Crypto ETFs are reshaping the landscape of digital asset investment, providing investors with opportunities to engage with blockchain assets without directly purchasing cryptocurrencies. Recently, the market has witnessed significant fluctuations, with Bitcoin ETFs experiencing notable $60M outflows while Ethereum funds rallied with $35.49M in inflows. As the appetite for crypto investment grows, alternative funds like Solana ETFs and XRP exchange-traded funds are emerging as viable options for portfolio diversification. These exchange-traded funds serve as a barometer for institutional interest in the crypto space, particularly as investors react to ongoing market uncertainties. With their potential for high returns, crypto ETFs are increasingly attracting attention from both seasoned and novice investors alike, making them a pivotal element in the contemporary investment environment.

Digital asset exchange-traded funds, often referred to as crypto ETFs, offer an innovative pathway for investors looking to tap into the rising trend of cryptocurrency investments. These financial instruments enable exposure to a variety of assets including Bitcoin, Ethereum, and other altcoins, making them a popular choice for those who seek to diversify their portfolios. With the emergence of funds dedicated to Ethereum and Solana, as well as notable offerings in the XRP space, alternative investment strategies are gaining traction among investors. By using these ETFs, individuals can mitigate some risks associated with direct cryptocurrency purchases while still participating in the growing blockchain economy. As such, the evolution of crypto-focused ETFs is helping to bridge the gap between traditional finance and the burgeoning world of digital currencies.

Understanding Crypto ETFs: An Overview

Crypto ETFs, or exchange-traded funds, offer investors a way to gain exposure to the growing world of cryptocurrency without needing to directly buy and hold the assets. They facilitate investors in accessing blockchain assets while also benefiting from the established trading infrastructure provided by the stock exchanges. As cryptocurrencies like Bitcoin, Ethereum, and Solana continue to gain traction among institutional and retail investors alike, understanding the mechanisms behind crypto ETFs becomes crucial. This financial product allows varied investor participation, making financial markets more inclusive.

The appeal of crypto ETFs lies not only in their accessibility but also in their potential risk mitigation. By diversifying investments through a basket of cryptocurrencies, these funds can help investors manage volatility compared to direct cryptocurrency investments. Moreover, innovative products such as Bitcoin ETFs, Ethereum funds, and even Solana and XRP ETFs are reflecting the shifting landscape of crypto investments. These products underscore the growing acceptance and integration of cryptocurrencies into traditional investment portfolios.

Recent Trends in Bitcoin ETFs: A Closer Look

Recent data indicates a concerning trend for Bitcoin ETFs, marked by significant net outflows. On December 8, Bitcoin exchange-traded funds faced withdrawals exceeding $60 million, signaling investor hesitance amidst the recent market volatility and the inability of Bitcoin to breach critical price points. This trend raises questions about investor confidence in Bitcoin’s current valuation and market position, especially as many seek refuge in more stable assets during uncertain times.

Despite the downward trend for Bitcoin ETFs, some products like BlackRock’s IBIT have demonstrated resilience. The inflow of $28.76 million into IBIT highlights a differentiation between specific funds within the sector; investors may be selectively positioning their capital based on perceived returns and risk profiles. Such mixed reactions reflect a broader trend where institutional investors are increasingly discerning in their cryptocurrency investments, focusing on funds that have solid backing and competitive advantages, especially in a fluctuating market.

Ethereum Funds Surge: What Investors Should Know

Ethereum ETFs have recently rebounded, with reported inflows of $35.49 million as of December 8, indicating a shift in investor sentiment. This revival can be attributed to several factors, including a renewed interest in Ethereum following key upgrades such as the Fusaka upgrade, which enhances the network’s efficiency. As Ethereum cements its position as a formidable alternative to Bitcoin, many investors are beginning to view Ethereum funds as valuable tools for portfolio diversification.

The strong performance of Ethereum ETFs not only underscores the technical advancements but also indicates a shift in how institutional investors view blockchain assets. With entities like BlackRock pursuing new ETF products tied to Ethereum, such as the proposed ETHB, it’s clear that market confidence in Ethereum’s potential is growing. Such developments highlight how organizations are closely monitoring the evolving landscape and adjusting strategies to capitalize on emerging opportunities in the crypto space.

