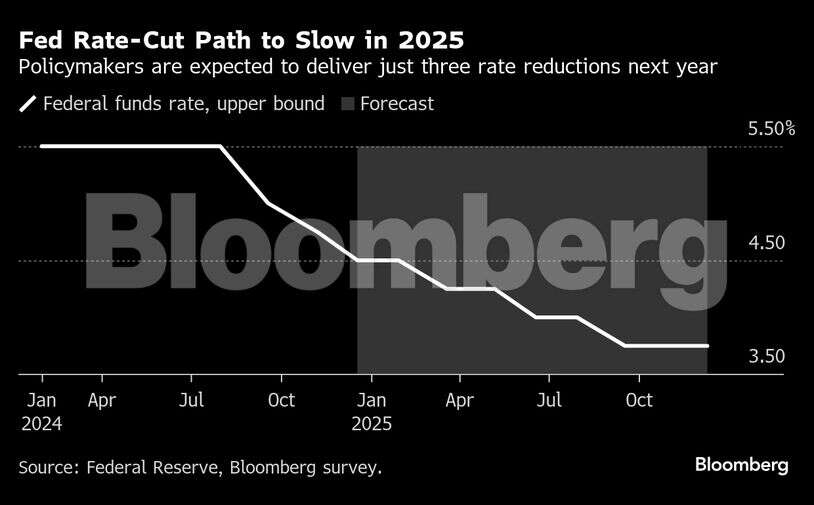

As speculation grows around the Federal Reserve rate cut prediction, analysts at Nomura Securities are making headlines with their updated stance on interest rates. Previously forecasting stability, Nomura now anticipates a 25 basis point decrease during the Federal Reserve’s December policy meeting. This shift is indicative of a broader economic forecast that includes potential monetary policy changes spurred by recent economic data and global market movements. The debate within the Fed appears to be intensifying, as a faction of members pushes for cuts to manage economic risks. With Fed rate cut news capturing investor attention, the implications of these predictions could significantly impact financial markets leading up to December 2025.

In light of evolving financial dynamics, the upcoming adjustments to the Fed’s interest rates have become a focal point for economic observers. Nomura Securities, a key player in financial analysis, has notably altered its previous outlook regarding the central bank’s intentions for December 2025, suggesting a potential reduction in rates. This evolving narrative underscores the central bank’s ongoing deliberations over monetary strategies as it navigates a complex economic landscape. Market participants are keenly monitoring these developments, as even slight shifts in policy can have broad implications for investment and economic stability. As the discourse surrounding rate modifications continues, stakeholders are left to ponder how such changes might reshape their financial planning.

Federal Reserve Rate Cut Prediction: A Shift in Monetary Policy

Nomura Securities has made headlines by shifting its forecast regarding the Federal Reserve’s interest rates. Initially, the expectation was that the Fed would maintain its rates in December. However, recent insights suggest a pivot in perspective, with Nomura now predicting a 25 basis point cut. This change is indicative of a broader trend in monetary policy changes, where analysts and financial institutions alike are reassessing their stances in light of emerging economic data and dovish signals from policymakers.

The anticipation of this rate cut raises important questions about the economic forecast for the coming years. With key segments of the Fed reconsidering their strategies, the implications can ripple across financial markets, influencing everything from mortgage rates to corporate borrowing costs. As we approach December 2025, the discussions surrounding the Fed’s potential rate cut will be pivotal for investors and economists alike.

Analyzing Nomura Securities’ Rate Cut Expectation

Nomura Securities has not only predicted a rate cut for December, but they are also keenly aware of the internal divisions within the Federal Reserve itself. Their analysis highlights that while some members remain hawkish and are likely to oppose any cut, there is a growing dovish sentiment that could sway the decision. This dichotomy within the Fed reflects a cautious approach to monetary policy changes as the economy shows mixed signals of recovery.

As we dissect the economic forecast provided by Nomura, it becomes clear that their predictions are based on calculated assessments of both market conditions and Fed communications. The reference to significant uncertainty surrounding the December policy decision underscores the complexities that influence interest rates, particularly how market expectations can influence Fed actions. Investors are advised to stay alert as developments unfold leading up to the policy meeting.

