The Binance insider trading incident has sent shockwaves through the cryptocurrency community, revealing serious compliance issues within one of the world’s leading exchanges. On December 7, 2025, a whistleblower alerted Binance’s internal audit department to allegations that an employee leveraged confidential information to promote a newly launched token on social media, profiting significantly in the process. This violation led to the immediate suspension of the employee and a commitment by Binance to cooperate fully with the ongoing insider trading investigation. In a proactive response, the exchange announced a $100,000 Binance whistleblower reward to incentivize further information sharing from the community. This situation underscores the ongoing need for transparency in crypto and the necessity for stringent compliance protocols in the rapidly evolving digital finance landscape.

In an alarming turn of events, Binance has found itself at the center of a scandal involving allegations of employee misconduct related to non-public information. The case sheds light on the challenges of maintaining ethical standards within the fast-paced environment of cryptocurrency markets. With the company’s swift action to suspend the implicated individual and engage in a thorough investigation, Binance aims to reinforce its dedication to fair trading practices. Furthermore, the promise of substantial rewards for whistleblowers highlights the importance placed on transparency and accountability in the industry. As regulatory scrutiny intensifies, the focus on cryptocurrency compliance will remain a critical issue for exchanges, making adherence to ethical guidelines even more crucial.

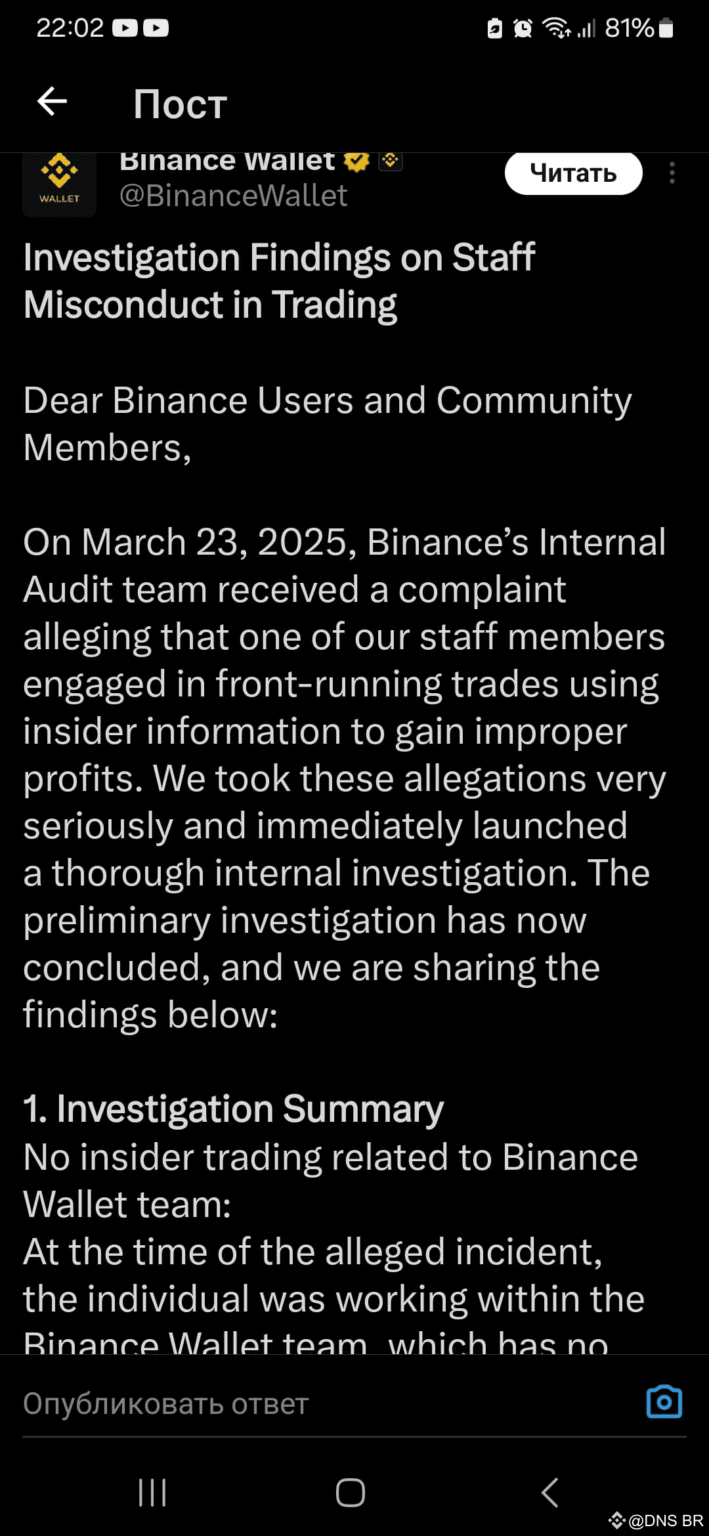

Understanding the Binance Insider Trading Incident

The recent Binance insider trading incident highlights the significant risks and consequences associated with the misuse of confidential information within the cryptocurrency market. On December 7, 2025, it was reported that a Binance employee allegedly profited from insider knowledge of a newly issued token, posting related content on the company’s official social media shortly after the token’s issuance. This violation of professional standards not only tarnished the company’s reputation but also raised new questions about the integrity and compliance mechanisms in place within leading crypto exchanges.

In response to this alarming breach, Binance acted swiftly by suspending the implicated individual and cooperating fully with regulatory authorities to ensure a thorough investigation. The company’s commitment to transparency and accountability was further underscored by its proactive approach to maintain user trust. Such incidents emphasize the need for strict adherence to ethical practices in crypto trading and the enforcement of robust compliance measures to prevent future occurrences.

Implications of Employee Suspension at Binance

The suspension of the employee involved in the alleged insider trading incident at Binance serves as a critical reminder of the company’s dedication to maintaining a compliant and ethical trading environment. By taking immediate action against the employee, Binance aims to convey a strong message about its zero-tolerance policy towards misconduct. This swift response not only seeks to restore confidence among its users but also illustrates the steps taken by Binance to enhance its internal controls to prevent any future violations.

