The latest BTC liquidation report reveals a staggering 19.92 million USD worth of Bitcoin positions liquidated in just the past hour. This substantial BTC price drop is indicative of the volatile nature of the cryptocurrency market, where liquidation events are becoming increasingly common. According to Coinglass data, a total of 50.441 million USD has been liquidated across various assets, with the majority being long positions. Traders seeking safety in this unpredictable environment often find themselves caught off guard, leading to significant losses. As the market reacts and adapts, understanding the nuances of cryptocurrency liquidation becomes vital for anyone involved in trading, from seasoned investors to newcomers.

In light of recent developments, the latest analysis on digital asset market liquidations sheds light on the current state of cryptocurrencies. The recent downturn in Bitcoin prices has resulted in substantial sell-offs, leading to significant liquidation amounts that draw attention from analysts and investors alike. The most recent data indicates that across the entire trading network, over 50 million USD has been affected, with a noteworthy portion related to Bitcoin and Ethereum. Such reports underscore the need for awareness regarding market dynamics and liquidation processes, especially as events like the BTC liquidation report catch the eyes of traders navigating these turbulent waters. With the cryptocurrency landscape constantly shifting, staying informed about ETH liquidation news and related trends will be essential for making strategic investment decisions.

Recent BTC Liquidation Report

In the latest BTC liquidation report, a staggering 19.92 million USD has been liquidated from the Bitcoin market in just one hour. This significant figure highlights the volatility prevalent in the cryptocurrency landscape, particularly during times of market fluctuations. Investors should remain vigilant, as such rapid changes can affect their positions significantly, leading to substantial losses.

