In an exciting development for the world of cryptocurrency trading, OKX is set to launch WET perpetual futures, a groundbreaking addition to its futures offerings. These innovative financial instruments allow traders to engage in market dynamics without the constraints of expiration dates, enhancing flexibility and trading opportunities. As cryptocurrency markets continue to evolve, understanding perpetual futures explained becomes essential for both novice and experienced investors alike. By harnessing the potential of WET perpetual futures, traders can explore various future trading strategies tailored to their risk profiles. This launch not only highlights the growing interest in crypto risk assets but also positions OKX as a pioneering platform in the competitive landscape of digital asset trading.

The upcoming introduction of WET perpetual derivatives by OKX marks a significant milestone in the cryptocurrency trading arena. These perpetual contracts function similarly to traditional futures but come without an expiration date, providing traders with endless possibilities for capitalizing on market fluctuations. By enhancing their trading toolkit with these perpetual derivatives, investors can implement diverse strategies to navigate the volatile crypto landscape effectively. Understanding the mechanics of these instruments is pivotal for effective risk management and optimizing potential profits. As interest surges in dynamic crypto assets, the rise of innovative offerings like WET perpetual futures is reshaping how traders approach the world of digital finance.

Introducing WET Perpetual Futures on OKX

OKX has set the stage for innovation in cryptocurrency trading with the anticipated launch of WET perpetual futures. These futures contracts, which allow traders to speculate on the price of WET without an expiration date, are designed to provide immense flexibility and opportunities for both novice and seasoned traders. Perpetual futures represent a significant advancement in trading mechanisms, enabling users to engage in a continuous trading environment where they can capitalize on the price fluctuations of WET, a cryptocurrency asset showing substantial promise.

The introduction of WET perpetual futures is a strategic move by OKX, catering to the growing demand for dynamic trading options in the crypto market. By offering this unique financial instrument, OKX not only enhances its futures trading proficiencies but also aligns with current trends that favor risk assets, especially in a macroeconomic environment that favors such investments. This will enable traders to implement effective future trading strategies, optimizing their trading portfolios based on the technical analysis of WET price movements.

Understanding Perpetual Futures Explained

Perpetual futures are a revolutionary financial product in the realm of cryptocurrency trading, allowing for uninterrupted positions that do not expire like traditional futures contracts. This feature offers traders the advantage of maintaining their positions as long as there is enough margin to cover potential losses, creating a more continuous trading experience. In essence, perpetual futures solve the problem of renewal costs and time constraints, empowering traders to harness price movements over extended periods without facing liquidation due to contract expiration.

For traders, especially those who engage with crypto risk assets, understanding the intricacies of perpetual futures is crucial. These contracts are often tied to an underlying index, which means they are not only reflecting the currency’s market price but also incorporating broader market sentiment. Through the use of effective future trading strategies, traders can better position themselves to take advantage of market volatility, making it imperative to grasp how perpetual futures function and their potential impact on profitability.

The Future of Cryptocurrency Trading: WET Futures Impact

The launch of WET perpetual futures by OKX marks a pivotal moment in the evolution of cryptocurrency trading platforms. As traders explore the inherent volatility of new crypto assets, leveraging perpetual futures can lead to significant gains or losses, depending on market conditions. With WET’s potential and increased adoption, the futures market becomes an exciting battleground where innovative strategies can be developed, allowing participants to mitigate risks while amplifying their investment returns.

As more investors turn towards cryptocurrencies as viable risk assets, understanding how to navigate the complexities of instruments like WET perpetual futures will be essential. The integration of perpetual contracts into trading approaches not only diversifies options for traders but also creates opportunities for engaging with different market trends. This highlights the necessity for educational resources and strategic planning to ensure a comprehensive grasp of market dynamics that influence investment outcomes.

Strategies for Trading WET Perpetual Futures

Developing sound trading strategies for WET perpetual futures will be paramount for those looking to maximize their profitability. Traders can utilize various analyses, such as technical analysis and fundamental analysis, to inform their trading decisions. By closely monitoring market trends, updates in cryptocurrency regulations, and understanding the overall sentiment towards risk assets, traders can position themselves effectively to seize profitable opportunities when they arise.

Furthermore, adept traders may consider employing leverage in their futures trading strategies to enhance potential returns. However, it is critical to balance the use of leverage with an awareness of associated risks, especially in the volatile crypto markets. Establishing blueprints that integrate stop-loss orders and profit targets can serve as protective measures, providing a safety net in a rapidly changing environment while engaging with WET perpetual futures.

Navigating Risk in Cryptocurrency Futures Trading

Risk management is a fundamental aspect of engaging in cryptocurrency trading, particularly with the introduction of WET perpetual futures. Traders must be cognizant of the inherent volatility of cryptocurrency markets and its impact on the performance of perpetual contracts. Utilizing strategies such as diversification across multiple crypto assets can mitigate risks associated with unfavorable price movements, allowing for a more secure trading experience.

