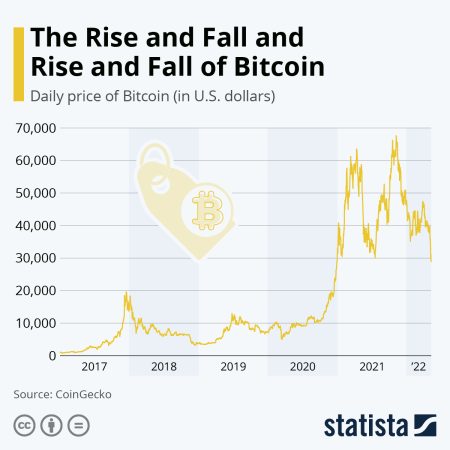

In a remarkable turn of events, Bitcoin recently surged past the $123,000 mark, edging closer to its all-time high and creating a buzz in the cryptocurrency markets. This surge is largely attributed to the bullish sentiment surrounding the fourth quarter of the year, which has seen a wave of optimism among investors. Historically, Q4 has been a strong period for cryptocurrencies, and this year appears no different.

The recent rally has been fueled by several factors, including increasing institutional interest, regulatory clarity in key markets, and a general uptrend in global stock markets. Investment giants are increasingly allocating portions of their portfolios to Bitcoin and other cryptocurrencies, seeing them as a hedge against inflation and currency devaluation. This shift is transforming Bitcoin from a speculative asset to a more credible investment option.

Moreover, the rise is also being supported by positive developments within the crypto ecosystem, such as advancements in blockchain technology and growing mainstream acceptance. Major companies are now integrating cryptocurrencies into their payment systems, further legitimizing Bitcoin’s role in the financial landscape.

As the year draws to a close, investors are optimistic that Bitcoin will continue its upward trajectory, potentially reaching new heights. This week-long rally has ignited discussions on various platforms, with traders and enthusiasts actively sharing their predictions and strategies. As Bitcoin approaches a new record, all eyes will be on its next move, making it an exciting time for the cryptocurrency community.