The landscape of **Cryptocurrency Holdings by Country** is rapidly evolving, with significant implications for investors and governments alike. As of 2025, the latest cryptocurrency rankings reveal that the United Arab Emirates leads the pack with a staggering 31% of global crypto assets, highlighting its dominance in the digital currency arena. Following the UAE, Turkey and Singapore claim the second and third spots, with 25.6% and 24.4%, respectively, reflecting a strong trend of cryptocurrency adoption worldwide. This data not only marks the top countries for cryptocurrency but also underscores the shifting dynamics of the global cryptocurrency market, as nations recognize the potential of digital assets. As we delve into the UAE cryptocurrency stats and the holdings of other nations like Vietnam and the United States, it becomes clear that the future of finance is unfolding before our eyes.

Understanding the distribution of cryptocurrency investments across nations is crucial in the realm of digital finance. The standings of countries in terms of their crypto portfolios not only illustrate the levels of acceptance but also the economic strategies embraced by these regions. In light of the 2025 analysis on national cryptocurrency assets, recorded leaders such as the UAE suggest a substantial commitment to digital currencies by major economies. Countries like Turkey and Singapore are also making their marks, reinforcing the trend of widespread cryptocurrency usage. This examination invites a closer look at how global adoption patterns are shaping the future of financial landscapes around the world.

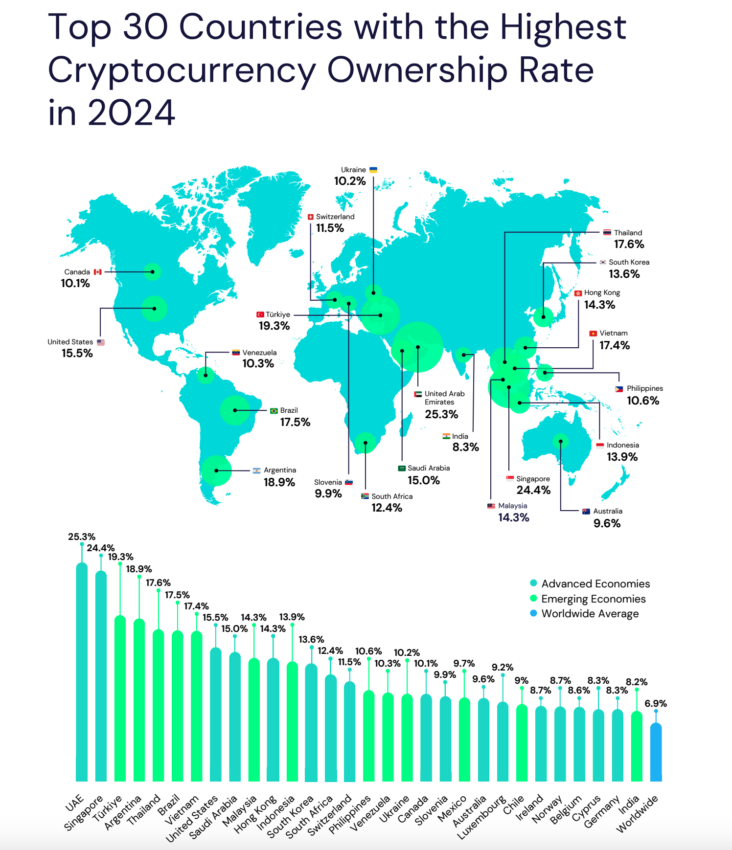

Overview of Cryptocurrency Holdings by Country in 2025

The landscape of cryptocurrency ownership is continually evolving, and as of 2025, the rankings show some significant shifts. Notably, the United Arab Emirates (UAE) has emerged as the leading country for cryptocurrency holdings, boasting an impressive 31.0%. This figure highlights the UAE’s progressive regulatory framework and enthusiastic adoption of digital assets, positioning it as a global leader in the cryptocurrency market. Countries such as Turkey and Singapore also demonstrate strong adoption, with holdings of 25.6% and 24.4%, respectively, showcasing their growing engagement with cryptocurrencies.

This ranking reflects broader trends in cryptocurrency adoption worldwide, where nations are increasingly recognizing the potential of digital currencies. While the UAE leads the pack, other countries like Vietnam and Brazil are not far behind, with holdings of 21.2% and 20.6%, respectively. These statistics indicate a rising interest in crypto assets across various regions, driven by factors such as economic decentralization, investment opportunities, and increased access to digital technology.

Top Countries for Cryptocurrency Rankings in 2025

Examining the top countries for cryptocurrency in 2025 reveals a diverse range of markets participating in the digital asset revolution. After the UAE, Turkey and Singapore continue to show robust enthusiasm for cryptocurrencies, with high adoption rates reflecting local economic conditions and regulatory advancements. The impressive percentages indicate not just ownership but potential transactions and investments in the cryptocurrency landscape, confirming the trend towards digital finance.