The Steady Rise of Solana ETFs

As market dynamics shift, Solana ETFs are displaying steady demand with inflows around $1.2 million recently recorded. Although this figure may seem modest in comparison to larger cryptocurrencies, it reflects consistent interest in Solana as a leading blockchain network. Given Solana’s focus on fast transaction speeds and low fees, it has garnered attention from various investor segments seeking alternatives to more established cryptocurrencies like Bitcoin and Ethereum.

The performance of Solana ETFs signifies a broader trend of diversification and investment in emerging blockchain technologies. Since their launch, Solana spot products have attracted considerable capital, evidencing an appetite for innovative solutions within the crypto ecosystem. As investors weigh their options, Solana’s unique offerings and continued growth place its ETFs in a favorable position, especially in a landscape that is progressively more accepting of diverse crypto assets.

XRP ETFs: Leading the Way in Institutional Adoption

On December 8, XRP ETFs made headlines by posting significant gains, with net inflows reaching $38.04 million. This performance underlines XRP’s unique position in the cryptocurrency market, particularly concerning its role in facilitating cross-border transactions. The growing institutional interest hinted at by the inflow figures suggests that investors are increasingly recognizing XRP’s utility and potential for future growth, separating it from the more traditional Bitcoin-centric narratives prevalent in the market.

As regulatory clarity surrounding Ripple and XRP begins to solidify, institutional investors have been keen to capitalize on this momentum. Crypto funds like Grayscale’s GXRP have seen heightened engagement, further cementing XRP’s status among top crypto assets. The inflow into XRP ETFs indicates a paradigm shift towards a more diversified approach to cryptocurrency investment, where funds beyond Bitcoin are gaining traction and acceptance in the financial mainstream.

The Impact of Federal Reserve Decisions on Crypto ETFs

The upcoming decisions by the Federal Reserve regarding interest rates are likely to impact the cryptocurrency market deeply, including various crypto ETFs. Investor behavior could shift significantly based on anticipated monetary policy changes, as seen historically in financial markets. With Bitcoin and other cryptocurrencies classified as risk assets, a change in interest rates may lead to fluctuations in investor sentiment across crypto ETFs, highlighting the intrinsic link between traditional finance and the crypto landscape.

As the market anticipates the Federal Reserve’s announcements, crypto ETFs may experience volatile trading patterns in the lead-up to the decision date. Institutional investors closely watch these developments, often adjusting their strategies accordingly. Increased uncertainty around rate hikes could lead to further reallocation away from traditional risk assets, making alternative investments like Bitcoin, Ethereum, and Solana more attractive. Thus, staying informed about regulatory and economic shifts is paramount for anyone considering a stake in crypto ETFs.

Institutional Interest in Blockchain Assets

The growing acceptance of blockchain technology and its applications is reflected in the increasing institutional interest in crypto ETFs. Large financial institutions, hesitant in the past, are now actively engaging the cryptocurrency space, recognizing its potential for diversification and risk-adjusted returns. Products encompassing Bitcoin ETFs, Ethereum funds, and cryptos like Solana and XRP demonstrate that traditional finance is not only adapting but also embracing the innovation these digital assets offer.

Institutional investors are leveraging crypto ETFs to access blockchain assets while mitigating some risks inherent in direct cryptocurrency ownership, such as security concerns and market volatility. This shift towards institutional participation underscores the increasing legitimacy of these assets as viable investment options. As the institutional appetite grows, we may anticipate more diverse and complex crypto investment products to emerge, catering to various investment strategies and risk tolerances.

Analyzing Market Volatility and Cryptocurrency Trends

Market volatility is intrinsic to cryptocurrencies, significantly affecting investor sentiment and strategies. Understanding the driving forces behind market oscillations can aid investors in making informed decisions regarding crypto ETFs. Recent tumultuous market behavior, alongside factors like regulatory developments and technological advancements, plays a crucial role in shaping trends within Bitcoin, Ethereum, and other altcoin ETFs. Investors must remain vigilant and adaptable to volatile conditions to capitalize on emerging opportunities.

As the cryptocurrency market continues to evolve, identifying trends through careful analysis can provide important insights. For instance, the divergence in performance among Bitcoin ETFs against the backdrop of positive inflows into Ethereum and XRP funds indicates that investors are increasingly looking to diversify their crypto holdings. Monitoring these shifts not only helps in assessing the vitality of specific cryptocurrencies but also aids in understanding broader market patterns, ultimately guiding investment decisions.

