In the world of cryptocurrency trading, the recent increase in a ZEC long position has captured considerable attention. A prominent whale recently made headlines by depositing $4.49 million USDC into HyperLiquid, aiming to amplify its ZEC long position by an astounding 10 times. This significant investment highlights not only the potential of ZEC trading but also the intriguing dynamics of crypto whale activity. As leverage trading continues to gain traction, such moves indicate a robust confidence in the future of this digital asset. Keeping an eye on HyperLiquid news can provide valuable insights for investors looking to explore similar strategies.

When discussing leveraged investments in ZEC, it’s important to recognize the broader implications of such significant financial maneuvers. The whale’s decision to substantially increase its holdings by using USDC is a strategic play in the volatile landscape of cryptocurrency. Positions like these reflect the intricate relationships between various digital currencies and the influence of large-scale investors. Moreover, understanding the factors driving long positions in ZEC can help traders navigate the complexities of leverage trading effectively. As the market evolves, staying informed about major players and their strategies will be crucial for anyone looking to succeed in crypto investments.

Understanding ZEC Long Positions in Crypto Trading

Investing in a ZEC long position can be a strategic decision for traders seeking to capitalize on potential price increases in Zcash (ZEC). Leveraging a position can amplify both returns and risks; in this case, the whale’s decision to use a 10 times leverage highlights a significant confidence in ZEC’s future performance. By deploying $4.49 million USDC into HyperLiquid, the whale aims to maximize their exposure to ZEC’s price movements. Such long positions are common in the crypto trading realm where volatility can lead to substantial profits.

Moreover, ZEC trading attracts diverse participant profiles, from retail investors to institutional whales. The leverage allows for the purchase of more ZEC than one’s capital would normally allow, thereby multiplying the potential return on investment. However, it also necessitates a thorough understanding of market dynamics and potential risks involved, particularly with leveraged instruments. With recent trends in crypto whale activity, traders are often looking for signals or potential market shifts that could indicate the right moment to enter or exit a long position.

The Impact of Whale Activity on ZEC Market Trends

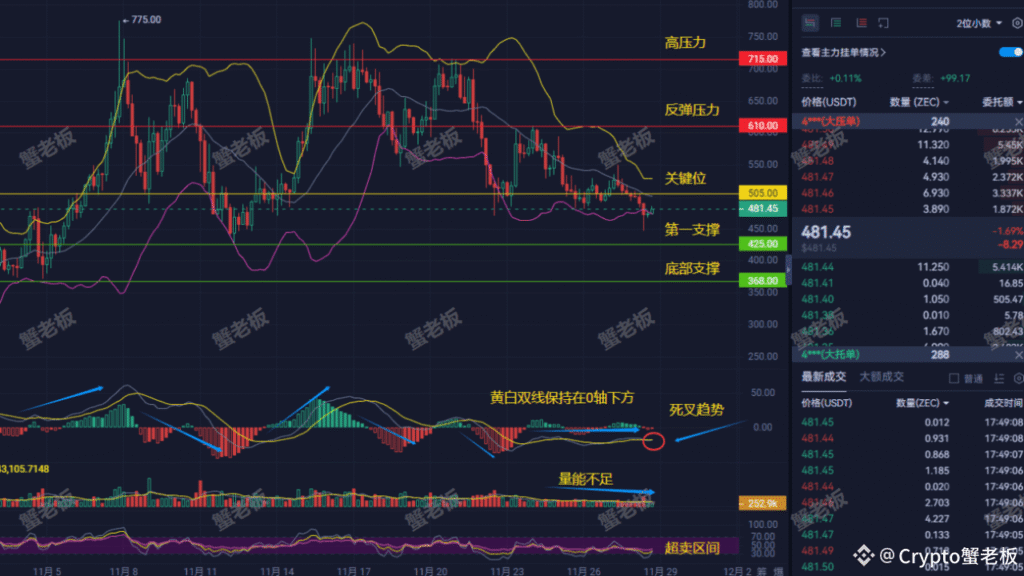

Whale activity can significantly influence market sentiment and price movements within the ZEC ecosystem. The recent deposit of $4.49 million USDC into HyperLiquid is a notable example of how large-scale transactions can affect trading volumes and attract attention in the market. When whales execute large trades, they often trigger reactions from retail investors, leading to increased volatility. This phenomenon is observable in ZEC’s trading chart, where spikes in price are frequently correlated with significant whale transactions.

