In the dynamic realm of cryptocurrencies, insights into the SOL price prediction have garnered significant attention from traders and investors alike. Recently, SOL has broken through the critical resistance level of 140 USDT, currently trading at 140.05 USDT, reflecting a solid 24-hour increase of 3.29%. This upward trend has sparked interest as SOL’s performance is closely monitored in the context of broader trends in the SOL cryptocurrency market. As we dissect the SOL market news and conduct a thorough SOL price analysis, it becomes clear that understanding SOL’s movements can provide valuable insights for future trading decisions. Stay tuned as we delve deeper into the latest SOL trading update to explore what these developments mean for the digital asset’s trajectory in the upcoming days.

As we explore the future trajectory of Solana (SOL), it’s essential to consider alternative indicators that impact its market performance. The recent advancements, particularly its breakthrough above 140 USDT, highlight the asset’s growing importance within the digital currency ecosystem. Analysis of trends and community sentiment reveals compelling factors influencing Solana’s valuation in the crypto landscape. Investors keen on capitalizing on the rising SOL cryptocurrency must keep an eye on the latest SOL market news and detailed SOL price analysis for educated trading strategies. Understanding these dynamics is crucial for anyone looking to navigate the fast-paced world of cryptocurrency effectively.

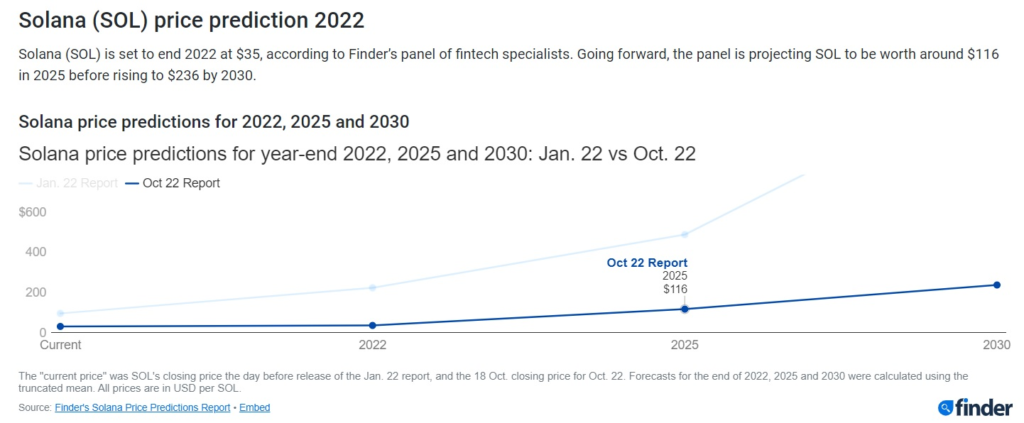

SOL Price Prediction for 2025

As we analyze the upward trend of SOL, the latest reports show a breakthrough over 140 USDT, indicating a robust performance in the cryptocurrency market. The recent 3.29% increase within the past 24 hours is an encouraging sign for traders and investors alike. Given this momentum, many experts speculate that SOL price prediction for 2025 could lean towards record highs, especially if the broader market coalesces around such growth patterns. This rise places SOL in a competitive position among other cryptocurrencies, drawing increased interest from both institutional and retail investors.

Moreover, to further understand SOL’s price trajectory, it’s essential to monitor SOL market news regularly. With the fluctuating trends in SOL’s trading update, stakeholders must keep a close eye on price analysis involving SOL USDT pairings. Keeping tabs on the overall trading volumes and price actions can aid in crafting a more accurate SOL price prediction. Investors looking for long-term potential can confidently position themselves as SOL shows extraordinary resilience in today’s cryptocurrency landscape.

Latest SOL Market News and Updates

In 2023, SOL cryptocurrency demonstrated exceptional resilience, bouncing back from market corrections and looking to secure a steady growth path. According to the latest updates, SOL has managed to sustain above the crucial 140 USDT resistance, now being quoted at 140.05 USDT. This behavior can be attributed to various factors, including growing adoption in decentralized applications and marketing efforts. Staying updated with SOL market news helps investors to gauge potential shifts and capitalize on trading opportunities that arise, ensuring they are at the forefront of SOL’s potent upward journey.

