The **Bitcoin bearish flag** is a crucial concept in the realm of cryptocurrency analysis and can significantly impact future BTC price predictions. This pattern, characterized by a brief consolidation phase after a decline, hints at a potential continuation of the downward trend. Analysts are closely watching how this formation unfolds, as it could lead to a target price hovering around $70,000 if confirmed. As traders gauge the evolving crypto market trends, understanding the implications of a bearish flag pattern becomes essential. Whether this formation ultimately leads to a resurgence in Bitcoin’s value remains to be seen, but the stakes are high for investors looking for insights into Bitcoin’s future trajectory.

In the world of digital currencies, identifying a **bearish flag** can serve as a vital indicator for potential market movements. This technical analysis formation shows sellers in control after a downtrend, suggesting that further declines may follow shortly. By observing these patterns, traders can enhance their understanding of **BTC target prices** amidst fluctuating market sentiment. With expertly crafted cryptocurrency predictions, analysts aim to unveil the possibilities lying ahead for Bitcoin and its community. As market participants navigate through these complex dynamics, the significance of recognizing such trends becomes ever more critical.

Understanding the Bearish Flag Pattern in Bitcoin

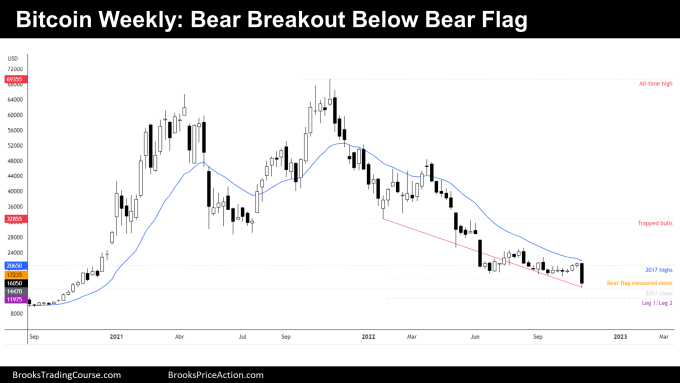

The bearish flag pattern is a technical analysis indicator that often signals a potential continuation of a downtrend after a brief consolidation phase. In the context of Bitcoin, recognized by its ticker symbol BTC, if traders observe such a pattern forming, it typically prompts increased scrutiny over future price movements. Analysts like Ali highlight the significance of recognizing these patterns as they can provide insights into the cryptocurrency’s volatility and potential trajectory in the challenging crypto market.

When Bitcoin is observed forming a bearish flag, it indicates that the price may be poised to drop further after a brief period of sideways trading. This consolidation phase can mislead novice traders into thinking that BTC is stabilizing or recovering. However, experienced analysts utilize tools like this pattern in their cryptocurrency analysis to make BTC price predictions. An essential part of this analysis is setting target prices; which in Ali’s prediction, suggests that if the bearish flag is confirmed, the BTC target price might drop to around $70,000.

Implications of a $70,000 Target Price for Bitcoin

Setting a target price of $70,000 for Bitcoin, based on the formation of a bearish flag, draws attention to the potential challenges for bullish momentum within the cryptocurrency. A forecast like this, grounded in technical analysis, raises concerns for current and prospective investors who are looking for upward trends in BTC prices. This target price can influence trading behaviors, affecting how traders react to current market sentiments and potentially driving prices lower if fear permeates the market.

However, achieving a target price of $70,000 is not solely determined by bearish patterns; it’s also influenced by broader crypto market trends and overall investor sentiment. If the anticipated downtrend materializes, it could lead to severe implications for Bitcoin’s position within the cryptocurrency landscape. Understanding these market conditions is vital for any crypto investor aiming to navigate the tumultuous environment of cryptocurrencies, particularly as market dynamics continuously shift.

Analyzing BTC Price Predictions Amid Market Volatility

In a highly volatile cryptocurrency market, accurate BTC price predictions become increasingly difficult. Analysts often rely on patterns like the bearish flag to make educated guesses about future movements. For investors, educating themselves about these predictive tools is crucial. Predictions surrounding Bitcoin can vary widely, influenced by everything from regulatory news to broader economic factors. Understanding the mechanics behind these predictions can significantly empower investors in their trading strategies.

Bearish flags, specifically, are critical indicators that, while signaling imminent decline, also present opportunities for skilled traders to capitalize on short positions. To leverage this information, traders must stay informed about the broader market conditions influencing Bitcoin. Keeping track of crypto market trends allows investors to make informed decisions when reacting to bearish movements, ensuring they do not panic but instead use these indicators to their advantage.

The Role of Technical Analysis in Cryptocurrency Trading

Technical analysis plays a pivotal role in cryptocurrency trading, allowing investors to decipher market movements and make informed decisions. It involves analyzing price patterns and historical data to predict future price trends, essential for understanding phenomena such as the bearish flag. Through technical analysis, traders define critical levels like resistances and supports, which provide insight into where the Bitcoin price may be headed.

By utilizing charts and technical indicators, analysts can better understand the probable outcomes of BTC price fluctuations. For example, a bearish flag pattern analysis might lead traders to predict a downturn; they can then plan their trades accordingly. This methodical approach contrasts with emotional trading, empowering investors to harness data-driven strategies instead of being swayed by market sentiment or speculation.

