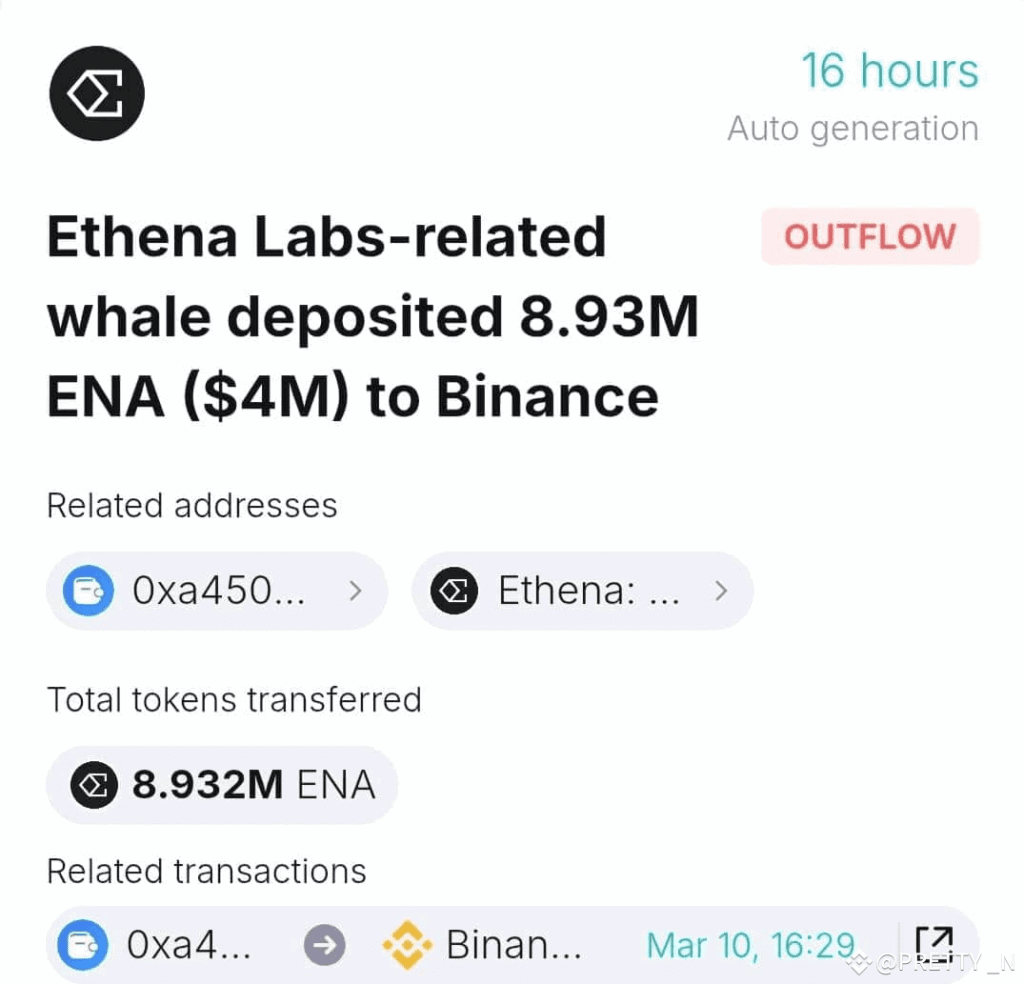

Ethena Labs Whale Movement has become a hot topic in the crypto community, especially after recent developments tracking significant whale crypto transactions. According to OnchainLens, a whale linked to Ethena Labs has received an impressive 46.79 million ENA from Bybit, amounting to roughly 12.78 million dollars. Notably, 21.79 million ENA, valued at about 5.23 million dollars, was sourced from Coinbase withdrawals, raising eyebrows among crypto market analysts. This surge in activity hints at potential shifts within the ecosystem, as the whale now holds a staggering 451.94 million ENA, translating to an astounding 121.8 million dollars at current market prices. As the landscape evolves, the implications of these movements will undoubtedly ripple through the crypto market, making it essential to stay updated with the latest Ethena Labs news and trends.

The recent dynamics surrounding major players in the cryptocurrency sector, particularly the movements of significant assets by entities associated with Ethena Labs, have captured the attention of traders and analysts alike. This surge, marked by substantial transfers from exchanges like Bybit and withdrawals from platforms such as Coinbase, underscores a critical trend in the digital currency space. The analysis of these large-scale transactions is crucial for understanding market behavior and predicting future price movements. As such, keeping an eye on these influential crypto figures can provide valuable insights into overarching market strategies and investor sentiments. As experts continue to dissect these transactions, the relevance of whale engagement in shaping the crypto markets cannot be understated.