Furthermore, the SOL trading update reveals significant trading volumes, indicating robust investor interest. Actual price analysis reflects a bullish sentiment that many traders interpret as a green light for potential entry points. With consistent performance over 140 USDT, SOL could maintain this momentum, especially as global financial conditions become more favorable. Keeping tabs on SOL’s market updates and competitor comparisons is key to formulating a well-rounded trading strategy.

Understanding SOL Trading Dynamics

Understanding the dynamics behind SOL trading is paramount for anyone interested in the cryptocurrency space. The recent surge of 3.29% indicates a potential buying opportunity as traders react to shifting market sentiments. Various factors influencing SOL’s price include trading volumes, investor behavior, and market sentiment towards cryptocurrencies in general. By analyzing SOL price analysis reports, traders can discern patterns that may predict future movements, thus enhancing their trading strategies.

In addition, it’s crucial for traders to stay informed about the various components that drive SOL’s price changes, such as market liquidity and broader macroeconomic factors. Keeping an eye on SOL market news can prevent traders from missing critical developments that could impact SOL’s trading dynamics. Regularly updated SOL trading updates provide concise information on market trends and trading volumes—significant resources for crafting informed trading decisions.

Impact of Recent Price Movements on SOL

The recent breakthrough of SOL over 140 USDT has sparked considerable interest in its price trajectory. The implications of such movements can lead to an influx of new investors eager to join the trend, which can further accentuate SOL’s position in the market. As reported, solid price analysis over the past 24 hours demonstrates a growth of 3.29%, indicating market confidence in SOL’s ability to sustain its gains. When analyzing this upward movement, the sentiment can often trigger a momentum-based approach, leading to increased trading activity and market speculation on SOL USDT performance.

Additionally, such significant price movements can often usher in volatility, which traders might exploit through active trading strategies. As SOL navigates through potential resistance levels, continuing to analyze SOL market news becomes essential in assessing whether these movements will sustain in the long term. Factors such as competition from other cryptocurrencies, regulatory news, and technological advancements specifically impacting SOL cryptocurrency will be pivotal in guiding future price predictions and trading decisions.

Analyzing SOL’s Recent Performance

As of late 2023, SOL has been characterized by notable fluctuations, yet the recent price rise signifies a potential consolidation phase after a period of corrective actions. Achieving a milestone of 140.05 USDT reveals robust market support, which may entice more traders to engage with SOL. Keeping abreast of SOL price analysis focusing on such breakouts allows investors to make calculated decisions based on historical performance and support levels.

Moreover, SOL’s recent performance can be contextualized by evaluating peer cryptocurrencies, offering a comparative perspective. By leveraging SOL trading updates against broader market conditions and analyzing relative strength, potential investors can gauge the asset’s standing. Continuous monitoring of SOL market news will provide insights into whether the present momentum can be sustained or if shifts in investor sentiment could lead to different directions in the coming days.

The Role of Fundamental Analysis in Predicting SOL Price Changes

Fundamental analysis plays a crucial role in predicting potential price changes in SOL and any other cryptocurrency. By examining various factors such as network updates, technological developments, and market adoption, investors can gain deeper insight into SOL’s intrinsic value and its capacity for growth. The information gathered from SOL market news often influences traders’ perceptions and decisions, particularly when significant events unfold that could greatly affect SOL’s market position.

In this analytical framework, specific metrics such as the number of active wallets, transaction volumes, and partnerships within the broader financial ecosystem serve as indicators of SOL’s vitality. Thus, evaluating these fundamentals in conjunction with SOL price analysis helps create a comprehensive overview of its future potential. Investors looking to capitalize on short-term and long-term opportunities should consider integrating fundamental analysis with technical insights from SOL trading updates.

