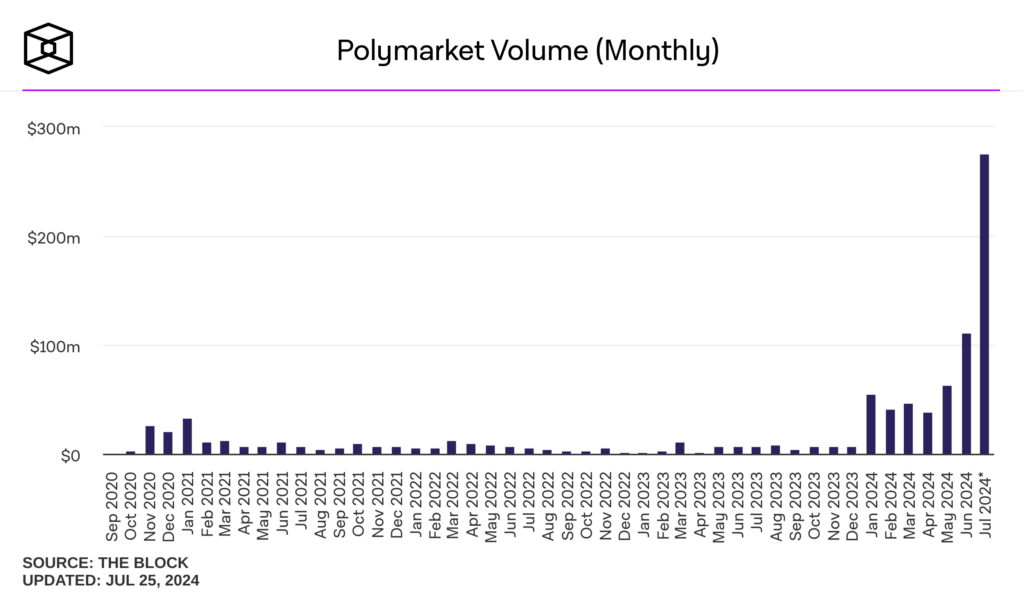

Polymarket volume double-counting has sparked a significant debate in the realm of decentralized prediction markets. Recent findings indicate that trades on Polymarket may be systematically double-counted across various public data dashboards, primarily due to technical issues within their smart contracts. This discrepancy could mean that the actual trading volumes on Polymarket are substantially lower than reported, potentially inflating interest and perception in the platform’s activity. Research conducted by Storm Slivkoff has illuminated how redundant maker-taker events contribute to this volume reporting issue, raising concerns among analysts and traders alike. As the scrutiny grows, understanding the nuances behind Polymarket’s trading volumes and the implications for market participants becomes increasingly crucial.

The topic of Polymarket’s volume discrepancies, often described as inflated trading figures, highlights ongoing issues related to data reporting in prediction markets. In simplest terms, these volume inconsistencies stem from the dual counting of trades – an occurrence where both the maker and taker of a transaction are registered separately, leading to exaggerated statistics. As experts analyze the implications of this phenomenon, it becomes clear that the effectiveness and accuracy of volume metrics can significantly influence the perception of market health and engagement. Moreover, the findings point to broader challenges in how decentralized platforms report their activity, with important implications for both users and stakeholders in the ecosystem. Thus, addressing these reporting issues is vital for fostering transparency and trust within the trading community.

Understanding the Allegations of Polymarket Volume Double-Counting

Recent investigations into Polymarket’s trading volumes have brought to light serious allegations regarding the accuracy of reported data on public dashboards. Research conducted by Storm Slivkoff reveals that the prominent decentralized prediction market is likely facing issues of double-counting trades, stemming principally from how its smart contracts handle OrderFilled events. Each trade instigates two events recorded: one for the maker and another for the taker. While these events are accurate in isolation, they are often aggregated indiscriminately by third-party dashboards, resulting in inflated trading volume figures that mislead potential users and analysts about actual market activity.

This alleged double-counting raises profound questions about the reliability of trading metrics within decentralized prediction markets like Polymarket. As participants in this space rely on reported volumes for decision-making, discrepancies can lead to misguided strategies and perceptions. The findings have ignited debates within the community, elucidating the need for refined volume reporting practices that accurately represent trading activity without inflating figures based on reporting methodologies. Understanding the roots of these discrepancies is crucial as the industry evolves amidst increasing scrutiny from regulators and stakeholders.

Implications of Volume Reporting Issues in Decentralized Prediction Markets

The broader implications of volume reporting issues such as those seen in Polymarket underscore significant challenges facing decentralized prediction markets across the board. Accurate volume representation is critical, not only for user confidence but also for market integrity. As Slivkoff’s research illustrates, the current framework misrepresents actual trading volumes, potentially leading to skewed perceptions of market depth and liquidity. When users view inflated volumes, they may assume there is greater interest and profitability in the market than is genuinely present, which could influence their trading behaviors and strategies.