Ethena Labs Whale Movement: Big Transactions Shaping the Crypto Market

Recent monitoring by OnchainLens has revealed significant whale transactions linked to Ethena Labs that may impact the cryptocurrency landscape. A notable transaction involved a whale receiving 46.79 million ENA from Bybit, with the current market value translating to approximately 12.78 million dollars. These types of large transfers highlight the ongoing activity of high-net-worth individuals in the crypto space and their potential influence on market dynamics.

Additionally, the whale’s holdings now total around 451.94 million ENA, which brings its total estimated worth to around 121.8 million dollars. Such massive transactions and accumulations often lead to speculation within the community, stirring interest in how they might affect token liquidity and price movements. Furthermore, as this whale previously withdrew 21.79 million ENA from Coinbase, it’s essential to analyze such activities as they can provide deeper insights into investor sentiment and broader market trends.

Frequently Asked Questions

What recent activities have been reported regarding Ethena Labs Whale Movement?

Recent monitoring by OnchainLens revealed that a whale connected to Ethena Labs received 46.79 million ENA from Bybit, valued at approximately 12.78 million dollars. This movement highlights the significant transactions involving the Ethena Labs whale and its impact on the crypto market.

How much ENA has the Ethena Labs whale recently received from Bybit?

The Ethena Labs whale recently received 46.79 million ENA from Bybit, which is currently worth about 12.78 million dollars. This transaction showcases the large-scale crypto movements associated with Ethena Labs.

What is the origin of the funds transferred to the Ethena Labs whale?

The funds received by the Ethena Labs whale include 21.79 million ENA, approximately worth 5.23 million dollars, which were withdrawn from Coinbase about three and a half months ago. This indicates a strategic approach in whale crypto transactions.

How much ENA does the Ethena Labs whale currently hold?

As of now, the Ethena Labs whale holds approximately 451.94 million ENA, valued at around 121.8 million dollars based on current market prices. This substantial holding demonstrates the influence of Ethena Labs in the crypto market.

What insights can be gained from the crypto market analysis regarding Ethena Labs whale transactions?

Crypto market analysis, particularly regarding the Ethena Labs whale’s transactions, suggests a trend of significant asset allocation and strategic movements in whale crypto transactions. The recent influx of ENA from Bybit could indicate confidence in the asset and potential future market movements.

How do Coinbase withdrawals play a role in the Ethena Labs Whale Movement?

Coinbase withdrawals have been integral to the Ethena Labs Whale Movement, with a portion of the funds contributing to recent ENA transactions. Specifically, 21.79 million ENA withdrawn from Coinbase three months ago were part of the total inflow observed in the recent Bybit transfer.

Why is the Ethena Labs whale significant in the current cryptocurrency landscape?

The Ethena Labs whale is significant due to its substantial holdings and activity within the crypto market, particularly the recent transactions involving millions of ENA. Such movements can influence market trends and investor sentiment, making it a focal point for crypto market analysis.

What are the implications of whale crypto transactions for the broader market?

Whale crypto transactions, such as those by the Ethena Labs whale, can significantly impact market dynamics. Large transfers can create volatility, influence pricing, and encourage trading activity among other investors, showcasing the importance of monitoring these entities in cryptocurrency.

| Key Point | Details |

|---|---|

| Whale Entity | Suspected to be associated with Ethena Labs |

| Total ENA Received | 46.79 million ENA (approx. $12.78 million) |

| Source of ENA Funds | 21.79 million ENA ($5.23 million) withdrawn from Coinbase |

| Current Holdings | Approximately 451.94 million ENA (approx. $121.8 million) |

| Monitoring Source | Data monitored by OnchainLens |

Summary

Ethena Labs Whale Movement is a significant occurrence in the crypto market, highlighted by a whale linked to Ethena Labs receiving a staggering 46.79 million ENA. This transfer, valued at approximately 12.78 million dollars, indicates active participation from substantial investors in the market. Notably, a portion of these funds, amounting to 21.79 million ENA, was sourced from prior withdrawals on Coinbase, signifying strategic movements within crypto exchanges. The whale’s total holdings now stand at approximately 451.94 million ENA, reflecting a market value of around 121.8 million dollars. This activity exemplifies the influential role of whales in cryptocurrency dynamics and their potential impact on market trends.