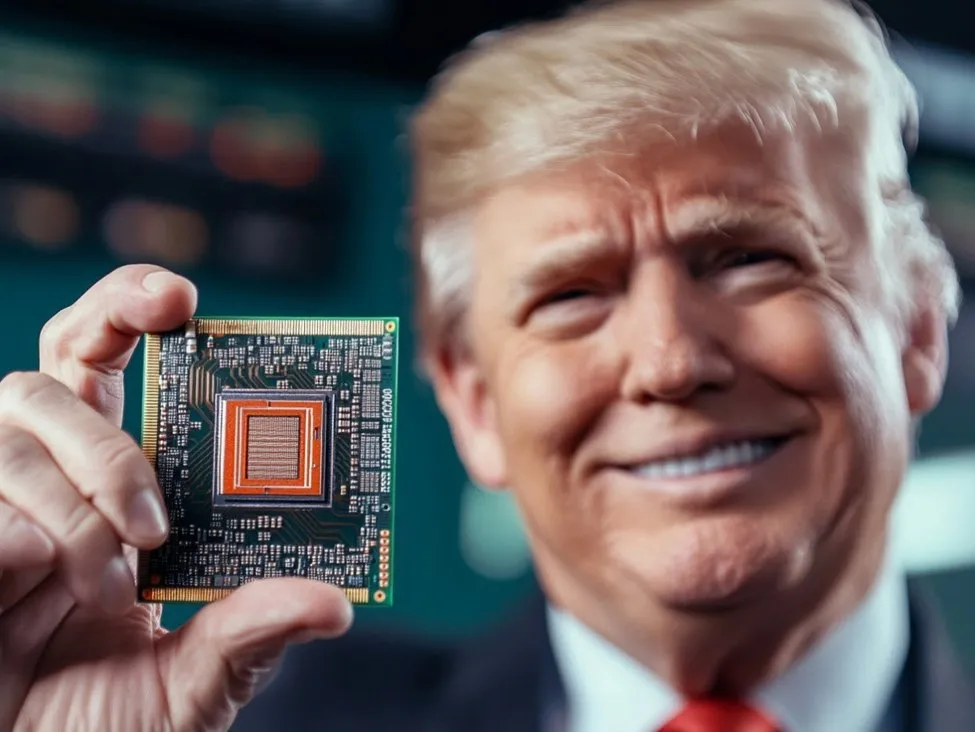

Trump Signals Green Light for Nvidia’s H200 AI Chip Shipments to China, Lifting Semis After Hours

A late-day post from President Donald Trump indicated his administration will permit Nvidia to ship certain AI chips to “approved customers” in China, sparking a bid in semiconductor shares and adding a fresh twist to U.S.–China tech policy that markets will parse for FX, equities and supply-chain implications.

Key Points

- Nvidia’s H200 chips to be allowed to ship to approved customers in China under conditions designed to protect U.S. national security, according to Trump’s post.

- Trump said a “25% will be paid to the United States,” implying a tariff or fee structure; details to be finalized by the Commerce Department.

- Similar treatment expected for AMD, Intel and other U.S. chipmakers, per the statement.

- Nvidia shares rose after hours to $187.30 from $185.50.

- Blackwell and Rubin, Nvidia’s next-gen AI platforms, are not part of the contemplated permissions.

Market Reaction

Nvidia gained in post-market trading, while traders anticipated a broader relief rally across U.S. semiconductors and Asia’s tech complex if final rules are issued as signaled. The prospect of selective reopening for advanced compute into China may temper worst-case decoupling fears, potentially boosting risk appetite in global equities and alleviating some supply-chain uncertainty.

In FX, any easing of U.S.–China tech frictions tends to be monitored through the lens of the yuan and dollar. A clearer path for AI hardware flows could support sentiment toward China-linked assets, though currency moves will hinge on the specifics of licensing, end-use controls and any new fee or tariff regime. U.S. yields and broader risk gauges could swing as investors recalibrate AI supply-demand, capex plans and export-control risk premia.

What Trump Said—and What’s Still Unclear

In a Truth Social post, Trump said he informed China’s President Xi that the U.S. will allow Nvidia to ship H200 products “to approved customers in China, and other Countries,” under conditions to safeguard national security. He added that “25% will be paid to the United States of America.” He wrote that the Commerce Department is finalizing details and that the “same approach will apply to AMD, Intel, and other” companies.

The statement also said Nvidia’s U.S. customers are moving ahead with its Blackwell chips—and later Rubin—which “are not part of this deal.” Trump criticized prior curbs that had pushed U.S. firms to design lower-spec “degraded” versions for China.

For markets, the key unknowns are the rule text, eligibility criteria for “approved customers,” technical performance thresholds, end-use verification and how any 25% payment will be structured and enforced. Until the Commerce Department publishes formal regulations, investors should treat the development as a policy signal rather than a final change.

Why It Matters for AI, Semis and Global Markets

– AI Supply Dynamics: Allowing H200 into parts of China could re-open a high-demand market segment, shaping Nvidia’s data center backlog and potentially reallocating global supply. AMD and Intel could see knock-on demand depending on scope and parity of treatment.

– Competitive Landscape: If high-end compute flows resume under controlled conditions, it could blunt the market share impact of domestic Chinese accelerators, while maintaining U.S. oversight over top-tier performance.

– Macro and FX: A measured thaw on tech restrictions could be modestly supportive for risk-sensitive currencies and equities, while the structure of any 25% payment could influence trade balances, corporate margins and pricing across AI infrastructure.

– Policy Volatility: Export policy has become a market variable in its own right. Positioning and implied volatility in semis and China-linked assets may adjust as traders handicap regulatory timelines and enforcement risks.

What to Watch Next

– Final Commerce Department language on chip specifications, licensing workflow and end-use controls.

– Company commentary from Nvidia, AMD and Intel on revenue guidance and China exposure.

– Reaction in Chinese equities and tech hardware suppliers as Asia opens.

– FX sensitivity in the yuan and semiconductor-linked currencies, plus shifts in U.S. yields as risk appetite evolves.

FAQ

What exactly did Trump announce?

He said the U.S. will permit Nvidia to ship H200 AI chips to “approved customers” in China and other countries under national-security conditions, with details to be finalized by the Commerce Department.

Does this apply to other chipmakers?

Yes. Trump said the “same approach will apply to AMD, Intel, and other” U.S. semiconductor firms, suggesting a broader framework rather than a single-company waiver.

Is there a new tariff or fee?

Trump stated that “25% will be paid to the United States of America.” The precise mechanism—tariff, fee, or another instrument—will depend on the final Commerce Department rules.

Are Nvidia’s Blackwell and Rubin chips included?

No. Trump said Blackwell and Rubin are not part of the contemplated permissions, signaling that the most advanced platforms remain outside this arrangement.

How did markets react?

Nvidia rose in after-hours trading to $187.30 from $185.50. Broader semiconductor sentiment improved, with traders anticipating potential spillover to peers once the policy is formalized.

What are the implications for FX markets?

A partial easing of U.S.–China tech frictions could support risk appetite, which tends to benefit risk-sensitive currencies. The yuan and dollar will likely respond to the final scope of licensing and any fee structure.

When could the change take effect?

Timing hinges on the Commerce Department’s publication of formal rules. Until that text appears, companies and investors should assume existing export controls remain in place.

What are the main risks for investors?

Policy reversals or stringent licensing could dilute the impact; a 25% payment could compress margins; and stricter end-use policing may limit the addressable market. Regulatory clarity is the key catalyst to watch.

This article was produced by BPayNews.