Investor Sentiment During Bearish Market Conditions

Investor sentiment is a major driving force in the cryptocurrency market, particularly during bearish conditions like those indicated by a bearish flag. When BTC begins to trend downward, fear and uncertainty can lead to panic selling, exacerbating declines and influencing how traders react. This anxiety can significantly affect future predictions, making it crucial for investors to gauge market sentiment and individual investor behavior.

Navigating investor sentiment during bearish phases is essential for successfully managing investments in Bitcoin and other cryptocurrencies. While some investors may see potential buying opportunities, others may choose to exit, fearing greater losses. Analysts often observe these sentiments closely, adjusting their BTC price predictions based on the prevailing mood within the crypto community. Understanding this interplay can help traders respond effectively to market shifts.

The Psychological Aspect of Trading Bitcoin

The psychological factors influencing cryptocurrency trading are often overlooked but play a significant role in shaping market dynamics. Investors’ emotions—fear, greed, and uncertainty—can drive market movements, particularly during periods when a bearish flag pattern appears. Recognizing how these emotions affect decision-making can help traders mitigate losses and better position themselves in uncertain times.

When the market indicates a bearish trend, such as through a bearish flag, psychological responses become pivotal. Traders may find themselves at odds, weighing the risks of holding versus selling at a loss. This mental battle can create volatility; as experienced traders may cling to technical analysis while novices react impulsively to changing sentiments. Understanding and managing this psychology is key to navigating the often tumultuous landscape of Bitcoin trading.

Key Technical Indicators to Watch for Bitcoin Trading

Apart from the bearish flag, numerous technical indicators can aid traders in making informed decisions about Bitcoin. Some of the notable ones include the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Fibonacci retracement levels. These indicators, when interpreted correctly alongside patterns like the bearish flag, offer deeper insights into the potential movements and BTC price predictions.

For traders looking to enhance their strategies, integrating multiple technical indicators allows for establishing a more comprehensive view of market conditions. By observing various signals and applying these insights to their trading strategies, investors can cultivate a more resilient approach, especially during bearish phases where market sentiments fluctuate drastically, impacting crypto market trends significantly.

The Future of Bitcoin in the Context of Bearish Patterns

The future of Bitcoin is a topic of intense speculation, particularly in scenarios where bearish patterns, such as the bearish flag, signify potential declines. Traders and analysts continuously debate about Bitcoin’s capacity to rebound from a bearish scenario, and the consensus often hinges on market sentiment, technological advancements, and regulatory developments. While some forecasts could be grim, there are always counterarguments that posit Bitcoin’s resilience could lead to eventual recovery.

Continuing to monitor for the formations of bearish flags and other patterns will be essential for future Bitcoin trading. This vigilance allows stakeholders to strategically hedge against potential downturns and capitalize on recovery rallies. Regardless of immediate price forecasts, Bitcoin’s long-term outlook remains a matter of extensive consideration and analysis, driven by ongoing trends and innovations within the broader cryptocurrency space.

Navigating Uncertainty in the Cryptocurrency Market

Navigating uncertainty in the cryptocurrency market requires a robust understanding of market indicators, technical analysis, and emerging trends. Time and again, BTC has shown instances of volatility that erode investor confidence and trigger strong emotional responses. Understanding these fluctuations and preparing for periods marked by bearish patterns equips traders to weather the market’s storms and seize opportunities as they arise.

In recognizing patterns such as the bearish flag, traders can set realistic expectations and develop sound investment strategies. It is also vital to adopt a long-term perspective along with an understanding of short-term dynamics. This balance allows investors to engage with Bitcoin more thoughtfully, ultimately leading to enhanced understanding and improved trading outcomes even in uncertain times.

Frequently Asked Questions

What is a Bitcoin bearish flag pattern?

A Bitcoin bearish flag pattern is a technical analysis signal indicating a potential price decline after a prior uptrend. This pattern forms when the price consolidates within a downward-sloping channel, suggesting a continuation of the bearish trend.

How does the Bitcoin bearish flag affect BTC price predictions?

The Bitcoin bearish flag can significantly influence BTC price predictions. Analysts often interpret the formation of this pattern as a sign that the price could drop further, impacting overall market sentiment and future projections.

What is the target price for Bitcoin if it forms a bearish flag?

If Bitcoin forms a bearish flag, analysts, including some prominent ones, suggest a potential target price of $70,000. This estimation is based on historical price movements and the technical implications of the bearish flag pattern.

What should investors consider during cryptocurrency analysis of a Bitcoin bearish flag?

During cryptocurrency analysis, investors should consider market trends, volume, and volatility when observing a Bitcoin bearish flag. Understanding these factors can help anticipate potential price movements and make informed trading decisions.

How do crypto market trends relate to Bitcoin bearish flags?

Crypto market trends are closely related to Bitcoin bearish flags as they reflect the overall sentiment and momentum in the market. A bearish flag can signify increased selling pressure, impacting how traders and investors react to BTC price fluctuations.

| Analyst | Prediction | Target Price | Source |

|---|---|---|---|

| Ali | Formation of a bearish flag | $70,000 | Odaily Planet Daily |

Summary

Bitcoin bearish flag is a term that refers to a potential bearish price movement for Bitcoin. According to analyst Ali, if BTC forms a bearish flag pattern, it might target a price of $70,000. This pattern indicates a possibility of further declining prices, making it crucial for traders to monitor market movements closely.