MicroStrategy Bitcoin strategy has garnered attention as the company embarks on a bold journey in cryptocurrency investment. With a commitment to hold Bitcoin at least until 2065, MicroStrategy sets a long-term vision that showcases their focus on Bitcoin accumulation as a primary asset. MicroStrategy CEO Phong Le emphasizes the importance of their stock as a unique proxy for investors seeking exposure, especially amidst the evolving landscape of Bitcoin ETFs. Currently, MicroStrategy proudly boasts an impressive stash of over 660,000 BTC, placing them among the world’s largest holders of Bitcoin. This strategic positioning reinforces their Bitcoin investment strategy, aiming for sustainable long-term returns in the dynamic digital economy.

The approach by MicroStrategy regarding its cryptocurrency portfolio reflects a calculated vision for the future of digital assets. By prioritizing steady growth through substantial Bitcoin reserves, they are reshaping investment norms in a world increasingly captivated by cryptocurrency. The insights from MicroStrategy’s leadership highlight the importance of steadfast commitment to Bitcoin, leveraging both market trends and the emergence of Bitcoin ETFs. With a significant amount of Bitcoin holdings, the company serves as a benchmark for serious investors looking to navigate this volatile asset class. Their forward-thinking philosophy underscores the potential of cryptocurrency, particularly in long-term financial planning.

MicroStrategy’s Commitment to Long-Term Bitcoin Holdings

MicroStrategy’s commitment to maintaining a strategy for long-term Bitcoin holdings is exemplified by CEO Phong Le’s announcement that the company plans to hold its Bitcoin reserves at least until 2065. This forward-thinking approach highlights MicroStrategy’s belief in the enduring value of Bitcoin as a digital asset. By adopting a long-term perspective, MicroStrategy positions itself not only as a tech company but also as a significant player in the cryptocurrency market, aligning its investment strategy with the increasing institutional interest in Bitcoin.

