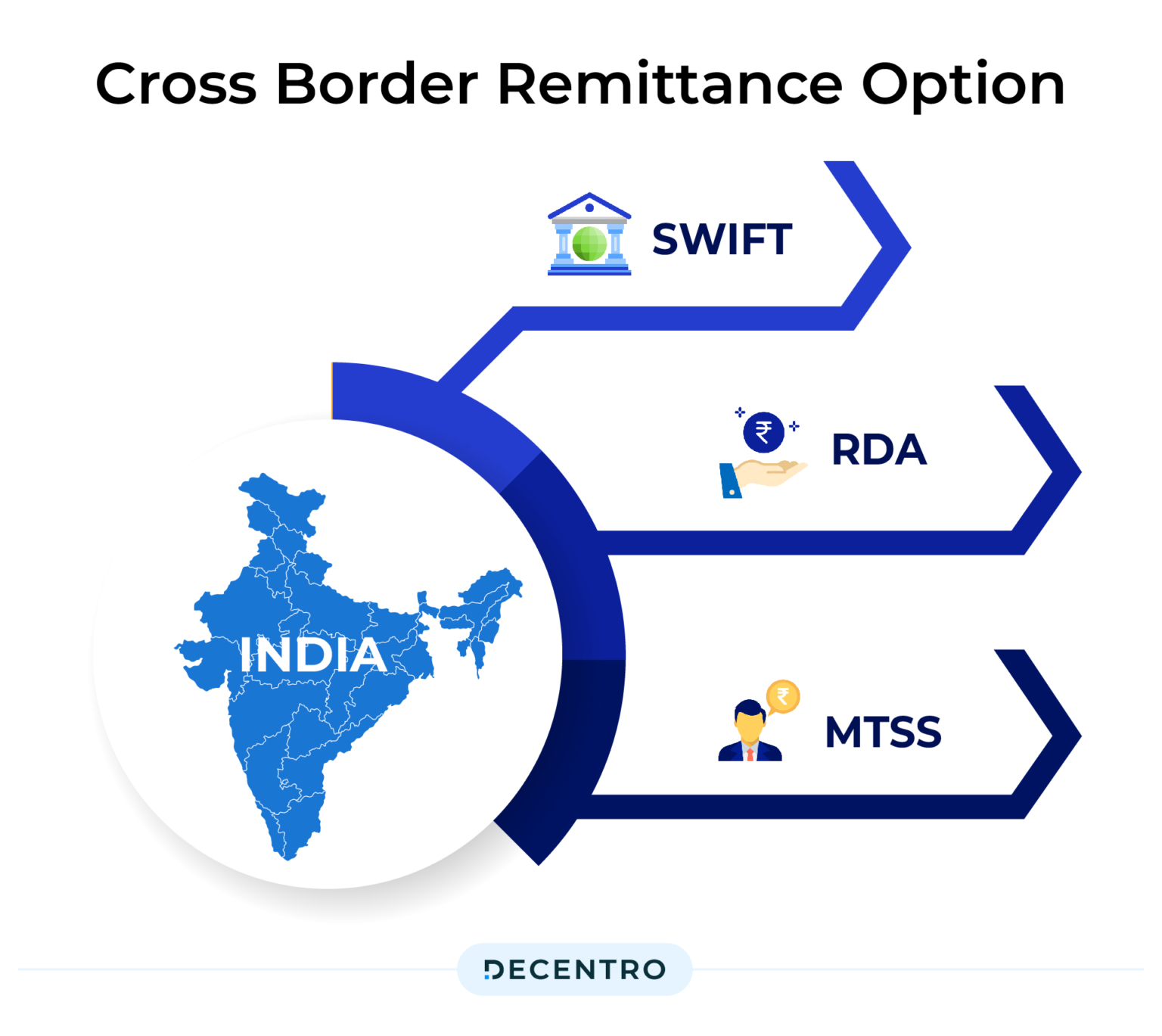

Fin cross-border remittance is revolutionizing the way individuals send money across borders by leveraging stablecoin technology. With the completion of a significant $17 million funding round led by Pantera Capital, Fin is poised to enhance cross-border payment solutions for users globally. The innovative platform focuses on facilitating instant remittances, addressing the prevalent remittance challenges that many face in today’s fast-paced economy. By utilizing stable cryptocurrencies, Fin not only ensures security and efficiency but also lowers the costs typically associated with traditional remittance methods. As the demand for seamless Fin funding continues to rise, the company stands at the forefront of a financial revolution.

