Euro stablecoins have emerged as a noteworthy player in the cryptocurrency landscape, achieving remarkable growth following the implementation of the MiCA regulatory framework. As of the latest reports, the market value of Euro stablecoins has surged to approximately $683 million, highlighting a doubling effect since the new regulations came into effect. While still trailing behind the dominant US dollar stablecoin market, Euro-based digital currencies, particularly EURS, have shown a promising increase in their market cap by 6.44%. In addition, recent data highlights an impressive performance by Circle’s EURC and Société Générale’s EURCV, with their trading volumes skyrocketing by 1139% and 343%, respectively. This burgeoning interest in Euro stablecoins signifies not only an evolution in digital currency acceptance in Europe but also the potential for further advancements within the Euro stablecoin market growth landscape.

The landscape of Euro-backed digital currencies is rapidly evolving, particularly following significant legislative shifts in Europe. Known as Euro stablecoins, these digital assets are designed to maintain a stable value tied to the Euro, providing a reliable alternative for traders and investors alike. With the backing of institutions, such as Circle and Société Générale, the performance of these currencies has become pivotal in their wider adoption. Furthermore, as the MiCA regulation reshapes the financial climate for cryptocurrencies, the surge in trading volumes and interest reflects a robust and expanding Euro stablecoin market. In this context, it’s crucial to explore the underlying factors contributing to this growth and the implications of increasing use cases for these innovative financial tools.

The Surge of Euro Stablecoins in 2023

The recent surge in the market value of Euro stablecoins reflects a burgeoning interest within the cryptocurrency ecosystem, particularly following the implementation of the MiCA regulation. As the Euro stablecoin market value has doubled to approximately $683 million, this growth highlights the increasing acceptance of cryptocurrencies among European investors and businesses. Additionally, while the current market cap demonstrates significant growth, it remains a small fraction of the $300 billion market value of US dollar stablecoins. This disparity illustrates an untapped potential for Euro-backed currencies in the crypto space.

Furthermore, recent reports indicate that the growth of Euro stablecoins is concentrated among a few dominant players, particularly EURS, Circle’s EURC, and Société Générale’s EURCV. Each of these tokens has showcased remarkable increases in trading volumes, indicating a healthy appetite for Euro-backed digital assets. The enthusiasm for these stablecoins suggests that as regulatory clarity improves with initiatives like MiCA, the Euro stablecoin market could further expand, attracting more investors seeking stability and utility within the evolving financial landscape.

Impact of MiCA Regulation on Euro Stablecoin Market

The Markets in Crypto-Assets Regulation (MiCA) has played a pivotal role in enhancing the legitimacy of Euro stablecoins, fostering a safer environment for investors in the European market. By providing a clear regulatory framework, MiCA aims to promote innovation while safeguarding consumers and maintaining market integrity. This regulatory clarity has undoubtedly contributed to the doubling of the market value of Euro stablecoins and has instilled confidence among traders, leading to an uptick in trading volumes for major stablecoins such as EURS and EURC.

Additionally, as smaller markets like Finland and Italy exhibit remarkable growth in search activity for Euro stablecoins, it suggests a rapidly growing awareness and acceptance of cryptocurrency products among European consumers. The MiCA regulation is expected to further accelerate this trend by appealing to traditional financial institutions considering the integration of digital currencies into their services. As a result, the synergy between MiCA and the Euro stablecoin market may create a compelling case for the continued expansion and evolution of the crypto market in Europe.