Moreover, these volume discrepancies can have downstream effects on how decentralized platforms manage risk and attract investments. Low-priced contracts, which are common in prediction markets, can result in significantly disproportionate notional volumes versus the actual capital that is at risk. As traders and institutions begin to analyze these misleading metrics, there may be a shift towards using alternative indicators such as open interest and fee revenue to gauge market health. This transition might lead to a more accurate understanding of how these platforms operate and may also affect competitive positioning among platforms like Polymarket and its rivals.

The Role of Smart Contracts in Volume Reporting

At the heart of the volume double-counting allegations is the underlying architecture of Polymarket’s smart contracts, which generates separate OrderFilled events for makers and takers. This structural design, while operationally sound, inadvertently creates confusion when third-party analytics tools aggregate data. The architecture is intended to provide a clear separation of roles within the trading process; however, it has exposed a loophole in how trading volumes are reported publicly. Understanding the mechanics of smart contracts is essential for market participants who rely on transparent and accurate data for their trading decisions.

In response to these concerns, it’s crucial for all involved parties—developers, analysts, and end-users—to foster a deeper understanding of smart contract functions within decentralized prediction markets. By identifying areas for improvement, emissions of redundant events can be addressed, leading to more reliable volume reporting. This could pave the way for innovative solutions and standardized practices that enhance clarity in volume reporting, thereby benefiting the entire ecosystem of decentralized prediction markets. Implementing robust checks and balances in smart contract technology could help eliminate potential discrepancies and strengthen user trust.

Industry Responses to Polymarket’s Volume Reporting

In the wake of Storm Slivkoff’s findings, Polymarket has fiercely defended its volume reporting practices, contending that the official platform does not engage in double-counting. They assert that while third-party dashboards may misrepresent data through their aggregation methods, Polymarket’s internal tracking is accurate and adheres to industry standards. This defense highlights an important aspect of trading platforms that use decentralized technology: the distinction between proprietary and open data reporting methods can lead to vastly different interpretations of the same events.

This debate takes on added complexity when considering the role of vested interests in the prediction market space. Some critics have pointed to Paradigm’s investment in Kalshi, an emerging competitor, as a potential bias source behind the scrutiny aimed at Polymarket. Companies in the decentralized finance sector must navigate a landscape of competitive pressures and allegations that can influence public perception and trust in their platforms. As industry players respond to these challenges, they will be compelled to ensure that data integrity is maintained, fostering stability and growth in the decentralized market.

Future Directions for Polymarket and Data Analytics

Looking toward the future, Polymarket’s strategic responses to the volume reporting controversy may set the tone for how decentralized platforms reevaluate their data analytics practices. With plans for a significant relaunch in the U.S. following CFTC regulatory approval, the onus will be on Polymarket to clarify its metrics and ensure transparency. Correlating data accuracy with user trust will be paramount, especially as the platform seeks to secure a high valuation in a competitive marketplace.

Moreover, as more data providers update their methodologies to account for discrepancies in reported volumes, market participants will benefit from more reliable statistics that reflect true trading activity. This evolution might also prompt industry-wide reforms surrounding data reporting standards, allowing platforms to adopt best practices for transparency and accuracy. The expert analysis around Polymarket’s volume reporting issues will likely catalyze discussions that shape the future of decentralized prediction markets, ensuring they are robust and trustworthy environments for all users.

The Importance of Accurate Volume Metrics in Prediction Markets

Accurate volume metrics are critical in trading environments, particularly in decentralized prediction markets where confidence hinges on data transparency. As evidenced by the recent allegations against Polymarket, inflated trading volumes can significantly distort investor perceptions and decision-making processes. Users rely heavily on these metrics to assess market liquidity, gauge momentum, and strategize their positions. As such, any inaccuracies can lead to misguided investments and potentially destabilizing market scenarios.

The situation with Polymarket serves as a cautionary tale for other platforms within the decentralized finance sphere. As the industry matures, there’s an increasing need for adherence to rigorous standards of accuracy and transparency. Awareness of potential pitfalls in data reporting should encourage innovation in how trading volume is calculated and communicated, allowing users to make informed choices based on realistic market conditions. Establishing a consensus on best practices concerning volume reporting will be crucial for fostering trust and integrity in the prediction market ecosystem.

Lessons Learned from Polymarket’s Volume Reporting Controversy

The controversy surrounding Polymarket’s volume double-counting allegations provides valuable insights into the operational challenges faced by decentralized platforms. It highlights the necessity of incorporating rigorous checks within smart contract design to ensure accurate data for all users. As developers and analysts dissect these events, a collective understanding of the critical role of smart contracts will emerge, driving further discussions on how they can be optimized for clearer reporting.

Additionally, the need for enhanced collaboration between prediction markets and data providers will become increasingly significant. The dialogue facilitated by this controversy may lead to the formulation of standard methodologies for volume reporting and transparency that can be adopted across various platforms. These lessons reinforce the idea that accurate volume presentation is vital for stakeholder confidence in prediction markets, ultimately shaping the future of decentralized finance.

Market Dynamics and the Future of Decentralized Prediction Platforms

As the discourse around volume reporting continues, the market dynamics within decentralized prediction platforms are poised for evolution. The scrutiny surrounding Polymarket will likely prompt other platforms to reassess their own data reporting mechanisms, leading to a wave of innovation focused on enhancing transparency and efficiency. As competition heats up, platforms will be motivated to differentiate themselves by offering more accurate metrics that reflect true trading environments.