Incorporating risk assessment tools and employing sound judgment when determining position sizes will be essential for maximizing the efficiency of trades. Additionally, staying informed about market news and trends relating to risk assets will empower traders to make well-informed decisions. As WET perpetual futures gain traction, a thorough understanding of risk dynamics will be essential for navigating this evolving sector of the cryptocurrency market.

The Role of OKX in Cryptocurrency Futures Market Trends

OKX’s commitment to enhancing the cryptocurrency trading landscape is evident in its proactive approach to launching WET perpetual futures. This initiative not only allows OKX to capture a growing share of the market but also sets a precedent for future innovations in trading mechanisms. By consistently adding novel products tailored for diverse trading needs, OKX positions itself as a leader in the cryptocurrency exchange space, particularly within the futures market.

The influence of OKX extends beyond mere trading functionality; it fosters a community of traders skilled in employing advanced futures trading strategies. By staying ahead with trend-setting offerings like WET perpetual futures, OKX attracts traders looking for both security and competitive advantage in the crypto marketplace. This ongoing evolution serves to strengthen the overall integrity of the cryptocurrency ecosystem while stimulating growth among various stakeholders.

Optimizing Trading through Advanced Tools on OKX

With the launch of WET perpetual futures, OKX is also enhancing the trader’s experience through advanced trading tools and resources tailored to crypto trading. Featuring intuitive interfaces, real-time data analytics, and comprehensive educational materials, OKX equips traders with all the tools necessary to refine their strategies. These enhancements make navigating WET and other crypto futures contracts easier, promoting more informed trading decisions.

For both novice and experienced traders, utilizing these advanced tools can lead to more effective portfolio management strategies. The emphasis on technology in cryptocurrency trading not only benefits individual traders but also contributes to a more robust trading environment. As WET perpetual futures gain popularity, traders who leverage these innovations are likely to see improved outcomes in their futures trading ventures.

The Future of Risk Assets in Cryptocurrency Trading

The evolution of cryptocurrencies has heralded a new era for risk assets, influencing how investors and traders perceive value in financial markets. With WET perpetual futures coming to the forefront, the landscape of risk assets within cryptocurrency trading is evolving rapidly. Investors are increasingly recognizing the potential for high returns, but they must balance this with an acute awareness of the accompanying risks inherent in trading volatile digital currencies.

As cryptocurrencies like WET solidify their presence as viable risk assets, the significance of understanding market fundamentals becomes clearer. Analyzing trends, regulatory impacts, and technological advancements are vital for positioning oneself effectively in this fast-paced environment. The future of cryptocurrency trading promises an exciting journey, and those equipped with knowledge and strategic insight will maximize their opportunities in the burgeoning market for risk assets.

Leveraging Cryptocurrency Trends for Better Futures Trading

In the dynamic world of cryptocurrency, understanding current market trends can significantly enhance the effectiveness of trading strategies, particularly for WET perpetual futures. By analyzing historical data and price movements, traders can uncover patterns that inform their trading decisions. This ability to discern trends can lead to strategically timed entries and exits in the futures market, optimizing overall performance and profitability.

Moreover, keeping a pulse on macroeconomic indicators and regulatory developments impacting cryptocurrencies plays a crucial role in futures trading strategies. As WET and other cryptocurrencies show varying levels of volatility, leveraging market insights allows traders to adjust their strategies accordingly, minimizing risk while capitalizing on market opportunities. In this way, successful participation in the cryptocurrency trading landscape hinges on a trader’s ability to remain informed and agile.

Frequently Asked Questions

What are WET perpetual futures, and how do they work on OKX futures?

WET perpetual futures are a type of derivative contract available on OKX futures that allows traders to speculate on the price movements of WET cryptocurrency without an expiration date. Unlike traditional futures, perpetual futures are designed to be held indefinitely, making them suitable for long-term trading strategies in cryptocurrency trading. Traders can open long or short positions using leverage, which amplifies both potential gains and risks.

What trading strategies can I use with WET perpetual futures on OKX?

Trading WET perpetual futures on OKX involves various strategies such as day trading, swing trading, and hedging. Day trading focuses on short-term price movements, while swing trading captures mid-term trends. Employing effective risk management techniques is crucial, especially with the volatility of cryptocurrency trading. Consider strategies like stop-loss orders to protect against significant losses.

How do I manage risk when trading WET perpetual futures?

Managing risk in WET perpetual futures trading on OKX requires setting clear parameters for maximum loss, using stop-loss orders, and diversifying your trading portfolio. Given the inherent volatility of crypto risk assets, it’s essential to use leverage cautiously and ensure that you only invest what you can afford to lose.

Can you explain the significance of funding fees in WET perpetual futures?

Funding fees in WET perpetual futures refer to periodic payments exchanged between long and short position holders, aimed at keeping the futures price aligned with the spot market price. Understanding how these fees work is crucial for effective future trading strategies, as they can impact overall profitability in cryptocurrency trading.

