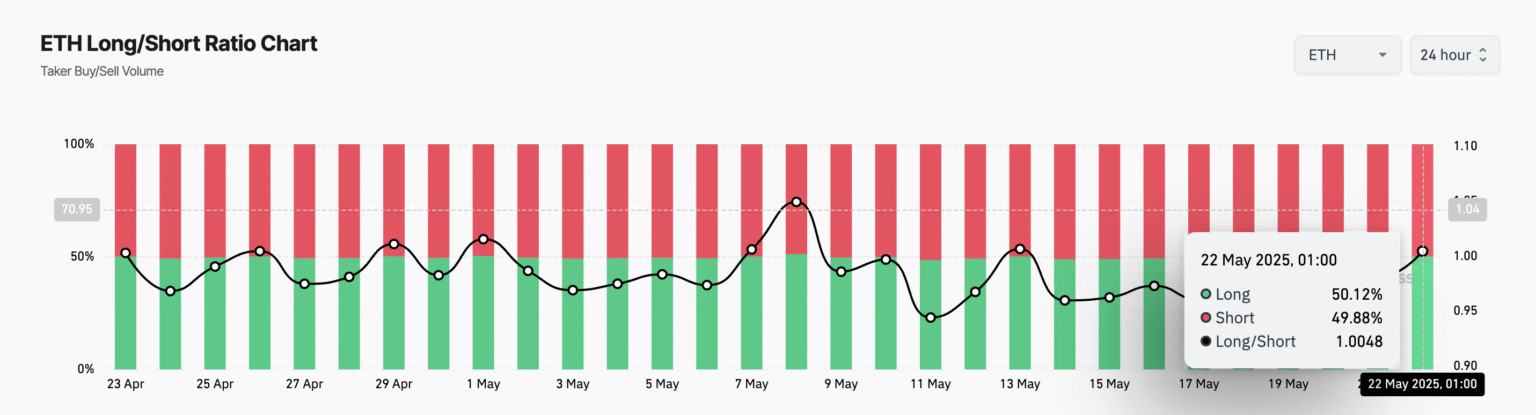

In the dynamic world of cryptocurrency investments, ETH long positions have become a focal point for traders looking to capitalize on Ethereum’s price movements. Recently, prominent investor Ma Ji Da Ge has added a substantial margin of 250,000 USD, reflecting his bullish outlook on ETH. This strategic move signals confidence in the potential for future gains, particularly as he opens new HYPE positions alongside existing holdings. With on-chain analysis suggesting increased market activity, the current value of his positions has soared to 11.17 million USD. As ETH trading strategies evolve, monitoring the performance of long positions like Ma Ji Da Ge’s can provide valuable insights into market trends and opportunities for other investors.

Within the vibrant landscape of digital assets, engaging in long-term bullish bets on Ethereum, or ETH, is a tactic that many traders adopt to maximize potential profits. These bullish bets signal faith in sustained price appreciation and often involve complex trading strategies, including HYPE positions that leverage market momentum. Observing influential figures like Ma Ji Da Ge, who recently enhanced his investments by adding significant funds, highlights the importance of strategic positioning in the cryptocurrency arena. The continued growth in total asset value, particularly at pivotal price markers, draws attention to the nuanced approaches adopted by savvy investors. Understanding such methodologies through on-chain data can empower new traders to align their strategies with market leaders.

Ma Ji Da Ge’s Strategic Increase in ETH Long Positions

In the volatile world of cryptocurrency trading, strategic positioning is crucial for maximizing profits. Recently, Ma Ji Da Ge demonstrated this by adding a substantial margin of 250,000 USD to his ETH long positions. With current market trends favoring Ethereum, his decision to bolster his investment was timely. On-chain analysis from industry experts indicates that such moves are indicative of increasing bullish sentiment in the market, particularly among seasoned traders. By selecting an optimal entry point at an average price of 2833.57 USD, Ma Ji Da Ge has positioned himself well to leverage the upcoming price movements.

As an influential trader, Ma Ji Da Ge’s actions serve as a barometer for retail and institutional investors alike. The continuous accumulation of ETH by him can spark interest and potentially lead to increased buying activity across the market. The current economic conditions, paired with favorable on-chain metrics, underscore the importance of effective ETH trading strategies that not only focus on positioning but also on understanding market dynamics and demand fluctuations. As he configures his portfolio to absorb market volatility, his HYPE position of 418,000 USD further accentuates his aggressive yet calculated approach.

Analyzing the Impact of On-Chain Metrics on ETH Positions

On-chain analysis plays a vital role in understanding the broader effects of market sentiment on cryptocurrency investments. It provides insights into trader behavior, transaction volumes, and the general pulse of the market. With Ma Ji Da Ge increasing his ETH long positions amidst these analytics, it highlights the interplay between market data and investment decisions. For traders considering their own positions, employing on-chain analysis could reveal opportunities to enhance their portfolio returns. Metrics such as active addresses, transaction counts, and network activity can serve as guiding indicators for crafting robust trading strategies.

