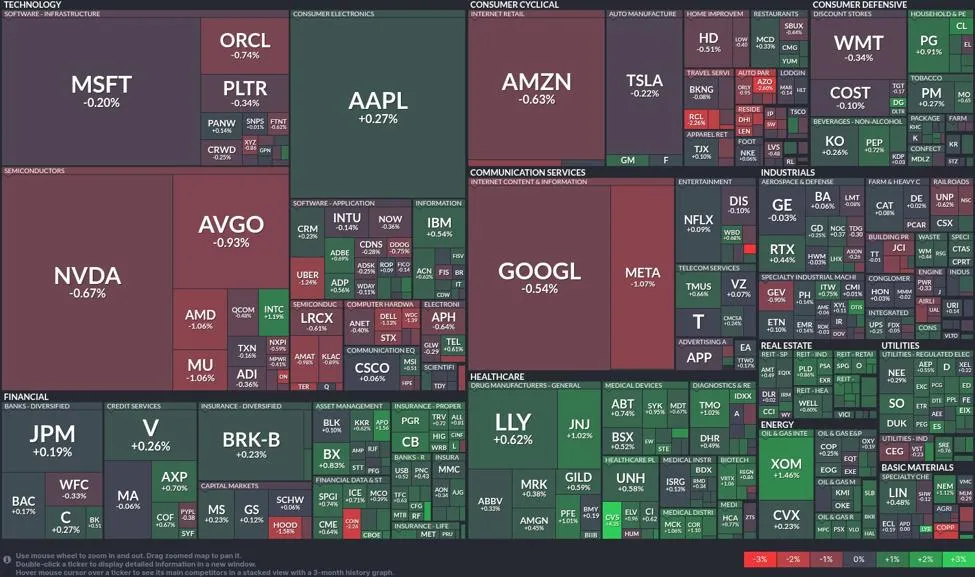

Energy shares rise as oil strength weighs on tech; traders balance rate risks and growth bets

Energy stocks outperformed while mega-cap tech slipped, setting a cautious tone across global risk assets as traders weighed firmer oil prices against lingering interest-rate uncertainty and elevated growth valuations.

Sector rotation takes the wheel

Flows favored cash-generative cyclicals, with oil majors extending their lead as crude’s steady bid buoyed earnings expectations and free cash flow narratives.

- Energy: Exxon Mobil gained +1.46%, and Chevron edged +0.23% higher as higher oil prices and resilient demand expectations underpinned the group.

- Technology: Growth names paused after a powerful year-to-date run. Microsoft dipped -0.20% and Nvidia fell -0.67%, reflecting sensitivity to discount-rate path and positioning fatigue.

- Healthcare: Defensive growth held a bid. Eli Lilly added +0.62%, supported by confidence in pipeline visibility and stable earnings quality.

Macro and FX lens

Oil’s advance sharpened the market’s inflation watch, keeping rate expectations in focus and nudging investors toward sectors with near-term cash flows. While bond yields and the dollar remain the fulcrum for cross-asset positioning, the latest rotation highlights a familiar pattern: energy strength tends to cushion cyclicals and commodities, while a tech pause often coincides with tighter financial-conditions anxiety.

In FX, sustained crude firmness often lends support to oil-linked currencies and widens performance dispersion across majors. Conversely, bouts of tech-led equity softness can augment defensive demand for the U.S. dollar and the yen when volatility rises. For now, liquidity conditions appear orderly, but volatility could pick up around upcoming inflation updates, central bank commentary, and inventory data that may recalibrate the growth–inflation mix.

Market snapshot

- Energy outperforms as crude’s strength bolsters cash-flow visibility and earnings sensitivity.

- Mega-cap tech lags, with Microsoft and Nvidia softer as investors reassess rate path and valuation risk.

- Healthcare grinds higher on defensive growth appeal and pipeline confidence.

- Risk appetite remains selective; breadth improves in cyclicals while growth leadership consolidates.

- FX focus: oil dynamics, inflation prints, and policy guidance remain key drivers of USD and rate-sensitive pairs.

What to watch next

- Oil supply-demand signals: Inventory data and shipping flows that could extend or temper the energy bid.

- Inflation pulse: Price indicators that might shift expectations for the timing and magnitude of policy moves.

- Earnings guidance: Updates from energy, semis, and healthcare to test the rotation’s durability.

- Volatility risk: Any widening in equity–rates correlation that could spill into FX and credit.

Questions and answers

Why are energy stocks outperforming today?

Higher oil prices and steady demand expectations are lifting revenue and cash-flow outlooks for the majors. That backdrop supports dividend and buyback capacity, drawing flows into the sector when rate uncertainty challenges long-duration growth names.

What’s pressuring technology shares?

Tech’s long-duration cash flows are sensitive to the discount-rate path. With inflation and policy still in focus, investors are trimming risk or consolidating gains, particularly in names that led the year’s rally. Even small shifts in rate expectations can have an outsized impact on growth valuations.

How does this sector rotation affect FX markets?

Persistently firm crude prices often support oil-linked currencies and commodity blocs, while tech-led equity softness can encourage defensive bids for the dollar and yen when volatility rises. The balance between oil dynamics and rate expectations remains the main driver for major pairs.

What indicators should traders prioritize now?

Watch inflation releases, central bank communications, and crude inventory data for clues on the growth–inflation trade-off. Also monitor equity–rate correlations and cross-asset volatility, which can quickly shift positioning across stocks, bonds, and FX.

Is the move away from tech a trend or a pause?

For now, it looks like consolidation rather than a structural reversal. If rates stabilize and earnings momentum in semis and software remains intact, leadership can reassert. But sustained oil strength and sticky inflation would keep the cyclical tilt alive.

Reporting by BPayNews.