Adobe rallies into earnings as bulls reclaim key moving average; traders eye $369 and $400 thresholds

Adobe shares ripped higher ahead of next week’s results, fueling a risk-on tilt in growth stocks as the chart flipped tactically constructive. With consensus calling for solid double‑digit EPS growth, traders are watching whether the stock can convert a technical breakout into a sustained trend.

Why ADBE vaulted higher today

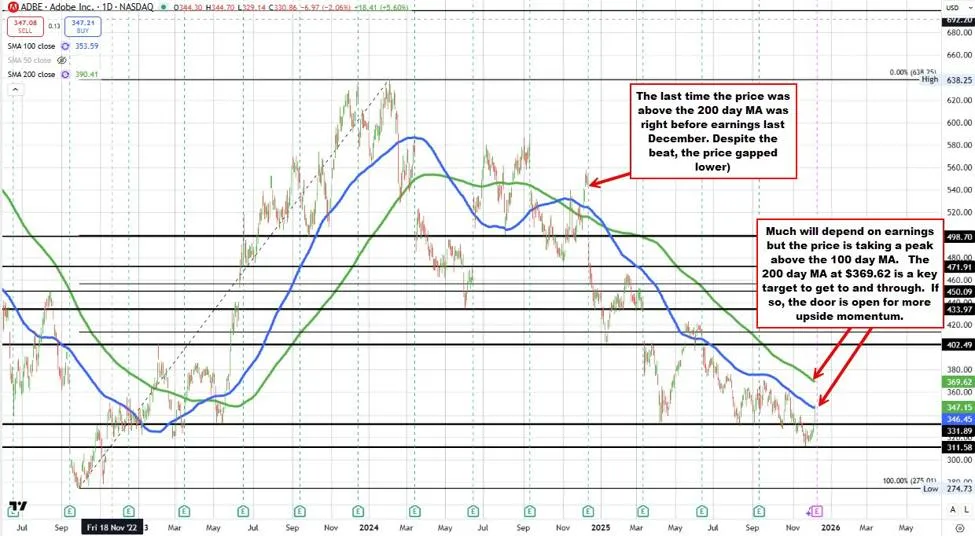

Adobe jumped 5.67% to $347.47, its largest one-day gain since early April, after buyers punched the stock back above the 100‑day moving average—a level that capped rallies for much of 2024. The rebound arrives after a deep drawdown this year: ADBE is still down 21.87% year-to-date and more than 45% below its January peak, leaving positioning lighter and sensitivity to positive catalysts higher.

Market chatter also leaned constructive, with some investors arguing that fears of AI eroding Adobe’s moat look overstated. That shift in sentiment, combined with improving technicals, helped ignite short-term momentum.

Earnings preview: expectations and setup

Wall Street expects Adobe to post EPS of $5.39 on $6.11 billion in revenue next Wednesday, up from $4.81 and $5.61 billion a year ago—growth of roughly 12% and 8.9%, respectively. A year ago, Adobe beat estimates but sold off on valuation and AI-competition worries. This time, the bar may be lower: the stock trades nearly $240 beneath last year’s pre-earnings levels, potentially tempering downside if guidance proves steady.

For multi-asset traders, Big Tech earnings often sway risk appetite and FX carry dynamics. A strong report that extends the equity rebound could support broader risk proxies, while a disappointment may revive defensiveness and dollar demand through safe-haven channels.

Technical levels: the roadmap into Wednesday

Today’s close nudged ADBE just above the 100‑day MA at $346.45. Bulls now need follow‑through to shift the medium‑term bias.

– Next upside magnet: the 200‑day MA at $369.62. A decisive break there would put $400 back in view, an area that also aligns with prior congestion and a round‑number psychological level.

– On intraday frames, momentum improved as price cleared the 200‑hour MA at $331.04 and last week’s reclaim of the 100‑hour MA at $324.19.

– Risk markers: a slide to the 200‑hour implies roughly ~5% downside from current levels; a retest of the 100‑hour would be about ~7% lower. Those lines offer clean invalidation points for short‑term setups.

Key Points

- ADBE surged 5.67% to $347.47, reclaiming the 100‑day MA ($346.45) ahead of earnings.

- Consensus: EPS $5.39 on $6.11B revenue; up 12% and 8.9% year-on-year.

- Shares remain down 21.87% YTD after a >50% peak-to-trough slide to the $311.58 low.

- Watch the 200‑day MA ($369.62); a breakout would target the $400 zone.

- Short-term risk lines: $331.04 (200‑hour) and $324.19 (100‑hour) guide downside of ~5–7%.

- AI-competition worries linger, but valuation headwinds are lighter than last year.

Market context and trader takeaways

– Positioning and volatility: ADBE’s multi-month slide has reset positioning, increasing the odds that an in-line print with steady guidance supports the stock. Conversely, weak commentary on Creative Cloud growth or GenAI monetization could quickly test support zones.

– Cross‑asset lens: Big Tech-led rebounds typically bolster equity beta and can soften demand for havens; however, with macro catalysts in play this month, headline risk remains high for both stocks and FX.

– Risk-reward: Into earnings, traders weighing ~5–7% downside to nearby moving averages against potential upside toward $369–$400 may see a favorable skew if the company clears expectations and guidance reassures on AI and margins.

FAQ

What are analysts expecting from Adobe’s upcoming report?

Consensus calls for $5.39 in EPS and $6.11 billion in revenue, up about 12% and 8.9% year-over-year.

Why did Adobe stock jump today?

Shares rallied after reclaiming the 100‑day moving average, signaling improving technical momentum. Sentiment also firmed as some investors suggested AI-driven competitive risks may be overstated.

Which technical levels matter most into earnings?

On the daily chart: $346.45 (100‑day MA) and $369.62 (200‑day MA). Above $369.62, bulls will look toward the $400 area. On the hourly chart: $331.04 (200‑hour MA) and $324.19 (100‑hour MA) as near-term support/risk markers.

How does Adobe’s print impact broader markets or FX?

Big Tech earnings often sway risk appetite. A constructive report could underpin growth equities and broader risk proxies, while a miss may lift defensiveness and support the dollar through safe-haven flows. Actual FX moves will hinge on concurrent macro data and yields.

What are the main risks for ADBE here?

Downside risks include weaker-than-expected guidance, signs of AI-driven market-share pressure, or failure to hold the 100‑day/200‑hour MAs. A rejection near the 200‑day could also cap the rally.

Reporting by BPayNews.