Furthermore, the significance of HYPE positions in the current market extends beyond mere speculation. These positions not only allow traders to capitalize on trendy movements but also underscore the importance of timing and market sentiment. By leveraging insights from on-chain metrics, investors can better understand the momentum behind price shifts, which is crucial when navigating the often unpredictable cryptocurrency landscape. As Ma Ji Da Ge’s strategic positioning exemplifies, integrating such analyses can be the cornerstone of a successful ETH trading strategy.

Understanding Ethereum Price Trends through Strategic Positions

Ethereum, being one of the leading cryptocurrencies, often captures the interest of investors looking for significant returns. The strategic decisions by key players like Ma Ji Da Ge to increase their ETH long positions demonstrates an astute understanding of market price trends. With Ma Ji Da Ge’s latest moves resulting in an unrealized profit of 25,000 USD from his ETH holdings, it becomes clear that recognizing key price levels is critical. Following his lead, investors are encouraged to track similar price trends and develop their own ETH trading strategies that align with market trajectories.

Moreover, the recent spikes in Ethereum’s trading volume, coupled with Ma Ji Da Ge’s investments, suggest a potentially bullish market phase. These developments call for both novice and experienced traders to engage in thorough market analysis to inform their trading decisions. Following the patterns established by influential figures in crypto trading can provide insights into predictable market behaviors and potential price rallies. Analyzing how substantial positions influence the price can prepare investors for engaging in profitable trades.

The Role of HYPE Positions in Cryptocurrency Investments

HYPE positions have become a tactical component for many investors looking to maximize their cryptocurrency gains through strategic timing. These speculative positions capitalize on trending narratives, often resulting in short-term yet significant profits. As seen in Ma Ji Da Ge’s actions, creating HYPE positions can facilitate rapid investment returns, and understanding the circumstances that drive these trends is crucial for traders aiming to enhance their portfolios. By blending HYPE strategies with comprehensive on-chain analysis, traders can position themselves advantageously against market fluctuations.

Additionally, the HYPE position of 418,000 USD shows how important it is for traders to maintain flexibility in their strategies. Market sentiments can change quickly, and being able to pivot to capitalize on HYPE can differentiate successful investors from those who falter. Beginners entering the cryptocurrency space are encouraged to familiarize themselves with the dynamics of HYPE investments while integrating traditional trading principles and on-chain insights. A well-rounded approach can empower traders to navigate the exhilarating yet uncertain waters of crypto market investments.

Best Practices for Effective ETH Trading Strategies

In the rapidly evolving landscape of cryptocurrency, establishing effective trading strategies is essential for long-term success. For investors like Ma Ji Da Ge, strategies that leverage market insights, including on-chain metrics, help facilitate smart trading decisions. One best practice is to maintain a diversified portfolio that includes both long and speculative positions, ensuring that risks are managed effectively. Moreover, staying informed about market developments and adjusting positions according to new data are crucial components of a successful ETH trading strategy.

Another important practice is to engage with the trading community to share insights and strategies. By participating in discussions about ETH trading strategies, investors can learn from the experiences of others and optimize their approaches. Platforms that provide real-time data and analytics can help in assessing the viability of existing positions while pinpointing potential opportunities. By implementing these best practices, traders can ensure that their strategies are robust and adaptable, positioning themselves for success in the ever-changing cryptocurrency market.

Leveraging On-Chain Analysis for Cryptocurrency Gains

On-chain analysis has emerged as a pivotal tool for investors seeking to enhance their trading outcomes in the cryptocurrency space. By evaluating blockchain data — such as transaction volumes, wallet activity, and market sentiment — traders can formulate more informed strategies. Ma Ji Da Ge’s recent performance exemplifies how leveraging such analysis can provide insights into price movements, maximizing potential profits from ETH long positions. The implementation of on-chain metrics allows traders to identify trends that might escape traditional analytical methods.

For example, observing spikes in ETH transactions can signal increasing interest, compelling traders to reconsider their entry and exit points. Moreover, adapting strategies based on on-chain analytics can lead to more effective response mechanisms during market downturns or surges. By embracing this holistic approach, crypto investors position themselves to make strategic decisions that align with real-time data, ultimately bolstering their investment portfolios and leading to greater crypto gains.

Market Sentiment and Its Influence on ETH Investments

Market sentiment is a driving force in the world of cryptocurrency investments, often dictating the ebb and flow of prices. Investors like Ma Ji Da Ge, who are attuned to the prevailing sentiments, can capitalize on market trends by making well-informed decisions to increase their ETH long positions. As sentiment shifts, so too do the strategies employed by traders — adapting to the optimistic or bearish outlook can be fundamental to optimizing one’s portfolio. Understanding the nuances of market sentiment is crucial for those looking to navigate the complexities of digital asset trading.