Moreover, the incident has potential long-term implications for Binance’s operational policies and its approach to cryptocurrency compliance. As the industry continues to evolve, exchanges must ensure that their employees are well-informed about compliance regulations and understand the serious consequences of violating them. Enhanced training programs and stricter monitoring can contribute to a more effective workforce that prioritizes ethical behavior and protects the integrity of the platform.

Strengthening Cryptocurrency Compliance Measures

In light of the insider trading incident, Binance recognizes the urgent need to fortify its cryptocurrency compliance measures. This incident has opened discussions about industry-wide standards and the importance of fostering a culture of transparency in crypto. As regulatory scrutiny within the crypto space intensifies, exchanges must adopt rigorous compliance frameworks to ensure that all operations adhere to legal standards. This not only protects the exchange’s reputation but also enhances user confidence, crucial for maintaining a loyal customer base.

To address compliance issues, Binance is reviewing its current policies to incorporate best practices and innovative solutions. Engaging with regulators and industry stakeholders will also play a pivotal role in shaping future compliance strategies. By committing to proactive measures that promote transparency, Binance can lead by example in the cryptocurrency market, highlighting the importance of ethical operations while setting a benchmark for others to follow.

Binance Whistleblower Reward Initiative

In the aftermath of the insider trading incident, Binance’s announcement of a $100,000 reward for whistleblowers reflects its commitment to fostering accountability and compliance within its operations. By incentivizing individuals to report insider misconduct, Binance not only strengthens its internal controls but also demonstrates a clear stance against unethical behavior. This initiative encourages employees and the broader community to remain vigilant and contribute to a more transparent trading environment.

The whistleblower reward program highlights the significance of community involvement in maintaining the integrity of cryptocurrency exchanges. By establishing formal channels for reporting suspicious activities, Binance aims to build trust among its users and create a collaborative approach toward combating fraud and misconduct. Such transparency promises to bolster the exchange’s reputation while positioning it as a leader in promoting ethical practices in the ever-evolving landscape of digital currencies.

Transparency in Crypto: A Necessity for User Trust

Transparency in the cryptocurrency industry has never been more critical, particularly after incidents like the one experienced by Binance. As exchanges manage vast amounts of capital and sensitive information, users expect a high level of integrity from these platforms. The recent insider trading incident serves as a stark reminder of the vulnerabilities present within the industry and the necessity for exchanges to adopt stringent transparency measures to protect their users.

By prioritizing transparency, Binance can enhance its credibility and user trust, which are essential in a market often scrutinized for its risk factors. Initiatives such as detailed reporting on compliance measures, ongoing communication about regulatory changes, and clear protocols for addressing misconduct will not only mitigate risks but also promote a healthier and more sustainable crypto ecosystem. Through transparency, Binance is taking steps to reassure its community that ethical practices are at the forefront of its operations.