Cross-border money transfers have evolved dramatically, as Fin’s pioneering approach demonstrates. This stablecoin-based service aims to simplify international transactions, providing an easy solution to the complex world of global remittances. By focusing on immediate transfers and tackling common remittance hurdles, Fin has garnered considerable investor interest, showing just how vital these payment solutions are. The ability to send funds across borders without the usual delays opens new opportunities for individuals and businesses alike. With innovative funding and strategic partnerships, Fin is set to lead the charge in transforming cross-border remittance operations globally.

Fin’s Impact on Cross-Border Remittance Solutions

Fin is revolutionizing cross-border remittance solutions with its innovative application designed for instant transfers. By harnessing the power of stablecoin technology, Fin facilitates seamless transactions across international borders, significantly reducing the time and costs typically associated with traditional remittance methods. As a result, users can complete large remittances within minutes, overcoming one of the primary remittance challenges faced globally.

The $17 million funding rounds led by Pantera Capital, along with investments from Sequoia and Samsung Next, underline the increasing interest in Fin’s approach to remittances. This financial backing not only strengthens Fin’s capacity to improve its service but also validates the demand for modernized cross-border payment solutions. Fin aims to leverage this funding to expand its offerings and enhance user experience in the remittance landscape.

Addressing Remittance Challenges Through Innovative Solutions

Many individuals and businesses still face significant remittance challenges, including high fees, long processing times, and a lack of trust in traditional banking systems. Fin’s use of stablecoin in cross-border transactions provides a viable alternative that addresses these issues. By minimizing transaction fees and providing a transparent, secure platform for instant remittances, Fin enables users to send money globally with confidence.

Moreover, Fin’s state-of-the-art application is built to support users in navigating the complexities of cross-border payments. With features tailored specifically for large remittances, it ensures that individuals can transfer substantial amounts wisely and efficiently. This customer-centric approach distinguishes Fin from conventional remittance services and strengthens its position in the evolving digital finance marketplace.

Revolutionizing Instant Remittances with Stablecoins

Instant remittances have become increasingly critical in today’s fast-paced world, where immediate access to funds can make a significant difference in urgent situations. Fin is at the forefront of this revolution, employing stablecoin technology to facilitate rapid cross-border payments. Unlike traditional remittance methods that can take days to process, Fin allows users to complete transactions in real time, ensuring that recipients receive their funds instantly.

The integration of stablecoins into Fin’s remittance platform presents a host of advantages, including stability in value and reduced volatility compared to traditional cryptocurrencies. This ensures that users can send and receive money without the fear of fluctuating exchange rates impacting the amount received. Consequently, Fin is paving the way for a more reliable and efficient remittance process that meets the needs of a diverse audience.

Funding Developments in the Fintech Sector

The recent completion of Fin’s $17 million financing round heralds a significant milestone in the fintech sector, showcasing the growing interest in innovative cross-border payment solutions. With contributions from notable investors like Pantera Capital, Sequoia, and Samsung Next, this funding signals the potential of Fin to disrupt traditional remittance models and expand its reach.

Investors are increasingly recognizing the importance of instant remittances and the role that blockchain technology plays in redefining financial services. Fin’s strategic funding allows the company to invest in technology enhancements and broaden its market presence, addressing the pain points often associated with remittance challenges while establishing itself as a leader in the fintech space.

The Future of Cross-Border Payments

As technology continues to evolve, the landscape of cross-border payments is shifting rapidly towards more efficient, user-friendly solutions. Fin’s application, powered by stablecoins, represents a future where remittance services are not only faster but more accessible to people worldwide. This shift is essential, especially for individuals in developing nations where traditional banking systems may be insufficient or unreliable.

Moving forward, the focus on instant remittances through innovative platforms like Fin may lead to a significant reduction in transaction costs and barriers to entry. Fin’s ambition to solve major remittance challenges will encourage more users to transition to digital solutions, ultimately contributing to the financial inclusivity that many regions desperately need.

What Makes Fin a Game Changer in Remittances

Fin stands out as a game changer in the remittance space due to its commitment to leveraging stablecoin technology for cross-border transactions. By prioritizing user experience, Fin has designed its service to be intuitive and accessible. This focus on usability is critical in attracting individuals who may have previously been deterred by complexity and fees associated with traditional remittance services.

Additionally, Fin’s partnerships with leading investors and fintech experts enhance its credibility and operational capacity. The company’s innovative approach not only addresses the immediate needs of users but also sets the stage for expanding financial services across borders. Such advancements could lead to more robust ecosystems where users can exchange value easily and securely.

The Role of Investment in Fin’s Growth

Investment plays a pivotal role in the growth trajectory of Fin, especially in refining its technology to better serve customers. The $17 million funding round showcases the trust investors have in Fin’s potential to transform cross-border remittances. These funds are essential for ongoing research and development, which will enhance the application’s functionalities.