The Role of Dovish Signals in Rate Cut Decisions

Dovish signals from the Federal Reserve are pivotal when discussing potential rate cuts. These signals can emerge from various channels, including statements from Fed officials, economic indicators, and overall market sentiment. Nomura’s revision of its forecasts is largely influenced by these signals, indicating a willingness among some Fed members to adopt a more cautious stance moving forward. Dovish inclinations have historically preceded rate cuts, suggesting that evolving economic conditions can significantly impact monetary policy decisions.

In this context, it’s crucial to assess how external factors, such as inflation rates and employment figures, will play into the Fed’s final decision. In the past, dovish signals have often been a precursor to increased liquidity in financial markets, creating opportunities for growth. As investors consider the implications of these policy changes, understanding the nuances of Fed communications, especially those coming from influential institutions like Nomura, becomes essential for crafting informed strategies.

Potential Economic Impacts of Lower Interest Rates

Should the Federal Reserve proceed with its predicted rate cuts, the potential economic impacts are multifaceted. Lower interest rates typically encourage borrowing and spending, as the cost of loans decreases. For consumers, this could mean lower mortgage rates and more accessible credit for personal and business expenditures. Businesses, on their end, might seize the opportunity to invest more in growth initiatives, thus fostering economic expansion and job creation.

Conversely, there are risks associated with prolonged low interest rates. For example, while they can stimulate growth in the short term, they may also contribute to asset bubbles and increased inflationary pressures over time. As Nomura Securities points out, careful consideration must be given to the balance of economic growth and inflation as the Fed navigates these potential monetary policy changes.

Fed Rate Cut News: Market Reactions

The announcement of potential Fed rate cuts often triggers immediate reactions in financial markets. Investors keenly watch for any news on interest rates, as changes can lead to significant shifts in market dynamics. Bond markets are particularly sensitive to such announcements, with prices adjusting rapidly in anticipation of changes in yields. Nomura’s updated predictions serve as critical news for traders and investors, as they adjust their portfolios to align with forecasted monetary policy developments.

Additionally, stock markets tend to react positively to news of rate cuts, as lower interest rates can lead to increased consumer spending and corporate profitability. However, it’s essential to recognize that market volatility can also accompany these adjustments, making it imperative for investors to stay informed about shifts in Fed communications and economic forecasts.

The Influence of Economic Indicators on Rate Decisions

Economic indicators play a crucial role in shaping the Federal Reserve’s decisions on interest rates. Key metrics such as inflation rates, unemployment figures, and consumer spending reports provide essential data points that influence the central bank’s monetary policy actions. As Nomura Securities evaluated the current economic landscape, they recognized the impact these indicators have on the Fed’s potential move towards a 25 basis point cut in December.

Continuous monitoring of these indicators allows analysts to gauge the health of the economy and predict the Fed’s future actions. For instance, if inflation remains below the target rate, the Fed may find justification for cutting rates to spur growth. Understanding this relationship is vital for economists and investors, as it provides insight into how monetary policy might evolve in response to changing economic conditions.

Understanding the Federal Reserve’s Decision-Making Process

The Federal Reserve’s decision-making process is complex and involves weighing various economic factors against its mandates. The Fed aims to promote maximum employment and stable prices, which necessitates thorough discussions among its members. With Nomura’s predictions of a rate cut in December, we see the significance of this internal dialogue, especially as differing views from both hawkish and dovish members play a role in the outcome of policy decisions.

Moreover, the influence of new leadership within the Fed adds another layer of complexity to the decision-making process. As new guidelines and objectives are set under the current Fed Chair, the implications for monetary policy could shape the economic forecast significantly. This transformation makes understanding the Fed’s motivations and strategies critical for both policymakers and market participants.

Investor Strategies Amidst Rate Cut Predictions

In light of the predictions from Nomura Securities regarding the Federal Reserve’s potential rate cuts, investors need to adapt their strategies accordingly. Lower interest rates often lead to a favorable environment for equities, and sectors such as technology and consumer discretionary might see heightened interest from investors. Understanding which sectors typically benefit from lower borrowing costs can be crucial for optimizing investment portfolios.