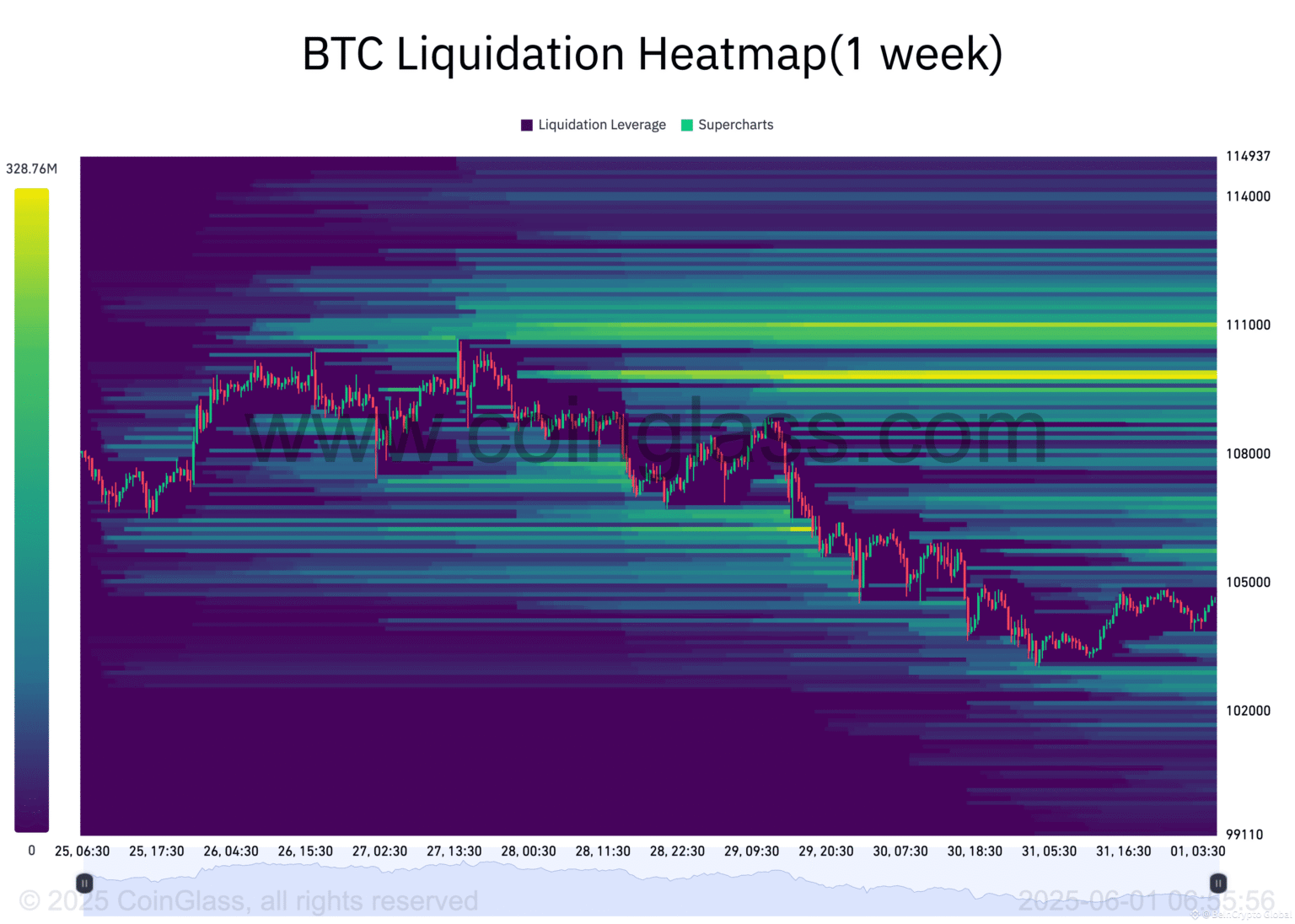

As per Coinglass data, this recent liquidation trend underscores a growing concern among traders about impending BTC price drops. Multiple factors contribute to these price movements, including market sentiment and external economic factors that can unpredictably influence cryptocurrency values. Therefore, understanding how liquidation events happen and what triggers them can help traders make informed decisions.

Understanding Cryptocurrency Liquidation Trends

Cryptocurrency liquidation events occur when traders’ positions are closed due to insufficient margin to maintain their trades. Understanding these trends is crucial for both short-term and long-term investors. In the previously mentioned report, significant liquidation amounts emphasize the importance of risk management, as long positions accounted for a whopping 49.3556 million USD of the total liquidated. Liquidations can create cascading effects in the market, driving prices lower and leading to further sell-offs.

Traders should closely monitor ETH liquidation news as well, as it reflects broader market dynamics. With ETH witnessing 9.43 million USD in liquidations, observing how these trends correlate with BTC can provide valuable insights. Fluctuations in liquidation across multiple cryptocurrencies can indicate overall market confidence or fear, impacting investment strategies across the board.

Impact of BTC Price Drop on Market Sentiment

The recent BTC price drop serves as a pivotal moment for market sentiment and often leads to increased liquidation activities. Traders reacting to price falls through panic selling can exacerbate bearish trends, subsequently resulting in a more pronounced decline in prices. This phenomenon reveals how closely interconnected trader behavior and market indicators are.

In the context of investment strategies, understanding that the BTC price drop can trigger liquidation panic among investors is essential. When traders see falling prices, the propensity to liquidate positions rises, leading to a feedback loop of decreased confidence in Bitcoin’s stability. Therefore, it’s imperative for investors to stay informed about both price trends and market sentiment variables affecting liquidations.

Analyzing Liquidation Data with Coinglass

Coinglass data serves as a crucial tool for understanding cryptocurrency market dynamics. By analyzing the data related to recent liquidations, investors can gain insights into market behavior and trader psychology. For example, the current liquidation statistics reflect a clear trend of greater exposure to long positions, suggesting that many traders were caught off-guard by the rapid price movements.

Moreover, utilizing Coinglass for liquidation analysis can help traders identify patterns that may influence their future trading strategies. For instance, seeing how similar liquidation spikes correlate with market downturns could inform decisions about when to enter or exit positions, ultimately mitigating risks associated with adverse market movements.

The Role of Margin Trading in Liquidations

Margin trading plays a significant role in the occurrence of liquidations in the cryptocurrency market. When traders leverage their positions, they increase potential gains; however, they also amplify their risks. The recent BTC liquidation report illustrates just how quickly those risks can materialize, especially in volatile markets where prices can fluctuate dramatically in short time frames.

Understanding the mechanics of margin trading is crucial for anyone involved in cryptocurrency investments. Awareness of how margin accounts work and the implications of liquidation can help traders adjust their strategies accordingly. Traders should consider maintaining lower leverage and ensuring adequate funds are available to avoid forced liquidations in times of market uncertainty.

Trends in ETH Liquidation News

While BTC often takes the spotlight, tracking ETH liquidation news is equally essential for comprehensive market analysis. The latest reports show that ETH has seen 9.43 million USD liquidated; this trend often indicates how Ethereum’s market responds to fluctuations in BTC prices. As the two cryptocurrencies are intrinsically linked, observing ETH’s movements can offer insights into broader market patterns.

Moreover, trends in ETH liquidations can signal shifts in investor behavior. If a significant amount of ETH is liquidated as BTC experiences a price drop, it can reflect overall market anxiety. Thus, keeping tabs on ETH alongside BTC can equip traders with a more nuanced understanding of market trends, allowing them to pivot their strategies based on multi-coin analyses.