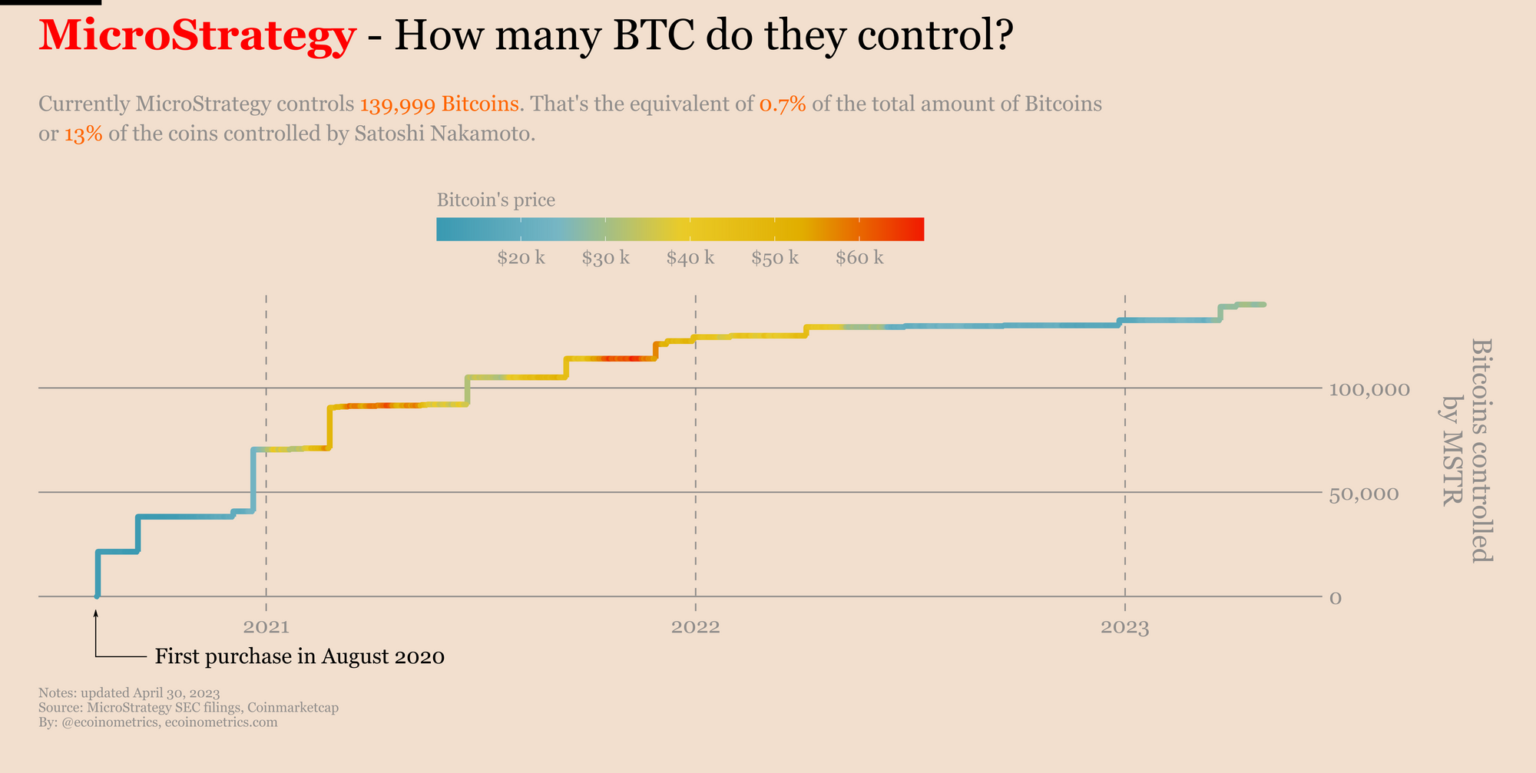

The company has been aggressively accumulating Bitcoin, currently holding over 660,000 BTC, which makes it one of the largest holders of Bitcoin in the world. This strategy not only reflects a deep-seated confidence in Bitcoin’s future potential but also offers investors a unique way to gain indirect exposure to the cryptocurrency through MicroStrategy’s stock. In this sense, the company acts as an essential proxy in the Bitcoin investment ecosystem, particularly for those who may be hesitant to purchase Bitcoin directly.

The Impact of Bitcoin ETFs on Market Dynamics

The rise of Bitcoin ETFs, especially spot Bitcoin ETFs, is transforming the landscape of cryptocurrency investments. These ETFs provide investors with more structured opportunities to gain exposure to Bitcoin without the complexities of direct ownership, such as custody and security issues. As MicroStrategy continues its long-term Bitcoin accumulation strategy, the emergence of these financial instruments allows both institutional and retail investors to diversify their portfolios while capitalizing on the burgeoning cryptocurrency market.

Moreover, Bitcoin ETFs are expected to attract significant capital inflows into the Bitcoin market, further validating its position as a mainstream asset class. MicroStrategy’s substantial Bitcoin treasury directly benefits from this shift, as increased demand for Bitcoin can lead to higher valuations. This dynamic plays a crucial role in helping MicroStrategy maintain its status as a leading player within the cryptocurrency ecosystem.

MicroStrategy CEO Phong Le’s Vision for Bitcoin Accumulation

MicroStrategy CEO Phong Le has a visionary outlook on the future of Bitcoin, which is reflected in the company’s strategic plan for Bitcoin accumulation. His leadership places significant emphasis on viewing Bitcoin not just as a temporary investment, but as a vital part of MicroStrategy’s long-term financial strategy. By adhering to this philosophy, MicroStrategy reinforces its position as a pioneering entity in the crypto space, where others may falter under market volatility.

Le’s vision underscores the broader narrative of Bitcoin’s potential for wealth preservation and growth. This perspective is especially relevant in times of economic uncertainty, as investors increasingly turn to Bitcoin as a hedge against inflation and currency devaluation. With MicroStrategy’s aggressive accumulation strategy, the company is not just holding Bitcoin; it’s endorsing a transformative asset class that may redefine how institutional wealth is managed in the years to come.

The Advantages of MicroStrategy’s Bitcoin Investment Strategy

MicroStrategy’s Bitcoin investment strategy offers numerous advantages that set it apart from other investment approaches. By adopting a corporate strategy of Bitcoin accumulation, MicroStrategy not only secures its own financial future but also acts as a lighthouse for institutional investors. This strategy is designed to leverage the long-term appreciation potential of Bitcoin, allowing the company to maximize returns while providing a protective moat against traditional economic downturns.