Moreover, with strong backing from top-tier investors, Fin can explore strategic partnerships and market opportunities that would otherwise be inaccessible. By bolstering its financial foundation, Fin is well-positioned to scale its operations and solidify its presence in the competitive remittance market.

User-Centric Features of Fin’s Application

Fin’s technology prioritizes user-centric features designed to enhance the overall remittance experience. With an emphasis on instant remittances, the application provides straightforward navigation, allowing users to execute transactions quickly. Features such as transaction tracking, real-time exchange rates, and low fees are incorporated, making Fin’s platform appealing to both casual senders and businesses making larger remittance transactions.

Additionally, the focus on security is paramount, with advanced encryption measures protecting user data and transactions. Fin aims to build a community of trust among users who may be wary of digital payments, thereby encouraging the adoption of their innovative remittance solutions over traditional methods.

The Growing Need for Reliable Remittance Solutions

In an increasingly globalized economy, the need for reliable remittance solutions has never been more pressing. Millions of individuals rely on cross-border transactions to support their families and businesses, highlighting the demand for services like those provided by Fin. As many face challenges with existing platforms, Fin’s approach to stablecoin remittances is both timely and necessary.

Better reliability and efficiency can lead to broader economic benefits, allowing families to receive funds more quickly and businesses to operate more effectively across borders. As Fin continues to innovate and expand, it will play a crucial role in addressing the growing demand for seamless and trustworthy remittance solutions in today’s dynamic financial landscape.

Frequently Asked Questions

What is Fin cross-border remittance and how does it work?

Fin cross-border remittance utilizes stablecoin technology to facilitate instant remittances across borders, enabling users to send money quickly and efficiently while addressing remittance challenges such as high fees and slow transaction times.

How does Fin’s stablecoin remittance compare to traditional cross-border payment solutions?

Fin’s stablecoin remittance offers significant advantages over traditional cross-border payment solutions by providing faster transaction speeds, lower costs, and enhanced security, thanks to blockchain technology that underpins stablecoins.

What are the benefits of using Fin funding for cross-border remittances?

Using Fin funding for cross-border remittances provides users with immediate access to their funds, mitigating the typical delays associated with traditional remittance services, while also benefiting from reduced transaction costs and improved customer experience.

What challenges does Fin aim to solve with its cross-border payment solutions?

Fin aims to solve various remittance challenges, including high transaction fees, currency volatility, and lengthy transfer times, by leveraging stablecoin technology to provide a more reliable and cost-effective alternative for users worldwide.

Is Fin’s instant remittances service available globally?

Yes, Fin’s instant remittances service aims to be accessible worldwide, targeting individuals and businesses needing efficient cross-border transactions, regardless of their geographic location.

How does Fin ensure security in its cross-border remittance transactions?

Fin ensures security in its cross-border remittance transactions by utilizing blockchain technology, which provides a transparent and immutable record of transactions, coupled with advanced encryption methods to protect user data.

Can large remittances be sent using Fin’s cross-border payment solutions?

Absolutely, Fin’s cross-border payment solutions are designed to handle large remittances efficiently, ensuring users can transfer significant amounts of money while minimizing costs and transaction times.

What makes stablecoin remittance through Fin a compelling choice?

Stablecoin remittance through Fin is compelling due to its ability to combine the speed of instant transfers, the stability of digital currencies, and the low costs associated with blockchain technology, making it a favorable choice for global remittances.

How does Fin address the remittance challenges faced by users?

Fin addresses remittance challenges by offering competitive pricing, fast transaction speeds, and a user-friendly platform that simplifies the process of sending money across borders, ultimately enhancing the overall remittance experience.

What recent developments have impacted Fin’s cross-border remittance services?

Recent developments, including Fin’s successful $17 million financing round led by Pantera Capital, enhance its ability to expand and improve cross-border remittance services, ensuring continued investment in technology and user support.

| Key Point | Details |

|---|---|

| Company Overview | Fin is a stablecoin cross-border remittance company. |

| Funding Information | The company has completed a $17 million financing round led by Pantera Capital, with participation from Sequoia and Samsung Next. |

| Valuation Details | Fin has not disclosed the valuation information for this funding round. |

| Product Feature | The application developed by Fin allows for instant cross-border remittances, including large remittances. |

| Problem Solving | Fin aims to address remittance challenges faced by users worldwide. |

Summary

Fin cross-border remittance is revolutionizing the way individuals send and receive money across borders. With the recent completion of a substantial $17 million funding round, Fin is set to enhance its offering of instant remittance services, targeting the persistent challenges users face globally. This innovative approach, backed by major industry investors like Pantera Capital and Sequoia, positions Fin as a key player in the financial technology landscape.