Federal Reserve profitability has been a hot topic in recent financial discussions, particularly as recent data indicates a significant turnaround from a previous three-year loss. Since November, the central bank has made strides in returning to profitability, which is essential for stabilizing the nation’s economic outlook. This positive shift is reflected in the reduction of deferred assets, which have dropped from $243.8 billion to $243.2 billion in just over three weeks. Moreover, the impact of interest rate cuts has played a crucial role in diminishing the costs associated with maintaining the federal funds rate, further improving the institution’s fiscal health. As the Federal Reserve adjusts its monetary policy update, market watchers will keenly observe how these changes may affect future interest rates and overall economic stability.

The financial performance of the Federal Reserve has recently garnered attention as the institution shifts from losses to gains, signaling a recovering economic landscape. This pivot reflects a decrease in liabilities relating to deferred assets, which had previously burdened the bank’s balance sheet. The central bank’s adjustments in monetary policy, including interest rate reductions, have eased the financial pressures it faces. With the recent federal funds rate maintained at a lower level, analysts are keen to assess the implications of these changes on broader financial markets. As conversations about the central bank’s profitability unfold, stakeholders remain alert to upcoming decisions that will shape future economic conditions.

The Federal Reserve’s Profitability Turnaround

The Federal Reserve’s journey back to profitability marks a significant turnaround after navigating an unprecedented period of losses over the last three years. As of early November, the central bank is reporting a positive shift in its financial performance, which is crucial for restoring confidence in its monetary policy and operational efficiency. This resurgence means that the Federal Reserve can start addressing and offsetting the substantial accounting entries related to its prior losses. The recent data indicating a return to profitability is a strong signal that the measures taken to stabilize the federal funds rate and reduce interest rate cuts are yielding positive results.

Additionally, the reduction in deferred assets from $243.8 billion to $243.2 billion highlights the Fed’s improving financial health. These assets represent the accumulated losses that the Federal Reserve had previously recorded, primarily due to the costs entailed in managing the federal funds rate. As interest rate cuts have begun to stabilize federal funds costs, the long-term financial outlook for the Federal Reserve appears more promising. Such a return to profitability is critical not only for the bank but also for the broader economy, as it indicates effective management of monetary policy and the potential for future stabilization in interest rates.

Impact of Interest Rate Cuts on Financial Performance

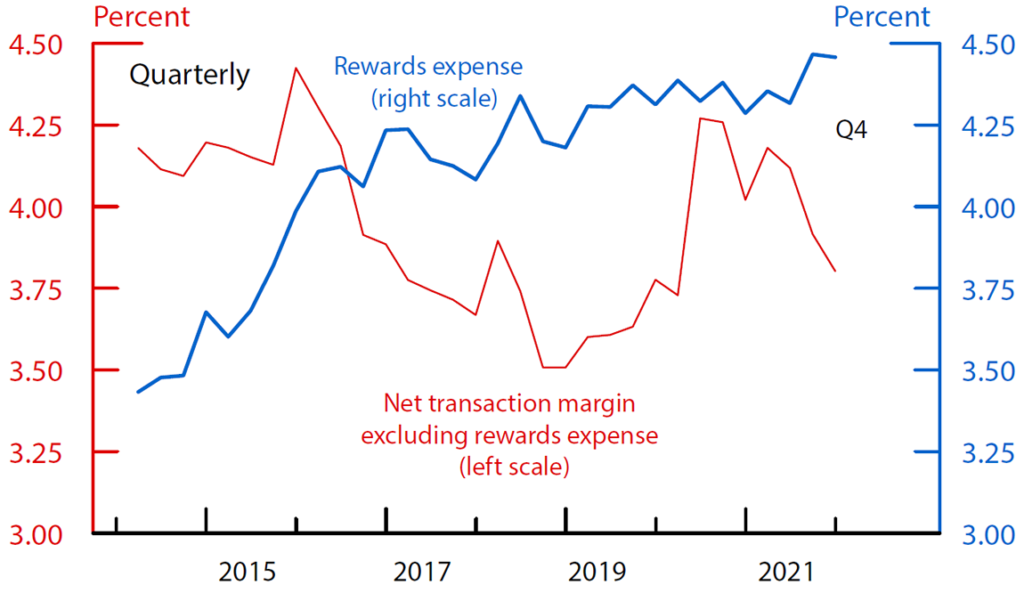

Interest rate cuts implemented by the Federal Reserve have played a pivotal role in curtailing its financial losses. These cuts, designed to stimulate the economy during uncertain times, have resulted in reduced expenses for the Federal Reserve regarding payments to banks. By maintaining the federal funds rate within the range of 3.75% to 4%, the Fed is fostering an environment where borrowing becomes cheaper, thus encouraging spending and investment. This reduction in interest rates has not only helped businesses but has also contributed significantly to the Federal Reserve’s move back into profitability.

Moreover, the strategic alignment of interest rates with the prevailing economic conditions has enabled the Federal Reserve to mitigate risks associated with financial instability. As the economy adjusts to lower interest rates, consumer confidence tends to rise, further supporting economic growth. If the Federal Reserve contemplates additional cuts, it will be crucial for monitoring inflation and ensuring that such measures do not lead to unwanted economic overheating. The delicate balancing act highlights the importance of ongoing adjustments in monetary policy to safeguard the Fed’s financial health while fulfilling its dual mandate of maximum employment and price stability.