This investment strategy effectively combines the benefits of holding a fixed digital asset with the company’s existing business operations. It allows MicroStrategy to generate business revenues while simultaneously accumulating significant Bitcoin reserves, creating a synergistic effect that enhances shareholder value. Additionally, this model invites other corporations to consider similar strategies, potentially leading to a broader acceptance of Bitcoin as a critical financial asset.

Navigating the Future of Cryptocurrency with MicroStrategy

As the cryptocurrency market evolves, MicroStrategy stands at the forefront with its innovative approaches to digital asset management. Navigating this unpredictable terrain requires astute decision-making and a clear vision, and MicroStrategy’s focus on Bitcoin accumulation embodies this ethos. The company’s strategy not only positions it as a leader in the Bitcoin space but also serves as a beacon for others looking to navigate the complexities of cryptocurrency investment.

Given the ongoing discussions surrounding Bitcoin’s regulation and market stability, MicroStrategy’s proactive stance on its Bitcoin holdings ensures that it remains well-prepared to adapt to future market conditions. This adaptable strategy, led by CEO Phong Le, is pivotal in ensuring that MicroStrategy continues to thrive as a key player in digital finance, paving the way for innovations that can elevate the entire industry.

MicroStrategy’s Role in the Institutional Bitcoin Adoption Movement

MicroStrategy has played a crucial role in spearheading the movement of institutional Bitcoin adoption. By being one of the first publicly traded companies to make substantial investments in Bitcoin, MicroStrategy has paved the way for other corporations to follow suit. This has not only increased the mainstream recognition of Bitcoin as a serious financial asset but has also encouraged a range of investment strategies that incorporate Bitcoin, especially among large financial institutions.

As institutions look for ways to hedge against inflation and diversify their portfolios, MicroStrategy’s achievements present a compelling case for Bitcoin investment. Their journey reflects an emerging trend where corporations recognize Bitcoin as a pivotal asset class, enhancing its legitimacy and attractiveness in the eyes of investors. This trend is monumental as it indicates a historical shift in how businesses view and engage with digital currencies.

Strategic Benefits of Holding Bitcoin for Corporations

Holding Bitcoin as part of corporate treasury strategy presents various strategic benefits that can enhance a company’s financial stability. For MicroStrategy, maintaining a considerable Bitcoin reserve allows the company to hedge against economic uncertainties and inflationary pressures that traditional currencies face. This compelling strategic rationale has led to the widespread adoption of Bitcoin among other corporations looking to preserve their wealth.

Moreover, incorporating Bitcoin into a corporation’s financial mix can also facilitate a buffer against market volatility. Companies like MicroStrategy can harness Bitcoin’s potential for appreciation over time, turning it into a powerful asset that complements their operations. The ability to actively manage a Bitcoin treasury provides organizations with a cutting-edge strategy to stay competitive in a rapidly evolving economic landscape.

MicroStrategy’s Bitcoin Accumulation Strategy as a Template for Others

MicroStrategy’s Bitcoin accumulation strategy has become a template for numerous other corporations seeking to invest in cryptocurrencies. With a firm commitment to holding assets long-term, MicroStrategy has demonstrated how a well-executed Bitcoin investment strategy can yield significant returns and provide a cushion against economic adversity. This pioneering approach has inspired other businesses to consider similar models, helping cultivate a broader base of Bitcoin adoption across various industries.

By showcasing the tangible benefits of Bitcoin, MicroStrategy encourages corporate leaders to integrate this innovative asset into their financial strategies. As more companies take this leap into cryptocurrency, the collective influence may drive further acceptance and stability in the market, solidifying Bitcoin’s status as a viable investment choice. Ultimately, MicroStrategy’s blueprint could revolutionize the finance sector and redefine wealth management.

Looking Ahead: MicroStrategy’s Vision for Bitcoin in 2065 and Beyond

As MicroStrategy sets its sights on 2065, the vision underlining its Bitcoin strategy is one of resilience and robustness in the face of changing market dynamics. By committing to holding Bitcoin for such an extensive period, the company signals a strong belief in the cryptocurrency’s potential as an enduring store of value, much like gold. This long-term outlook positions MicroStrategy not merely as an early adopter but as a stalwart advocate for Bitcoin’s future.