Additionally, monitoring these large trades can provide insights into potential long-term market trends. For instance, if a whale maintains its long position and continues to invest heavily in ZEC, it may signal confidence that could encourage other investors to follow suit. This ripple effect is vital for considering USDC investments and understanding the broader context of leverage trading strategies employed by various actors in the market.

Leverage Trading: Risks and Rewards in Crypto Markets

Leverage trading is a double-edged sword in the realm of cryptocurrency, promising both amplified rewards and increased risks. Utilizing leverage allows traders to control larger positions than their actual capital would permit, as seen with the recent whale’s significant long position in ZEC. While potential profits can grow exponentially, the downside risks are equally significant. A small unfavorable move in the price of ZEC can result in substantial losses, especially for highly leveraged positions, which may lead to liquidations.

For traders considering leverage trading, it’s critical to implement risk management strategies, such as stop-loss orders, to mitigate potential losses. The current market environment, intensified by whale activity and the volatility of cryptocurrencies, necessitates vigilance and strategy formulation. While the potential to earn greater profits exists, the trader must remain acutely aware of how rapid price fluctuations can affect their leveraged investments.

Recent HyperLiquid News and Market Movements

HyperLiquid has emerged as a significant platform for traders seeking to interact with cryptocurrencies via leverage trading options. The latest news regarding the whale’s $4.49 million USDC deposit is a clear indicator of the growing activity and interest in leveraging positions within the platform. As more traders flock to HyperLiquid to take advantage of its features, the platform’s role in shaping the dynamics of ZEC trading becomes increasingly pronounced.

Such developments often lead to increased scrutiny of market behaviors and trading patterns. Crypto enthusiasts and analysts alike are keenly observing how HyperLiquid handles these larger transactions, as they provide vital data for understanding trader sentiment and market viability. As more significant movements occur, keeping abreast of HyperLiquid news will be crucial for anyone involved in ZEC trading or other cryptocurrencies.

The Role of USDC in Crypto Investments

USDC, a stablecoin tied to the US dollar, serves as a critical tool for crypto investors looking to hedge against volatility. In the context of the recent whale activity, the $4.49 million USDC deposit into HyperLiquid signifies a strategic move towards stability amidst unpredictable market conditions. Using stablecoins like USDC for trading allows investors to swiftly enter and exit positions without the complexities of converting from one crypto to another during a trade.

Moreover, the increasing use of USDC in transactions complements broader trends in digital asset investments. As more investors recognize the value of stablecoins for their liquidity and stability, USDC’s prominence is likely to grow, especially in leverage trading scenarios where quick maneuverability can lead to favorable outcomes. The implications of using USDC in such high-stakes environments warrant close monitoring by traders aiming for successful outcomes in their ZEC investments.

Market Sentiment and Leveraged Trading: A Delicate Balance

Market sentiment plays an indispensable role in the dynamics of leveraged trading, particularly within the crypto space. The recent whale’s actions reflect a bullish sentiment surrounding ZEC, which could influence other traders’ psychology and trading behaviors significantly. When major players position themselves strongly in particular assets, such as increasing a ZEC long position, it often leads to heightened interest and participation from smaller traders.

However, with this increased activity comes the challenge of maintaining a balanced market environment. Traders must be cautious of overexcitement driven by significant whale movements, as rapid price changes can lead to emotional and reactive trading decisions. A well-informed trader recognizes that while whale activity can provide insights, relying solely on these signals without a thorough analysis of market indicators may lead to unfortunate trading outcomes in leveraged scenarios.

Analyzing Long Positions: Strategies and Considerations

When analyzing long positions in cryptocurrencies like ZEC, having a strategic framework is essential to navigate the complexities involved. The decision made by the whale to increase its long position using leverage illustrates a targeted approach that could yield substantial rewards if the market moves in their favor. Traders considering similar strategies should assess fundamental and technical indicators to determine optimal entry and exit points.

Moreover, employing analytics tools and market predictions is crucial for long-position strategies. Keeping an eye on developments in crypto whale activity, and how it can impact ZEC markets, offers additional layers of insight. It also helps in aligning trading activities with market trends, enhancing the likelihood of success in leveraged investments in ZEC or any cryptocurrency.

Leveraging ETH and DYDX: A Comparative Analysis

The trading maneuvers of the whale reveal a diverse investment strategy, showcasing not only a 10 times long position in ZEC but also involvement in ETH and DYDX trading with varying leverage. This comparative analysis highlights how different cryptocurrencies can function within a portfolio, allowing for diversified risk exposure. The whale’s penchant for higher leverage in ETH (20 times) and a more moderate approach with DYDX (5 times) indicates a nuanced understanding of each asset’s market behavior.

