Dollar-Yen Jumps Toward 156 After Powerful Quake Off Japan; Breaks Above 200-Hour Average as Yields Rise

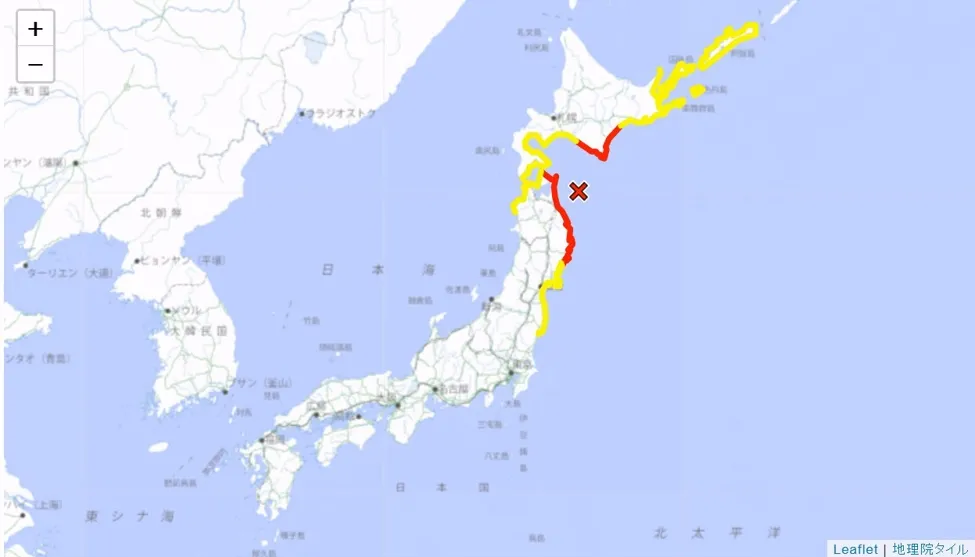

USD/JPY climbed after a magnitude-7.6 earthquake struck off Japan’s Aomori coast, with tsunami warnings and advisories issued. The pair pierced key technical resistance and tracked a modest uptick in U.S. yields, keeping the focus on 156.00 and last week’s highs.

Market move

The yen softened despite the natural disaster backdrop, as USD/JPY extended higher with U.S. 10-year Treasury yields up about 4 basis points. Traders latched onto the move after the pair cleared short-term resistance, a sign that rates dynamics and momentum may be overpowering typical safe-haven impulses in the near term.

Key Points

- USD/JPY broke above its 200-hour moving average near 155.64 and the top of a recent swing zone around 155.75.

- Intraday high pushed toward 155.91 after the quake and tsunami alerts.

- Next resistance sits at last week’s peak around 156.17, then the Nov. 26 high near 156.736.

- U.S. 10-year yields up roughly 4 bps, helping underpin the dollar.

- Reversal risks include a drop back below the 200-hour MA; further downside focus on the 100-hour MA around 155.29.

Technical picture

A clean break above the 200-hour moving average at roughly 155.64 unlocked upside momentum, with price also punching through the 155.75 swing cap. The move stalled just under 156.00, but trend followers will eye a test of 156.17 (last week’s high). A decisive break there strengthens the case for a run at the late-November high near 156.736.

On the downside, a slip back below the 200-hour MA would sap momentum and refocus the market on the 100-hour MA around 155.29. Losing that level would hand control back to sellers and shift bias lower in the short term.

Macro drivers and market tone

The yen’s failure to catch a safe-haven bid underscores that FX is trading rates-first: higher U.S. yields continue to support the dollar leg of USD/JPY. Liquidity conditions around headline-driven events can amplify moves, and with Japan-related headlines in focus, intraday volatility may stay elevated. Traders remain sensitive to the risk of official jawboning if yen weakness accelerates near multi-decade extremes, though today’s price action appears primarily yield- and technical-led.

Near-term scenarios

– Bullish continuation: A break above 156.17 invites a test of 156.736 and potentially deeper upside extension if yields climb further.

– Fade risk: Failure to clear resistance and a drop back below 155.64 would signal a false break, opening a retracement toward 155.29.

FAQ

Why did USD/JPY rise despite an earthquake in Japan?

USD/JPY reacted more to the rise in U.S. Treasury yields and a technical breakout than to safe-haven dynamics. In the very short term, rate differentials and momentum often dominate, even when headline risk would normally support the yen.

What are the key levels to watch now?

Immediate resistance sits at 156.17 (last week’s high), followed by 156.736 (Nov. 26 high). On the downside, the 200-hour MA near 155.64 is pivotal support; below that, the 100-hour MA around 155.29 is critical for trend control.

How do tsunami warnings affect FX markets?

They can elevate short-term volatility and headline risk, but the impact depends on the severity of damage, disruption to activity, and whether broader risk sentiment or rate moves dominate trading.

What could invalidate the bullish intraday setup?

A sustained drop back below the 200-hour MA at approximately 155.64 would undermine momentum. A break beneath the 100-hour MA near 155.29 would tilt bias back toward sellers.

Are Japanese authorities likely to intervene?

Authorities closely monitor rapid yen moves, especially near multi-decade extremes. While today’s upswing appears driven by yields and technicals, traders should stay alert for official commentary if depreciation accelerates. This article was prepared by BPayNews for informational purposes.