The Future of Crypto ETFs: Navigating New Territories

The future of crypto ETFs looks promising amidst the rapid evolution of the cryptocurrency landscape. As more investors participate in blockchain assets, the demand for diversified investment products is expected to grow. Institutional players are paving the way for innovative ETF structures, such as those based on Ethereum’s staked performance or multi-cryptocurrency baskets. This evolution in product offerings will likely enhance liquidity and accessibility for retail investors, making it easier for them to engage with the burgeoning crypto market.

Moreover, as regulatory frameworks continue to evolve, establishing clearer guidelines for crypto ETFs, investor confidence may further enhance. This clarity can lead to the introduction of additional ETF products that incorporate various cryptocurrencies, catering to different market segments and investment demographics. The crypto market’s trajectory points towards a more structured and sophisticated investment environment, where crypto ETFs play a pivotal role in bridging the gap between traditional finance and the digital asset economy.

Frequently Asked Questions

What are Crypto ETFs and how do they work?

Crypto ETFs, or cryptocurrency exchange-traded funds, are investment funds that aim to track the performance of various blockchain assets like Bitcoin, Ethereum, and Solana. They trade on stock exchanges and allow investors to gain exposure to cryptocurrencies without directly owning them. This type of investment simplifies crypto investing for institutional players and retail investors alike, making it easier to diversify portfolios with digital assets.

Why did Bitcoin ETFs experience $60 million in outflows?

Bitcoin ETFs faced significant outflows of $60.48 million recently due to a sluggish performance of Bitcoin, which failed to break key price levels. This reflects investor wariness in the current volatile market. While some funds like BlackRock’s IBIT saw inflows, the overall trend indicates profit-taking rather than a shift in long-term interest towards Bitcoin ETFs.

What is driving the inflows into Ethereum ETFs?

Ethereum ETFs are witnessing positive momentum, recently gaining $35.49 million in inflows. This surge is largely attributed to increased interest following Ethereum’s Fusaka upgrade, aimed at enhancing transaction speed and reducing costs. These developments position Ethereum as a compelling option for investors seeking diversification beyond Bitcoin.

Why are Solana ETFs gaining popularity?

Solana ETFs are demonstrating steady demand, with recent inflows of $1.2 million, showcasing investor interest despite market volatility. Since their launch, Solana exchange-traded funds have garnered approximately $639 million, indicating a growing appetite for blockchain assets that extend beyond the traditional Bitcoin and Ethereum narratives.

How do XRP exchange-traded funds compare to other Crypto ETFs?

XRP exchange-traded funds are currently outperforming other Crypto ETFs, with a highlighted inflow of $38.04 million recently. Grayscale’s GXRP and other XRP funds have captured investor attention due to regulatory clarity and Ripple’s unique use-case in cross-border transactions, signaling a shift towards diversifying into altcoins beyond Bitcoin.

What impact does the Federal Reserve have on Crypto ETFs?

The Federal Reserve’s decisions on interest rates can significantly influence Crypto ETFs. As the Fed approaches critical announcements, such as the recent one on December 10, investor sentiment tends to fluctuate. Many view Bitcoin ETFs and other crypto investments as riskier assets; thus, tighter monetary policy could lead to decreased interest and investments in Crypto ETFs.

Can institutional investors impact the performance of Crypto ETFs?

Yes, institutional investors play a crucial role in impacting the performance of Crypto ETFs, as their investments significantly influence market demand for cryptocurrencies like Bitcoin, Ethereum, and Solana. Their participation highlights the growing acceptance of blockchain assets within traditional finance, further enhancing the appeal of Crypto ETFs.

Are Bitcoin ETFs or altcoin ETFs more popular among investors?

Bitcoin ETFs remain widely recognized and often attract more substantial investment compared to altcoin ETFs. However, recent trends show increasing interest in altcoin ETFs, such as those for Ethereum and XRP, as investors seek diversification and exposure to broader gains in the crypto market.