The Cascading Effects of Liquidation Events

Liquidation events do not occur in isolation; they often trigger a chain reaction leading to further market instability. A wave of forced liquidations can cause rapid price declines, which affects not only Bitcoin but the entire cryptocurrency ecosystem. Understanding this ripple effect is vital for traders, especially during periods of high volatility characterized by significant BTC price drops.

Moreover, the cascading effects of liquidations can lead to a loss of confidence among investors. As prices plummet and traders reflect on their losses, it can cause a psychological barrier, making it difficult for them to re-enter the market. Hence, mitigating the impacts of liquidation events requires a deeper understanding of market structure and trader psychology.

Strategies for Managing Liquidation Risks

To effectively manage risks associated with liquidation in the cryptocurrency market, traders must adopt robust strategies. One core approach is employing stricter risk management protocols, including setting stop-loss orders and diversifying investment portfolios. By limiting potential losses, traders can navigate market volatility without facing forced liquidations.

Additionally, traders should aim to stay educated on liquidity trends and use analytic tools like Coinglass to monitor liquidation activities. Understanding the indicators that signal increased liquidation risks allows traders to make proactive adjustments to their trading strategies, reducing vulnerability during peak volatility periods.

Conclusion: Navigating the Liquidation Landscape

As the cryptocurrency market continues to evolve, understanding and navigating the liquidation landscape becomes increasingly critical for traders. With ongoing fluctuations in BTC and ETH prices causing significant liquidation events, grasping the contributing factors is essential for strategic investing. Traders need to keep their ear to the ground and remain adaptable to shifting market conditions.

In conclusion, staying informed about BTC liquidation reports and broader liquidation trends while employing sound trading practices can empower traders to manage risks effectively. By applying lessons learned from recent market behaviors, individuals can build resilience against future liquidation shocks, potentially enhancing their long-term success in the ever-changing world of cryptocurrency.

Frequently Asked Questions

What is the latest BTC liquidation report indicating about market trends?

The latest BTC liquidation report indicates that in the past hour, approximately 19.92 million USD has been liquidated specifically for Bitcoin (BTC). This suggests potential market volatility, as a total of 50.441 million USD was liquidated across the network, primarily from long positions.

How does the BTC liquidation report affect investor strategies?

The BTC liquidation report highlights significant liquidation activity, with 19.92 million USD liquidated in BTC. This data can influence investor strategies, especially during a period of BTC price drop, prompting traders to reassess their risk management and investment decisions.

Where can I find the latest Coinglass data on BTC liquidation?

You can find the latest Coinglass data on BTC liquidation and overall cryptocurrency liquidation reports on the Coinglass website, which provides comprehensive liquidation analysis and up-to-date figures regarding BTC and ETH.

What factors contribute to the liquidation amounts reported for BTC and ETH?

The liquidation amounts reported for BTC and ETH, such as the 19.92 million USD for BTC, are typically influenced by sudden price fluctuations, market sentiment, and overall trading volume. High leverage in long positions can lead to increased liquidation figures, especially during a BTC price drop.

How does the BTC liquidation report compare with Ethereum liquidation news?

Recent BTC liquidation reports show that 19.92 million USD was liquidated, while Ethereum (ETH) liquidation news reports indicate a figure of 9.43 million USD. This comparison highlights a greater level of volatility or over-leverage in the Bitcoin market relative to Ethereum during this reporting period.

What does a high liquidation amount in the BTC liquidation report signify?

A high liquidation amount in the BTC liquidation report, such as the recent 19.92 million USD, signifies increased market volatility and potential rapid price changes. It often reflects high trader leverage and can be an indicator of a bearish market trend.

| Key Point | Amount Liquidated (USD) | Details |

|---|---|---|

| Total Liquidations in Network | 50.441 million | Total liquidations include all cryptocurrencies in the network. |

| Liquidation for BTC | 19.92 million | The liquidation amount specific to Bitcoin. |

| Liquidation for ETH | 9.43 million | The liquidation amount specific to Ethereum. |

| Long Positions Liquidated | 49.3556 million | The majority of liquidations were from long positions. |

| Short Positions Liquidated | 1.0854 million | A small amount of liquidations came from short positions. |

Summary

The BTC liquidation report indicates a significant event where over 50 million USD has been liquidated across the crypto network in just one hour, highlighting the dynamic changes in trading positions among investors. In particular, Bitcoin saw liquidations amounting to 19.92 million USD, showcasing the impact of long positions in the market, which accounted for a staggering 49.3556 million USD of the total. This overview underscores the volatility and rapid shifts in the crypto market, particularly relating to Bitcoin and Ethereum.