In the years leading up to 2065, MicroStrategy’s influence on the cryptocurrency market is expected to grow, encouraging further institutional participation. By championing Bitcoin as a strategic asset, the company is actively laying the groundwork for a future where Bitcoin is not just an investment but a cornerstone of financial strategy for corporations worldwide. As the landscape evolves, MicroStrategy remains committed to spearheading this transformative journey.

Frequently Asked Questions

What is MicroStrategy’s Bitcoin strategy for the long term?

MicroStrategy’s Bitcoin strategy focuses on long-term holdings and accumulation. The company plans to hold Bitcoin at least until 2065, as stated by CEO Phong Le. Their approach prioritizes Bitcoin as a core asset in their investment strategy, making them one of the largest holders of Bitcoin globally.

How does MicroStrategy’s CEO view the rise of Bitcoin ETFs?

MicroStrategy CEO Phong Le has acknowledged the rise of spot Bitcoin ETFs as beneficial for market allocation. However, he believes that MicroStrategy’s stock remains a key vehicle for investors wanting exposure to Bitcoin investments, highlighting the company’s ongoing commitment to its Bitcoin accumulation strategy.

What is the significance of MicroStrategy’s Bitcoin accumulation strategy?

MicroStrategy’s Bitcoin accumulation strategy signifies its commitment to cryptocurrency as a valuable long-term investment. With over 660,000 BTC accumulated, the company aims to leverage this strategy to maintain significant Bitcoin holdings, positioning itself as a leader in the Bitcoin investment landscape.

How does MicroStrategy’s Bitcoin strategy compare to traditional investments?

Unlike traditional investments, MicroStrategy’s Bitcoin strategy revolves around a long-term commitment to Bitcoin, viewing it as a hedge against inflation and a superior store of value. While traditional assets may fluctuate, MicroStrategy’s approach emphasizes sustained Bitcoin accumulation to maximize value over time.

What are the benefits of investing in MicroStrategy’s stock for Bitcoin exposure?

Investing in MicroStrategy’s stock offers indirect exposure to Bitcoin, allowing investors to benefit from the company’s Bitcoin accumulation strategy without directly acquiring Bitcoin. This approach enables investors to integrate Bitcoin into their portfolios while leveraging MicroStrategy’s expertise in Bitcoin investment strategy.

How has MicroStrategy’s Bitcoin accumulation impacted its market positioning?

MicroStrategy’s aggressive Bitcoin accumulation has positioned it as one of the largest Bitcoin treasury holders globally. This substantial holding enhances the company’s market influence and credibility as a Bitcoin investment strategy leader, drawing interest from investors seeking long-term Bitcoin holdings.

What is the future outlook for MicroStrategy’s Bitcoin strategy?

The future outlook for MicroStrategy’s Bitcoin strategy appears strong, with plans to hold Bitcoin until at least 2065 and continue its accumulation strategy. As Bitcoin adoption grows, the company may expand its influence in the market, further establishing itself as a significant player in Bitcoin investments.

| Key Point | Details |

|---|---|

| Long-Term Holding | MicroStrategy plans to hold Bitcoin until at least 2065. |

| Accumulation Strategy | The company will continue a long-term strategy of accumulating Bitcoin. |

| Spot Bitcoin ETFs | The rise of spot Bitcoin ETFs opens new avenues for market allocation. |

| Stock as Proxy | MicroStrategy’s stock serves as a key proxy for investors wanting Bitcoin exposure. |

| Bitcoin Holdings | MicroStrategy has accumulated over 660,000 BTC, becoming a leading Bitcoin treasury company. |

Summary

The MicroStrategy Bitcoin strategy emphasizes a long-term commitment to holding Bitcoin until at least 2065, showcasing the company’s belief in the asset’s potential growth. MicroStrategy is set on a clear path of accumulating Bitcoin, thereby solidifying its status as one of the largest holders in the cryptocurrency market. With the emergence of spot Bitcoin ETFs, there are now more options for investors, yet MicroStrategy’s stock remains a vital choice for those looking to gain exposure to Bitcoin indirectly. This dual strategy of holding and accumulating positions the company as a pivotal player in the ever-evolving cryptocurrency landscape.