In the evolving landscape of financial markets, the Federal Reserve rate cut is poised to play a pivotal role in shaping economic dynamics. As analysts speculate about the potential implications, experts like Halfwood Xia emphasize that a rate cut, coupled with the Fed’s balance sheet expansion, could usher in a wave of liquidity normalization. This anticipated shift is expected to drive broad market gains across sectors, including significant movements in US stocks and crypto assets. Recent reports highlight that tight liquidity conditions could soon transition to a more favorable environment for investors, reminiscent of the liquidity landscape of late 2019. With December shaping up to be a critical month for market participants, the interplay between rate cuts and Federal Reserve strategies offers a compelling narrative for those tracking US stock market news and crypto market gains alike.

The recent discussions surrounding the Federal Reserve’s adjustment of interest rates have garnered significant attention from investors and analysts alike. By examining the Fed’s strategies such as balance sheet management and interest rate decisions, we can understand their impact on market liquidity. Many believe that easing these financial constraints will revitalize various asset classes including cryptocurrency and equity markets. Insights from financial analysts illuminate how potential movements towards liquidity normalization could influence market trajectories throughout the month. In this context, the outlook for economic stability hinges on the Fed’s actions and their subsequent effects on investor sentiment and capital flows.

Impact of the Federal Reserve Rate Cut on Market Liquidity

The anticipated Federal Reserve rate cut could have a profound impact on market liquidity, marking a pivotal shift in economic conditions. Analysts, including Halfwood Xia, predict that such a move would return liquidity to normalized levels, fostering an environment ripe for investment and growth across various sectors. When the Fed lowers rates, borrowing costs decrease, which encourages spending by businesses and consumers—this creates a ripple effect that can stimulate economic activities in both the US stock market and the crypto market.

Historically, substantial rate cuts by the Fed have led to significant market gains, as evidenced during periods of economic downturn followed by recovery phases. By reinstating balance sheet expansion alongside rate cuts, the Fed seeks to inject more capital into the economy, further enhancing liquidity. This dual approach not only boosts investor confidence but also supports a potential upswing in asset prices, setting the stage for robust market performance throughout December.

Cryptocurrency Market Reactions to Federal Reserve Policies

The cryptocurrency market has consistently shown a responsiveness to changes in Federal Reserve policy, particularly rate cuts and liquidity measures. As Halfwood Xia highlighted, the prospect of a Fed rate cut could serve as a catalyst for significant gains in the crypto market. Investors tend to flock to cryptocurrencies during times of easing, as they often seek alternative investments when traditional markets are perceived to be volatile or uncertain.

Moreover, with potential rate cuts and resumed balance sheet expansion, the environment is becoming increasingly favorable for crypto assets. The January 2020 surge in Bitcoin‘s price can be attributed in part to FOMO (Fear of Missing Out) that coincided with Federal policies aimed at loosening monetary supply. Should the Fed continue on this path, market watchers expect a similar surge in crypto market valuations, bringing renewed interest and investment into the sector.

Analyzing the US Stock Market Under Fed’s Economic Measures

As the Federal Reserve contemplates a rate cut, the US stock market is poised for substantial changes. Observing the trends outlined by Halfwood Xia, many traders anticipate that reduced borrowing costs will invigorate the stock market. With lower interest rates, businesses are more likely to invest in growth initiatives, which in turn can lead to increased revenues and stock prices. Companies accessing cheaper loans can expand operations or hire more employees, further driving economic activity.

Additionally, it is important to consider that when the Fed indicates a willingness to stop reducing its balance sheet, it suggests that the central bank is committed to supporting economic stability. This reassurance can bolster market sentiment and lead to a rally in stock prices, especially in sectors most affected by interest rates, such as technology and consumer goods. Investors will be closely watching for signs of the Fed’s actions this December, as these could set the tone for stock performances well into the next year.

Liquidity Normalization and Its Effects on Different Markets

Liquidity normalization refers to the process by which monetary policy shifts back towards more standard practices, aimed at stabilizing economic conditions. Halfwood Xia’s analysis indicates that if the Federal Reserve resumes balance sheet expansion, it could counterbalance previous liquidity tightening, creating a more favorable economic milieu for all markets. This shift would likely support gains not just in the crypto and stock markets, but also in other asset classes, including precious metals that often thrive in times of economic uncertainty.