As we delve deeper into the rankings, countries like Vietnam and Brazil affirm their growing prominence in the global cryptocurrency market with substantial holdings. Vietnam’s 21.2% clearly delineates its proactive stance towards embracing cryptocurrencies as a staple of modern finance, while Brazil’s 20.6% signals a transformation in how cryptocurrencies are perceived within the nation. These countries’ investments in crypto infrastructure and education have spurred more citizens to enter the cryptocurrency space.

UAE Cryptocurrency Stats: A Closer Look

The cryptocurrency statistics from the UAE are remarkable, especially as the nation garners international attention for its innovative financial practices. The 31.0% ownership rate of cryptocurrencies suggests that a significant portion of the population is not only aware of digital currencies but is actively investing in them. This trend can be attributed to the government’s supportive policies and initiatives aimed at fostering fintech growth, including the establishment of free trade zones for cryptocurrency businesses.

Moreover, the UAE’s strategic location as a business hub for the Middle East and its favorable tax regulations contribute to a flourishing ecosystem for cryptocurrency startups and investors. As the global cryptocurrency market continues to expand, the UAE is uniquely positioned to leverage its existing infrastructure and investor base to amplify its role as a center for crypto innovation.

Cryptocurrency Adoption Worldwide and Its Trends

Cryptocurrency adoption worldwide has seen a significant acceleration in recent years, particularly as technological advancements and global connectivity increase. As indicated by the various country rankings, more nations are embracing the idea of digital currencies as viable investment vehicles. Worldwide, factors like inflation, currency fluctuations, and an increased interest in decentralized finance have fueled this trend, pushing cryptocurrencies into the mainstream.

The 2025 statistics reveal that countries like South Korea (13.6%) and Germany (8.9%) are also playing vital roles in the growth of cryptocurrency acceptance. As national governments and institutions begin to recognize the benefits of blockchain technology, a shift in perception is taking place, encouraging further investment and participation in the global cryptocurrency market.

Emerging Markets in Cryptocurrency: Opportunities and Challenges

Emerging markets are increasingly becoming hotspots for cryptocurrency innovation and adoption. Countries like Vietnam and Brazil stand out due to their significant holdings of 21.2% and 20.6%, respectively. This growth often stems from younger populations eager to explore digital investments, alongside an increase in smartphone penetration and internet access. However, these opportunities often come bundled with challenges, such as regulatory hurdles and market volatility.

As more emerging markets adopt cryptocurrencies, they must navigate the complex landscape of regulations and security risks. The need for education around safe trading practices and understanding blockchain technology is critical for nurturing a secure crypto environment. Ultimately, while the prospects of adopting cryptocurrencies in emerging markets are bright, addressing these challenges will be key to ensuring sustainable growth.

The Role of Government Regulations in Cryptocurrency Growth

Government regulations play a crucial role in shaping the landscape of cryptocurrency investment and adoption. Countries leading the sector, such as the UAE and Turkey, have introduced regulatory frameworks that encourage innovation while providing necessary safeguards. This balance of innovation versus regulation is essential in promoting safe trading and protecting investors, ultimately leading to higher cryptocurrency holdings within these nations.

Conversely, regions with stricter regulations may experience slower growth rates in cryptocurrency adoption. As authorities worldwide grapple with formulating effective policies, the decisions taken by governments today will profoundly affect the trajectory of cryptocurrency adoption worldwide, especially as the global cryptocurrency market continues to evolve.

The Future of Cryptocurrency: Predictive Insights for 2025 and Beyond

Looking ahead, the future of cryptocurrency appears promising, with projections indicating that adoption rates will only continue to rise. The current trends in cryptocurrency rankings, particularly those seen in the UAE, Turkey, and Singapore, are likely to set a precedent for future growth. With increasing institutional investment and clearer regulatory landscapes, cryptocurrencies are expected to gain further legitimacy, attracting even more users and investors.

As the digital finance sector matures, potential technological advancements, such as enhanced security measures and the emergence of Central Bank Digital Currencies (CBDCs), could reshape the investor landscape. By 2025 and beyond, we should expect to see a more interconnected global cryptocurrency market, enhancing its position as a cornerstone of modern financial systems.

Investing in Cryptocurrency: Strategies and Insights

For investors looking to navigate the ever-evolving world of cryptocurrency, understanding market dynamics and developing sound investment strategies is vital. With the recent rankings showing prominent countries holding significant cryptocurrency assets, there is ample opportunity for investors to participate in various markets. Diversifying one’s portfolio across different cryptocurrencies and keeping abreast of global trends will be essential for maximizing returns.