Performance Analysis of Top Euro Stablecoins

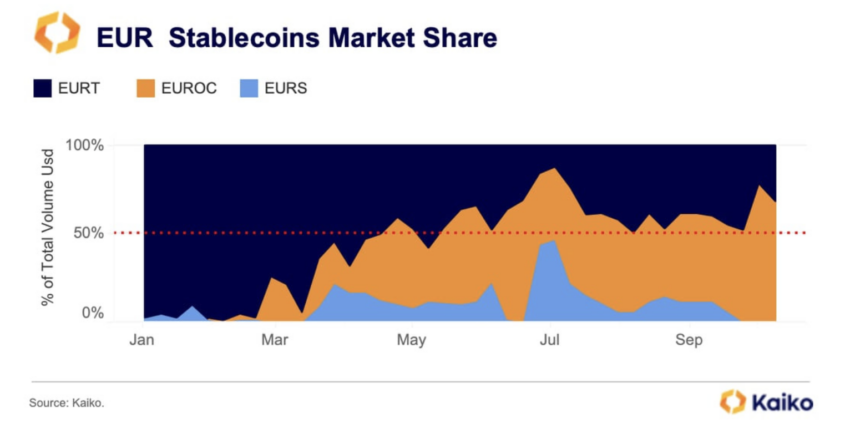

When analyzing the performance of leading Euro stablecoins, a stark increase in trading volumes propels EURS, Circle’s EURC, and Société Générale’s EURCV to the forefront of the market. EURS recently achieved a market cap increase of 6.44%, which reinforces its status as one of the leading Euro stablecoins in the sector. Meanwhile, Circle’s EURC demonstrated astonishing growth in trading volume, surging by 1139%, while Société Générale’s EURCV experienced an impressive growth of 343%. Such substantial gains highlight the potential and interest surrounding Euro-backed digital assets.

Moreover, the performance of these stablecoins indicates a shift in investor sentiment towards Euro-denominated assets, particularly among European audiences. The growth trends captured in Decta’s report suggest that Euro stablecoins are increasingly viewed as viable alternatives to their US dollar counterparts. This ongoing transformation in trading dynamics is likely to yield more competitive products and services within the Euro stablecoin market, leading to an overall health boost for the cryptocurrency market in Europe.

Trends Driving the Growth of Euro Stablecoins

Several key trends are contributing to the robust growth of Euro stablecoins as evidenced by the remarkable increases in market cap and trading volume. One major factor is the rising need for stable digital assets among European businesses and consumers, especially in light of economic volatility and the desire for hedging against inflation. Euro stablecoins offer a practical solution for users seeking stability within the digital asset ecosystem, making them attractive alternatives for everyday transactions and remittances.

In addition, the increasing acceptance of cryptocurrencies in European fintech ecosystems has fostered a fertile ground for innovation and collaboration between tech companies and traditional financial institutions. With platforms facilitating access to Euro stablecoins, user adoption is anticipated to rise further. This trend aligns well with burgeoning interest in DeFi (Decentralized Finance) and blockchain technologies, paving the way for Euro stablecoins to thrive as integral components of the evolving financial landscape in Europe.

Analyzing Trading Volumes of Euro Stablecoins

The trading volume of Euro stablecoins offers crucial insights into their overall market dynamics and investor behavior. Reports indicate that Circle’s EURC has experienced an incredible surge in trading volume, soaring by 1139%. This substantial increase not only demonstrates heightened investor interest but also emphasizes the vital role of liquidity in driving market growth. A higher trading volume often signals increased market participation and confidence among traders, potentially leading to more stable prices and opportunities for profit.

In contrast, Société Générale’s EURCV also witnessed significant growth, with trading volumes rising by 343%, reflecting a strong market position amidst increasing competition. As more institutions and retail investors recognize the utility of Euro stablecoins for transactions, this trend of rising trading volume is likely to continue. The interplay between trading volumes and market cap growth indicates a vibrant and expanding Euro stablecoin ecosystem, one that stands to benefit from future regulatory clarity and broader acceptance within conventional finance.

Consumer Behavior and Market Sentiment towards Euro Stablecoins

An analysis of consumer behavior regarding Euro stablecoins reveals a growing market sentiment favoring these digital assets. The significant increases in search activity across countries like Finland and Italy indicate a surge in consumer interest, as more individuals seek to understand and utilize Euro-backed cryptocurrencies. As public perception shifts towards viewing Euro stablecoins as legitimate and secure, the market is likely to adopt a more bullish outlook, influencing potential investment decisions.

Furthermore, as consumers become more educated about the advantages and applications of Euro stablecoins—such as ease of transaction and lower volatility compared to other cryptocurrencies—demand is anticipated to rise. This shift not only contributes to increased trading volumes but also underscores the necessity for regulatory bodies to ensure a supportive framework for the growth of Euro stablecoins in Europe. Ultimately, consumer behavior is critical in shaping the future trajectory of the Euro stablecoin market as it continues to evolve.