Market Sentiment and Its Influence on SOL Trading

Market sentiment significantly influences trading patterns within SOL and the wider cryptocurrency ecosystem. The hype that follows a spike in price, like the recent 3.29% increase, often creates a FOMO (fear of missing out) mentality among traders, leading to increased buying pressure. Monitoring SOL market news can reveal shifts in sentiment, allowing investors to predict how these changes might impact future trading activity.

Additionally, understanding what drives market sentiment—be it regulatory news, macroeconomic trends, or overall demand for cryptocurrencies—can provide traders with an edge. Emotional responses often dictate market actions, causing price swings that knowledgeable traders can take advantage of. Regular helping from SOL’s trading updates to gauge changes in market sentiment can significantly enhance trading effectiveness and calibrate entry and exit strategies.

Future Prospects for SOL in a Competitive Landscape

Looking ahead, the future prospects for SOL appear optimistic within the highly competitive cryptocurrency landscape. As SOL continues to evolve and adapt to new market demands, its ability to maintain and enhance its market position will depend on numerous factors, including technological advancements and competitive innovations. The recent upward trend over the 140 USDT mark signifies that SOL may capitalize on its strengths, potentially outpacing peers in both technology adoption and market share.

Furthermore, staying informed on SOL price predictions, as well as its competitors’ performance, will be key for investors looking to navigate this vibrant digital asset landscape. A proactive approach, fueled by diligent insights from SOL market news and comprehensive SOL price analysis, will empower traders to strategically position themselves for upcoming fluctuations in the cryptocurrency market.

Evaluating SOL’s Strengths and Weaknesses

In evaluating the strengths and weaknesses of SOL, it’s essential to review its underlying technology and market adoption. As a platform known for its scalability and speed, SOL’s strengths lie in its ability to handle a high number of transactions with lower fees compared to many competitors. Recent SOL market news highlights partnerships and projects utilizing its blockchain, which further solidifies its position as a viable player in the cryptocurrency space.

Conversely, potential weaknesses may include volatility induced by speculative trading and competition from emerging blockchain technologies. Addressing these weaknesses will require ongoing innovation and adaptability in an ever-evolving landscape. For investors and traders, understanding both SOL’s strengths and weaknesses through diligent market analysis and trading updates can create a balanced view, ensuring informed decision-making aligned with market dynamics.

Frequently Asked Questions

What is the latest SOL price prediction based on the current market trends?

As of December 9, 2025, SOL has broken through the 140 USDT mark, currently trading at approximately 140.05 USDT. This recent performance, showing a 24-hour increase of 3.29%, indicates bullish sentiment which might affect future SOL price predictions positively.

How are SOL market trends influencing SOL price analysis?

Recent SOL market news highlights a significant uptrend as SOL surpassed 140 USDT. This presents an intriguing SOL price analysis opportunity, suggesting that if current bullish trends continue, SOL could maintain or exceed this valuation in the near term.

What should traders look for in SOL trading updates that could affect SOL price prediction?

In SOL trading updates, traders should focus on key market indicators, such as trading volume and price breaks like the recent increase to 140.05 USDT. These factors are vital for forming accurate SOL price predictions and understanding potential market movements.

How does the recent SOL price increase affect future SOL cryptocurrency predictions?

The increase of 3.29% after SOL broke the 140 USDT threshold is a promising indicator for SOL cryptocurrency predictions. Positive performance in the short term can attract more investors, potentially pushing the price higher in the coming weeks.

What role does market sentiment play in SOL price prediction?

Market sentiment plays a crucial role in SOL price prediction. The recent SOL market news indicates a strong bullish sentiment with SOL trading above 140 USDT, suggesting that optimist perspectives may drive further price increases, affecting overall SOL price forecasts.

| Date | Current Price (USDT) | 24H Increase (%) | Source |

|---|---|---|---|

| 2025-12-09 | 140.05 | 3.29 | Odaily Star Daily |

Summary

SOL price prediction suggests a bullish trend as SOL breaks through the significant resistance level of 140 USDT, with recent metrics indicating a 3.29% increase over the past 24 hours. This performance highlights growing interest and potential upward momentum in the market for SOL, signifying stronger investor confidence and market adoption moving forward.