The balance between tightening and normalization can drastically affect market dynamics. Investors typically seek liquidity when making investment decisions; hence, the return of normalized liquidity could lead to increased market participation across various sectors. Assets such as gold and silver, which historically perform well during economic fluctuations, may see renewed interest as the Fed stabilizes monetary conditions and lowers rates. Ultimately, achieving a healthy balance of liquidity will be crucial for sustaining market confidence during these uncertain times.

Halfwood Xia’s Predictions for Market Trends in December

According to Halfwood Xia, December presents a critical time for markets, particularly if the Federal Reserve moves forward with a rate cut and balance sheet expansion. His insights suggest that both the stock and crypto markets are primed for growth during this month, driven by anticipated improvements in liquidity conditions. Market participants will be eager to see how these Federal measures affect market behavior, with expectations of increased asset valuations across the board.

Moreover, Xia’s previous analysis from November established a groundwork for understanding these potential shifts. If the Fed opts to halt the balance sheet reduction, it would signal an intention to maintain economic growth. This could invite a surge of new investment, bolstering the US stock market while simultaneously enhancing the attractiveness of cryptocurrencies, all of which are expected to thrive in a more favorable economic environment.

The Interplay Between Fed Policy and Economic Indicators

The relationship between Federal Reserve policies and broader economic indicators is complex yet crucial. With movements such as rate cuts and balance sheet expansions, the Fed plays a significant role in shaping economic landscapes. Analysts like Halfwood Xia analyze these indicators to forecast market performance, focusing on how changes in monetary policy can influence aspects such as employment rates, consumer spending, and ultimately, market valuations.

While the immediate effects of a rate cut may be felt in terms of increased liquidity and market activity, the long-term implications can vary. If the Fed’s decisions align with strong economic growth, we could witness sustained market momentum. Conversely, if these measures fail to stimulate growth adequately, it may signal underlying economic weaknesses. Therefore, the interplay between Fed policy and economic indicators remains a critical area for investors as they gauge future market movements.

Understanding the Risks Associated with Fed Rate Cuts

While a Federal Reserve rate cut can herald positive changes for various markets, it is not without risks. With reduced interest rates, the potential for asset bubbles increases, particularly if investors become overly optimistic about the economic outlook. As noted in Halfwood Xia’s assessments, the balance sheet expansion could lead to inflated asset prices if not managed prudently, creating vulnerabilities that could destabilize markets in the long run.

Additionally, a prolonged period of low rates can distort traditional investment strategies, leading to an increase in risky assets. Investors may chase higher yields, leading to asset mispricing and increased volatility. It is essential for market participants to remain vigilant and aware of these potential risks as they navigate through the implications of the Fed’s monetary policies, especially in light of December’s anticipated decisions.

Looking Forward: The Future of Market Adjustments

As we approach the end of the year, market participants are increasingly focused on how the Federal Reserve’s actions will shape the forthcoming economic landscape. Halfwood Xia’s predictions suggest that substantial market adjustments could be anticipated following a rate cut and renewed balance sheet expansion. This could lead to significant shifts not just in the US stock market, but across global financial ecosystems, as investors realign their portfolios in response to changing conditions.

Ultimately, the future of market adjustments hinges on various factors including economic growth rates, inflation, and investor sentiment. The actions taken by the Fed in December will be pivotal, and analysts will scrutinize the central bank’s decisions closely. If the expected liquidity influx occurs, it may pave the way for a new phase of economic expansion, highlighting the interconnectedness of Fed policies and global market dynamics.

The Role of Economic Analysis in Predicting Market Trends

Economic analysis plays a vital role in predicting market trends, particularly in relation to the Federal Reserve’s monetary policies. Analysts like Halfwood Xia utilize economic data and historical context to project possible outcomes following significant monetary changes. Through data-driven assessments, they provide insights into how rate cuts and liquidity adjustments could affect various financial markets, influencing the decisions of investors and policymakers alike.

Furthermore, understanding the implications of Fed actions on sectors such as technology, finance, and commodities is essential for accurate forecasting. By incorporating leading economic indicators, analysts can identify potential trends, allowing investors to make informed decisions in a complex and often volatile landscape. As the Fed’s strategy evolves, the insights derived from economic analysis will remain crucial in navigating the shifting tides of market conditions.

