The latest crypto market report brings forth critical insights as the digital asset ecosystem grapples with macroeconomic fluctuations. Recent crypto news suggests an indecisive market, with BTC and ETH experiencing mild fluctuations amidst a backdrop of extreme caution indicated by the Fear and Greed Index. Institutional investment continues to play a pivotal role, highlighted by Grayscale’s recent ETF submissions, which signal growing interest from major players. Moreover, the advancements in DeFi developments emphasize the innovative potential of this sector, with new products like the intent-based flash loans gaining traction. As we dissect the current landscape, the focus remains not just on price movements, but also on the underlying narratives shaping this transformative industry.

This update on the cryptocurrency landscape provides valuable observations about recent trends in digital assets. As we delve deeper into the ongoing dynamics, it becomes evident that the fluctuations in BTC and ETH prices are reflective of broader investor sentiment, especially amid institutional interest heightening through developments like the Grayscale ETF. The progress within decentralized finance showcases an environment ripe for innovation, where new products emerge to cater to diverse investor needs. Furthermore, as the market absorbs these shifts, understanding the nuances of institutional participation will be crucial for anticipating future movements. This review aims to shed light on the critical factors influencing the crypto market today.

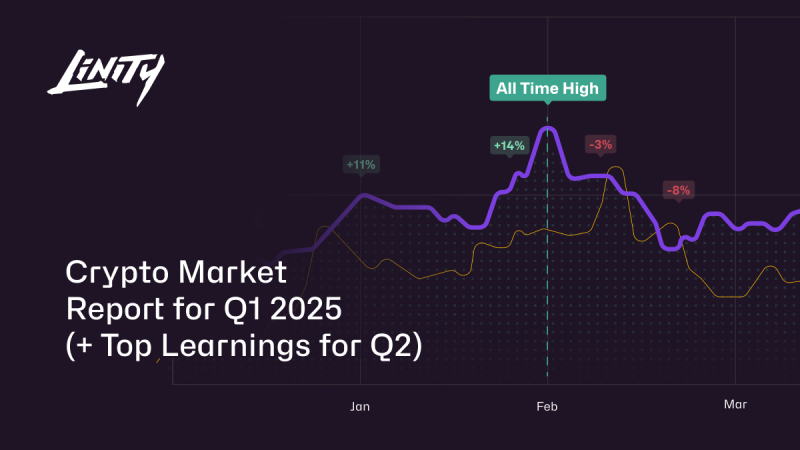

Current State of the Crypto Market

The latest crypto market report from Gate Ventures highlights a cautious atmosphere within the market, driven by a cooling in macro indicators. As BTC and ETH fluctuate within a narrow range, investors remain apprehensive, reflected in the Fear and Greed Index rating of ‘extreme fear.’ Despite the overall market sentiment, there was a minor rebound of +3.9% recently, with certain developments hinting at renewed institutional interest that could potentially stabilize these fluctuations.

Key developments such as the recent submission by Grayscale for the SUI Trust application, alongside the launch of its Chainlink ETF, are noteworthy. These initiatives signify a shift towards institutional participation in the crypto space. However, ongoing ETF net outflows illustrate the market’s reluctance to commit heavily amidst uncertainties, which is vital for forecasting future trends in crypto investments.

Institutional Investment Trends in Crypto

As suggested in the latest crypto market report, institutional investment is shaping the landscape of cryptocurrency with growing interest in regulated products like Grayscale’s LINK ETF. On its debut, the ETF garnered an impressive inflow of $41 million, demonstrating the allure of alternative assets for institutional investors. Such investments are critical as they can provide the necessary liquidity and market stability needed for cryptocurrencies like BTC and ETH to thrive.

Moreover, the merging of traditional finance with crypto through institutional investment is fostering a robust infrastructure. Reports indicate that 23 financing deals were completed this week alone, with almost half attributed to DeFi sectors. This trend reflects the pivotal role that institutional players are playing in sustaining and advancing the market, presenting opportunities for the next phase of growth in digital assets.