Federal Reserve Monetary Policy Updates and Future Directions

The Federal Reserve’s monetary policy updates are a vital component of its financial strategy and have garnered significant attention in recent Federal Reserve news. Recent shifts, particularly regarding interest rate adjustments, serve as a response to changing economic conditions, including concerns about the labor market. The Fed’s proactive measures to lower interest rates signal its commitment to fostering economic growth even amid uncertainties. These updates not only inform market participants about upcoming adjustments but also promulgate transparency and credibility in the central banking process.

As the Federal Reserve continues to monitor inflation rates and overall economic growth, future monetary policy updates may include further interest rate cuts. Such decisions will likely hinge on labor market outcomes and other macroeconomic indicators. Although officials express concerns about potential slowdowns, the overarching goal remains to maintain a stable economic environment conducive to long-term growth. Looking ahead, the Federal Reserve’s approach will be essential in navigating challenges and sustaining its recent return to profitability.

Understanding Deferred Assets in Federal Reserve Operations

Deferred assets are critical to understanding the financial operations of the Federal Reserve, particularly in light of recent profitability updates. These assets represent the accumulated financial toll incurred from previous operational losses, and as of late November, the Federal Reserve has successfully reduced its deferred assets from $243.8 billion to $243.2 billion. This decline suggests that the Fed is successfully managing its expenses and gradually recovering from a challenging financial period. Financial analysts closely monitor these metrics as they reflect the effectiveness of the Fed’s monetary policy in fostering economic stability.

The declining amount of deferred assets also symbolizes a turning point in the Federal Reserve’s quest for financial sustainability. By actively addressing these deferred entries through smart monetary policy decisions, the Fed aims to restore its credibility and bolster its operational resilience. As the economy progresses, continued focus on reducing deferred assets will be essential for reinforcing public confidence and supporting the Federal Reserve’s monetary goals.

Future Outlook for Federal Reserve and Economic Stability

The future outlook for the Federal Reserve involves careful scrutiny of economic indicators and ongoing adjustments to its monetary policy. As recent data shows a return to profitability, the Fed is in a better position to navigate potential economic headwinds. Ensuring economic stability while maintaining an appropriate federal funds rate will be critical as market conditions evolve. Key indicators such as inflation and labor market data will shape future policy decisions, possibly leading to further interest rate adjustments if deemed necessary.

In the coming months, the Federal Reserve will likely focus on reinforcing its commitment to transparency and responsiveness to economic shifts. Market participants will be watching closely for signals regarding interest rate cuts or any monetary policy updates that could affect their investment strategies. A balanced approach allows the Fed to maintain its dual mandate while striving to minimize risks associated with fluctuations in the economy. By taking these factors into consideration, the Federal Reserve aims to foster sustainable growth and ensure its ongoing profitability.

Frequently Asked Questions

What is the current status of Federal Reserve profitability?

As of recent data, the Federal Reserve has returned to profitability after experiencing an unprecedented three-year loss. This turnaround was noted since early November, as profitability started to offset prior accounting entries related to past losses.

How have deferred assets impacted the Federal Reserve’s profitability?

Deferred assets have decreased from $243.8 billion to $243.2 billion between November 5 and November 26. This reduction in deferred assets is a positive indicator of the Federal Reserve’s improved profitability and financial health.

What role do interest rate cuts play in Federal Reserve profitability?

Interest rate cuts have significantly contributed to the Federal Reserve’s return to profitability. The costs associated with maintaining the federal funds rate target have decreased, primarily due to the rates being lowered, which positively affects the Fed’s profit margins.

What is the current federal funds rate and its relevance to Federal Reserve profitability?

The current federal funds rate is maintained between 3.75% and 4%. This rate has decreased from its 2023 peak of 5.25% to 5.5%, helping to alleviate losses and improve the Federal Reserve’s profitability outlook.

How does monetary policy affect the Federal Reserve’s profitability?

Monetary policy, including interest rate adjustments, directly impacts the Federal Reserve’s profitability. The Federal Reserve’s decisions on rate cuts have played a key role in stabilizing its financial position and reducing operational losses.

Are further interest rate cuts likely to occur, and how would that affect Federal Reserve profitability?

Given concerns about labor market conditions, further interest rate cuts by the Federal Reserve may be possible. Such cuts could continue to enhance profitability by lowering the costs incurred from maintaining the federal funds rate.

| Key Point | Details |

|---|---|

| Return to Profitability | The Federal Reserve has ended a three-year loss streak and returned to profitability as of November 2023. |

| Deferred Assets Reduction | The Federal Reserve’s deferred assets decreased from $243.8 billion on November 5 to $243.2 billion on November 26. |

| Impact of Interest Rates | The end of interest rate cuts has halted losses, with current rates held between 3.75% to 4%. |

| Future Outlook | The Federal Reserve may consider further interest rate reductions due to concerns over labor market conditions. |

Summary

Federal Reserve profitability has recently improved as the institution has returned to profit after a difficult three years. The reduction in deferred assets and stable interest rates have contributed to this positive trend. Going forward, monitoring labor market conditions will be crucial as potential interest rate cuts could further influence the Federal Reserve’s financial health.