What role do market conditions play in trading WET perpetual futures?

Market conditions greatly influence WET perpetual futures trading on platforms like OKX. Factors such as market sentiment, economic indicators, and overall trends in cryptocurrency trading can affect the volatility and direction of WET prices. Traders should keep abreast of market news and analyze trends to make informed trading decisions.

How can I get started with WET perpetual futures on OKX?

To get started with WET perpetual futures on OKX, you need to create an account on the platform, complete any necessary verification, and deposit funds. Once your account is funded, you can navigate to the futures section, find WET perpetual futures, and start trading based on your analysis and trading strategies in cryptocurrency markets.

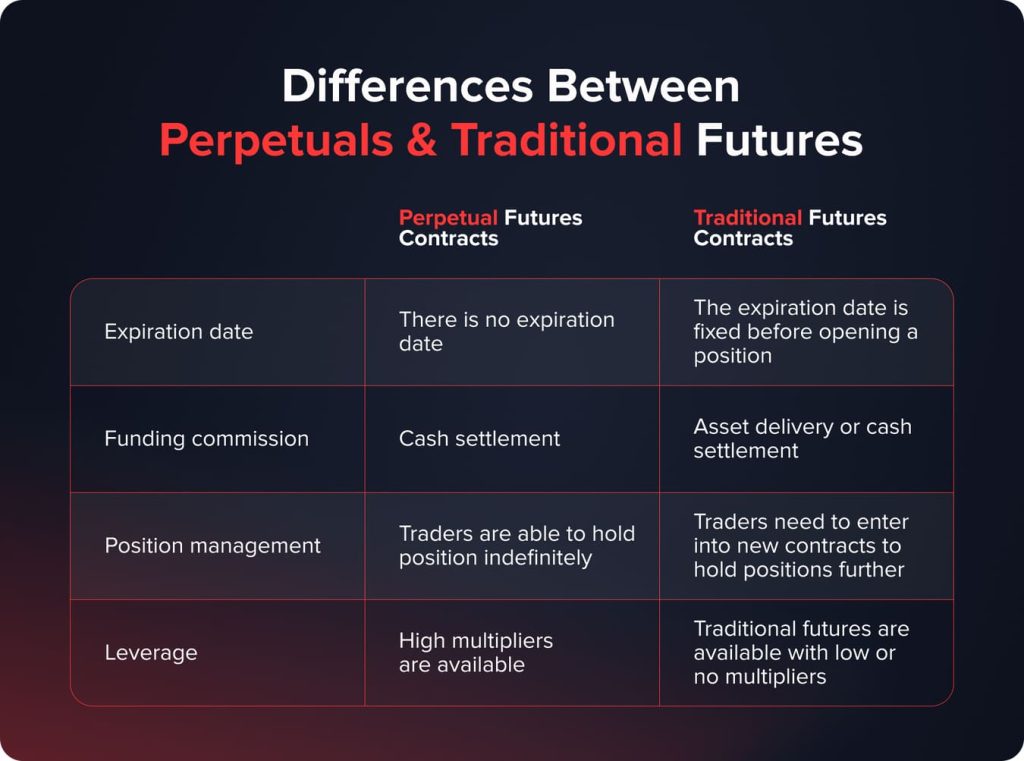

What makes WET perpetual futures different from traditional futures contracts?

WET perpetual futures differ from traditional futures contracts primarily in their lack of an expiration date. Unlike typical futures that settle at a specific date, WET perpetual futures on OKX can be held indefinitely, which allows for greater flexibility in trading strategies and positions in the fast-evolving cryptocurrency market.

| Date | Event | Details |

|---|---|---|

| 2025-12-09 | OKX Launch | OKX will launch WET perpetual futures. |

| 2025-12-09 | Regulatory Update | The U.S. Office of the Comptroller confirms banks are allowed to engage in risk-free principal cryptocurrency asset trading. |

| 2025-12-09 | Job Market | U.S. October JOLTs job openings reported at 7.67 million, surpassing the expected 7.15 million. |

| 2025-12-09 | Bitcoin Update | Bitcoin breaks through 91,000 USDT with a 24-hour increase of 0.35%. |

| 2025-12-09 | Market Partnerships | Stripe and Paradigm open Tempo blockchain to the public, partnering with Kalshi and UBS. |

| 2025-12-09 | ETF Insights | The average cost price of U.S. spot Bitcoin ETF approaches $83,000. |

Summary

WET perpetual futures are set to launch by OKX, marking a significant advancement in cryptocurrency trading. This development showcases the growing interest in perpetual contracts, particularly in the volatile cryptocurrency market. Traders can benefit from leveraging their positions in this innovative futures market, which offers continuous trading without expiration. Overall, the introduction of WET perpetual futures by OKX is a noteworthy event, promising to enhance trading dynamics for investors looking to navigate the cryptocurrency landscape.