Frequently Asked Questions

What impact will a Federal Reserve rate cut have on the US stock market?

A Federal Reserve rate cut is expected to stimulate the US stock market by lowering borrowing costs and encouraging investment. As liquidity normalizes, market confidence may increase, leading to broad market gains across various sectors.

How might the Federal Reserve’s balance sheet expansion influence crypto market gains?

If the Federal Reserve expands its balance sheet while implementing a rate cut, it could enhance liquidity in the crypto market, potentially leading to significant gains in crypto assets. This environment mimics the favorable conditions expected in December as liquidity tightens into normal ranges.

What is liquidity normalization, and how does it relate to a Federal Reserve rate cut?

Liquidity normalization refers to the restoration of healthy levels of liquidity in the financial markets. A Federal Reserve rate cut can facilitate this process by providing easier access to capital, helping reduce tightness in the market and encouraging investment.

What did Halfwood Xia predict about the Fed’s actions and market trends?

Halfwood Xia predicted that if the Federal Reserve cuts rates and resumes balance sheet expansion, there could be broad market gains, including increases in US stocks, crypto assets, and precious metals, particularly in December.

Will the Federal Reserve’s rate cut affect precious metals prices?

Yes, a Federal Reserve rate cut typically supports the prices of precious metals. As liquidity improves and the dollar may weaken, investments in gold and silver tend to rise, making them attractive store-of-value assets.

How does the Fed’s rate cut impact liquidity conditions in the market?

The Federal Reserve’s rate cut improves liquidity conditions by making borrowing cheaper, which encourages spending and investment. This shift can lead to an overall increase in the available capital in the markets, supporting both stock and crypto growth.

What historical reference did Halfwood Xia make regarding the Federal Reserve’s approach?

Halfwood Xia referenced the liquidity environment of October 2019, suggesting that a similar easing phase might emerge if the Federal Reserve cuts rates and expands its balance sheet, which could lead to increased asset valuations across the market.

| Key Point | Details |

|---|---|

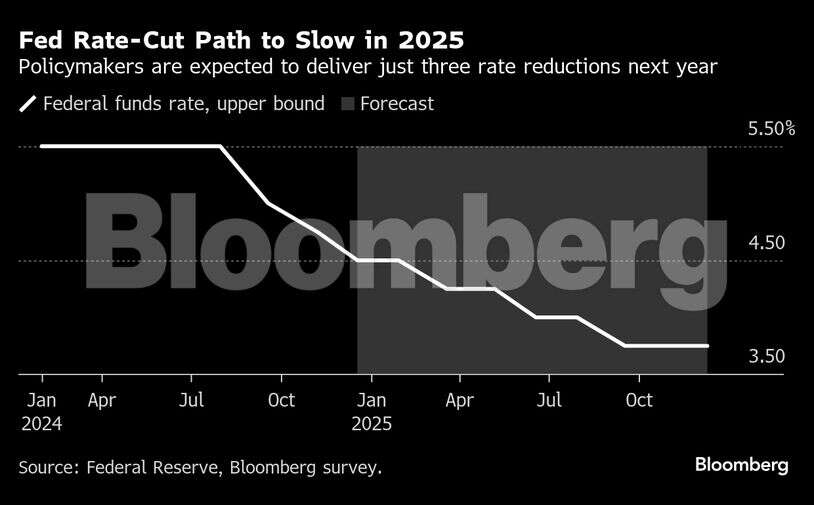

| Rate Cut Expectations | The Federal Reserve is expected to cut interest rates soon. |

| Balance Sheet Expansion | Analyst predicts the Fed may restart balance sheet expansion, improving liquidity. |

| Market Impact | A rate cut and balance sheet expansion could lead to gains in US stocks, crypto, and precious metals. |

| Liquidity Normalization | The move is expected to return liquidity to normal levels, similar to October 2019. |

| Future Prospects | A larger easing cycle may materialize after May next year under new leadership. |

Summary

The Federal Reserve rate cut is anticipated to have a significant impact on the financial markets. As analyst Halfwood Xia suggests, if the Fed reduces rates and expands its balance sheet, it could lead to increased liquidity and broad market gains. This expected recovery in liquidity may encourage investment in various assets, including stocks and cryptocurrencies, heralding a positive trend throughout December. Investors should stay informed as the Fed’s decisions in the coming weeks could shape market dynamics for the foreseeable future.