Impact of DeFi Developments

Recent developments in decentralized finance (DeFi) have been monumental, particularly with the launch of the first intent-based flash loan product by Aave and CoW. Such innovations expand the capabilities of programmable DeFi, shifting traditional financial paradigms. The growing interest in DeFi among institutional investors complements this, indicating a broader acceptance of blockchain technology’s innovative potential in enhancing financial services.

Additionally, Galaxy’s acquisition of Alluvial signals a shift towards institutional-grade liquid staking. This strategic move not only diversifies their portfolio but also underscores a collective push towards creating robust, scalable DeFi solutions that appeal to larger stakeholders. The intertwined growth of DeFi and institutional investment could provide a resilient foundation against market volatility, propelling the crypto market to new heights.

Understanding BTC and ETH Fluctuations

BTC and ETH have been experiencing notable fluctuations, which are closely monitored by traders and investors alike. The narrow trading ranges imply cautious trading strategies, as investors await clearer signals amidst ongoing macroeconomic pressures. The hesitant market sentiment is reflected in the fluctuating prices, which continue to oscillate based on external economic factors, regulatory developments, and overall investor confidence.

Yet, even with these fluctuations, there lies a palpable optimism fueled by institutional interest. As firms flock to crypto, particularly in light of products like Grayscale’s ETFs, it becomes evident that the larger macroeconomic climate is influencing these digital assets differently than the past. This dynamic suggests that while BTC and ETH can be prone to volatility, their long-term outlook may inadvertently benefit from increased institutional engagement.

The Rise of ETFs and Institutional Products

The emergence of ETFs like Grayscale’s LINK ETF represents a significant milestone in the cryptocurrency landscape. With a $41 million inflow on its launch day, this ETF is indicative of strong institutional demand for diversified exposure to digital assets. Such products provide a bridge for traditional investors hesitant to dive into the highly volatile crypto market, thereby legitimizing and stabilizing investment flows into cryptocurrencies.

While the performance of these products can vary, their presence reflects a growing acceptance of cryptocurrencies in mainstream finance. Regulatory efforts to create a favorable environment for ETFs can entice more institutional investments, which could lead to greater market depth and less volatility. The ongoing negotiations around ETF regulations are critical in shaping the future investment landscape in crypto.

Challenges and Opportunities in the Crypto Market

Despite the prevailing sense of ‘extreme fear’ noted in the Fear and Greed Index, there are underlying opportunities within the crypto market. The recent +3.9% rebound hints at a potential turning point where institutional fundamentals can reshape investor psychology. Engaged players in financing, such as those involved in DeFi, are creating new avenues for capital flow, which could precipitate recovery phases.

However, investors must tread carefully amid this evolving landscape. Ongoing challenges such as regulatory uncertainties and macroeconomic instability continue to pose significant risks. As institutional investment grows and new products are launched, understanding the delicate balance of risk and opportunity will be essential.

Navigating the Fear and Greed Index

The Fear and Greed Index is a crucial tool for gauging market sentiment, and its current rating of ‘extreme fear’ reflects widespread caution among investors. This sentiment can lead to subdued trading volumes and hesitance in decision-making. Investors often use this indicator to time their entries and exits in the market, aligning their strategies with prevailing emotional trends.

However, extreme fear can also present lucrative buying opportunities for seasoned investors. History has shown that market recoveries often follow phases of low sentiment. By analyzing price movements alongside the Fear and Greed Index, savvy investors may identify strategic positions that could yield gains as the market begins to stabilize and institutional interest permeates more broadly.

Institutional Interest Versus Retail Sentiment

The dichotomy between institutional interest and retail sentiment is increasingly pronounced in today’s crypto market. While the continued inflow of institutional capital suggests a confidence in crypto’s potential, retail sentiment often swings based on immediate market conditions, exacerbated by emotional reactions reflected in tools like the Fear and Greed Index. As retail traders react to price changes, institutions may often operate with a longer-term perspective, investing in developments that could shape future directions.