Such diversification can help manage potential losses while maximizing profit opportunities across different trading environments. For traders considering similar strategies, it’s vital to understand the distinct market forces at play for each cryptocurrency involved. By weighing the risks and rewards of leveraged positions in ZEC alongside ETH and DYDX, investors can develop a robust trading strategy that caters to market conditions and personal risk tolerance.

Future Outlook for ZEC and the Broader Crypto Market

The future of ZEC and the broader crypto market remains an area of great interest for investors, especially following impactful moves from large players. The whale’s significant long position indicates a belief in the positive trajectory of ZEC’s price, bolstered by current trends in USDC investments and leverage trading. As more investors engage with ZEC, the overall market dynamics may shift, potentially leading to price appreciation and increased liquidity.

However, the volatile nature of cryptocurrencies necessitates a watchful eye on external factors, such as regulatory changes, technological advancements, and market sentiment shifts. Traders and investors alike should remain agile and responsive to these changes to strategically position themselves in both long and short positions for ZEC and other assets within the cryptocurrency ecosystem.

Frequently Asked Questions

What is a ZEC long position and how does it relate to ZEC trading?

A ZEC long position refers to a trading strategy where an investor anticipates that the price of ZEC (Zcash) will rise, allowing them to profit from the increase. In ZEC trading, taking a long position typically involves entering the market with expectations of future price increases, supported by trading platforms like HyperLiquid.

How does leverage trading work in the context of ZEC long positions?

Leverage trading allows an investor to control a larger position in ZEC by borrowing funds from the trading platform. For instance, if a whale deposited $4.49 million USDC into HyperLiquid to enhance their ZEC long position by 10 times leverage, they could control a position worth $44.9 million, amplifying potential profits or losses.

Why are crypto whales increasing their ZEC long positions on platforms like HyperLiquid?

Crypto whales often increase their ZEC long positions based on market trends, potential price surges, or strategic investment decisions. For instance, a whale depositing $4.49 million USDC into HyperLiquid to boost its ZEC long position suggests confidence in ZEC’s price performance and long-term value.

What impact does whale activity have on ZEC trading and market dynamics?

Whale activity, such as substantial deposits to increase ZEC long positions, can significantly impact ZEC trading by influencing price movements and market sentiment. Increased long positions may signal bullish trends, potentially attracting more traders and investors to ZEC.

How does a 10 times leveraged long position affect risk in ZEC trading?

A 10 times leveraged long position in ZEC trading amplifies both potential gains and losses, making it a high-risk strategy. For example, while a whale might aim for increased profits, they also expose themselves to greater risks, evidenced by significant unrealized losses from their leveraged positions.

What should investors consider before entering a ZEC long position?

Before entering a ZEC long position, investors should consider market conditions, leverage risks, and their investment strategy. Additionally, monitoring influencer activity, like whale trades or USDC investments, can provide insights into market trends, particularly on platforms like HyperLiquid.

How significant is the recent whale deposit of $4.49 million USDC for ZEC long positions?

The recent whale deposit of $4.49 million USDC into HyperLiquid to bolster a ZEC long position is significant as it indicates institutional confidence in ZEC’s market potential. Such large transactions can also affect market dynamics by signaling increased interest among other traders.

What strategies can retail investors use to replicate the success of whales in ZEC trading?

Retail investors can study the strategies employed by crypto whales, such as utilizing leverage trading and focusing on high-impact news like HyperLiquid developments. They should also consider risk management and timing their entries and exits based on market analysis.

| Key Point | Details |

|---|---|

| Whale Investment | A whale deposited $4.49 million USDC into HyperLiquid. |

| Leverage Increase | The investment boosts its ZEC long position by 10 times. |

| Open Orders | The whale still has open orders to increase ZEC holdings further. |

| Other Positions | Additionally, the whale holds long positions in ETH (20x leverage) and DYDX (5x leverage). |

| Unrealized Losses | Currently showing an unrealized loss of $1.29 million with total losses of $2.7 million. |

Summary

ZEC long position is notably attractive, especially after a whale’s significant investment of $4.49 million USDC into HyperLiquid, enhancing its leverage by 10 times. This demonstrates a strong commitment to ZEC by strategic investors. Moreover, the whale’s pursuit of further acquisitions indicates bullish sentiment for ZEC, despite facing unrealized losses in other assets. Overall, ZEC remains a focal point for investment strategies, as indicated by this major transaction.