the implications for future ETH short positions and overall market strategies will undoubtedly be a topic of interest in upcoming Ethereum market updates.

Recent reports emphasize losses incurred in trading Ethereum as traders navigate the complex landscape of the cryptocurrency market. A prominent case involves a trader known for their remarkable success rate, who has recently faced financial setbacks with an ill-timed short strategy. As market fluctuations continue to impact trader performance, the challenges of managing risk and capitalizing on favorable trades become increasingly apparent. This situation serves as a crucial reminder of the unpredictable nature of crypto investments. The data from Lookonchain renders an insightful view into the performance metrics of traders, showcasing both their successes and failures within the vibrant Ethereum ecosystem.

Understanding ETH Trading Losses

In the volatile world of cryptocurrency, trading losses can be a significant part of a trader’s journey, especially for large positions in ETH. A recent report highlighted a notable case where a skilled trader with an impressive 83% win rate faced a staggering loss of $3.4 million when closing their ETH short position. This incident underscores the complexities and risks associated with crypto trading, particularly in the Ethereum market, which is notorious for its price fluctuations.

Trading losses can occur despite a high success rate, emphasizing the importance of risk management strategies. The trader in question, known for their exceptional performance in crypto trading, underscored the unpredictability of the market. As new traders and seasoned investors alike follow daily updates, including the latest crypto trading news, it becomes vital to learn from such experiences to improve personal trading strategies.

Analyzing ETH Short Positions

ETH short positions can be a double-edged sword in the realm of crypto trading. Shorting Ethereum allows traders to profit from market declines, but it also carries the risk of severe losses if the market shifts unexpectedly. The recent closure of a short position by a trader with an 83% win rate serves as a reminder of these risks. Despite their skilled approach and historical success, the recent short position resulted in a significant financial hit, illustrating the necessity of a well-rounded trading strategy.

The market for Ethereum can change rapidly due to various factors, including investor sentiment and significant market news. This is why monitoring tools like Lookonchain are crucial for traders who wish to maintain an edge. These tools help track various metrics and transactions, providing traders with insights that can either reinforce their strategies or prompt them to adjust their positions swiftly.

The Impact of Market Conditions on Trading Outcomes

Market conditions play a crucial role in determining the outcomes of trading strategies. In the case of the trader who closed their ETH short position at a loss, it is important to recognize that even well-established strategies can falter under adverse conditions. Economic factors, regulatory changes, and significant news events can quickly alter the ETH landscape, leading to unanticipated price movements that impact traders’ positions.

For traders, being aware of current Ethereum market updates is key to making informed decisions. The ability to adapt to market shifts can significantly enhance a trader’s resilience and potential for success. The unfortunate loss incurred highlights the need for traders to stay updated with the latest developments in crypto trading news, allowing for more agile responses to changing conditions.

Risk Management in Cryptocurrency Trading

Effective risk management is essential for long-term success in cryptocurrency trading. After experiencing substantial losses, such as those incurred by the trader who closed their ETH short position, it becomes clear that managing exposure to risk is critical. Techniques such as setting stop-loss orders, diversifying portfolios, and utilizing proper position sizing can help mitigate losses and protect against unforeseen volatility.

Additionally, traders must continuously evaluate their risk tolerance and adjust their strategies accordingly. Keeping track of performance through metrics, such as win rates and overall profitability, is vital for understanding one’s trading capabilities. Even successful traders can encounter losses, and being prepared for such events can help maintain confidence and stability in trading practices.

The Role of Technology in Tracking Trades

In the modern era of cryptocurrency trading, utilizing technology to monitor trades can vastly improve outcomes. Lookonchain provides valuable insights into traders’ transactions, offering real-time data crucial for decision-making. Traders can analyze past moves, current market positions, and potential future trends using these platforms, enhancing their understanding of market dynamics.

The integration of technology into trading strategies equips investors with tools to assess their performance, including tracking win rates and loss statistics. Such data is invaluable, especially when facing challenging trading conditions like those experienced by the trader who closed their ETH short position. By leveraging advanced tools, traders can enhance their strategies and minimize risks in an unpredictable market.

Key Lessons from High-Profile Trading Losses

High-profile trading losses often serve as cautionary tales for those in the cryptocurrency space. The recent closure of an ETH short position resulting in a $3.4 million loss highlights critical lessons about the inherent risks associated with speculative trading. Even those with an 83% win rate are susceptible to significant setbacks, urging other traders to adopt a more cautious approach.

From these experiences, traders can learn the importance of rigorous risk assessment and the necessity of having a well-defined trading plan. Developing resilience in trading techniques and learning from past mistakes can pave the way for more sustainable trading practices in the future.