This interplay between institutional strategies and retail behavior will be pivotal in determining market trends. Institutions leveraging educational resources and strong fundamentals are likely to position themselves favorably, while retail investors may find themselves at a crossroads, needing to adapt to the evolving landscape of crypto investments.

Looking Ahead: Future Implications for Crypto

As the crypto market continues to develop, several implications arise from current trends. The recent increase in institutional investments signals a shift in the market dynamics, potentially leading to greater mainstream acceptance of cryptocurrencies. Continuous advancements in DeFi, coupled with structured investment vehicles like ETFs, indicate a forthcoming evolution of market infrastructures that could stabilize price fluctuations, enhancing the overall market appeal.

Moreover, ongoing developments within regulatory frameworks will play a critical role in shaping the future of crypto investing. As institutions demand clearer guidelines, this could lead to more widespread adoption and innovations in products offered in the crypto space. The interplay between institutional interest, regulatory developments, and market sentiment will ultimately determine the trajectory of cryptocurrencies in the coming years.

Frequently Asked Questions

What does the latest crypto market report indicate about BTC and ETH fluctuations?

The latest crypto market report highlights that BTC and ETH are currently experiencing fluctuations within a narrow range. This limited movement reflects the overall cautious sentiment in the market, as indicated by the ongoing extreme fear status in the Fear and Greed Index.

How is institutional investment influencing the current crypto market dynamics?

Institutional investment is playing a pivotal role in shaping the current crypto market dynamics. Recent reports show that strong institutional narratives, such as Grayscale’s application for the SUI Trust and the launch of its LINK ETF, are contributing to a market rebound of +3.9% despite prevailing cautious sentiments.

What developments in DeFi are highlighted in the recent crypto market report?

The recent crypto market report emphasizes significant DeFi developments, including Aave and CoW’s launch of the first intent-based flash loan product. This innovation showcases the evolving landscape of programmable DeFi, underscoring the continuous growth and sophistication of decentralized finance.

How have Grayscale’s ETF products performed recently in the crypto market?

Grayscale’s ETF products have demonstrated strong performance recently. The launch of the LINK ETF attracted $41 million in inflows on its first day, indicating robust institutional demand for regulated alt-assets and contributing to the overall positive sentiment in the crypto market.

What insights can be drawn from the total financing activity in the crypto market this week?

This week’s crypto market report reveals that a total of 23 deals were completed, with DeFi representing 48% of the activity. The total disclosed financing amount reached $215 million, marking a 31% increase, which signifies growing investor interest and confidence in the crypto market despite weak sentiment.

How does the Fear and Greed Index impact investor behavior in the crypto market?

The Fear and Greed Index serves as a gauge for market sentiment, with its current position in ‘extreme fear’ indicating investor caution. This sentiment influences trading behavior and decision-making, often leading to hesitance in buying or selling crypto assets like BTC and ETH.

What role does the Gate Ventures crypto market report play for investors?

The Gate Ventures crypto market report provides valuable insights into market trends, fluctuations, and institutional activities. By understanding these factors, investors can make better-informed decisions amidst the complexities of the crypto landscape, especially in the context of BTC and ETH price movements and DeFi developments.

| Key Point | Details |

|---|---|

| Market Sentiment | Overall market remains cautious with an ‘extreme fear’ index, despite a 3.9% rebound on Monday. |

| Cryptocurrency Performance | BTC and ETH show narrow fluctuations, while ETF net outflows are ongoing. |

| Institutional Activity | Grayscale’s LINK ETF launched with $41 million inflow; SUI Trust application submitted. |

| DeFi Developments | Aave and CoW created the first intent-based flash loan; Galaxy acquired Alluvial. |

| Financing Overview | 23 deals completed, total financing of $215 million, 31% increase; DeFi constitutes 48% of these deals. |

| Future Outlook | Despite current sentiments, institutional participation suggests a strengthening foundation for future recovery. |

Summary

This crypto market report reveals the latest trends and developments impacting the market. Although the overall sentiment remains cautious, key indicators show signs of institutional interest that may signify a future recovery. With significant structures in place, the market might experience important shifts towards improvement in the coming cycles.