Additionally, educating oneself about the technology behind cryptocurrencies, as well as the socio-economic factors influencing cryptocurrency adoption in different countries, will empower investors to make informed choices. With proper due diligence, investors can effectively chart their paths in the dynamic landscape highlighted by rankings such as those for 2025.

Understanding the Impact of Blockchain Technology on Cryptocurrency Holdings

Blockchain technology serves as the backbone of the cryptocurrency ecosystem and is fundamental in driving higher valuations and adoption rates globally. By providing a secure and transparent method for transactions, blockchain minimizes fraud and enhances user confidence, leading to increased cryptocurrency holdings. The implications of such technology are profound, prompting countries like the UAE and Turkey to invest heavily in blockchain infrastructure to support their digital asset initiatives.

As the understanding of blockchain’s benefits grows, it will potentially correlate with higher adoption rates and more significant investments in cryptocurrency across various nations. The synergy between blockchain technology and cryptocurrency holdings underscores a broader trend towards embracing technological advancements for economic growth and innovation.

Frequently Asked Questions

What are the cryptocurrency holdings by country in 2025?

As of 2025, the rankings of cryptocurrency holdings by country highlight the UAE leading with 31%. Turkey follows in second place with 25.6%, while Singapore secures third at 24.4%. Additional notable countries include Vietnam (21.2%), Brazil (20.6%), and the United States (15.5%), among others. These statistics reflect the global cryptocurrency market’s dynamics.

Which country has the highest cryptocurrency holdings in 2025?

The UAE ranks first in cryptocurrency holdings in 2025 with an impressive 31%. This prominent position underscores the UAE’s growing influence in cryptocurrency adoption worldwide.

How does Turkey rank in cryptocurrency holdings by country?

Turkey ranks second in cryptocurrency holdings by country in 2025, with a significant 25.6%. This reflects Turkey’s increasing participation and interest in the global cryptocurrency market.

What are the top countries for cryptocurrency according to recent statistics?

According to cryptocurrency rankings for 2025, the top countries include UAE (31.0%), Turkey (25.6%), Singapore (24.4%), and Vietnam (21.2%). These countries are leading in cryptocurrency adoption worldwide.

What are the cryptocurrency adoption rates like in the UAE?

The UAE exhibits the highest cryptocurrency adoption rate, with 31% of its population holding cryptocurrencies in 2025. This statistic ranks the UAE at the forefront of global cryptocurrency holdings.

Which countries follow the UAE in cryptocurrency rankings for 2025?

Following the UAE’s 31%, the countries with significant cryptocurrency holdings in 2025 are Turkey (25.6%), Singapore (24.4%), and Vietnam (21.2%). These figures highlight key players in the cryptocurrency landscape.

How does the United States perform in cryptocurrency holdings globally?

The United States ranks sixth in cryptocurrency holdings by country in 2025, with a total of 15.5%. This illustrates its important role in the global cryptocurrency market.

What factors contribute to the UAE’s leading position in cryptocurrency holdings in 2025?

The UAE’s leading position in cryptocurrency holdings, boasting 31% in 2025, can be attributed to supportive regulations, a growing fintech ecosystem, and a robust infrastructure for digital assets.

Are there any significant trends in cryptocurrency adoption worldwide as of 2025?

In 2025, significant trends in cryptocurrency adoption worldwide include increasing regulatory support, heightened interest from institutional investors, and the rising popularity of decentralized finance (DeFi) applications.

How do China’s cryptocurrency holdings compare to other countries?

China ranks lowest among the major countries in cryptocurrency holdings, with only 3.7% in 2025. This contrasts sharply with leaders like the UAE and Turkey, showcasing the varying degrees of adoption worldwide.

| Country | Percentage of Cryptocurrency Holdings |

|---|---|

| UAE | 31.0% |

| Turkey | 25.6% |

| Singapore | 24.4% |

| Vietnam | 21.2% |

| Brazil | 20.6% |

| United States | 15.5% |

| Hong Kong | 14.3% |

| South Korea | 13.6% |

| Germany | 8.9% |

| Japan | 5.0% |

| China | 3.7% |

Summary

Cryptocurrency holdings by country have seen significant trends in 2025, with the UAE leading at 31%. This ranking highlights the growing interest and adoption of cryptocurrencies across various nations. Countries such as Turkey and Singapore have also shown remarkable cryptocurrency investments, indicating a global shift towards digital currencies. As the cryptocurrency market evolves, understanding these holdings by country can provide insights into regional cryptocurrency dynamics and future trends.