The Role of European Markets in Stablecoin Adoption

European markets are playing an increasingly influential role in the adoption of Euro stablecoins, particularly as users seek alternatives to traditional banking systems. The success of stablecoins like EURS and EURC is reflective of a broader trend where European consumers are embracing digital financial solutions amid growing economic uncertainties. As the demand for seamless transactions and cross-border payments escalates, Euro stablecoins are positioned to fill the gap, effortlessly integrating into existing financial infrastructures.

Moreover, with institutions like Société Générale entering the stablecoin market, we can observe a trend towards collaboration between traditional finance and cryptocurrency. This partnership signals a shift in the financial landscape, as more stakeholders recognize the potential of Euro stablecoins to enhance efficiency and accessibility. Hence, the role of European markets in facilitating stablecoin adoption cannot be overstated; as awareness and usage increase, we may witness a profound transformation in how currencies operate within the Eurozone.

Future Projections for Euro Stablecoin Development

Looking ahead, the future of Euro stablecoins appears bright, with projections indicating significant growth as regulatory frameworks mature. The implementation of MiCA regulation is expected to bolster investor confidence and foster innovation among Euro stablecoins, paving the way for new entrants and enhanced market dynamics. Established players like EURS and Circle’s EURC are likely to expand their offerings to capture a larger share of the growing market, while new projects may emerge to address gaps in user needs or target specific demographics.

In addition, evolving consumer preferences for digital assets could further propel the demand for Euro stablecoins. As consumers become more comfortable with blockchain technology and its benefits, the likelihood of mainstream adoption increases. Furthermore, conscientious development of Euro stablecoins that prioritize transparency and regulatory compliance will likely position them favorably in discussions surrounding cryptocurrency. Overall, these factors suggest that Euro stablecoins are poised for a future filled with opportunity and substantial growth.

Frequently Asked Questions

What impact has the MiCA regulation had on the Euro stablecoin market growth?

The MiCA regulation has significantly boosted Euro stablecoin market growth, leading to a doubling of its market value to approximately $683 million since its implementation. This regulatory framework has provided clarity and stability, encouraging more users and investors to engage with Euro stablecoins.

How does the trading volume of EURS compare to other Euro stablecoins?

EURS has experienced a noteworthy market cap increase of 6.44%, establishing it as a leading Euro stablecoin. Its trading volume growth highlights the increasing popularity and trust in Euro stablecoins, especially in the competitive landscape where it operates.

What has been the performance of Circle’s EURC in the Euro stablecoin market?

Circle’s EURC has shown remarkable performance in the Euro stablecoin market, with a staggering increase in trading volumes by 1139%. This surge indicates a strong market interest and demand for Circle’s offerings in the Euro stablecoin segment.

What factors are contributing to the growth of Société Générale’s EURCV in the Euro stablecoin space?

Société Générale’s EURCV has seen significant growth, particularly a 343% increase in trading volumes. This growth can be attributed to increasing institutional interest in Euro stablecoins, enhanced regulatory clarity, and the expanding acceptance of digital assets across the European market.

Why is there a growing interest in Euro stablecoins across Europe?

The rising interest in Euro stablecoins is driven by factors such as the MiCA regulation providing a safer framework, increased market search activity, and significant growth rates in countries like Finland and Italy. This heightened attention reflects a broader trend towards digital euro assets and their potential for financial innovation.

| Key Point | Details |

|---|---|

| Market Value Growth | Euro stablecoins’ market value has doubled to approximately $683 million since the MiCA came into effect. |

| Comparison with US Dollar Stablecoins | Despite significant growth, Euro stablecoins still lag behind US dollar stablecoins, which exceed $300 billion in market value. |

| Leading Tokens Growth | The growth is concentrated among leading tokens like EURS, which saw a 6.44% market cap increase, and Circle’s EURC and Société Générale’s EURCV with remarkable trading volume increases of 1139% and 343%, respectively. |

| Search Activity Increase | Decta’s survey reported substantial rises in search activity for Euro stablecoins across the EU, with notable increases in Finland (400%) and Italy (313.3%). |

Summary

Euro stablecoins have seen remarkable growth, doubling in market value to $683 million since the implementation of the MiCA regulation. This surge highlights the increasing interest and adoption of digital currencies pegged to the Euro, even though they remain far behind their US dollar counterparts. The rise of leading Euro stablecoin tokens and increased search activity across various EU countries further signals a positive trajectory for Euro stablecoins in the future.