The Role of Regulatory Authorities in Crypto Trading

The involvement of regulatory authorities following the Binance insider trading incident underscores the essential role that governance plays in the cryptocurrency market. Regulatory bodies are tasked with overseeing trading practices to protect investors and maintain fairness across exchanges. The proactive stance taken by Binance to cooperate with these authorities illustrates the importance of aligning with regulatory standards to avert potential legal repercussions and ensure a secure trading environment.

Additionally, regulatory authorities are crucial in establishing a framework for compliance that all cryptocurrency exchanges must adhere to. This framework not only protects users but also fosters an industry-wide commitment to ethical conduct. As the cryptocurrency landscape continues to grow, strong partnerships between exchanges like Binance and regulatory bodies will be vital in promoting a transparent, compliant marketplace that benefits all stakeholders involved.

Best Practices to Prevent Insider Trading

To mitigate the risk of insider trading within cryptocurrency exchanges, it is imperative for companies like Binance to adopt best practices that enhance compliance and monitoring. Implementing stringent internal controls, conducting regular audits, and ensuring employees undergo comprehensive training on ethical standards can significantly reduce the potential for misconduct. These measures not only protect the company’s reputation but also enhance user confidence by ensuring a fair trading environment.

Moreover, fostering an organizational culture that prioritizes ethics and transparency is crucial for preventing insider trading. Encouraging employees to voice concerns and report suspicious activities through established channels, as demonstrated by Binance’s whistleblower reward initiative, can empower individuals to uphold integrity within the organization. By institutionalizing these best practices, cryptocurrency exchanges can more effectively combat insider trading and facilitate a healthier trading ecosystem for users.

The Importance of Community Vigilance in Crypto Trading

Community vigilance plays a pivotal role in maintaining the integrity of cryptocurrency exchanges. In light of the Binance insider trading incident, it becomes evident that users and stakeholders must remain proactive in identifying irregularities and reporting suspicious activities. This collective responsibility empowers the community to contribute to a safer trading environment and reinforces the importance of ethical conduct within the industry.

Binance’s proactive outreach for reports through its whistleblower program exemplifies the exchange’s recognition of the vital role the community plays in ensuring compliance and transparency. By fostering open communication between users and management, Binance is encouraging a collaborative approach to combat insider trading and other unethical practices. Ultimately, community vigilance can lead to more robust trading standards and a more trustworthy cryptocurrency landscape.

Frequently Asked Questions

What is the Binance insider trading incident involving employee suspension?

The Binance insider trading incident refers to a recent case where a Binance employee was suspended for profiting from insider information regarding a newly issued token. The employee allegedly tweeted about the token shortly after its on-chain issuance, violating company standards. Binance has suspended the individual and is cooperating with regulatory authorities to investigate the matter.

How is Binance handling the insider trading investigation?

Binance is actively handling the insider trading investigation by immediately suspending the involved employee and contacting regulatory authorities. They are committed to cooperating fully with the investigation to ensure accountability and uphold the integrity of cryptocurrency compliance.

What actions has Binance taken to improve transparency in crypto after the insider trading incident?

In light of the insider trading incident, Binance has announced measures to strengthen internal controls and maintain transparency in crypto. They emphasize principles such as user-first mentality, fairness, and integrity, which are essential in their operations moving forward.

What is the Binance whistleblower reward related to insider trading?

The Binance whistleblower reward is an initiative where Binance offers a total of $100,000 to the earliest and most effective whistleblower who reports insider trading incidents. This reward aims to encourage the community to report valid leads and enhance compliance and transparency within the platform.

What measures is Binance implementing to prevent future insider trading violations?

To prevent future insider trading violations, Binance is committed to strengthening internal controls and reinforcing compliance protocols. Following the recent incident, Binance will continue to prioritize transparency in crypto operations and enforce strict policies to protect user trust.

| Key Points |

|---|

| Binance reported an employee profiting from insider information related to a new token, as announced on December 7, 2025. |

| The employee was found to have tweeted about the token shortly after participating in its on-chain issuance, violating company standards. |

| The involved employee has been suspended and Binance is cooperating with regulatory investigations. |

| Binance is offering a $100,000 reward for the most effective whistleblower who reports valid leads through official channels. |

| Binance reiterated its commitment to transparency, fairness, and integrity, promising to strengthen internal controls to prevent future incidents. |

Summary

The Binance insider trading incident has highlighted significant breaches of internal ethics within the company. Following the wrongful actions of an employee who profited from insider information regarding a new token, Binance has taken swift action to suspend the individual and cooperate with investigations. With a strong emphasis on transparency and accountability, Binance aims to restore trust while issuing a reward for whistleblowers to encourage reporting of unethical practices. This incident serves as a reminder of the importance of integrity in cryptocurrency trading.