The recent developments amplify the necessity for platforms to maintain credibility in an increasingly competitive landscape. By adopting robust data verification measures, decentralized prediction markets can establish themselves as trustworthy venues for traders. This ongoing emphasis on accuracy and compliance may attract a wider audience, ultimately bolstering market activity and user engagement within the prediction market space.

Navigating the Regulatory Landscape for Prediction Markets

The regulatory landscape for prediction markets continues to be a critical factor influencing the operational framework of platforms like Polymarket. As the platform prepares for a significant U.S. relaunch in the wake of regulatory approval, understanding the implications of volume reporting is paramount. The complexities surrounding volume metrics may draw the attention of regulators, necessitating clear reporting standards to ensure compliance and user protection.

Navigating these regulations requires transparency and an ongoing commitment to maintaining high standards in reporting practices. As more regulations come into play, prediction markets must balance innovation with accountability to establish themselves as reputable platforms in the financial ecosystem. The future of decentralized prediction markets will greatly depend on how successfully they respond to these regulatory challenges while ensuring that their contributions to market dynamics remain solid and trustworthy.

Frequently Asked Questions

What is Polymarket volume double-counting and how does it occur?

Polymarket volume double-counting refers to the inflation of trading volumes reported on public dashboards due to the platform’s smart contracts emitting separate OrderFilled events for both makers and takers in a trade. This redundancy leads to the same trade being counted twice, creating a misrepresentation of actual trading activity.

Why has Storm Slivkoff’s research raised concerns about Polymarket trading volumes?

Storm Slivkoff’s research raised concerns because it revealed that Polymarket’s reported trading volumes are approximately twice the actual volume due to technical discrepancies in the on-chain data. This issue highlights how volume reporting issues can mislead market participants in decentralized prediction markets.

How does Polymarket’s smart contract structure contribute to volume reporting issues?

Polymarket’s smart contract structure contributes to volume reporting issues by generating separate events for each side of a trade—maker and taker. As public dashboards often aggregate these events indiscriminately, they end up double-counting the same trade, leading to inflated trading volume figures.

What steps are being taken to address Polymarket volume double-counting by data providers?

In response to the allegations of volume double-counting, several major data providers like DefiLlama and Blockworks are updating their dashboards to differentiate between maker and taker volumes. This aims to provide a more accurate representation of activity on Polymarket and resolve the issues stemming from raw event data aggregation.

Is Polymarket’s internal team addressing the claims of volume double-counting?

Yes, Polymarket’s internal team disputes the claims of volume double-counting by asserting that their official site reports taker-side volume correctly and aligns with industry standards. They emphasize that the issue primarily affects third-party dashboards, which do not filter redundant event data.

What are the broader implications of the Polymarket volume double-counting controversy?

The broader implications of the Polymarket volume double-counting controversy include challenges in accurately measuring trading activity on decentralized prediction markets. It raises questions about the reliability of traditional volume metrics and highlights the need for improved reporting practices and alternative metrics, such as open interest and fee revenue.

How might the Polymarket volume double-counting issue affect future regulatory perspectives?

The Polymarket volume double-counting issue might affect future regulatory perspectives by scrutinizing the integrity of volume reporting on decentralized prediction markets. As Polymarket seeks to relaunch in the US with regulatory oversight, transparency in trading volume and compliance with standards will be crucial for gaining the trust of regulators and investors.

Can users trust the trading volumes reported by Polymarket dashboards?

Users should approach the trading volumes reported by some Polymarket dashboards with caution. Given the potential for double-counting in volume reporting, it is essential to verify figures and consider alternative metrics that may provide a clearer picture of market activity.

| Key Point | Details |

|---|---|

| Allegations of Double-Counting | Research indicates Polymarket trades are reported as double the actual volume due to redundant events in the smart contracts. |

| Impact of Redundant Events | Separate events for makers and takers lead to inflated volume reporting on public dashboards. |

| Internal vs. External Volume Reporting | Polymarket asserts that its official reports are accurate and reflect standard practices, while third-party dashboards face data aggregation issues. |

| Industry Response | Major data providers are updating their dashboards, but some continue to adhere to their original methodologies. |

| Broader Market Implications | The situation highlights the difficulties in measuring trading activity on prediction markets and underscores the need for better metrics such as open interest and fee revenue. |

| Upcoming Changes | The timing of this issue arises as Polymarket prepares for a relaunch in the US and its potential valuation increases. |

Summary

Polymarket volume double-counting has emerged as a critical issue in the realm of prediction markets, as recent findings reveal discrepancies in how trading volumes are reported. Research indicates that Polymarket’s use of separate OrderFilled events for makers and takers is leading to inflated trading volumes on public dashboards. While Polymarket maintains that its internal volume reporting is accurate, the controversy highlights broader challenges in accurately assessing trading activities in decentralized markets. As the platform aims for a relaunch in the US and addresses the scrutiny from data analysts, understanding these discrepancies will prove essential for market participants.