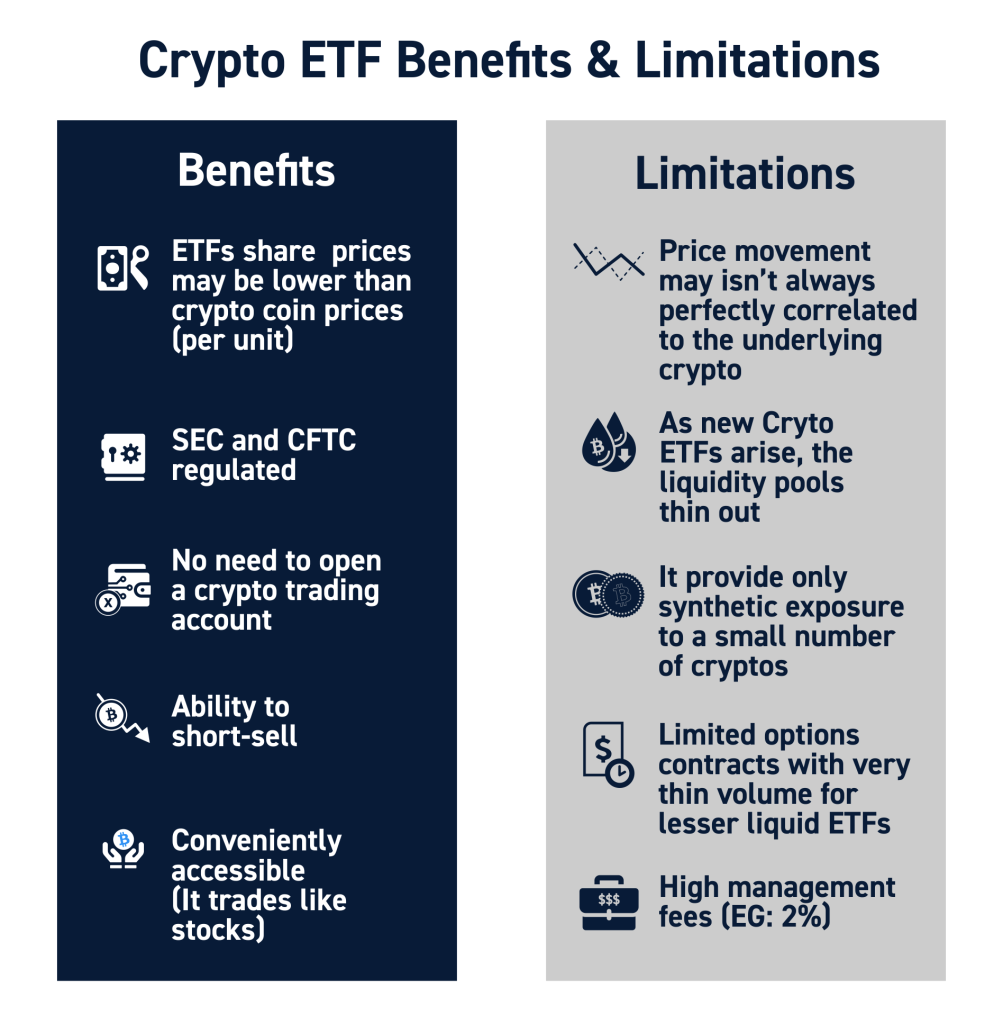

What are the risks associated with investing in Crypto ETFs?

Investing in Crypto ETFs carries several risks, including market volatility, regulatory changes, and the inherent risks associated with the underlying cryptocurrencies. As a newer investment class, Crypto ETFs can experience sharp price fluctuations, making it essential for investors to conduct thorough research and consider their risk tolerance.

| Cryptocurrency ETF | Net Flow on December 8 | Recent Performance |

|---|---|---|

| Bitcoin ETF (BTC) | -$60.48M | Trading at $90,150, faced sluggish performance. |

| Ethereum ETF (ETH) | + $35.49M | Trading at $3,124, gained over 10% in last week. |

| Solana ETF (SOL) | + $1.2M | Consistent demand, trading at $133, down 2% in last 24 hours. |

| XRP ETF (XRP) | + $38.04M | Led by Grayscale’s GXRP, strong institutional interest. |

Summary

Crypto ETFs have demonstrated contrasting trends recently, with Bitcoin suffering significant outflows while Ethereum, Solana, and XRP ETFs benefited from inflows. This disparity highlights the evolving landscape of cryptocurrency investment, especially among institutional players looking beyond Bitcoin for diversification opportunities. As market conditions fluctuate, the resilience of certain crypto ETFs signals a growing acceptance of digital assets in mainstream finance.