Evolving Strategies in Ethereum Trading

As the Ethereum market continues to evolve, so too must the strategies employed by traders. The trading landscape for ETH is marked by rapid changes, often influenced by technological advancements, investor sentiment, and global events. In light of these dynamics, it is vital for traders to remain adaptable, continually reassessing their positions and strategies to align with current market conditions.

Traders can utilize resources like crypto trading news and market updates to stay informed about significant shifts. By engaging with various analytical tools and platforms, they can refine their strategies to minimize losses and potentially capitalize on emerging trends, thus ensuring their trading approach remains competitive and effective amidst the fluid nature of the crypto market.

The Importance of a Reliable Trading Network

A solid trading network can greatly enhance a trader’s chances of success in the competitive world of cryptocurrency. Establishing connections with other traders, participating in forums, and leveraging social media platforms can provide insights and strategies that may not be readily available through traditional channels. Networking allows for the sharing of experiences, including lessons learned from significant losses like that of the trader who closed an ETH short position.

Additionally, a reliable trading community can facilitate the exchange of critical information, such as the latest crypto trading news. This helps traders make informed decisions, potentially influencing their strategies and execution methods. By utilizing a strong network, traders can enhance their knowledge and response to market volatility, ultimately leading to better trading outcomes.

Final Thoughts on Ethereum Market Strategies

In navigating the complex realm of Ethereum trading, developing effective strategies is paramount. While a high win rate can indicate skill, the reality remains that losses are an inevitable part of trading. The example of a skilled trader incurring a substantial loss when closing their ETH short position illustrates this truth. Moving forward, it is essential for traders to strike a balance between taking calculated risks and implementing robust risk management practices.

As the Ethereum market continues to develop, staying abreast of market updates and adapting strategies accordingly will be key for traders seeking success. By focusing on continuous learning and remaining agile, traders can navigate challenges more effectively and carve a path towards sustained profitability in the cryptocurrencies landscape.

Frequently Asked Questions

What caused the ETH trading losses for the trader with an 83% win rate?

The ETH trading losses for the trader with an 83% win rate can be attributed to the closure of a short position which resulted in a loss of 3.4 million dollars. This significant loss was reported by Odaily Planet Daily on December 29, 2025, and monitored through Lookonchain metrics.

How does the closure of an ETH short position impact trading losses?

Closing an ETH short position can lead to trading losses if the market price moves against the trader’s expectations. For instance, the smart trader mentioned incurred a loss of 3.4 million dollars when they closed their position, despite previously maintaining a high win rate overall.

What insights can we gain from the Ethereum market update regarding ETH trading losses?

The Ethereum market update revealed critical information regarding ETH trading losses, particularly through the actions of a trader who, despite having an 83% win rate, faced a significant loss of 3.4 million dollars after closing a short position. Such updates are vital for understanding market trends and trader behavior.

How can Lookonchain monitoring assist in avoiding ETH trading losses?

Lookonchain monitoring provides real-time analysis of trader activities and their outcomes, helping traders identify patterns and make informed decisions. This monitoring could potentially prevent ETH trading losses by allowing traders to react promptly to adverse market developments.

What does an 83% win rate indicate about the potential for ETH trading losses?

An 83% win rate suggests that a trader is generally successful; however, even successful traders can incur ETH trading losses. For instance, the smart trader experienced a 3.4 million dollar loss despite a high win rate, highlighting that market volatility can adversely affect even experienced traders.

Can ETH trading losses be mitigated by staying informed through crypto trading news?

Yes, staying informed through crypto trading news is crucial for mitigating ETH trading losses. Knowledge of market shifts and updates, such as those reported by Odaily Planet Daily, can help traders adjust their strategies and potentially avoid significant losses.

What are the risks associated with high leverage in ETH trading that can lead to losses?

High leverage in ETH trading can increase potential losses, as traders may face margin calls if the market moves unfavorably. The mentioned trader, despite a high win rate, faced a significant loss of 3.4 million dollars due to volatile market conditions that exceeded their risk tolerance.

| Key Points | ||||||

|---|---|---|---|---|---|---|

| Trader’s Identifier: pension-usdt.eth (0x367…D17) | Date of Report: December 29, 2025 | Time of Closure: 06:00 | ETH Short Position Loss: $3.4 million | Overall Transactions: Approximately 70 | Win Rate: 83% | Total Profit from Trading: $21.84 million |

Summary

ETH trading losses can significantly impact a trader’s performance, as demonstrated by the case of a smart trader who recently closed their ETH short position, incurring a notable loss of 3.4 million dollars. Despite achieving an impressive win rate of 83% across approximately 70 transactions, this loss underscores the inherent risks involved in trading cryptocurrencies. It highlights the importance of effective risk management and strategic decision-making in the volatile ETH market.