Conversely, investors should also remain cautious and consider the risks associated with a low interest rate environment, such as increased volatility and potential asset bubbles. Diversifying investments and focusing on fundamentally strong companies can help mitigate some of these risks. Overall, being proactive in response to Fed rate cut news will allow investors to navigate the evolving economic landscape more effectively.

Future Projections: Rate Cuts Beyond December 2025

Nomura’s forecast extends beyond the imminent rate cut in December 2025, anticipating further cuts in mid-2026. As economic conditions evolve, the Federal Reserve’s response will likely adapt as well. Economic forecasts suggest that if inflation remains subdued and growth slows down, the Fed may have to employ additional cuts to sustain economic momentum. Thus, keeping an eye on future projections is vital for understanding the trajectory of U.S. monetary policy.

In this context, market participants should prepare for a landscape where rate cuts become a central theme of economic strategy. Continuous assessment of economic indicators, along with Fed communications, will help investors position themselves strategically in anticipation of these shifts. Being informed of potential future rate changes will aid in making well-timed financial decisions.

Frequently Asked Questions

What recent changes has Nomura Securities made regarding the Federal Reserve rate cut prediction for December 2025?

Nomura Securities has reversed its previous forecast, now predicting that the Federal Reserve will cut interest rates by 25 basis points during the policy meeting in December 2025. This change reflects a response to new economic forecasts and dovish signals indicating a shift in monetary policy.

How does Nomura Securities justify its Federal Reserve rate cut prediction?

Nomura justifies its Federal Reserve rate cut prediction by highlighting the emergence of sufficient dovish signals that support moderate members of the Fed in considering further risk management-style rate cuts. They believe this could lead to a rate cut of 25 basis points in December 2025.

What level of uncertainty surrounds the Federal Reserve rate cut prediction made by Nomura Securities?

Nomura Securities has indicated that there is significant uncertainty regarding the Federal Reserve’s policy decision in December 2025, despite their prediction of a potential rate cut. The sentiment is that various factors at play may influence the final stance taken by the Fed.

What impact could the Federal Reserve’s rate cut have on economic forecasts for 2026?

Should the Federal Reserve follow through with a rate cut as predicted by Nomura Securities in December 2025, it may positively influence economic forecasts for 2026 by providing a more accommodative monetary policy environment, potentially stimulating growth.

Which members of the Federal Reserve are expected to oppose the rate cut according to Nomura Securities?

Nomura Securities predicts that four hawkish members of the Federal Reserve are likely to oppose the anticipated 25 basis point rate cut in December 2025, suggesting each member’s stance will impact the final decision.

What future rate cuts does Nomura anticipate from the Federal Reserve beyond December 2025?

Nomura Securities expects the Federal Reserve to continue lowering rates into 2026, predicting additional cuts of 25 basis points in both June and September under the leadership of the new Fed Chair.

What does the phrase ‘risk management-style rate cuts’ mean in relation to the Federal Reserve rate cut prediction?

‘Risk management-style rate cuts’ refer to the Federal Reserve’s approach to lowering interest rates as a precautionary measure to manage economic risks, particularly when signs suggest that further stimulation may be necessary to support the economy.

How might Nomura’s adjustments to its Federal Reserve rate cut prediction influence investor sentiment?

Nomura’s adjustments to its Federal Reserve rate cut prediction may lead to shifts in investor sentiment, with market participants potentially becoming more optimistic about economic growth and aligning their investment strategies based on anticipated changes in interest rates.

| Key Point | Details |

|---|---|

| Nomura Securities Update | Nomura Securities predicts a Federal Reserve rate cut in December. |

| Revision of Forecast | Previously expected the Fed to maintain rates, now anticipates a 25 basis point cut. |

| Dovish Signals | Indications suggest a shift towards risk management-style rate cuts. |

| Internal Fed Dynamics | Disagreement within the Fed exists, with four hawkish members likely opposing the rate cut. |

| Future Predictions | Further cuts of 25 basis points expected in June and September 2026. |

Summary

The recent prediction regarding the Federal Reserve rate cut indicates a significant shift in market expectations, as Nomura Securities now anticipates that the Fed will lower rates in December. This change reflects emerging dovish signals within the Federal Reserve, despite some internal opposition. As speculations grow, understanding the nuances of these predictions will be vital for investors and market analysts alike.