Furthermore, utilizing sentiment analysis tools can aid investors in gauging public perceptions and reactions to market events. By monitoring social media trends, trading volumes, and the activities of prominent traders, all connected to the larger narrative influencing Ethereum’s price movements, investors can refine their strategies accordingly. Embracing such analytical approaches allows traders to remain agile and responsive, ensuring they can effectively position themselves regardless of the sentiment surrounding their crypto investments.

The Evolution of Cryptocurrency Investment Strategies

As the cryptocurrency market continues to mature, so too do the methods and strategies employed by investors. The evolution of these strategies, driven by influential participants like Ma Ji Da Ge, highlights the necessity for ongoing adaptation. With a growing focus on both on-chain analysis and market analytics, contemporary traders are equipped with tools that enable them to execute more sophisticated ETH trading strategies. Investors must remain vigilant, evolving their tactics in accordance with changing market dynamics to ensure they stay ahead of the curve.

This evolution also emphasizes the importance of education and ongoing learning for investors. With the increasing complexity of cryptocurrency markets, traders are encouraged to constantly seek out new information and updates on prevailing analytics. The successful trader today is one who invests time in comprehensively understanding not only their chosen assets but also the strategies that can maximize returns in an increasingly competitive environment. Through this commitment, traders can better navigate the intricacies of the cryptocurrency landscape, fostering long-term success.

Frequently Asked Questions

What are ETH long positions and how do they work?

ETH long positions refer to the strategy of buying Ethereum (ETH) with the anticipation that its price will rise in the future. Investors can capitalize on this expected increase by holding their ETH until they sell at a higher price for profit, often utilizing margin to enhance their investment capabilities.

Who is Ma Ji Da Ge in the context of ETH trading strategies?

Ma Ji Da Ge is an influential figure in the cryptocurrency trading community, known for his aggressive ETH trading strategies. His recent activities, including increasing his long positions, showcase his commitment to maximizing returns on his ETH investments.

What is a HYPE position in ETH trading?

A HYPE position in ETH trading refers to a speculative investment made with the hope that market sentiment will drive prices significantly higher, typically observed in volatile market conditions. Recently, Ma Ji Da Ge opened a new HYPE position worth 418,000 USD as part of his broader trading strategy.

How does on-chain analysis contribute to understanding ETH long positions?

On-chain analysis evaluates Ethereum’s blockchain data to provide insights into trading behavior, such as accumulation patterns and investor sentiment. By analyzing this data, traders can better inform their decisions regarding ETH long positions, as evidenced by analyst Ai Yi’s reports on recent activities in the market.

What is the significance of margin in ETH long positions?

Margin trading allows investors like Ma Ji Da Ge to leverage their existing capital to open larger ETH long positions. By adding 250,000 USD as margin, he enhances his trading capacity, potentially increasing both profits and risks associated with his investments.

How do unrealized profits affect decisions on ETH long positions?

Unrealized profits indicate the gains that a trader has not yet locked in by selling their assets. In the case of Ma Ji Da Ge, with an unrealized profit of 25,000 USD in his ETH long positions, these gains may influence his decision to hold or sell, depending on market conditions.

What are the potential risks of increasing ETH long positions?

Increasing ETH long positions carries inherent risks, including market volatility and potential losses if the price of Ethereum declines. Traders like Ma Ji Da Ge must remain vigilant about market trends and manage their positions carefully to mitigate these risks.

How can investors develop successful ETH trading strategies?

Developing successful ETH trading strategies involves a combination of market analysis, understanding pricing trends, and employing risk management techniques. Investors can study figures like Ma Ji Da Ge and implement strategies such as on-chain analysis and margin trading to enhance their approaches.

| Key Point | Details |

|---|---|

| Margin Added | 250,000 USD |

| Recent Activity | Ma Ji Da Ge continues to increase his ETH long positions. |

| Total Position Value | 11.17 million USD |

| ETH Position | 10.75 million USD with an average opening price of 2833.57 USD |

| Unrealized Profit | 25,000 USD |

| HYPE Position Value | 418,000 USD |

Summary

ETH long positions have become a strategic focal point for traders like Ma Ji Da Ge, particularly after a significant margin addition. By boosting his ETH holdings and opening a new HYPE position, he showcases an aggressive bullish approach in the market. With a total position value of 11.17 million USD and an impressive unrealized profit, this strategy reflects confidence in the continued growth and potential of Ethereum.

Related: More from Market Analysis | Related Box Test | Crypto Worries Over Iranian Oil Supply: Is It Overhyped? in Crypto Market